| Description | Calculation | Value |

|---|---|---|

| Your Age: | ||

| Your Income: | € | |

| Pensionable Income: | (maximum €115,000) | € |

| Maximum Contribution: | (age related) | € |

| Your Tax Relief: | € | |

| Employer Contribution: | € | |

| Total Contribution: | € |

Pension contributions in Ireland benefit from a tax incentive whereby income tax relief is applied to earnings that are contributed towards your pension. This tax relief is at your marginal or higher rate of income tax.

Depending on your salary or earnings and your age, there are maximum limits to the amount of income allowed as pension contributions that can benefit from tax relief i.e. you cannot claim tax relief on unlimited pension contributions.

Find out how much you can save for retirement and maximise the tax relief available to you using our maximum pension contribution calculator.

Table of Content

What are pension contributions?

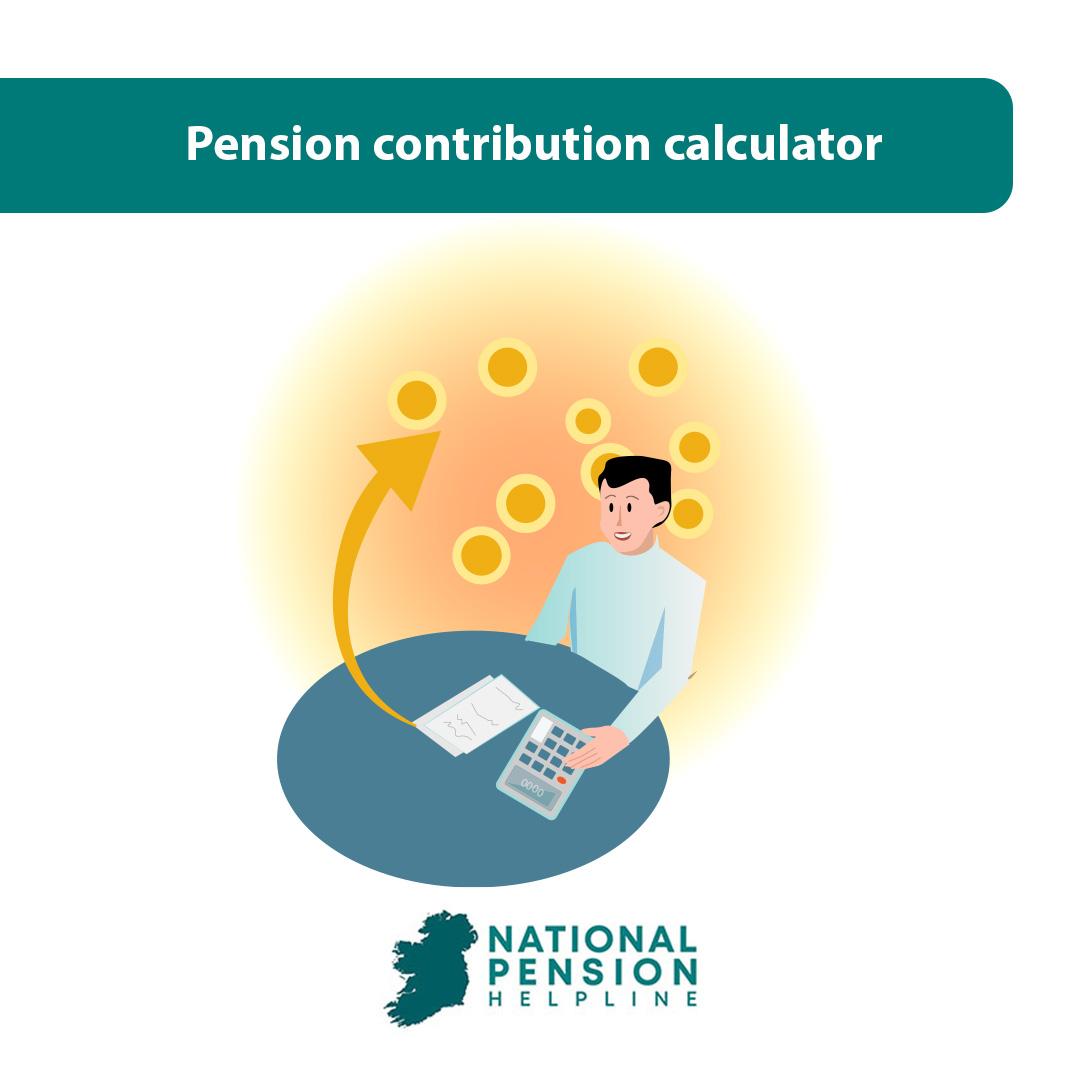

A pension is a long term savings plan to provide an income when you retire. A pension contribution is money that you alone, or you and your employer, or your employer alone, contribute to a pension scheme to provide you with a pension. There are various kinds of pension contributions.

What types of pension contributions benefit from tax relief?

Pension contributions to all types of revenue approved pension schemes benefit from income tax relief. The contributions may take the following forms:

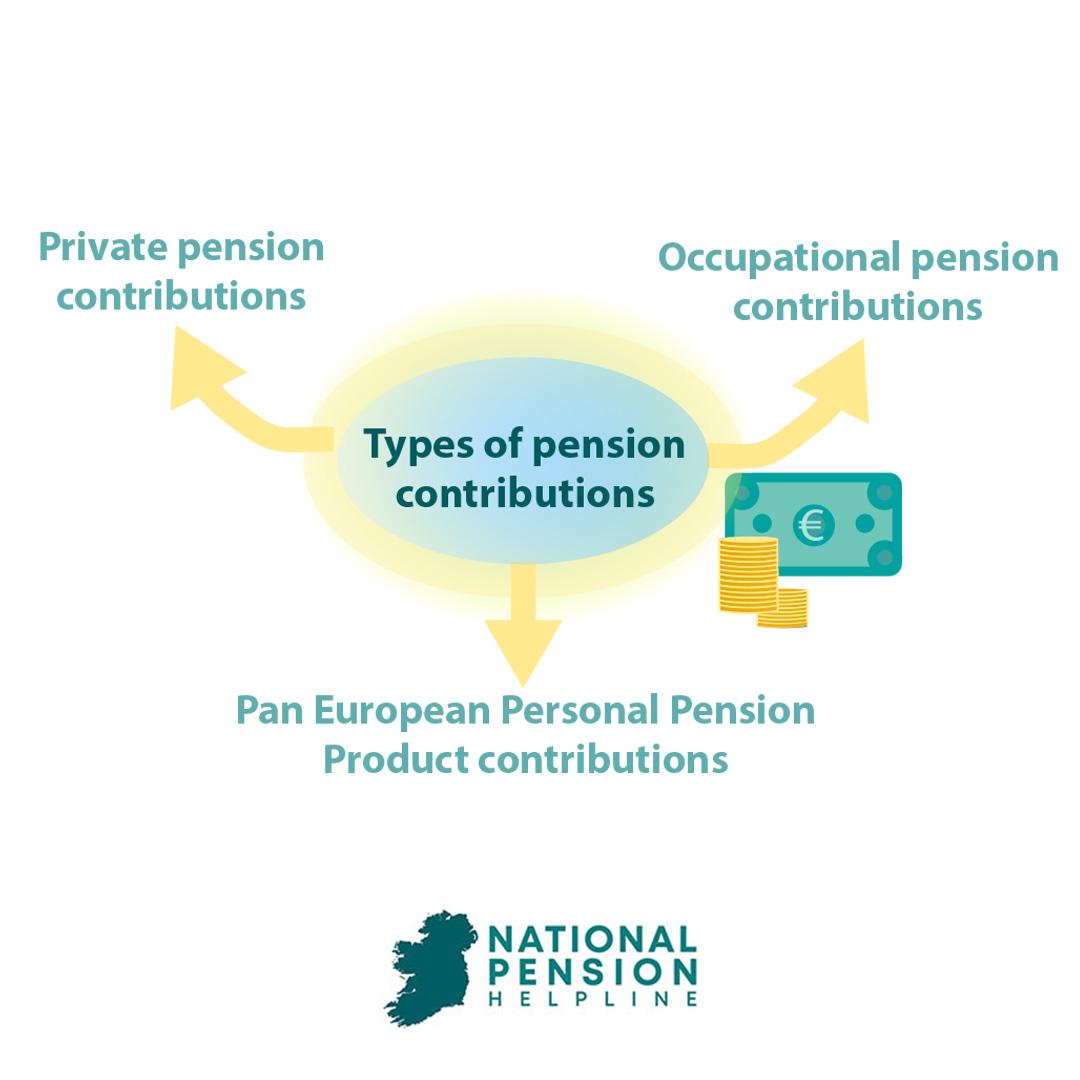

How are maximum pension contributions calculated?

The maximum pension contributions are the maximum contributions that can benefit from tax relief at your marginal rate of income tax.

There is both an age and income percentage related maximum and an overall total earnings limit.

Age related earnings percentage limits

The age related earnings percentage limit sets out the maximum pension contributions that you can make that are eligible for income tax relief.

Where you have more than one source of income, only the income from which the pension contributions are made is eligible for this relief.

| Age | Percentage |

| <30 | 15% |

| 30 – 39 | 20% |

| 40 – 49 | 25% |

| 50 – 54 | 30% |

| 55 – 59 | 35% |

| 60+ | 40% |

Total earnings limit

You can avail of income tax relief on pension contributions on earnings below €115,000 per year.

This total does not include employer contributions to your pension.

Learn more about your pension contributions today

Pensions can be complex and confusing and it is difficult to know how best to save for your retirement.

If you wish to maximise the tax relief you can avail of while saving for retirement, use our maximum pension contribution calculator.

Alternatively, you can contact us and discuss your pension today. Get expert advice and assistance from our experienced and independent pension advisors for your retirement planning.

Similar Calculators

Pension retirement calculator (how much you need to contribute to reach your retirement goals)

Pension lump sum calculator (how much you can withdraw from your pension tax free)

Defined benefit calculator (how much is your DB pension worth at today’s transfer rates)