If you’re serious about retirement planning and well versed in the benefits of pension investing then you’ve no doubt come across the advice to “maximise your pension contributions” and “make sure you’re in the right funds”.

These two tidbits of advice, in combination with starting a pension at an early age, are what will lead you to a seven figure pension pot in retirement.

However, did you know that in Ireland, there is such a thing as having too much of a pension.

Sounds bizarre right? Surely, the powers that be would want you to have as much of a pension as possible in order to ensure that you have a comfortable retirement and aren’t overly relying on the State for financial support.

But alas, it all comes down to taxation and, more specifically, ensuring that those planning for retirement don’t ‘abuse’ the pension system as a means for wealth accumulation and tax avoidance.

The mechanism by which this behaviour is discouraged is called the “Standard Fund Threshold (SFT)”. This article seeks to explain the Standard Fund Threshold in more detail.

Table of content

What Is The Standard Fund Threshold?

In the words of the Irish Government, “the Standard Fund Threshold is a ceiling on the total capital value of tax-relieved pension benefits that an individual can draw upon in his or her lifetime from all of that individual’s pension arrangements”.

Put simply, there’s a limit on how much can be in your pension pot and if you exceed that limit there are some not-so-favourable taxation consequences.

According to Jim Connolly (Head of Retirement Planning, AIB) the Standard Fund Threshold was introduced in 2005 for the purpose of dealing with tax arbitrage whereby wealthy individuals were abusing older pension rules to accumulate millions worth of pension assets.

At that time, the Standard Fund Threshold was set at €5M, but as a result of the financial crisis, it was reduced to €2.3M in 2010 and further reduced to €2M in 2014 where it has remained for the past 10 years.

How does the Standard Fund Threshold work? The Standard Fund Threshold operates around what are known as Benefit Crystallisation Events (BCEs). According to Revenue, each of the following constitutes a Benefit Crystallisation Event:

In essence, anytime a Benefit Crystallisation Event occurs, the individual uses up part of their Standard Fund Threshold.

The extent to which the Standard Fund Threshold is utilised is dependent on the sum total capital value attributed to the Benefit Crystallisation Event in question and previous Benefit Crystallisation Events.

The capital value attributed to a Benefit Crystallisation Event will be arrived at in different manners depending on the pension arrangement itself i.e. defined benefit pension arrangements versus defined contribution pension arrangements.

Exceeding The Standard Fund Threshold

So, what happens if the Standard Fund Threshold is exceeded?

In the event that the capital value of a Benefit Crystallisation Event, either individually or cumulatively with prior Benefit Crystallisation Events, exceeds the Standard Fund Threshold of €2M, a “chargeable excess” arises and a tax charge equal to 40% of the excess is immediately applied.

Now, if you’re thinking to yourself “that doesn’t sound too bad” you haven’t heard the worst part yet! When the individual draws down the remaining post-tax excess as a pension they will suffer further taxation at the individual’s marginal rate! According to a report provided by KPMG in 2024, in the case of a marginal rate taxpayer, the combination of the taxation of the chargeable excess over the Standard Fund Threshold and the ordinary taxation of pension benefits may lead to an effective tax rate of 68.8% on chargeable excess above the SFT.

This means that, in theory, one might have actually been better off receiving the pension contributions as regular salary payments seeing as 52% is better than 68.8% – a rare instance where opting to receive earned income is a tax-efficient decision.

Granted, in practice, this would depend on the investment performance of the invested contributions and whether the capital appreciation of such outweighed the higher effective tax rate on the chargeable excess over the Standard Fund Threshold.

Regardless, the system is set up in such a way as to discourage the accumulation of capital in excess of €2M within an Irish pension.

The Standard Fund Threshold Is Broken

Fortunately, there is widespread agreement, both within Government and amongst leading financial institutions, that the Standard Fund Threshold is in need of a change.

In December 2023, Minister for Finance Michael McGrath announced a targeted review of the Standard Fund Threshold regime and opened a public consultation on the matter.

The review was prompted by the 2022 report of the Commission on Taxation and Welfare entitled “Foundations for the Future” which, as part of a large number of recommendations covering various aspects of taxation in Ireland, suggested that the Standard Fund Threshold should be periodically benchmarked to an appropriate and fair level of estimated retirement income.

As part of the public consultation, there were a number of reports submitted by leading institutions such as KPMG, The Irish Tax Institute and Chartered Accountants Ireland among others.

KPMG noted that as the Standard Fund Threshold has not changed since 2014 it is not reflective of economic, social or demographic changes that have occurred over the past decade nor is it reflective of the Irish State’s current fiscal position as compared to the fiscal position in the years following the financial crisis i.e. when the current Standard Fund Threshold was set.

Therefore, the Standard Fund Threshold should be reviewed and adjusted to take account of:

According to KPMG, the Standard Fund Threshold of €2M was likely set in 2014 to discourage defined benefit pensions above €60,000.

The rationale behind this is that the ‘capital value’ of a €60,000 per annum pension would have been €1.8M (based on a ‘capitalisation factor’ of 30 i.e. €60,000*30 = €1.8M) plus the maximum tax-free lump sum of €200K – giving a Standard Fund Threshold of €2M.

Therefore, when “rebasing” the Standard Fund Threshold, the two elements to consider are;

a) The capital value of the pension and

b) The tax-free lump sum.

In KPMG’s preferred scenario (see Image 1), they would have the maximum pension capital value and the maximum tax-free lump sum rebased to €2,974,800 and €500,800 respectively, resulting in a rebased Standard Fund Threshold of €3,475,600.

That’s an increase of 73.78% which, in turn, would mean that Irish retirees could accrue 73.78% more assets in their pensions before being penalised with 68.8% effective taxation!

Table 1 – Source: Examination of the Standard Fund Threshold (KPMG, 2024)

Cumulative effect of adjustments to SFT (adjusted in line with CPI)

| Pension capitalised value (€) | Tax-free lump sum (€) | Cumulative impact on SFT (€) | |

|---|---|---|---|

| 2014 amount | 1,800,000 | 200,000 | 2,000,000 |

| Inflation adjustment (21.5%) | 387,000 | 43,000 | 430,000 |

| Long term interest rate adjustment | 510,300 | – | 510,300 |

| Increase in life expectancy rates | – | 145,800 | 145,800 |

| Socio- economic developments | – | 72,000 | 72,000 |

| Rebased amount | 2,697,300 | 460,800 | 3,158,100 |

Table 2 – Source: Examination of the Standard Fund Threshold (KPMG, 2024)

Cumulative effect of adjustments to SFT (adjusted in line with average earnings growth rate)

| Pension capitalised value (€) | Tax-free lump sum (€) | Cumulative impact on SFT (€) | |

|---|---|---|---|

| 2014 amount | 1,800,000 | 200,000 | 2,000,000 |

| Increases in average wage adjustment (34%) | 612,000 | 68,000 | 680,000 |

| Long term interest rate adjustment | 562,800 | – | 562,800 |

| Increase in life expectancy rates | – | 160,800 | 160,800 |

| Socio- economic developments | – | 72,000 | 72,000 |

| Rebased amount | 2,974,800 | 500,800 | 3,475,600 |

But that’d be just to bring the Standard Fund Threshold from 2014 into 2024. In line with Commission on Taxation and Welfare’s suggestions, the Standard Fund Threshold would then, according to KPMG, be periodically adjusted using an “earnings adjustment factor” among other factors including life expectancies, interest rates and socio-economic developments. KPMG also put forward further suggestions including:

Of course, KPMG’s submission along with all of the other public consultation submissions are just suggestions for the Government to take on board when assessing the Standard Fund Threshold regime. Ultimately, the decision lies with the Irish Government as to how the Standard Fund Threshold will be amended. But it seems quite likely that significant positive change will come to fruition.

How To Manoeuvre Around The Standard Fund Threshold

In the meantime, the question remains as to how one should manoeuvre around the Standard Fund Threshold. Davy provides some interesting insights into the most effective strategies that have been implemented for their clients when dealing with the Standard Fund Threshold.

1. Cease future pension contributions

This was briefly alluded to earlier in the article whereby we asserted that you’d likely be better off receiving a salary in lieu of further pension contributions that would place your pension over the Standard Fund Threshold.

Reason being, the chargeable excess would be liable to tax at an effective rate of 68.8% versus 52% under PAYE. Therefore, a simplistic yet effective strategy is to cease pension contributions and direct that capital elsewhere – perhaps into a non-pension investment(s).

NPH Top Tip: One of the most tax-efficient transactions you can make outside of a pension is an investment that’s covered under the Employment Investment Incentive. This could be a worthy consideration for those at the Standard Fund Threshold looking for a non-pension investment!

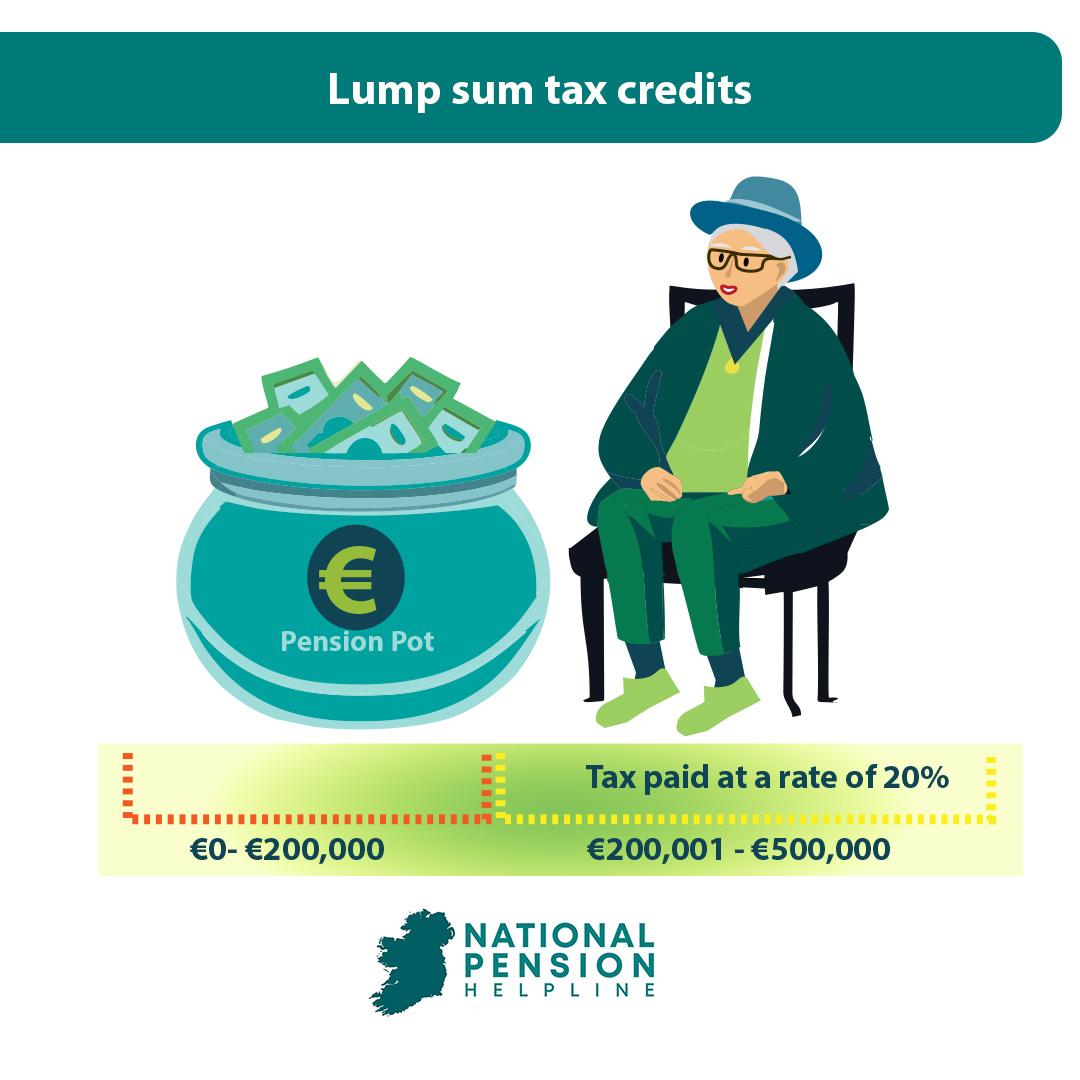

2. Avail of lump-sum tax credit

As per Revenue, tax paid at a rate of 20% on the amount of cash lump sums taken from pensions between €200,001 – €500,000 may be offset against tax arising from any chargeable excess over the Standard Fund Threshold.

There are no other reliefs, allowances or deductions permitted to be offset against chargeable excess tax.

This means that, where sufficient lump sums have been taken, an additional €150,000 above the Standard Fund Threshold can be achieved before chargeable excess tax is due.

The figure of €150,000 is derived from the fact that €60,000 worth of tax would be paid on lump sums between €200,001 – €500,000 (i.e. €300,000*20%) and €150,000 over the Standard Fund Threshold would yield chargeable excess tax of €60,000 (i.e. €150,000*40%) which would be offset entirely by the tax incurred on the lump sums.

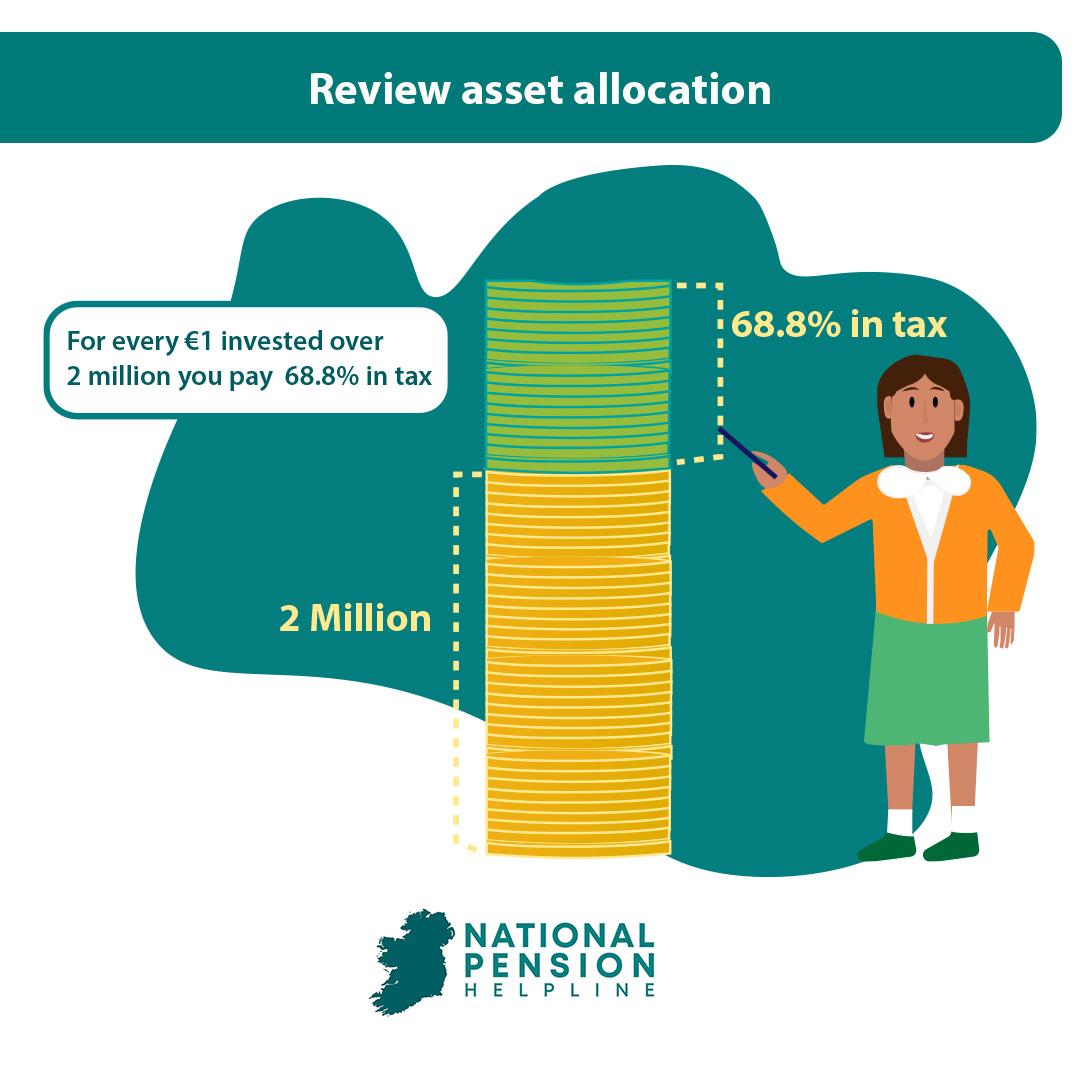

3. Review asset allocation

Due to the existence of the Standard Fund Threshold, there is an effective limit on the risk/reward profile of certain investments.

As an example, with equities, over short and/or medium time horizons, we can expect a relative degree of price volatility on both the upside and downside.

However, for every €1 invested in equities over the Standard Fund Threshold, our upside is significantly limited (i.e. due to effective taxation of 68.8%) while we still hold all of the downside risk.

Therefore, it may make sense to revise one’s asset allocation in the context of both the Standard Fund Threshold and the individual’s personal circumstances as well as their attitude towards and tolerance for risk.

4. Access benefits early

For those who have early access to pension benefits, say, at age 50 (i.e. those with occupational pension schemes where they are no longer working for the company), it may make sense to “access” these benefits as early as possible in order to trigger a Benefit Crystallisation Event.

One such strategy would be to take a tax-free pension lump sum and/or transfer the remaining balance to an Approved Retirement Fund (ARF).

A Benefit Crystallisation Event will be deemed to arise on both the lump sum and the capital value transferred to the ARF.

However, the Standard Fund Threshold does not apply to the value of pension assets within an ARF once transferred. Therefore, investment returns post-transfer can be achieved within the ARF without fear of chargeable excess tax. There are specific rules relating to ARFs which you can read more about here.

5. Phasing access to pension benefits

As indicated by Davy, it may be possible to utilise Personal Retirement Savings Accounts (PRSAs) in such a way that the maximum tax efficient amount is accessed as early as possible with the remaining balance deferred until such a time that the individual wishes to incur the chargeable excess tax charge. You can read more about PRSAs here.

Standard Fund Threshold Examples

Let’s take a look at two examples of how chargeable excess tax is calculated and collected in practice.

Example 1

Let’s say the individual has triggered a Benefit Crystallisation Event with a capital value of €5M. There are no previous Benefit Crystallisation Events to be considered. It is assumed that there is no lump sum taxation at 20% to be offset.

Value of current BCE: €5M

SFT: (€2M)

Chargeable excess: €3M

Tax @ 40%: €1.2M

As per Revenue, the chargeable excess of €3M is subject to tax at a rate of 40% under Schedule D Case IV i.e. €1.2M. This charge is deemed to occur in the year of tax assessment in which the Benefit Crystallisation Event which gave rise to the chargeable excess occurred.

As per s787R TCA, the administrator of the pension arrangement shall deduct the tax from the chargeable excess, submit a Form 787S and pay the tax due within three months of the end of the month in which the Benefit Crystallisation Event which gave rise to the chargeable excess occurred.

However, both the administrator of the pension arrangement and the individual are jointly and severally liable for the tax owed. Chargeable excess tax will arise irrespective as to whether either the administrator of the pension arrangement or the individual are resident in the State.

Example 2

Let’s say the individual has triggered a Benefit Crystallisation Event with a capital value of €500K. There are previous Benefit Crystallisation Events equal to €4M to be considered. It is assumed that there is no lump sum taxation at 20% to be offset.

Value of earlier BCEs: €4M

SFT: (€2M)

Chargeable excess: €2M

Tax @ 40%: €0.8M*

*This liability would have been settled by the administrator of the pension arrangement

Remaining SFT: Nil

Value of current BCE: €0.5M

Chargeable excess: €0.5M

Tax @ 40%: €0.2M

Speak the a pension expert today

If you’d like assistance in navigating the Standard Fund Threshold, both now and in the future, The National Pension Helpline has a team of vetted pension experts who can assist you in devising the most optimal plan.