Do I need a pension review?

The most common answer is yes. Where we spend our income and how much of it we’re willing to use on goods and services is something we constantly review – grocery prices, energy bills, healthcare, transport, entertainment. We demand good value at every turn. So why should our pension be any different?

Often we set up our pension plan at an early stage in our career, without always understanding the financial parameters that manage it. We know it’s an investment in our future and often there’s a figure we expect to pay out at a later stage, but we’re not always sure whether we’re getting good value for money.

Pension plans can change in value and performance over time. A pension review can help you understand your own pension and whether it’s delivering the value it should. It will also help you recognise if there are better value options available to you.

Table of Contents

Pension Review

What is a pension review?

A pension review is a process whereby you work with a qualified pension advisor to examine your current pension plan and set out to fully understand its parameters.

The goal is to determine whether it offers the best value available to you, the amounts you can expect at retirement, the rules governing payment and when you can expect to avail of its value. There are many other aspects too that can be included, including identifying alternative pension opportunities that could replace or supplement your existing pension.

Taking a starting point that all funds can go up as well as down, the review is an opportunity for you to examine how your fund has performed over the past few years.

Why review your pension?

Reviewing your pension is a way for you to take better control of your future. It arms you with the information, rules and risk levels that govern your pension scheme and ultimately shape your future financial outcome. It will provide you with options and predicted outcomes that will allow you to make better-informed decisions about your future.

Pension investing is extremely tax efficient and the earlier we start taking advantage of the benefits associated with it, the more we will reap the rewards of those benefits in the long-term. This is one reason why pension reviews are so important, because they will shed light on whether or not you’re taking full advantage of the potential tax benefits available.

What causes pensions to become insufficient for a comfortable retirement?

Another key reason to review you pension regularly is that Revenue allows larger and larger percentages of our salaries to be contributed to pensions as we get older and that should be taken advantage of.

In Ireland, insufficient pension funds at retirement really boils down to

- Not starting early enough

- Not increasing your investments over time

- Poor investment allocation, extortionate brokerage commissions and low fund allocations

Can I improve my pension?

There are a number of ways to improve your pension plan, depending on the type of plan you have.

Essentially, a pension is an investment fund that is built upon the contributions paid into it by you and/or your employer throughout your career. You may have moved it around between pension providers as you moved jobs or you may have stopped payments for a period. A review will allow you to assess how these steps may have impacted your future pension value and to identify steps that can be taken to improve your pension position.

Can I access my pension early?

Generally, in Ireland, you can start to draw down funds from an occupational pension once you turn 50 and are no longer with the employer that set up the scheme. If you are still employed with that company then you will have to wait until you are 60 before drawing down any funds.

Cashing in your pension at 50 does not give you access to your entire pension. It allows you to withdraw a maximum of 25% as a tax-free lump sum and the remaining amount must be reinvested in a retirement fund (ARF) or an annuity.

While it can be a useful source of cash in middle age, starting to access it early will, of course, reduce the value of the pension over time and isn’t always encouraged. It’s best to leave your pension invested for as long as possible.

If you do start to benefit from your pension early it is important that you make arrangements around your PRSI payments to ensure that you can still access the State pension at retirement age.

For anyone experiencing ill health, there are rules in place to give you access to your pension early, should you need them.

A pension review will help you understand your options around accessing funds early and also provide you with advice to improve your pension situation if the rules around your current scheme aren’t favourable to early release.

Should I plan for my retirement lifestyle?

Pension schemes of all types are designed to help you continue to enjoy the lifestyle you have experienced throughout your career once you retire. The State pension is currently set at €277.30 a week. It is designed to give you a basic level of retirement income.

For many people, this will not be enough to pay for the standard of living that they are used to. Plus, with over 65s set to double by 2050, there’s no guarantees that State Pension benefits will exist as they do now. In order to salvage the State Pension system, the Government will have to make changes, and it’s not yet known how these changes will impact the standard of living of the retirees of the future.

Indeed, some people discover at retirement age that their contributory pension will also not provide quite enough to meet their needs. An independent review of your pension now will allow you to better understand the real value of the payments your current scheme will provide. It will also allow you to make amendments to your scheme or to supplement it in a variety of ways to ensure you are protected for the future.

What pension types can be reviewed?

A pension review can cover any of the pension types, such as defined contribution pensions (DC), defined benefit pensions (DB), personal or executive pensions, and others. Most frequently, the people seeking independent reviews are those in a DC or DB pension. This is because, by definition, a self-employed person who takes out a personal pension is usually actively involved in the pension type as they are sole traders or company owners.

Contributory pension holders don’t have to be as actively involved and so often lack key knowledge about their pension. However, for those making additional voluntary contributions into a personal retirement savings account (PRSA) as part of a contributory scheme, it’s very likely that they will need to be actively involved if they want the best outcome for their pension investments. A pension review will highlight whether the investments being made within such accounts are suitable to the individual’s current circumstances and future goals.

A Defined Contribution pension (DC) is one in which you share the payments with your employer. For example, you might pay 6% of your salary into your pension pot each month and your employer supplements this with an additional payment, usually of a higher percentage such as 14%. This is entirely dependent on the company you work for.

A Defined Benefit pension (DB) is one whereby you are given a set value that you will receive at pension age. This is usually based on years in service and salary level throughout your career.

People on a DC or DB pension scheme have had their fund managed by their employer and its scheme trustees and therefore they have been at a distance from the scheme management throughout their careers. As we move closer to retirement or early retirement it is advantageous for those on a DC or DB pension to take independent pension advice to make sure the pension type is still suitable for their personal circumstances.

Case Study

EXAMPLE 1 – LOW GROWTH FUND

Michael

Michael had a number of individual pensions throughout his life. At age 47 he decided to have a pension review.

His largest pension was invested in a low risk fund, returning only 2% per year. This meant that his growth potential was stunted, and his returns over the past 8 years had barely kept pace with inflation.

After a quick chat, we decided to consolidate his 3 funds into a single master fund which we invested into a 4.5% return fund. This allowed Michael to compound growth and get ready for his golden years in peace. After 10 years, his funds have doubled in size and he is in line for a very comfortable retirement.

EXAMPLE 2 – NO GROWTH FUND

Colette

Colette at 32 has just moved jobs.

She had 12 years of service with a UK bank, and decided to conduct a pension review. Her old pension was being partially held in a cash fund. This means that she was earning zero interest on her investments and in real economic terms, she was actually losing money due to inflation.

We transferred her UK pension back to Ireland and reinvested her fund into a medium-high risk return account. This allowed Colette to grow her fund as quickly as possible at her young age and get regular updates on her fund performance.

Pension investment options

What are my pension contributions being invested in?

Understanding how your pension is invested is a crucial step in managing its performance. For many people, engaging with the investment and the sectors that it is involved in can often be too much information, but it is useful to know. A pension review can help you with this. Pensions are broadly invested in a number of key sectors or classes, including property, bonds, equities and cash.

The level of engagement you will need to have when it comes to investment selection within your pension will vary from scheme to scheme. However, it’s typically advisable to periodically assess whether your current investments make sense in the context of your personal circumstances and retirement goals, and whether or not there’s anything that you could be doing differently for the benefit of your future self.

European Union Risk Rating

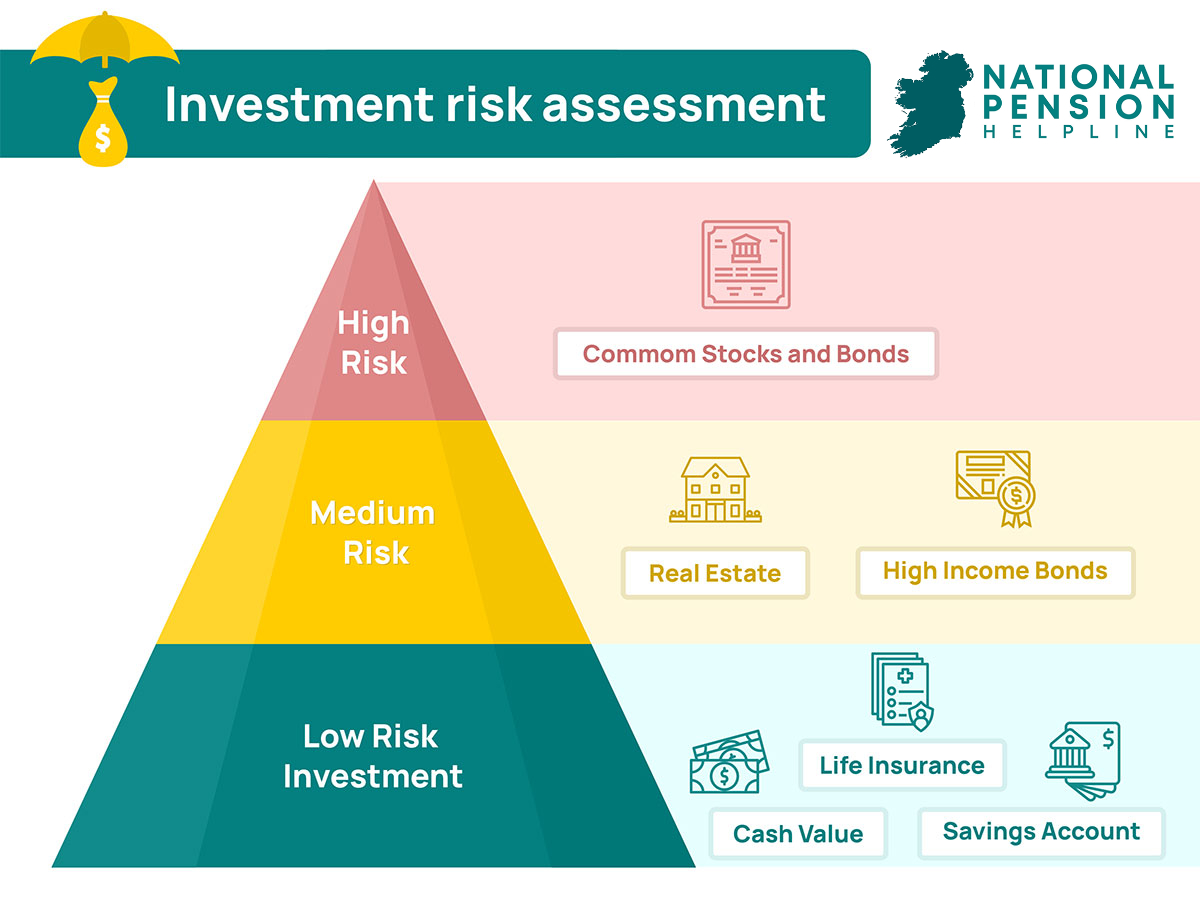

As a member state of the European Union, Ireland’s pension landscape is controlled by EU legislation. As part of this, the EU publishes risk assessment reports on the industries and sectors that pensions are invested in. A pension is an investment just like any other and faces risk, allowing its value to go up or down throughout its lifespan.

The EU publishes a numbered scale, currently numbered 1 to 7, that represents the level of risk your pension scheme is engaging with, in its investment management. Funds with a higher risk (up to 7) represent funds that usually pay greater dividends but are at a much greater risk of losing value. Those with a lower risk (starting at 1) represent fund types that usually pay lower dividends but are less likely to put your ultimate pension value at risk.

Despite the European Risk Ratings, you should still gain an independent understanding of investment risk and what it actually means for your pension.

Many commentators agree that the biggest risk associated with investing is not investing at all, and the second biggest risk is not investing in so-called ‘risky investments’ simply out of fear of losing money.

Generally speaking, the younger you are, the more risk you can afford to take on with your investments. With that in mind, carrying out a pension review alongside a qualified advisor will shed light on whether or not you could be taking on more ‘risk’ in order to optimize the returns on your pension investments.

Management Fees

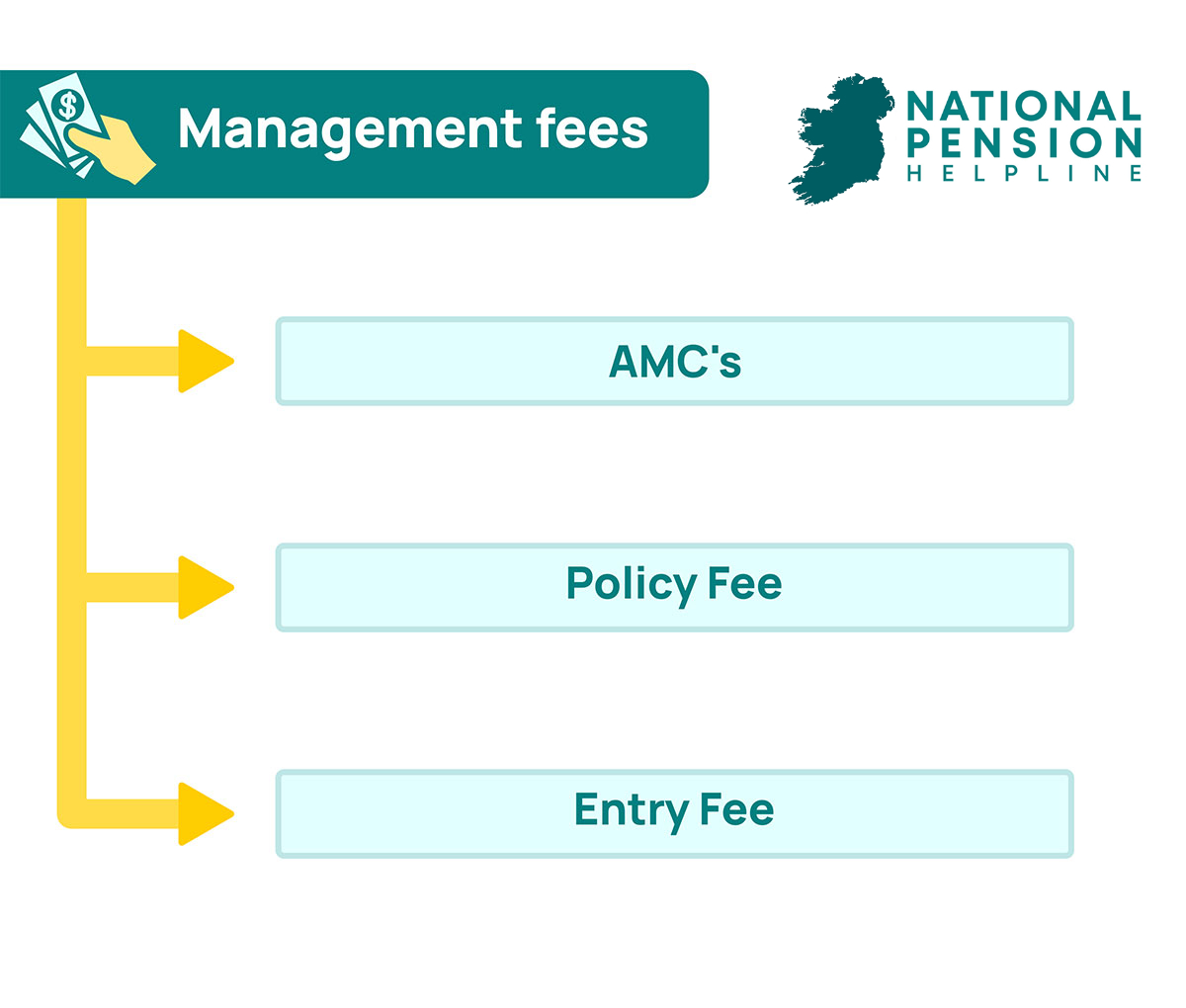

What are management fees and how much am I paying? The financial institution that manages your pension on your and your company’s behalf will charge a fee to manage it. This fee differs between companies and pension types but it is important to be aware of how much it is and if there is better value to be found elsewhere. Generally, there are three types of management fee: AMCs, Entry fees and Policy fees

AMC stands for Annual Management Charge and is a percentage payment based on the value of your fund. As an example, it could be 0.5% of fund assets per year. As it is charged annually this is a repeat payment and can have an impact on funds.

Entry fees and bid/offer charges refer to the difference between the amount that is paid in and the amount that is used to invest. Entry fees are a percentage of contributions. So, if the entry fee is 2% then for every €100 contributed only €98 will actually be invested.

Policy fees refer to the amount charged each month by the pension provider to be a member of the scheme. It’s often a fixed amount of, for example, €4 per month. In a contributory pension arrangement, this is sometimes paid by the employer.

There are a range of other fees that are also linked to the normal management of your scheme such as custody and trustee fees, dealing costs, and taxes that are applied to certain fund types. A pension review will allow you to better understand each of these.

How often should I review my pension?

This is a personal choice and is dictated by how actively you want to be involved in your pension management.

Those who choose to stay actively involved in their pension scheme review their funds regularly, often every 12 months.

They are eager to monitor how the fund is progressing and if there is value to be won by making adjustments. Many people treat their pension the same way they would assess any other investment that they might make.

Being actively involved will help you to protect your pension and ensure it delivers what you need at retirement.

Get Irelands best pension advice

For the best pension advice in Ireland, The National Pension Helpline has a panel of vetted pensions experts who can help.

Just submit your information through our online assessment below and you’ll be matched with the expert best suited to your situation.