Did you know that the earlier you start a pension, the more likely it is that you’ll be financially secure in retirement? It sounds obvious, especially to those who understand the ins and outs of pensions, but despite that, 34% of workers in Ireland have no pension coverage outside of the State pension.

Of this group, 47% state that the main reason for not having a pension is that “they never got around to organising it and that they’ll do it in the future”.

For anyone who’s serious about retirement planning, this logic is of course flawed, given that the best time to start a pension is in your early 20’s. Yes, you read that correctly – the best time to start a pension, from a numerical perspective, is in your early 20’s, not your 30’s, 40’s, 50’s or 60’s!

This goes against the common misconception in Ireland that “pensions are for old people”. Quite the contrary! Pensions are subject to the same guiding principles for success as ‘regular old investing’, you know, the kind you see in movies like The Wolf Of Wall Street and The Big Short.

Ok, maybe they’re bad examples of “investing”, but the point remains, a pension is nothing more than an investment vehicle for your savings.

Table of Contents

Who offers pensions in Ireland?

There are 6 main pension providers in Ireland: Acorn, Irish Life, Aviva, Zurich, New Ireland & Standard Life.

For occupational schemes, you may encounter Mercer or AON, but the 5 companies listed above are the big players in private pensions in Ireland.

| Provider | Personal Pension | PRSA | Setup Cost | Annual Charges |

|

✅ | ✅ | Free | Varies depending on fund selection |

|

✅ | ✅ | Free | Varies depending on fund selection |

|

✅ | ✅ | Free | Varies depending on fund selection |

|

✅ | ✅ | Free | Varies depending on fund selection |

|

✅ | ✅ | Free | Varies depending on fund selection |

|

✅ | ✅ | Free | Varies depending on fund selection |

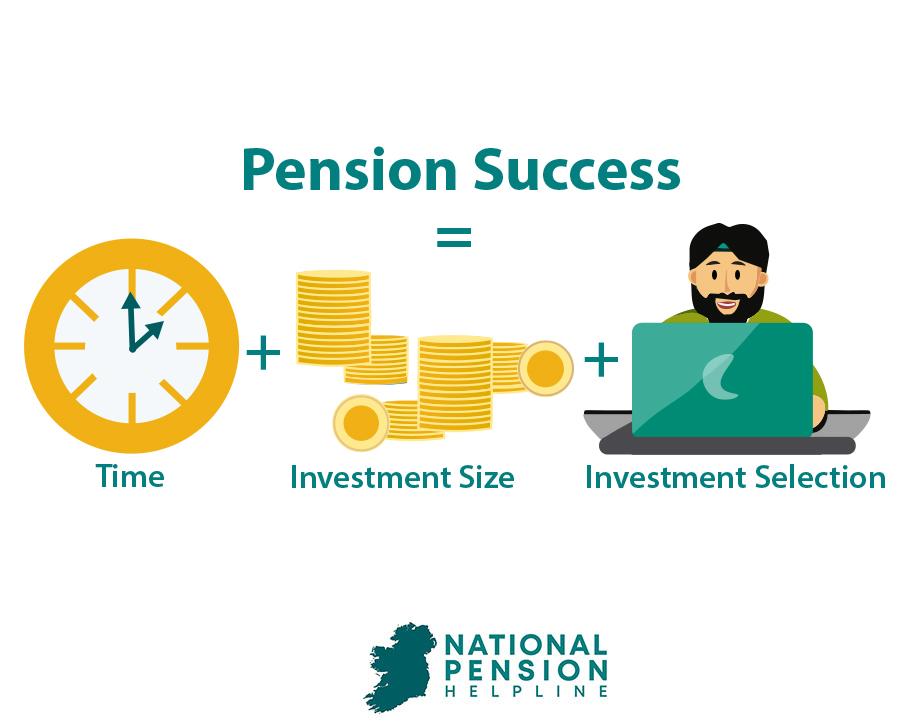

Like all investment vehicles, success is largely defined by three factors:

Put simply, the size of your pension in retirement is largely a function of how much you invest, what you invest in and how long you invest for.

With time being a key ingredient for success in any investment endeavour, in the context of starting a pension, we can therefore agree that it’s very much a case of “the earlier the better”. This article seeks to show you why that is, what you’re missing out on by not starting a pension and how to start a pension with the help of the National Pension Helpline.

Why Start A Pension

Before we look at the numbers, let’s talk about some of the reasons as to why you should start a pension. Let’s face it, most people, even those who have a pension, don’t really understand what they are and how they work.

So, it’s totally understandable as to why one would be hesitant or sceptical about allocating a larger portion of their paycheck towards a pension. You wouldn’t want to spend money on something that you don’t understand, especially when you’ve other financial priorities like mortgage repayments, rental costs, childcare costs and the overall high cost of living in Ireland!

In fact, 40% of workers say that they can’t afford to contribute to a pension in Ireland.

Regardless, it’s undeniable that starting a pension is beneficial to your financial future and here are some of the reasons why that is.

1. Inflation

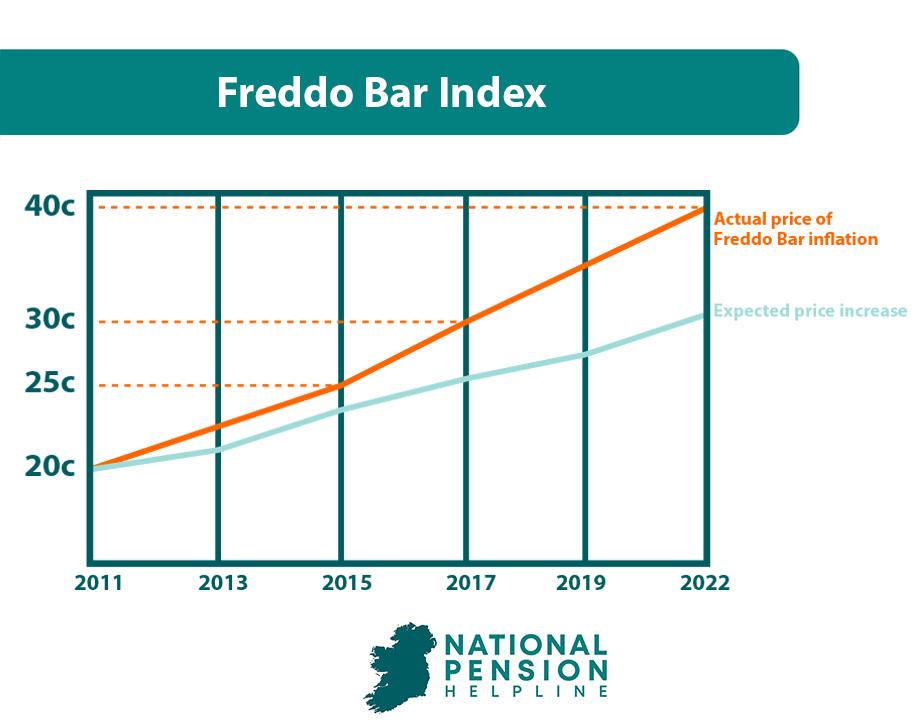

The first reason to start a pension is inflation.

According to the European Central Bank (ECB), the target rate of inflation for the Euro Area is 2%. It’s very important to understand what that means for your money.

Inflation refers to the rate of increase in the price of goods and services over time.

Remember how Freddo bars used to be way cheaper when you were a kid as compared to now? That’s inflation at play, as well as some other factors.

Put simply, there’s an expectation that prices will naturally increase over time and, as per the ECB, the target rate for that increase is 2% per annum.

So, with that in mind, it’s fair to say that over the medium to long term, the price of goods and services will increase by an average of 2%.

Put simply, there’s an expectation that prices will naturally increase over time and, as per the ECB, the target rate for that increase is 2% per annum.

So, with that in mind, it’s fair to say that over the medium to long term, the price of goods and services will increase by an average of 2%.

Why? Because the ECB will use the various monetary tools at their disposal to try and make that happen. That’s why the ECB has been increasing interest rates since July 2022, in a bid to try and tame Eurozone inflation which spiked post-pandemic.

In Ireland, inflation was running at 9.2% in October 2022 compared to 5.1% in October 2023. Therefore, inflationary conditions are improving but they’re still not where the ECB wants them to be.

Regardless, inflation is bad news for your money when your money is sitting idle in a bank account earning little to no interest. Why? Because as the price of goods and services increase your money can purchase less of those goods and services than it could previously.

In other words, the purchasing power of your money reduces as a result of inflation. Therefore, over time, you’re slowly becoming poorer and poorer even though your savings account balance may remain constant.

The only way to prevent this from happening is by having your money earn a return that at least keeps up with, but ideally exceeds, the rate of inflation.

As we mentioned, the rate of inflation in Ireland as of October 2023 is 5.1% and one of the best deposit rates currently available (as of the time of writing on November 13th 2023 ) is 4.25% with Raisin Bank. But even with that rate, especially after taxes, this return is insufficient to protect your money from the current effects of inflation in Ireland.

So the answer is to turn away from savings products and towards investment products. According to Vanguard, since 1993, the global stock market has returned on average an annual return of 9.3%. One could take relative comfort in the fact that such a return would likely be sufficient to protect oneself from the effects of inflation and then some. Point being, investing, not saving, is the answer to protecting your money from inflation.

In the wise words of the late John Bogle, founder of Vanguard, “invest you must”. A pension is your gateway to investment products like global equity funds, global bond funds and whatever other funds are best suited to your own personal circumstances and attitude towards and tolerance for risk. While a pension isn’t the only way that these products can be accessed, it is the best way, and much of the reason why has to do with the second reason to start a pension.

2. Tax Relief

The second reason to start a pension is tax relief.

The Irish Government really wants you to save and invest for retirement. Just like how they incentivise other behaviours such as startup investing, entrepreneurship and property development, the Government incentivises pension investing through the tax code. More specifically, they provide three stages of tax relief when investing in pensions.

It’s this tax relief which makes accessing investment products via a pension much more attractive than through the likes of an online brokerage platform. Why? Because the tax relief provides additional investment returns that wouldn’t have otherwise existed had a pension not been utilised.

Tax Relief Going Into The Pension

The first stage of tax relief is going into the pension i.e. tax relief on the contributions that you make to your pension. As per Revenue, contributions to a pension are afforded relief from income tax but not USC or PRSI. The two rates of income tax in Ireland are 20% and 40%. Therefore, the value of the tax relief on your pension contributions will depend on a) the contribution size and b) what tax bracket you’re in.

For 2024, the higher rate of income tax of 40% will apply to every Euro earned over €42,000 for single individuals in Ireland. Higher rate taxpayers who contribute to a pension can get an unrealised 67% return on investment by simply choosing to invest in a pension. How? If the taxpayer chooses to invest €100 of their paycheck in a pension, the actual cost to them is €60. Reason being, had they not invested that €100 in a pension, they would have received €60 in their bank account after Revenue took their share of income tax at 40% i.e. €40. Therefore, they’re turning €60 into €100 by choosing to invest in a pension which is an investment return of 67%.

There aren’t many people who would turn down a guaranteed 67% return on investment. Remember, the annual average return of the global stock market since 1993 has been in the region of 9.3%! For standard rate taxpayers, the actual cost of a €100 investment in a pension is €80. Therefore, they’re getting an unrealised 25% return on investment by investing in a pension. Unfortunately, personal contributions to a pension aren’t unlimited. Revenue restricts how much money you can contribute in a year of assessment based on a) your age and b) a maximum earnings limit of €115,000.

| Age | Max Contribution |

| Under 30 | 15% |

| 30-39 | 20% |

| 40-49 | 25% |

| 50-54 | 30% |

| 55-59 | 35% |

| 60 or over | 40% |

Tax Relief In The Pension

The second stage of tax relief is in the pension i.e. tax relief on the investment returns of the contributions invested. As per Revenue, pension income and gains are exempt from income tax and capital gains tax respectively. This means that pension investments can grow at a much faster rate than non-pension investments, seeing as the full gross proceeds can be reinvested without having to account for income tax or capital gains tax.

Tax Relief Coming Out Of The Pension

The third stage of tax relief is coming out of the pension i.e. tax relief when you draw on the pension in retirement. When you reach retirement, Revenue will allow you to take 25% of your pension as a tax-free lump sum. This is subject to a maximum tax-free lump sum lifetime limit of €200,000. This applies to the first €200,000 of tax-free lump sums taken. Tax-free lump sums between €200,001 and €500,000 are taxable at the standard rate of income tax of 20%. Any lump sums taken in excess of €500,000 will be taxed at 40%.

As a result of these three stages of tax relief, pension investing in Ireland is a highly efficient form of investing for retirement.

3. Employer Matching

The third reason to start a pension in Ireland is because of employer matching.

Employer matching refers to the practice whereby your employer agrees to ‘match’ your personal contributions to a pension scheme up to a specified limit. As an example, your employer may agree to match your personal contributions up to a maximum of 5% of your salary. So, provided you’re contributing at least 5% of your salary to your pension, your employer will also contribute the equivalent of 5% of your salary. Put simply, this is free money that you otherwise wouldn’t have had if you didn’t contribute a sufficient percentage of your salary to a pension.

The average matching percentage in Ireland is said to be in the region of 5% but some employers go much higher than that. As a result, certain workers in Ireland may be leaving thousands of Euros on the table every year by not sufficiently availing on their personal pension contribution limits.

Remember, this is additional money that is being placed into a highly tax efficient investment account for the benefit of your future self and if you can afford to do so, you should be maximising this benefit.

4. The State Pension Problem

The fourth reason to start a pension in Ireland is because Ireland’s state pension system is unsustainable. More on that here.

According to the CSO, 57% of those with no pension expect the State pension to be their main source of income in retirement.

What’s worrying is that the majority of these workers are likely unaware of the fragility of Ireland’s state pension system.

In September 2022, KPMG issued their actuarial review of Ireland’s social insurance fund which is the pool of money out of which State pension payments are made to retirees. It was found that the present value of future deficits in the social insurance fund amounted to €271 billion or 115% of Ireland’s national debt.

Currently, whenever there is a deficit in the social insurance fund (i.e. where fund income is less than fund expenditure) the difference is funded by the Government. Clearly, a deficit of €271 billion can’t be sustainably funded by the Irish Government.

The crux of the problem is the inadequacy of Ireland’s state pension system in the face of changing demographics. Namely, an increase in Ireland’s old-age dependency ratio i.e. the ratio of individuals aged 65 and over to individuals in the working population.

According to the Irish Fiscal Advisory Council, this ratio is currently in the region of 25%. As such, considerations such as PRSI contribution rates, weekly pension payment rates and the State pension age are designed with that ratio in mind.

However, by 2050, Ireland’s old-age dependency ratio will be 46%, meaning there will be just over two workers for every retiree in the State. This change in demographics is what will drive deficits in the social insurance fund should nothing change.

We don’t know what the state pension will look like in 10, 20 or 50 years time. Invariably, change will have to happen.

PRSI rates will increase, the state pension age will be extended and the benefits provided by the state pension may even fall. It’s impossible to know for certain what will happen and, as such, the best port of call is to reduce reliance on the state pension in retirement by starting a private pension as soon as possible.

Opportunity Cost of Not Starting A Pension

Having looked at four good reasons to start a pension, we’ll now hammer home the point by looking at the numbers. The best way to visualise the financial benefits associated with starting a pension is by looking at the opportunity cost of not starting a pension. Opportunity cost is defined as “the potential foregone profit from a missed opportunity”. It is the cost of choosing one alternative over another. In the context of starting a pension, the opportunity cost of not doing so is equal to the sum of:

- The tax relief available on pension contributions.

- Additional contributions from employer matching (if applicable).

- The investment return realised on a) and b) over X amount of years.

The goal here is not to highlight the opportunity cost of not investing, the goal is to highlight the opportunity cost of not investing via a pension.

Reason being, it’s possible to make non-pension investments with after-tax money in similar and/or different investment products to achieve similar net investment returns.

However, when you invest outside of a pension, you don’t receive the tax relief and you don’t receive the additional employer matching (if applicable). As such, this is the true opportunity cost of not starting a pension.

Example 1

Sarah is a 20 year old working in the financial services sector. She is currently earning €30,000 per annum and has decided to start a pension. The following is assumed:

| Salary increase per annum | 3% |

| Employer matching* | 3% |

| Personal pension contribution level | Maximum at every age bracket |

| Investment return per annum | 3% after inflation and fees |

| Higher tax band throughout | €42,000 |

| Income tax rates | 20% lower and 40% higher |

| Investment horizon | 40 years |

*Note that the opportunity cost associated with employer matching is the additional matching contribution that becomes available as a result of fully utilising one’s personal contribution limit. In many cases, a minimum contribution percentage will be contractually required by both the employer and employee, which doesn’t represent an opportunity cost.

By the time Sarah is turning 60 years old and is getting ready for retirement the following will be true as a result of her decision to start a pension:

Example 2

John is a 20 year old working in the ICT sector. He is currently earning €35,000 per annum and has decided to start a pension. The following is assumed:

| Salary increase per annum | 3% |

| Employer matching* | 4% |

| Personal pension contribution level | Maximum at every age bracket |

| Investment return per annum | 5% after inflation and fees |

| Higher tax band throughout | €42,000 |

| Income tax rates | 20% lower and 40% higher |

| Investment horizon | 40 years |

*Note that the opportunity cost associated with employer matching is the additional matching contribution that becomes available as a result of fully utilising one’s personal contribution limit. In many cases, a minimum contribution percentage will be contractually required by both the employer and employee, which doesn’t represent an opportunity cost.

By the time John is turning 60 years old and is getting ready for retirement the following will be true as a result of her decision to start a pension:

How To Start A Pension

You can start a pension online in minutes with the National Pension Helpline’s new online application system. However, depending on your employment pension options, it may be more advantageous to use your existing company pension scheme.

Non-pensionable employment

You might be in non-pensionable employment. According to Revenue, “a non-pensionable employment is one where either:

a) The employee is not included for retirement benefits under an approved occupational pension scheme relating to the employment.

Or

b) Where the sole benefit arising is a lump sum payable upon death”.

Where this is the case, your employer is legally obliged to ensure that you have access to at least one standard personal retirement savings account (PRSA).

In this scenario, you would start a pension by starting and/or increasing your pension contributions to this PRSA. Remember, you can personally contribute anywhere between 15%-40% of your earnings to a PRSA per year depending on your age.

Your employer is not legally required to contribute to your PRSA. You should have a conversation with your employer to find out more information about the PRSA that’s available for you.

Pensionable employment

You might be in pensionable employment. Pensionable employment is one where the employee is included for retirement benefits under an approved occupational pension scheme relating to the employment (that isn’t solely a lump sum payable upon death).

Many employers will mandate a minimum contribution to be made by both the employer and the employee to the occupational pension scheme.

As a result, you could very well already have a pension without even knowing it! However, it’s highly unlikely that this minimum contribution alone will be sufficient to financially support you in retirement. As such, you should consider making additional voluntary contributions (AVCs) to your pension.

Some employers will allow you to make AVCs to the occupational pension scheme without limit (aside from the age-related limits under tax law).

Certain employers may only permit a specified level of AVCs to the occupational pension scheme while others may prohibit AVCs to the occupational pension scheme altogether. Where an employer restricts your ability to make AVCs to the occupational pension scheme they are legally obliged to nominate a standard PRSA to facilitate your AVCs.

In this scenario, you would start a pension by increasing your pension contributions to the occupational pension scheme and/or the nominated standard PRSA.

Remember, making AVCs to the occupational pension scheme may unlock a higher level of employer matching contributions up to a specified limit. This is literally free money that you’re getting by choosing to increase your personal pension contributions!

Self-employment

You might be self-employed. For self-employed individuals, the best way to start a pension is to utilise a PRSA. This is especially true for directors operating a business under a corporate entity.

Reason being, as a result of Finance Act 2022, companies can technically make unlimited contributions to a directors PRSA. If clarified to be an intentional change by Revenue, this would make employer PRSA pension contributions the best and most tax-efficient cash extraction method for company directors and shareholders (where a contract of service is deemed to exist).

Auto-enrolment

It’s worthwhile mentioning that the Irish Government is introducing a system of pensions auto-enrolment in the second half of 2024. If you haven’t started a pension by that date then you could very well end up being enrolled in the new system. However, for reasons we discuss in this article, this may not be in your best interest. So the best time to start a pension is today!

NPH Start A Pension Tool

If you’d like to start your pension (or PRSA) online quickly and conveniently then you can do so by submitting an application to the National Pension Helpline here.

The National Pension Helpline has a team of vetted pension experts who can assist you in getting started with the best pension for you. You can take our quick online application.