Introduction

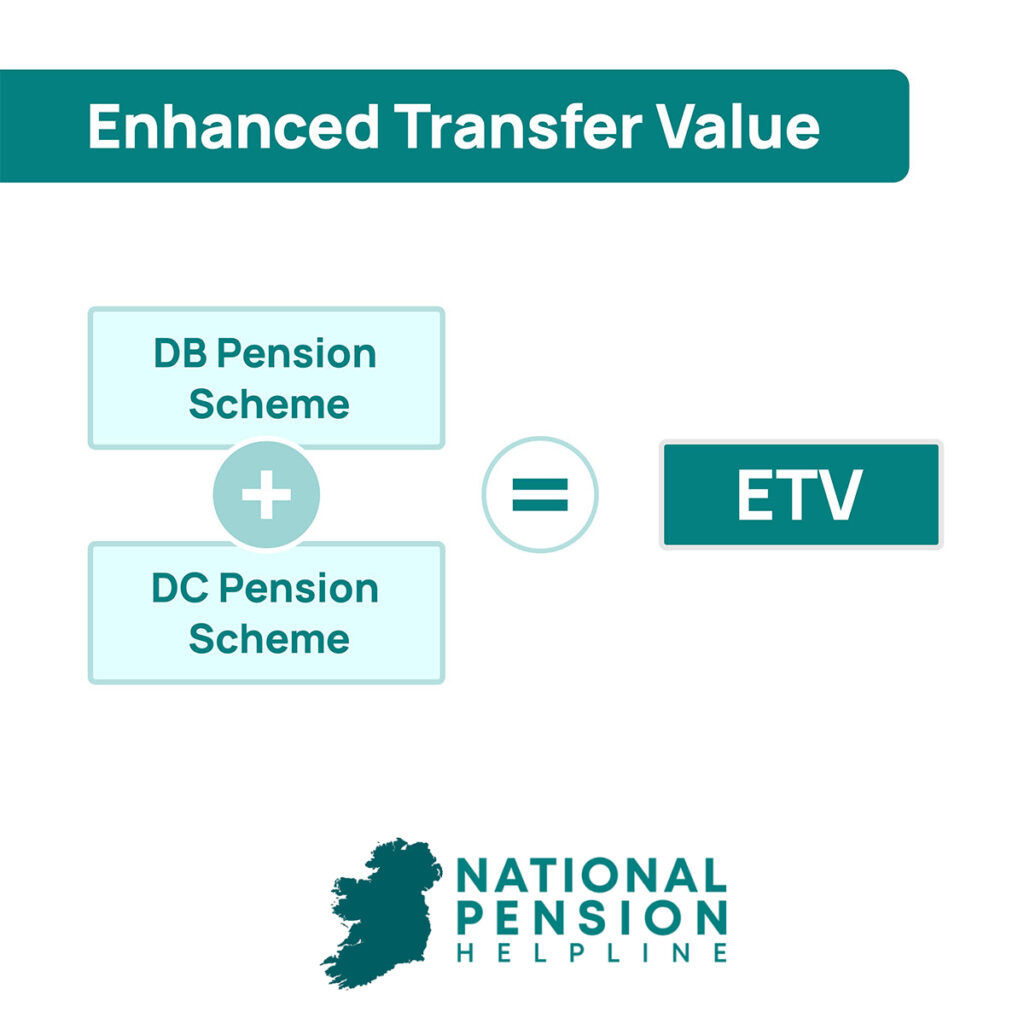

An Enhanced Transfer Value is an offer to encourage deferred members to consider moving out of the company’s defined benefit pension scheme. This enhanced pension transfer value is the companies’ way of moving people from a Defined Benefit scheme to a defined contribution scheme which you control, typically a Personal Retirement Savings Accounts (PRSA) or a Personal Retirement Bond (PRB).

Reducing the number of members reduces the risk for the scheme overall and allows the company to plan better for the future. This reduction in risk is why it makes sense for companies to provide enhanced transfer values.

Many defined benefit schemes are underfunded, creating the risk that they will not be able to pay out the levels of retirement benefit they promised at the outset. If the pension pot cannot cover your DB pension in future this will be a major issue and may require some form of government intervention, similar to the case of Waterford Crystal* where the workers had to spend years suing the government in the EU courts to reclaim their pensions.

Hence the term defined Benefit Conundrum: is it better to stay or to avail of your enhanced pension transfer value now?

Enhanced Transfer Value & Defined Benefit Pensions

Everything you need to know

On paper, staying in a Defined Benefit Pension is advantageous to the member – but only if pension fund has enough liquidity to support it. Many people with a scheme such as this are unsure as to whether to stay in it or transfer out – especially if they are offered an attractive Enhanced Transfer Value.

If you need help with deciding what to do with your DB pension then get in touch – we are a 100% cost and commitment free service.

Taking advice before deciding is critical for any DB holder considering accepting an Enhanced Transfer Value. Our team of expert pension advisors (regulated by the Central Bank) will help you choose the right path for your specific situation.

Table of Contents

What is an Enhanced Transfer Value?

An Enhanced Transfer Value is an offer made by a company to “buy out” the members of their Defined Benefit (DB) pension scheme. Typically an enhanced transfer value is 20-30 times your annual retirement package.

The Enhanced Transfer Value is a once-off offer from your previous employer. It’s designed to give you enhanced benefits in the form of the value of your existing pension plus additional benefits to protect and grow your pension in the future. It is usually a very advantageous offer which will generally benefit the member financially if they choose to avail of it.

It can be particularly beneficial to deferred members. Deferred members of defined benefit schemes are those who have left the scheme early due to changing job, for example, but are still entitled to a benefit from the scheme when it matures at retirement age. Very often, deferred members will have another pension scheme in place with their new employer, and so, transferring an older DB pension to a new pension arrangement can be very attractive.

Risks of being a deferred member of a defined benefit pension scheme

A Defined Benefit pension is based on the principle that you will receive a guaranteed retirement income at a certain value. However, it is very important to note that many DB schemes are over subscribed and so the benefits that were predicted at the outset are merely predictions. They can and usually do change by the time your retirement age comes around.

This is because, while the predictions can be very attractive, they are only a promise of a future payment – rather than a guarantee. If a company cannot persuade enough members to transfer out they will be unable to fund the pension going forward. DB pensions were very popular during the past few decades and were created on the basis of a long-term career with the one company.

However, the economy has changed and people move from job to job, sometimes picking up a number of different pension pots as they change roles. This leaves an accumulation of deferred members who have moved on but are still due a pay-out on retirement. If the company cannot manage the number of members, the fund value will fall and the predicted pay-out for your pension will be reduced – sometimes by a large percentage. This is why many people choose to take an Enhanced Transfer Value when it is offered.

It allows them to move their pension pot into another vehicle which will give them greater security, better flexibility and more control of their pension. If you are being offered an Enhanced Transfer Value for your pension then get in touch with a pension advisor to explore whether it will be in your favour to accept it or not.

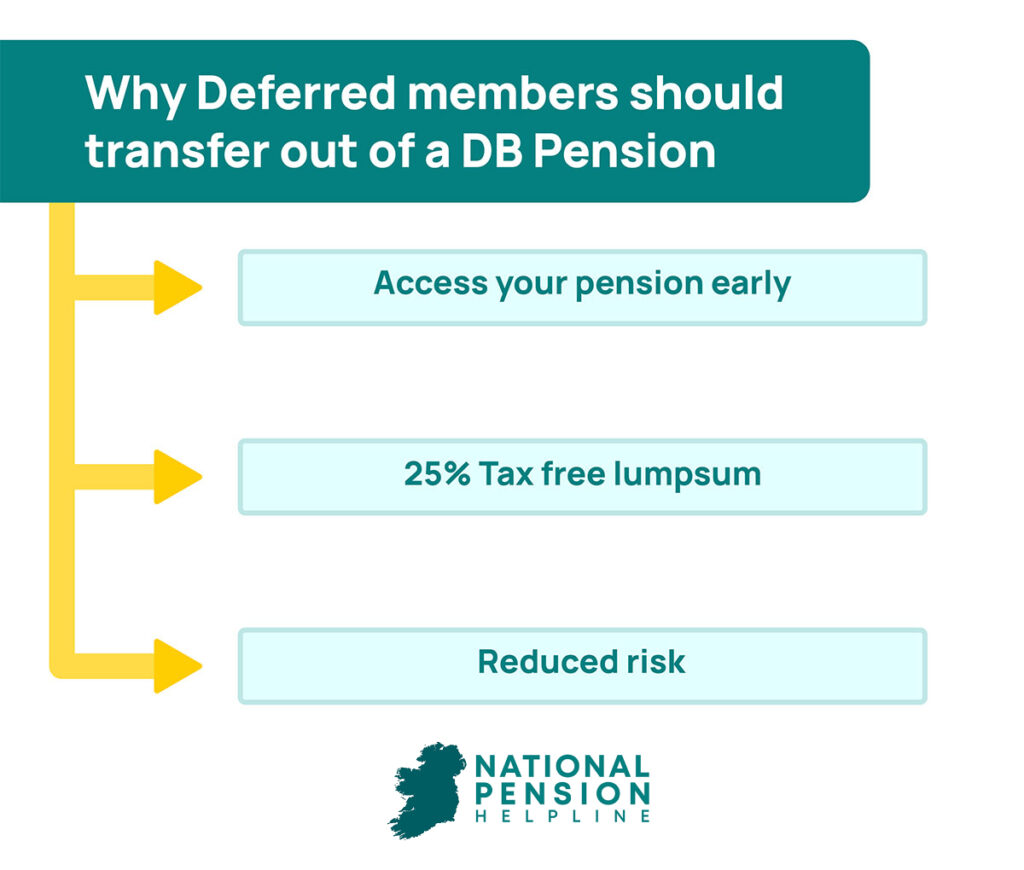

Reasons a Deferred member should transfer out of a DB pension

There are a number of good reasons to take an Enhanced Transfer Value if your company offers you one.

The first is that it can allow you to access your pension early. If you transfer to a Personal Retirement Savings Account (PRSA), you can draw down your pension from the age of 60.

If you have stopped working there are certain situations where you can transfer your funds into a personal retirement bond and start to draw down payments in your 50s. If this is attractive to you, then seek advice from a pension advisor who can take you through all aspects of this.

When you transfer your DB pension into a Personal Retirement Savings Account (PRSA) you have the option to take a 25% tax free lump sum from your pension.

This is very attractive to many people as it is an unexpected windfall from their career pension investment at a time of life when it can be put to good use. By moving your pension into a personal scheme in your own name you have much greater flexibility and freedom to develop your pension and help it grow.

By moving into a new arrangement you can reduce the risk associated with remaining in a Defined Benefit scheme that is sometimes unpredictable in its outcome.