Private or Personal Pensions can be a way for the self-employed or people working with a company which does not have a pension scheme to take charge of their savings for retirement.

While employees of a company can relax and take part in a group pension scheme, those working for themselves, or without an occupational pension must research and handle what pension product they desire to secure their future.

Table of Content

Types of Private Pension

There are multiple different types of private pension plans available in Ireland, with different options changing depending on how the individual wishes to see their money invested, the level of return they seek, and the level of risk they are willing to accept on their investment.

What are the Benefits of a Private Pension

Having a private pension scheme is a reliable way for a self-employed person to ensure that they will have a solid income in retirement. It is also an option for people working with a company which does not offer an occupational pension scheme.

Pension Contributions

Pension contributions are the payments made by an employee or self-employed person into their chosen pension scheme. Contributions may be made in regular fixed payments, deducted from paychecks, or in additional voluntary payments.

How much a person should contribute to their pension fund depends on the amount of income they wish to have in retirement. Pensions are also an extremely tax-efficient way of saving money, with income tax relief available for contributions based on age.

Pension Withdrawals

Typically a person with a PRSA or Personal Pension Plan can begin drawing down their pension from the age of 60. However, if you are a PAYE employee with a PRSA and leaving service, it can be drawn down from the age of 50.

However, there are options for people to cash in their pension early, and to begin receiving some of the benefits from the age of 50.

Depending on what pension you have, and what the rules of the scheme are, you may be able to receive a tax-free lump sum of up to 25% of the value of the pension fund. The balance of the fund must then be reinvested in an Annuity or Approved Retirement Fund (ARF).

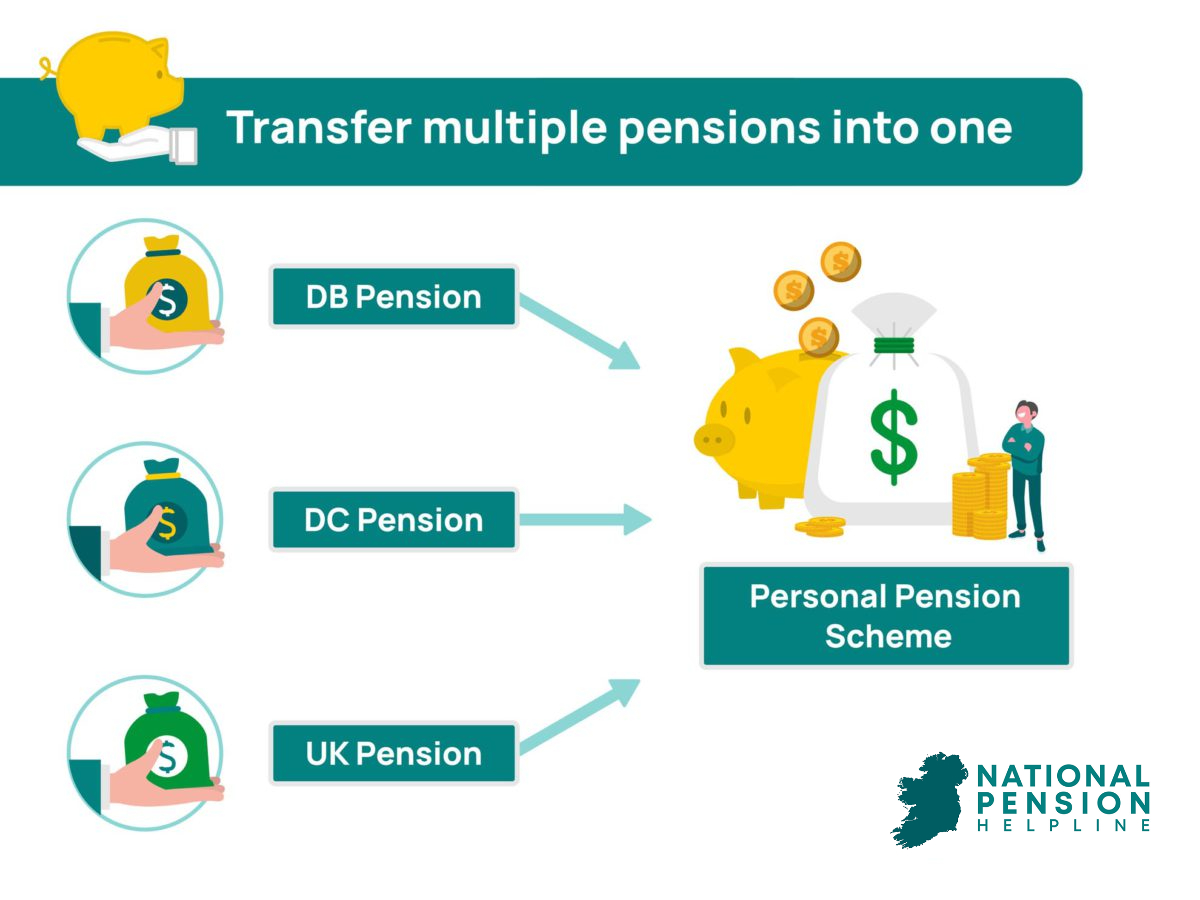

Pension Transfers

Pension products are highly varied in Ireland, and at many points in their life, people might find themselves wanting to transfer their pension, group different pensions together, or move to a fund that they think is more advantageous.

Before transferring to a new pension, people should think carefully about any costs associated with changing pension providers and the tax implications. Consideration should be how certain they are about receiving greater benefits by moving pensions instead of staying put.

Personal Pension Review

Investing in a pension is a long-term process, carried out over decades to prepare for retirement. It would be foolish to simply start a pension while young, and then continue onwards for decades without reviewing the progress of a pension fund.

How to Start a Pension

Starting a pension is something which should be done in consultation with an experienced financial advisor to ensure that you are getting the best pension product for your needs.

When choosing between different private pension plans, a financial advisor can help you choose between a PRSA or PPP, and between different providers, based on your income and desired lifestyle on retirement.

The other big part of starting a pension is deciding how much risk you are willing to accept. The main types of pension investments are Equities, Property, Cash, and Bonds. Each of these will come with different levels of risk and projected returns. Decide how much risk you are willing to take with your pension.

Start Your Personal Pension Today

To learn more about your Self Employed pension options and to figure out what option works best for you, fill out our eligibility quiz and a trusted financial advisor will be in touch for a free consultation.