Introduction to Company Pensions

Company pensions are created by employers to help employees provide for their retirement. They create tax efficient salary deduction processes that positively contribute to the employee’s future.

Very often the employer also contributes to the employee’s pension pot by making a like-for-like payment each time the employee does so.

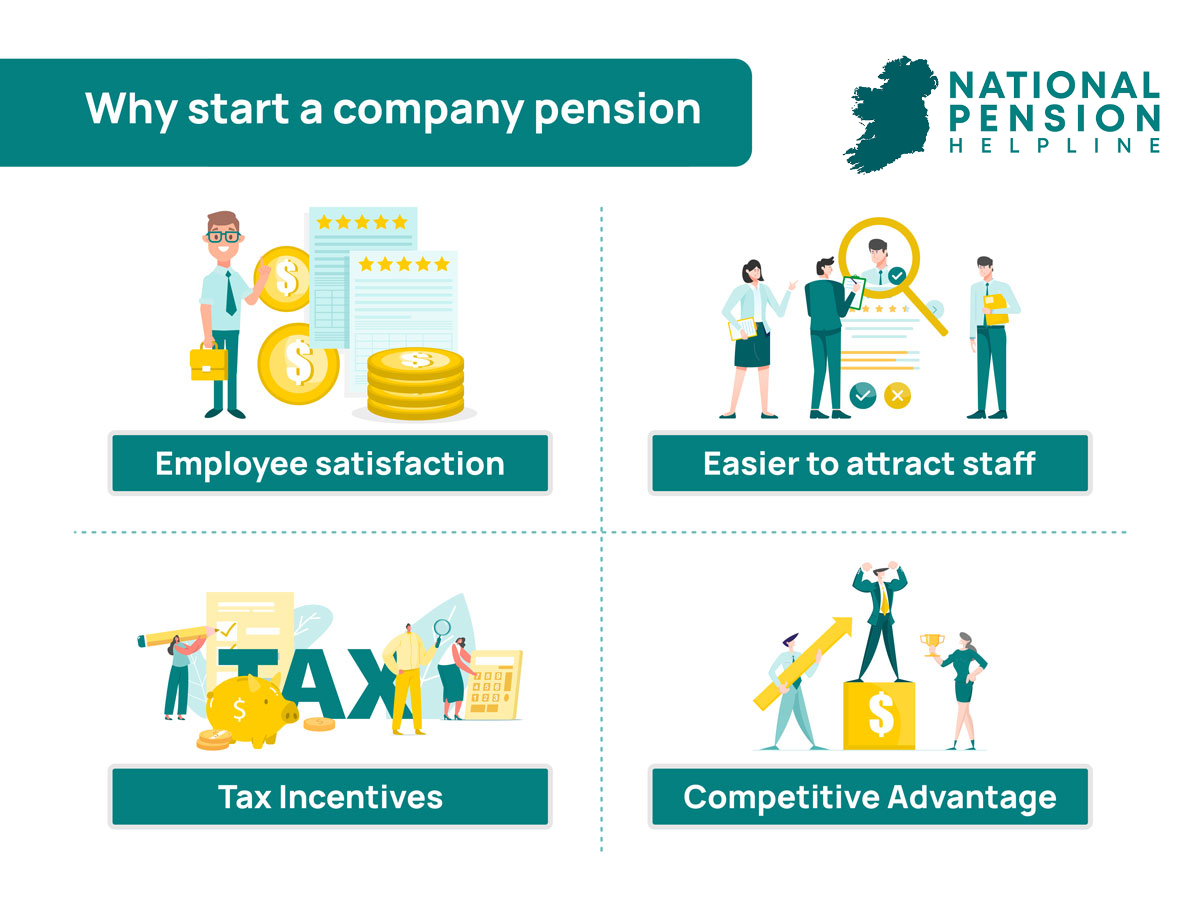

The motivation of an employer often comes from a number of avenues. For example, the provision of a pension scheme is often an important factor in attracting talent to your company.

An employee may be motivated to choose to work with one company over another based on its pension provision.

Another motivating factor is to reward existing employees and give them a tangible benefit to remain working for the company. The employee feels appreciated and acknowledges the employer’s efforts to provide for their financial future.

A third benefit to the company is in the form of tax incentives that benefit the employer and allow them to make employees.

If you would like to learn more about setting up a company pension is then click here.

Table of Contents

Why set up a company pension?

Company Pension Tax incentives

Tax incentives for the employer and the employee are the most frequently mentioned reasons for setting up a pension scheme. They allow the employer to make contributions to the employee’s pension pot which are very tax efficient for the company itself. The employee also benefits from payments made to their retirement fund in the form of tax incentives.

Employee satisfaction

Another major driver of the creation of company pensions is the strengthening of employee satisfaction. A company that invests in its employees’ future is one that will have a much greater employee satisfaction rating.

It will more easily retain talent as well as being one which can attract talent that recognise the value of a company pension plan.

Do I have to set up a company pension?

Not all companies have a pension scheme and to manage this scenario the State has introduced Auto Enrolment, a State pension scheme that ensures that all workers over a certain threshold have access to a pension scheme.

Companies can set up their own pension scheme or utilize the Auto Enrolment scheme.

What is Auto enrolment

Auto enrolment Pensions refers to the process whereby a person will be automatically enrolled in a company pension scheme unless they choose to opt out.

This is considered a more efficient way of capturing the largest number of people in the scheme, rather than making it opt-in. As long as you are earning more than €20,000 you will automatically be enrolled in the scheme.

Deductions will be made from payroll and you won’t need to enroll in a new scheme every time you move jobs. The scheme is personal to you and continues regardless of the job you are in.

What companies will need to do to auto enroll workers in a company pension

All companies will be expected to facilitate Auto Enrolment in their workplace. The process to do so is simplified to ensure that companies can comply with the legislation that oversees it.

A central administration of the scheme will be maintained by the State and the employer will simply register with this body and facilitate deductions from payroll into the scheme.

All other paperwork and administration will be managed centrally by the authority. The company’s involvement is minimal.

For more on Auto enrolment and what it means for your company click here.

Choosing my company pension

What company pension options are available?

Companies are free to work with any pension provider in the market in the provision of their company pension. It’s a complicated business but one that rewards extensive research. The tax incentive benefits are crucial and each of the private pension providers have advisory teams to help you understand the implications for your company.

The arrival of auto enrolment also increases the options available to company directors. While the Auto Enrolment option appears to be a very straightforward choice, the tax incentives for companies are quite different from those that may be available if the company works with a private pension provider.

Who will manage my company pension?

Company pensions are managed by trustees. The company establishes a trust with selected well-informed trustees to establish the pension and to manage it from year to year. The financial entity that oversees the pension will also play a role on a rolling basis to ensure that the pension is managed correctly but under the Pensions Act (1990) the trustees have the main responsibility for the administration of funded occupational schemes.

Start a company pension today

If you have questions around your company’s pension provision get in touch with an expert pension advisor today.