In this article, we’ll be taking a holistic view of the taxation of pensions in Ireland. We’ll look at pension taxation through the lens of an individual who begins their pension journey at the point of entry into the workforce right up until the day the individual retires and begins drawing on their accumulated pension pot.

The Irish Government really wants you to save and invest for retirement. So much so that they’ll provide you with very favourable tax incentives as a reward for choosing to engage with the pension system.

Remember, these tax incentives, while beneficial to the likes of you and me, ultimately cost the state money. So the Irish government clearly views the upside of encouraging participation with the pension system via tax relief as outweighing the downside of the cost of that relief to the State.

Table of Content

Tax Relief 1: ‘Going In’

The first stage of tax relief becomes available when you make contributions to your pension. As per Irish tax law, relief from income tax is available on contributions made to a pension plan. This relief is afforded at the individual’s higher rate of income tax i.e their marginal rate of tax (PAYE).

However, no relief from Universal Social Charge (USC) or Pay Related Social Insurance (PRSI) is available on contributions made to a pension plan. Given that income tax relief is available at an individual’s marginal rate of tax this means that, in 2024, if you’re earning less than €42,000 as a single individual, then you’ll be afforded relief from income tax at a rate of 20%.

If you’re earning more than €42,000 as a single individual, then you’ll be afforded relief from income tax at a rate of 40%. Clearly, the latter is more valuable than the former.

The value of this relief is best explained by using examples. Before we go through these examples, it’s important to note that relief from income tax on pension contributions is not unlimited. There are two restrictions in place that effectively limit the amount that one can contribute tax efficiently to a pension in a given tax year.

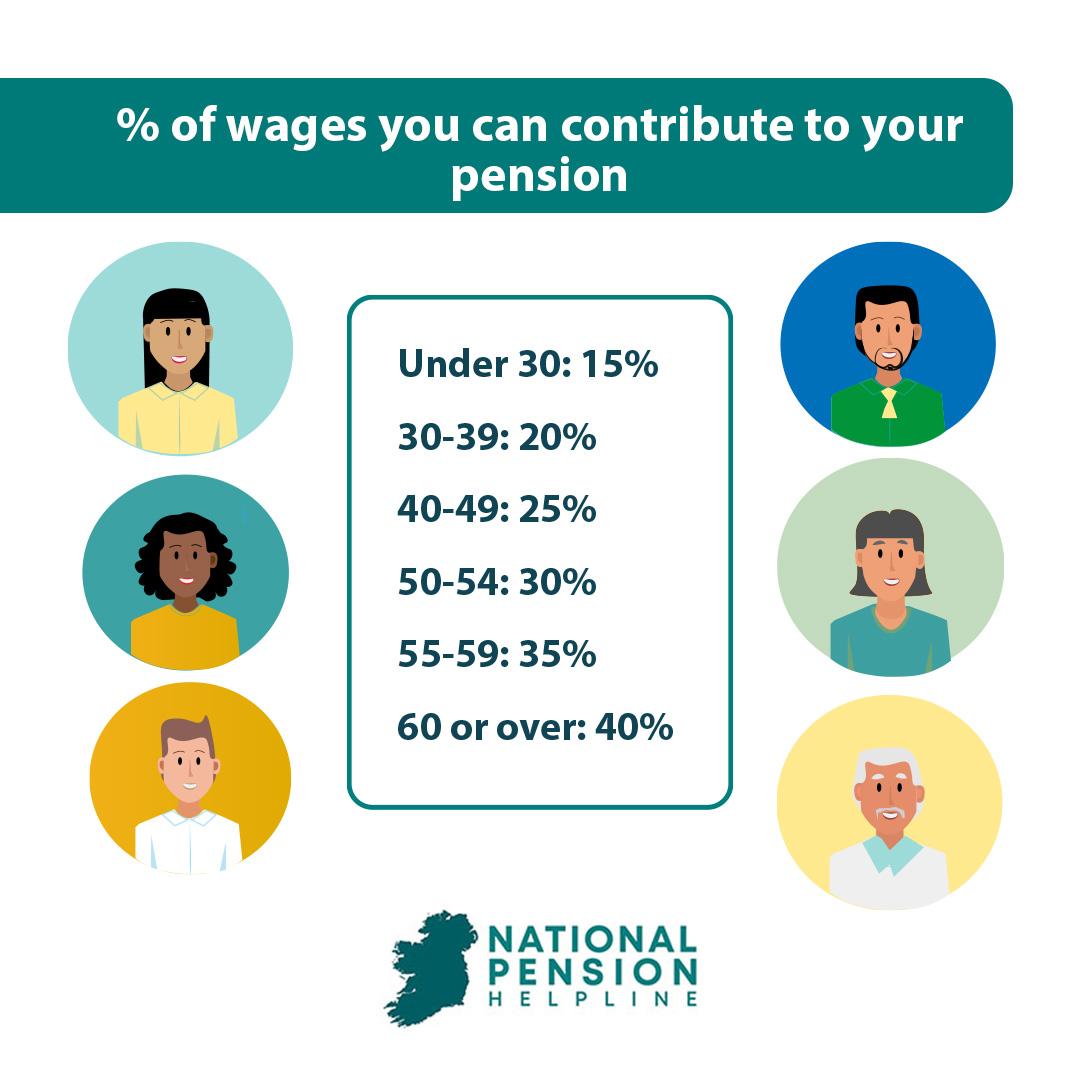

The first is an age-related contribution limit that is set out in Irish tax law. Essentially, the percentage amount of your annual earnings that you can contribute to a pension tax efficiently is limited based on your age. The allowable percentage increases as you get older.

The age-related percentage limits are as follows:

In addition to the age-related contribution limits, Irish tax law places a limit on the maximum amount of earnings that can be taken into account for calculating tax relief.

This limit is €115,000 per year as per s790A(2) TCA 1997. With that in mind, let’s look at two examples which illustrate the value of the relief available:

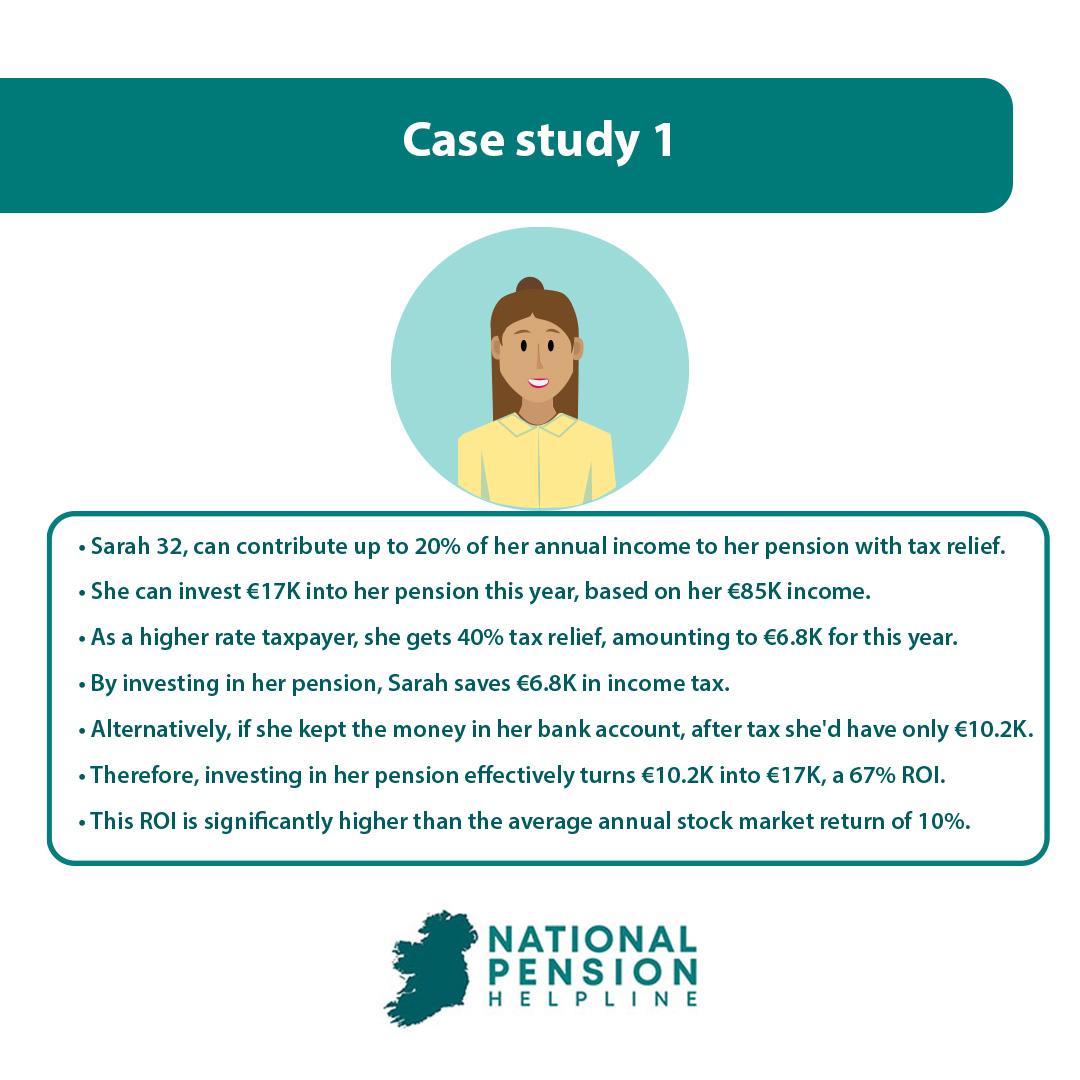

Example 1: Relief at 40% (Higher rate taxpayer)

Sarah is a senior manager in one of the Big 4 accountancy firms. She’s 32 and earns an annual salary of €85,000. Sarah is very proactive about her retirement planning and wishes to fully utilise her annual tax-efficient pension contribution allowance.

Given that Sarah is 32, she can contribute a maximum of 20% of her annual income to a pension while being afforded relief from income tax on the contributions. Therefore, Sarah can contribute €17,000 to her pension tax-efficiently in the current tax year (i.e. €85,000 * 20% = €17,000).

As Sarah is a higher rate taxpayer (i.e. earning more than €42,000) income tax relief will be afforded at her marginal rate of tax i.e. 40%. Therefore, Sarah will receive tax relief worth €6,800 in the current tax year (i.e. €17,000 * 40%). From a monetary perspective, Sarah has saved €6,800 in income tax by choosing to invest €17,000 into her pension.

Another way of looking at the value of this relief is from a return of investment (ROI) perspective. The value of Sarah’s invested contribution is €17,000.

However, had Sarah chosen to receive that money into her bank account, she would have only received €10,200 given that €6,800 (i.e. 40%) would have gone to the Exchequer.

So, in effect, Sarah has automatically turned €10,200 into €17,000 by choosing to invest in a pension. This equates to an automatic return on investment of 67%. For context, the average annual return of the stock market is said to be in the region of 10%!

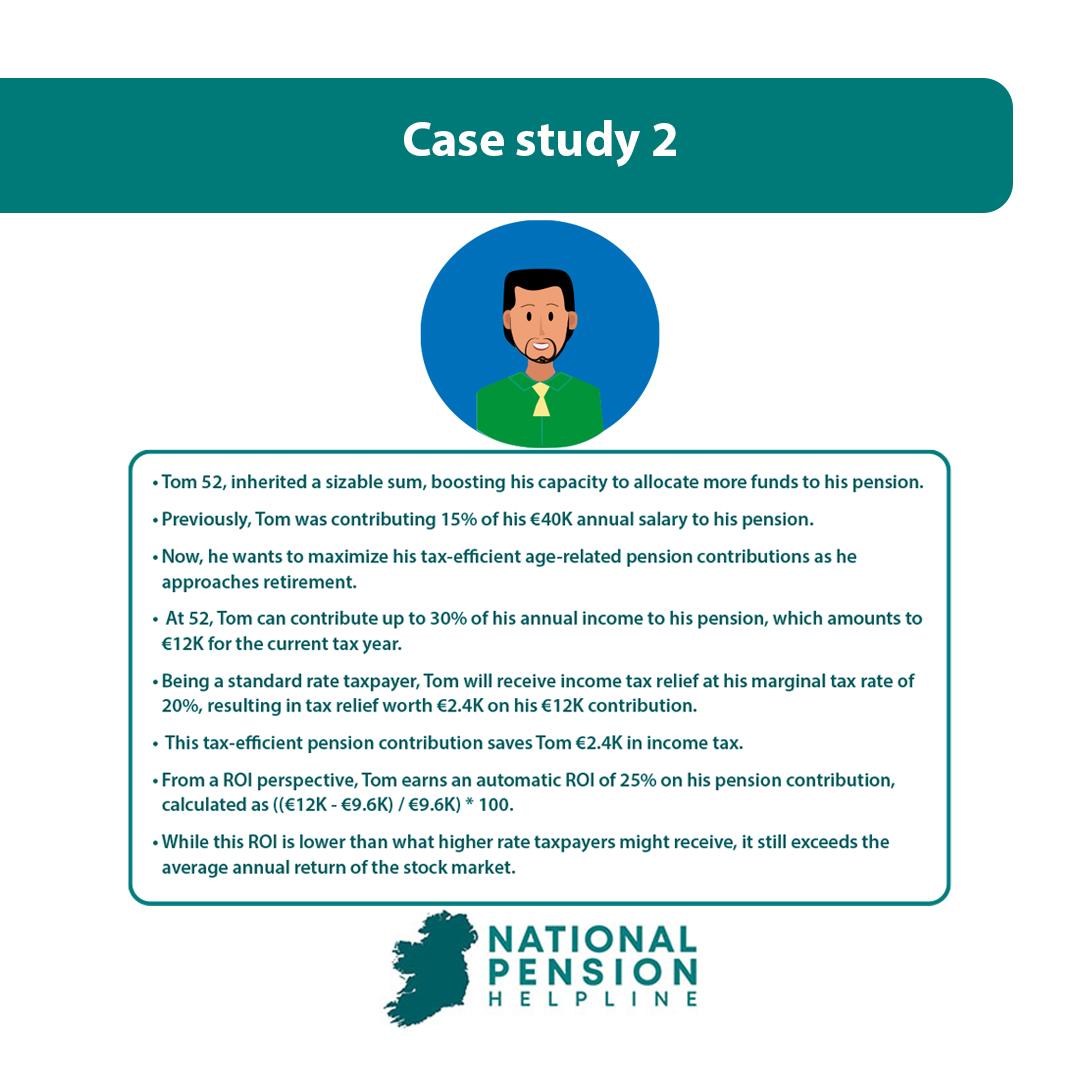

Example 2: Relief at 20% (Standard rate taxpayer)

Tom is an engineer with a leading telecommunications company. He’s 52 and earns an annual salary of €40,000. Tom recently received a sizable inheritance which has increased his capacity to allocate more of his annual salary to a pension. Previously, Tom was contributing 15% of his salary to a pension, but he now wants to fully avail of his maximum tax-efficient age-related contribution as he approaches retirement.

As Tom is 52 years of age, he can contribute a maximum of 30% of his annual income to a pension while being afforded relief from income tax on the contributions. Therefore, Tom can contribute €12,000 to his pension tax-efficiently in the current tax year (i.e. €40,000 * 30% = €12,000).

As Tom is a standard rate taxpayer (i.e. earning less than €42,000) income tax relief will be afforded at his marginal rate of tax i.e. 20%. Therefore, Tom will receive tax relief worth €2,400 in the current tax year (i.e. €12,000 * 20%).

From a monetary perspective, Tom has saved €2,400 in income tax by choosing to invest €12,000 into his pension. From an ROI perspective, Tom has earned an automatic return on investment of 25% (i.e. (€12,000 – €9,600)/€9,600) * 100).

While significantly less valuable than the ROI available to higher rate taxpayers, the automatic ROI on offer for standard rate taxpayers still surpasses that of the average annual return of the stock market.

Did you know?: employer contributions to an employee’s pension plan are not taken into consideration when calculating either the age-related percentage contribution limit or the employee’s earnings threshold.

Tax Relief 2: ‘In’

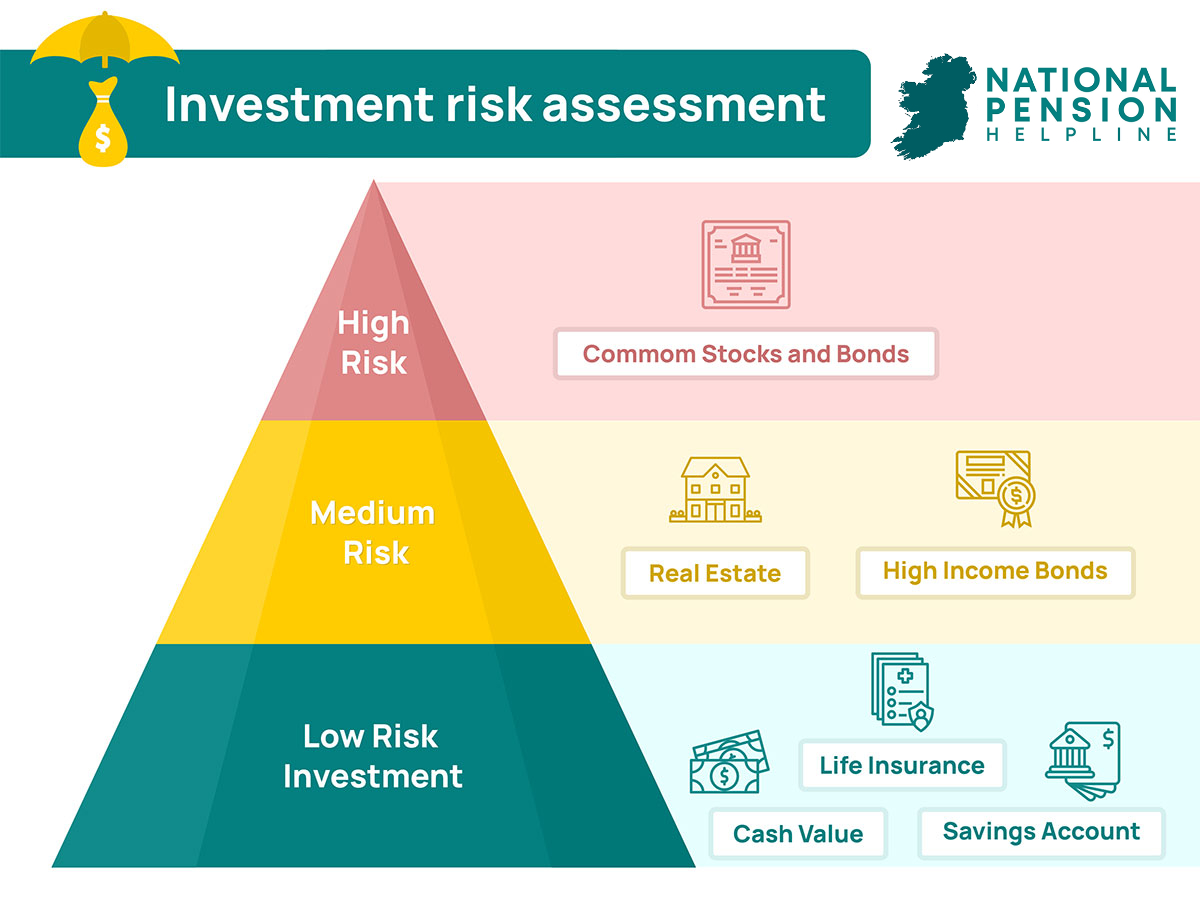

The second stage of tax relief becomes available when the pension contribution has been invested in whatever financial asset(s) you’ve decided is/are best suited to your own personal circumstances as well as your attitude towards and tolerance for risk.

If you have not actively made this decision, it’s likely that your contributions are being invested in the ‘default investment strategy (DIS)’ of the pension provider with whom your pension is being held.

In Ireland, investment growth within pension plans, which includes both investment income and capital gains, are exempt from both income tax and capital gains tax respectively. This means that your investments are permitted to grow tax-free throughout the life of the investment. Given that investment income can be taxed as high as 52% and capital gains at a rate of 33%, this is a very significant tax saving associated with investing via a pension.

Tax Relief 3: ‘Coming Out’

The third stage of tax relief becomes available when you decide to draw down your pension. Under Irish tax law, you can take up to 25% of the value of your pension fund as a tax-free lump sum up to a maximum lifetime limit of €200,000.

This means that the maximum pension size which would qualify for full utilisation of the tax-free lump sum is €800,000 (i.e. €800,000 * 25% = €200,000).

Lump sums taken between €200,001 and €500,000 are taxable at the standard rate of tax of 20%. Any excess lump sums above €500,000 are taxable at the higher rate of tax of 40%.

Pension Taxation During Retirement

Where there tends to be more confusion is around the taxation of pensions during retirement, specifically, the taxation of ARFs and annuities.

1. Approved Retirement Fund (ARF)

Many individuals, upon reaching retirement, will opt to transfer their pension into an approved retirement fund (ARF). An ARF is very similar to a pre-retirement personal pension in the sense that it’s a personal investment account. Therefore, the individual may continue to invest their accumulated capital in whatever financial assets they deem fit. To learn more about ARFs, check out our dedicated article here.

As for the taxation of ARFs, ARFs benefit from tax-free investment growth and any capital gains or investment income realised by your ARF investments are completely tax free within the ARF.

ARF holders are required (in order to avoid double taxation) to withdraw at least 4% of their ARF’s value each year between ages 60 and 70. That increases to 5% from age 71 and to 6% for those with ARF assets in excess of €2M.

These withdrawals will be liable to income tax, USC and PRSI (where applicable) and tax will be collected by the ARF provider via the PAYE system.

In the event of your death, your ARF will pass onto those who are specified to receive it under the terms of your will. From a taxation perspective, the following applies:

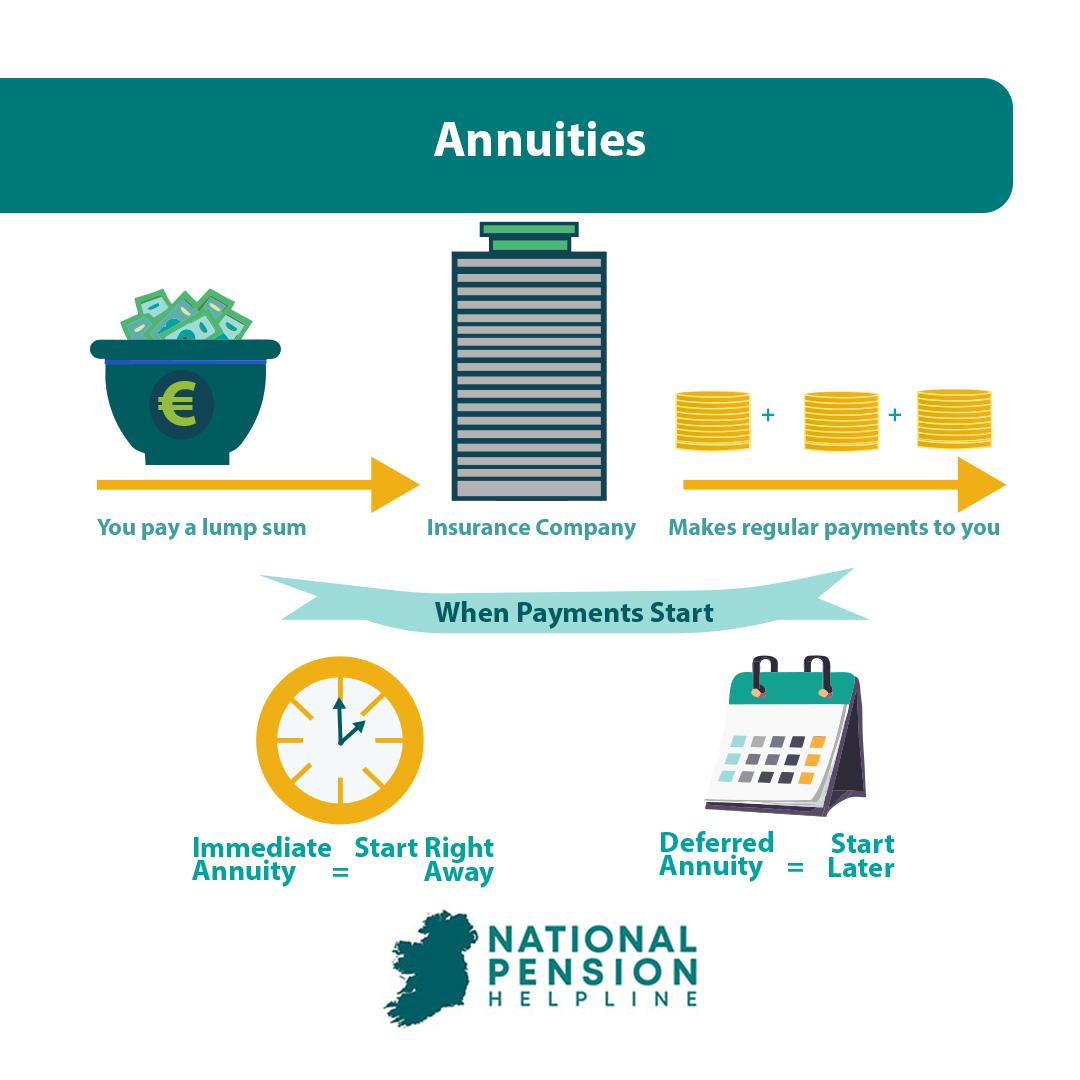

2. Annuities

Did you know?: If your pension is worth over €2M you could be getting taxed by as much as 68.8% – read our article here to learn more.

A Brief Note On The Standard Fund Threshold (SFT)

If you have a pension(s) worth over €2 million or if you expect to have a pension(s) worth over €2 million in retirement then you need to read our article on the Standard Fund Threshold (SFT) as a matter of urgency.

TLDR; you could be getting taxed by as much as 68.8% if you’re not managing your pension effectively! Don’t delay, learn about the SFT today.

Conclusion

Taxation is the most significant outgoing that we as Irish tax residents have. Therefore, finding ways to effectively manage our tax liability is, and will continue to be, a core component to long-term wealth creation in Ireland.

A pension is the most tax-efficient investment vehicle available to those who are tax resident in Ireland. As such, we should be looking to fully utilise our tax-efficient pension contributions insofar as possible.

The Irish tax landscape is highly dynamic and positive change is always on the horizon.

The Irish Government, in collaboration with the Commission on Taxation and Welfare and other 3rd parties, is actively considering and working on a series of adjustments to the tax legislation which should help bolster the attractiveness of pension investing and ensure that it remains highly attractive to Irish tax residents.

Keep an eye on our website for the latest developments in Irish taxation as it relates to pensions.

In the meantime, the National Pension Helpline has a panel of vetted pension experts who are on hand to help and advise you on your pension needs today.