According to the Central Statistics Office, 1 in 3 workers in Ireland have no pension coverage outside of the State pension. After Budget 2024, the annual State pension equates to €14,419.60.

Given that the average earnings in Ireland is in the region of €47,000, anyone earning that amount with no pension coverage would experience a near 70% drop in their annual income upon retirement! Imagine trying to support your pre-retirement standard of living on just 30% of your pre-retirement income.

For many, it simply wouldn’t be possible, and thus, a decline in standard of living post-retirement would inevitably occur. This level of pension inadequacy isn’t acceptable.

But don’t be fooled, those who do have pension coverage outside of the State pension don’t necessarily have adequate pension coverage.

In other words, having a private pension is one thing, but having enough money in that private pension is another thing altogether. In reality, the majority of workers in Ireland aren’t adequately prepared (financially) for retirement.

But let’s stick with those who have no private pension coverage at all, that is, no occupational or personal pension to their name. The CSO reports that 47% of those workers report “never getting around to organising it and/or putting it off until a future date” as one of the main reasons why they have no pension coverage. This response highlights a fatal weakness in Ireland’s current pension system.

You see, for those in non-pensionable employment (i.e. those who work for an employer with no occupational pension scheme), the onus is currently on the employee to take action towards setting up a personal pension (i.e. a personal retirement savings account or ‘PRSA’).

While this can and typically is facilitated through the employer, the problem is that the process doesn’t happen automatically for the employee. The employee is seldom aware that they have pension options to begin with.

The starting point for solving this problem is getting employees in non-pensionable employment with no pension coverage automatically enrolled into a pension scheme so that they at least have some form of pension coverage outside of the State pension.

Conveniently, the name for such a policy is “Automatic Enrolment” or “auto-enrolment” for short. We know that auto-enrolment is effective in closing pension coverage gaps across different income, occupation and age groups. In fact, our neighbours in the UK have had auto-enrolment in place for over a decade.

In 2021, employees in the UK saved over £114 billion into their pensions, an increase of £32.9 billion in real terms since the introduction of UK auto-enrolment in 2012.

The success of auto-enrolment can be attributed to the behavioural economics concept of nudge theory. Essentially, by making pension participation an “opt-out” choice via auto-enrolment rather than an “opt-in” choice (as it currently is in Ireland), nudge theory suggests that more people will end up participating in a pension by virtue of not opting-out.

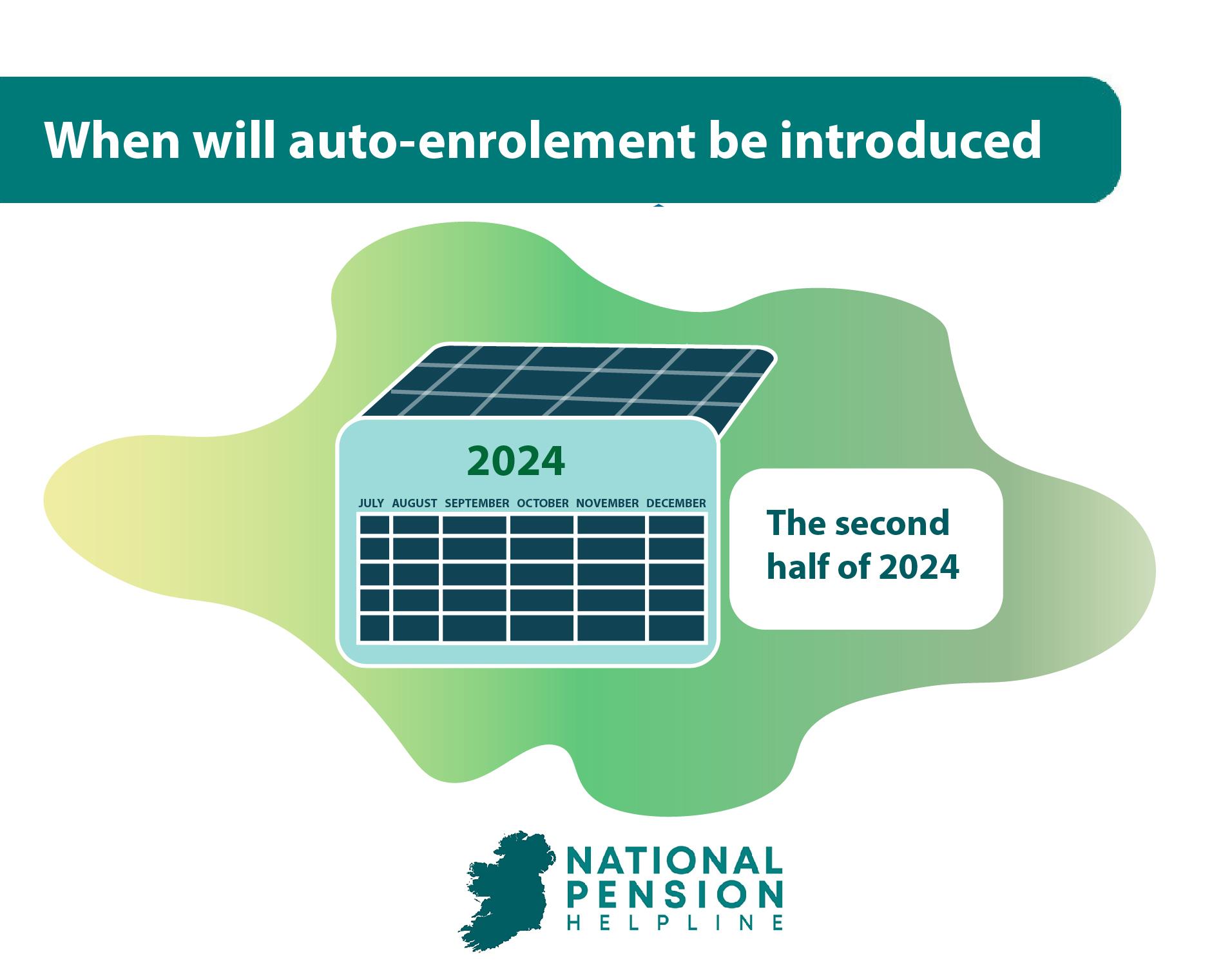

We’ve been behind the curve in terms of pension thinking for years. Fortunately, Ireland is set to introduce auto-enrolment in the second half of 2024. In this article, we’ll be talking about what auto-enrolment will mean for both employers and employees.

According to the Central Statistics Office, 1 in 3 workers in Ireland have no pension coverage outside of the State pension. After Budget 2024, the annual State pension equates to €14,419.60.

Given that the average earnings in Ireland is in the region of €47,000, anyone earning that amount with no pension coverage would experience a near 70% drop in their annual income upon retirement! Imagine trying to support your pre-retirement standard of living on just 30% of your pre-retirement income.

For many, it simply wouldn’t be possible, and thus, a decline in standard of living post-retirement would inevitably occur. This level of pension inadequacy isn’t acceptable.

But don’t be fooled, those who do have pension coverage outside of the State pension don’t necessarily have adequate pension coverage.

In other words, having a private pension is one thing, but having enough money in that private pension is another thing altogether. In reality, the majority of workers in Ireland aren’t adequately prepared (financially) for retirement.

But let’s stick with those who have no private pension coverage at all, that is, no occupational or personal pension to their name. The CSO reports that 47% of those workers report “never getting around to organising it and/or putting it off until a future date” as one of the main reasons why they have no pension coverage. This response highlights a fatal weakness in Ireland’s current pension system.

You see, for those in non-pensionable employment (i.e. those who work for an employer with no occupational pension scheme), the onus is currently on the employee to take action towards setting up a personal pension (i.e. a personal retirement savings account or ‘PRSA’).

While this can and typically is facilitated through the employer, the problem is that the process doesn’t happen automatically for the employee. The employee is seldom aware that they have pension options to begin with.

The starting point for solving this problem is getting employees in non-pensionable employment with no pension coverage automatically enrolled into a pension scheme so that they at least have some form of pension coverage outside of the State pension.

Conveniently, the name for such a policy is “Automatic Enrolment” or “auto-enrolment” for short. We know that auto-enrolment is effective in closing pension coverage gaps across different income, occupation and age groups. In fact, our neighbours in the UK have had auto-enrolment in place for over a decade.

In 2021, employees in the UK saved over £114 billion into their pensions, an increase of £32.9 billion in real terms since the introduction of UK auto-enrolment in 2012.

The success of auto-enrolment can be attributed to the behavioural economics concept of nudge theory. Essentially, by making pension participation an “opt-out” choice via auto-enrolment rather than an “opt-in” choice (as it currently is in Ireland), nudge theory suggests that more people will end up participating in a pension by virtue of not opting-out.

We’ve been behind the curve in terms of pension thinking for years. Fortunately, Ireland is set to introduce auto-enrolment in the second half of 2024. In this article, we’ll be talking about what auto-enrolment will mean for both employers and employees.

Auto-Enrolment for Employees in Ireland

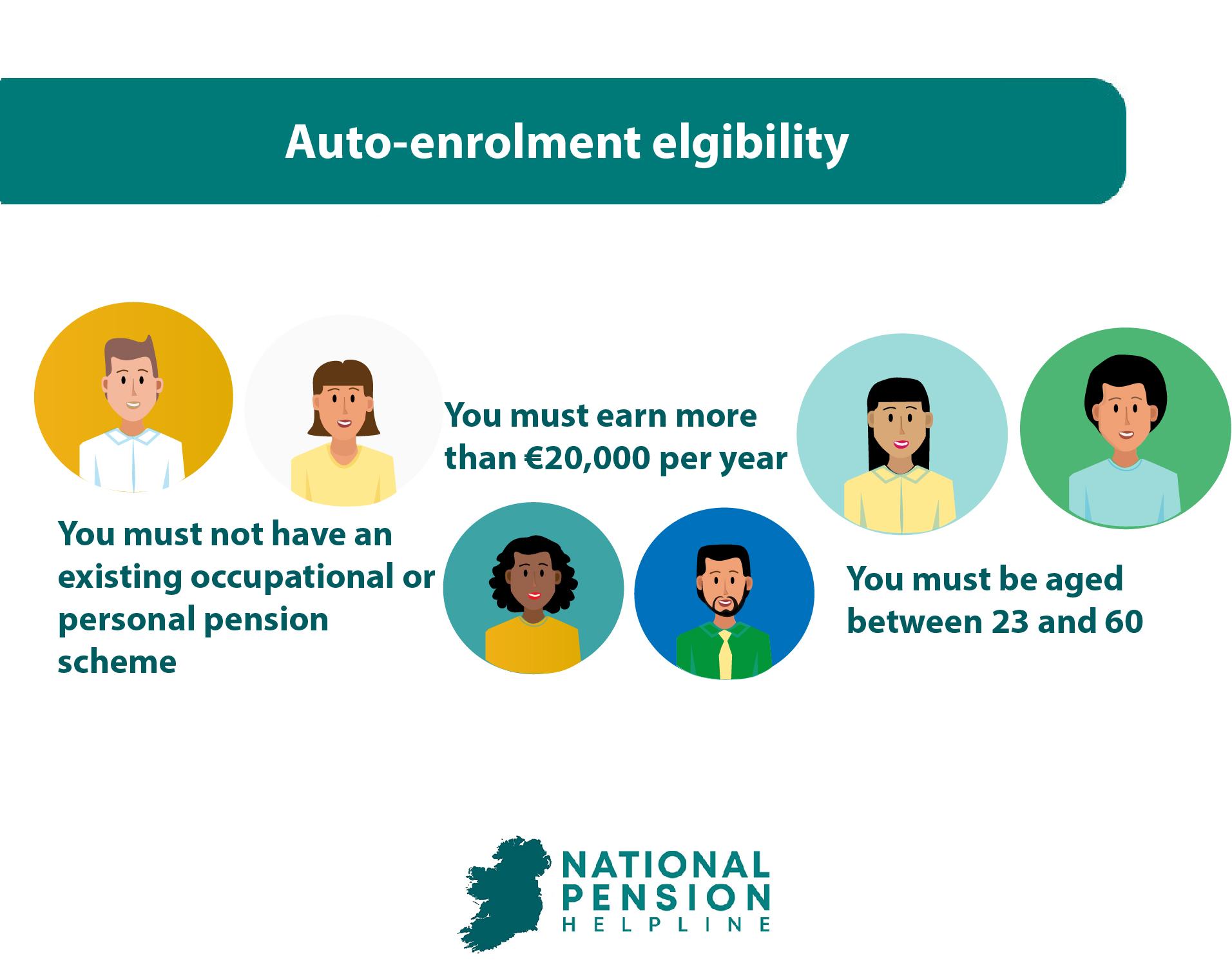

The first thing we need to clarify is what employees will be eligible for Ireland’s auto-enrolment system when it launches in the second half of 2024. There are three requirements you must satisfy in order to be eligible for auto-enrolment in Ireland:

If you satisfy each of these conditions then you will be automatically enrolled into the system when it launches in 2024.

You cannot avail of auto-enrolment if you already have a private pension, it is not possible to do both.

If you earn less than €20,000 per year and/or if you’re outside of the 23-60 age bracket then you can choose to opt-in to the system provided you don’t have an existing occupational or personal pension scheme.

So what does being part of auto-enrolment mean for you?

Most notably, contributions to your pension will be made out of your paycheck before your paycheck hits your bank account.

In other words, you’ll have less money at your disposal each month.

Make no mistake about it, auto-enrolment is a net positive outcome for employees in Ireland. However, there will undoubtedly be the perception that this is “a new tax” of sorts that is being levied by the Government on workers.

This is simply untrue as the money which you’re missing out on today is being invested for the benefit of your future self.

Free Money in your pension

You will be getting free money by participating in auto-enrolment.

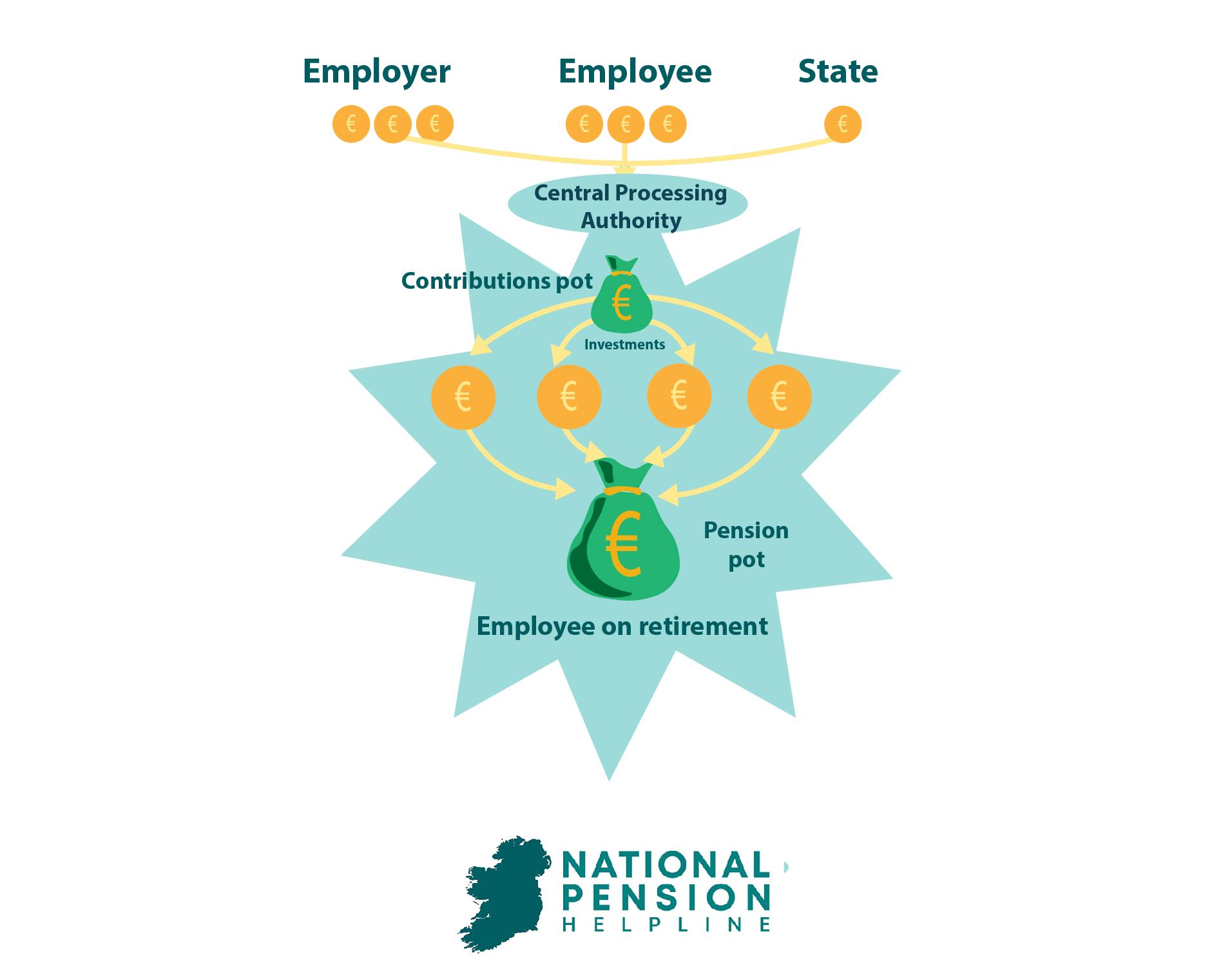

For every €3 that is contributed to your pension from your paycheck, your employer will be required to match this contribution with €3 of their own and the Irish state will also contribute €1.

Put simply, every €3 out of your paycheck results in €7 going into your pension. By definition, this is free money that you wouldn’t have had had you not participated in auto-enrolment. Remember, that €7 isn’t just lying dormant in an account until you reach retirement. It’s being invested in a wide variety of assets which provide investment returns over time thus allowing your pension pot to grow in value.

Idea being that when you reach retirement, in addition to the State pension, you’ll also have the “auto-enrolment private pension pot” to support you financially.

What’s more, if you happen to change jobs you can continue to keep contributing to the same auto-enrolment account. You’ll also be able to view your account online via a portal.

How much money will be taken from your paycheck each month?

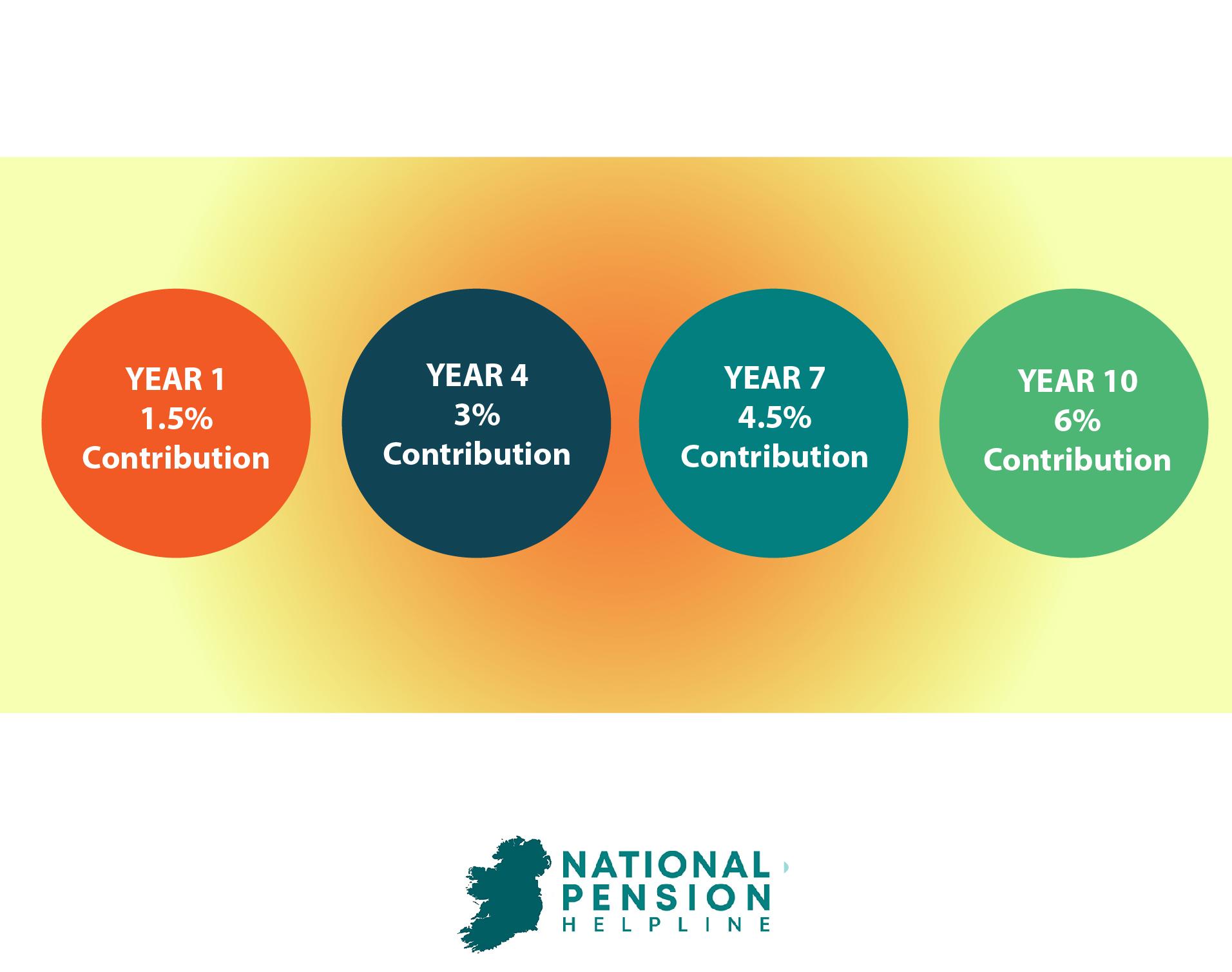

From years 1-3, employee contributions will equal 1.5% of gross pay. In other words, if you’re earning €20,000 per annum, in year one you’d contribute €300 to your pension which works out as €25 per month.

But remember, your employer will match this €300 with €300 of their own, along with €100 from the Irish state, giving you a total yearly pension contribution from all sources equal to €700 in year one.

From years 4-6, the contribution rate will equal 3%, rising to 4.5% from years 7-9 before hitting 6% from year 10 onwards. The idea here is that the increase in contributions is phased in over time thus giving employees, employers and the Irish state time to adjust.

As was alluded to earlier, you do have the ability to opt-out of auto-enrolment if you wish. If you’re enrolled into the system you must stay enrolled for six months. In months 7 and 8 employees can opt-out of the auto-enrolment system. For the first 10 years, the opt-out option will only be available in months 7 and 8 after each contribution rate increase.

An alternative to opting-out is to suspend or pause your contributions which can be done at any time after the mandatory six month entry period.

Remember, if you opt-out or suspend your contributions, all contributions (i.e. employee, employer and Irish state) will cease. If you do choose to opt-out or suspend contributions, you will be automatically re-enrolled into the system after two years provided you’re still eligible.

Will auto-enrolment affect my current pension?

Auto Enrolment Architecture

Unlike traditional pension investments where the individual is spoiled for choice, Auto enrolment has only 4 investment managers, each of whom will provide 4 investment options. These investment options are expected to represent a risk spectrum from 1 – 4.

Automatic Enrolment Saver Journey

Sean works in a factory and his salary is equal to the average annual earnings of €40,000. He is enrolled at the age of 23 and continues to contribute to the AE system until he retires at the age of 66 giving a total contribution history of 43 years.

Breakdown of projected fund at retirement

| Source | € Value | % of total |

|---|---|---|

| Employee contributions | €132,200 | 23% |

| Employer contributions | €132,200 | 23% |

| State subsidy | €44,067 | 8% |

| Net investment returns | €255,917 | 45% |

| Total projected fund | €564,384 | 100% |

Note: This example assumes that Sean has a static career without promotion and that his income grows by 1.5% per year resulting in his salary increasing to about €76,000 by the end of the 43 years.

The Problem with Auto-Enrolment for Employees

While auto-enrolment is a net positive outcome for employees in Ireland (because it’s clearly better to have a pension than to not) there are some downsides of participating in the Irish pension system using auto-enrolment.

To reiterate, the downside is not pensions themselves, but rather Ireland’s proposed system for auto-enrolment. Firstly, there’s the taxation treatment. As was noted by Sage, employee contributions to their auto-enrolment pension will be taken from net income after income tax, USC and PRSI have been accounted for.

This is different to how employee pension contributions are normally treated whereby there’s an exemption from income tax but not USC and PRSI. So which system is better?

Let’s say we have an employee who is earning above €42,000 which is the threshold for the higher rate of Irish income tax of 40% after Budget 2024.

Under auto-enrolment, a net contribution of €60 by the employee would result in a further €20 being invested by the Irish state (i.e. €1 for every €3 invested). This means that the effective gain realised as a result of the Irish state’s participation is 33% (i.e. (€80 minus €60)/€60).

In the case of a non-auto-enrolment pension contribution, we can view the ‘Irish state’s participation’ as the income tax exemption which is afforded to pension contributions. In this case, a “net contribution” of €60 for our higher rate taxpayer would be the same as a gross contribution of €100, with the difference being the €40 that is saved by not having to pay income tax at 40% on €100.

In this case, the effective gain realised as a result of the Irish state’s participation is 67% (i.e. (€100 minus €60)/€60). Therefore, on a pure taxation basis, participating in the pension system via auto-enrolment is less favourable to higher rate taxpayers than self-participation.

For standard rate taxpayers (i.e. those paying income tax at the lower rate of 20%) the position is different. A “net contribution” of €60 for our standard rate taxpayer would be the same as a gross contribution of €75, with the difference being the €15 that is saved by not having to pay income tax at 20% on €75. In this case, the effective gain realised as a result of the Irish state’s participation is 25% (i.e. (€75 minus €60)/€60).

Therefore, on a pure taxation basis, participating in the pension system via auto-enrolment is more favourable to standard rate taxpayers than self-participation. However, when you account for the fact that employer matching is mandated under auto-enrolment, the less favourable taxation treatment for higher rate taxpayers can actually be mitigated to some degree.

This is because if a higher rate taxpayer was to set up PRSA, while they would get income tax relief at 40% on contributions, their employer would not be obligated to contribute to their PRSA. So the net outcome of using a PRSA could actually be worse despite getting better tax relief. However, this is entirely dependent on contribution levels and that brings us to the second downside of auto-enrolment, contribution limits.

As has been made clear by the Irish Government, employee contributions under auto-enrolment will be fixed according to the specified rate schedule over the next 10 years and, as a result, employees won’t be able to contribute less or more than the set rate at a given point in time.

Specified Rate Rules

Auto-enrolment contributions will gradually increase over a period of 10 years from when the system is introduced. Phasing in contribution amounts on a staged basis will allow time for savers to adjust to the contribution rate and for businesses to adjust to the increase contribution costs.

| Years 1 – 3 | Years 4 – 6 | Years 7 – 9 | Years 10+ |

|---|---|---|---|

| 1.5% | 3% | 4.5% | 6% |

The problem is that under the Irish Taxes Consolidation Act an individual can currently make pension contributions in a given year up to the following age-related limits as a percentage of remuneration:

| Up to 30 years | 15% |

| 30-39 years | 20% |

| 40-49 years | 25% |

| 50-54 years | 30% |

| 55-59 years | 35% |

| 60 years and over | 40% |

Translation? An individual under the age of 30 can currently contribute 10 times more money to their pension annually, through the likes of a PRSA, than they’ll be able to contribute using auto-enrolment for the first three years.

An individual over the age of 60 can currently contribute over 26 times more money annually than auto-enrolment will allow for!

This is why auto-enrolment is only ever going to be more beneficial than a PRSA where contributions are low and the harsh reality is that if you’re in that position, then you’re not going to be financially prepared for retirement.

Put simply, if you’re someone who’s serious about retirement planning, then there’s no reason to be relying on auto-enrolment for your participation in the pension system. Again, this is because of the small contribution rates that apply to auto-enrolment.

Even with the mandated contributions from employers and the Irish state, the net contribution pales in comparison to what’s achievable outside of auto-enrolment.

Other notable downsides include:

a) Limited investment selection for contributions.

b) Auto-enrolment funds only become accessible upon reaching the State pension age.

c) Only option for drawing down the funds in retirement is a combination of a tax-free lump sum and a gradual, taxable cash drawdown over time.

All of these downsides can be mitigated by avoiding auto-enrolment. If you’re serious about retirement planning, the available information about auto-enrolment in Ireland would suggest that you’d be better off either setting up a PRSA via your employer or finding an employer who offers an occupational pension scheme.

Auto-Enrolment for Employers in Ireland

Speaking of employers, what does auto-enrolment mean for them? Auto-enrolment will come with a very real cashflow obligation for employers. As was noted in the previous section, employers will be required to match employee contributions at steadily increasing percentage rates for the next 10 years and beyond.

This means having to have the additional cash on hand to meet the contribution matching requirements in addition to the wages that you’re already paying your staff. The Irish Government’s initial guidance states that failure to meet auto-enrolment obligations as an employer can result in penalties and even prosecution, so this isn’t something that can be taken lightly.

Fortunately, it’s not all bad news. There is an earnings threshold in place of €80,000 which means that the employee’s salary, against which the employee/employer contribution amount is calculated, can never exceed €80,000.

This allows an employer to calculate their maximum obligation per employee for a given year. For example, in year one, the maximum contribution that any employer could be expected to make for one employee is €1,200 (i.e. €80,000*1.5%). In practice, employers should look at their own payroll and create an estimation of the obligation that will be created by auto-enrolment for their business.

The contributions that are made by employers under auto-enrolment will be deductible for corporation tax purposes, thereby allowing businesses to reduce their tax bill.

There are some technical requirements of auto-enrolment as well. The Government’s guidance notes that an employer’s payroll system must be able to take instruction for auto-enrolment and be able to calculate and pay the relevant contributions to the Central Processing Authority. In other words, the collection of these contributions will be managed through the employer’s payroll software.

There will also be a need to communicate auto-enrolment with employees who will be affected as to explain why additional cash is being taken from the paycheck each month. The Government has been quick to highlight the benefits of auto-enrolment to employers i.e. no pension administration burden, no setup fees, increased competitiveness as an employer and employee wellbeing.

However, in practice, it’s likely that employers whose employees are setup with PRSAs are going to be in a better position than employers whose employees are utilising auto-enrolment.

Reasons to set up a PRSA over utilising auto enrolment

- Because the employees have PRSAs, they’re not going to be eligible for auto-enrolment. That means there will be no mandated employer contributions.

- PRSAs currently come with no obligation for the employer to make contributions to the PRSA, thereby giving the employer total control over any contributions that are made.

- PRSAs allow for much higher contributions on the part of the employee as well as much more flexibility in terms of investment choice. Provided the PRSAs are adequately funded, this advantage negates any of the benefits associated with mandated contributions and State participation under auto-enrolment.

- As a result of Finance Act 2022, employer contributions made to an employee’s PRSA are not counted towards the employee’s age-related contribution limit and are not considered as a benefit in kind (BIK). What this means is that employers can, if they wish, contribute to their employees PRSAs without limit, a clear advantage over auto-enrolment.

In advance of auto-enrolment’s introduction in the second half of 2024, an employer might consider getting their employees setup with PRSAs to avoid having to participate in the scheme and to avail of the natural benefits of PRSAs over auto-enrolment (based on the currently available information).

What’s Next for Auto-Enrolment?

So what’s next for auto-enrolment? The Irish Government is targeting a launch date in the second half of 2024 for the new system of pension auto-enrolment in Ireland. However, that target date could very well be subject to some fairly substantial caveats.

For one, we don’t know how ready (or not ready) the backend system supporting auto-enrolment is. As well as this, given the vast number of businesses which come in all shapes and sizes across the country, it’s unclear whether the second half of 2024 is a feasible target date for said businesses.

Plus, the auto-enrolment ‘can’ has long been kicked down the road and so it’s understandable to be sceptical about its exact launch date until it’s set for certain (which it has yet to be).

If one were to speculate on a launch date, based on what we’ve seen in the past as well as current roadblocks, one could say that a Q3/Q4 2024 launch is optimistic while a 2025 launch may be more realistic.

Remember, not all stakeholders agree with the current plans for auto-enrolment and the Small Firms Association recently called for the implementation date to be pushed out to 2025, or even 2026, to give smaller enterprises the chance to respond to the changes.

So take everything you hear about auto-enrolment with a pinch of salt!

Key Takeaways

While auto-enrolment is a net positive outcome for Irish employees, it is not the silver bullet to the Irish pension crisis. The sentiment behind the policy is good, but in reality, what it offers in practice is not a real solution.

The core problem is, and always will be, pension adequacy. Employees in Ireland do not have enough money invested in private pensions to support them in retirement.

Auto-enrolment only solves the problem of having a private pension, it doesn’t solve the problem of having enough of a private pension.

Yes, the UK has seen an uptick in pension contributions since the introduction of auto-enrolment, and yes, that will happen in Ireland as well. For example, it’s estimated that 750,000 people will be eligible for auto-enrolment.

Assuming an average wage of €30,000, that would result in €337.5M worth of employee contributions in the first year alone. No doubt the Irish Government will be quick to highlight the exact number!

But remember, none of this really matters when only 1.5% of an employee’s wage is being contributed. For context, that same employee could contribute a minimum of 15% today!

There’s no denying that having some sort of private pension, no matter how small, is better than having no pension at all. But we have to be realistic about what these numbers can actually do for people in retirement.

The message from the Government should probably be “auto-enrolment is coming so make sure you either set up an occupational scheme or encourage your employees to avail of a PRSA”.

Why? Because both of these vehicles can facilitate much larger pension contributions and thus, much larger pension pots, for employees. Encouraging workers to proactively engage with either of the aforementioned pension vehicles is the true antidote whereas auto-enrolment is more of a bandage.

To emphasise a message from earlier, in terms of retirement planning, you can achieve everything that auto-enrolment will facilitate over the next 10 years, and much much more, right now.

If you’re serious about retirement planning as an employee, or if you care about the future financial wellbeing of your employees as an employer, then there is no logical reason to wait for auto-enrolment to be introduced.

The National Pension Helpline has a team of vetted pension experts who can help you get started with whatever pension related objectives you want to achieve. As the information concerning auto-enrolment is ever-changing, the National Pension Helpline will continue to follow and report on the information as it develops.

This page will be updated on a regular basis as updates come in. The best way to stay informed is to join our newsletter.