Pension Transfers – Everything you need to know about transferring your pension in 2024

Choosing whether or not to transfer your pension is a common question people in Ireland face. There are a range of reasons why you might want to pension transfer and the sections below are designed to help you understand the process and make the best informed decision on your own personal situation.

The 3 most popular reasons to transfer your pension

1. Pension tax free lump sum (at 50)

In some cases, you may be able to access up to 25% of your pension tax free at age 50, instead of waiting until retirement. An attractive feature of this early pension access is that you may be eligible to make the withdrawal as a 100% tax-free lump sum.

Take our online pension transfer assessment to find out more.

2. Higher Returns

Often the idea of a pension transfer is attractive because another pension provider is offering better benefits than your current provider. These benefits often include annual returns, risk exposure, investment strategies or management rates.

3. Improved Control

Many people transfer their pensions because they have so many separate pension pots that they become difficult to manage and review. Often it makes sense to consolidate all your funds into a single diversified high-growth fund. This way communication and control of your investments is greatly improved.

However, while this might be sold as an attractive and easy decision it comes heavy with responsibility and risk. Over the lifetime of your pension there are many ways in which the value can rise or fall depending on market performance, the type of pension you have and the job market.

To make sure you get the very best outcome at retirement it is vital that you seek independent pension advice on your pension plan before deciding to transfer your pension.

In the following sections, we set out to answer these important questions related to pension transfers:

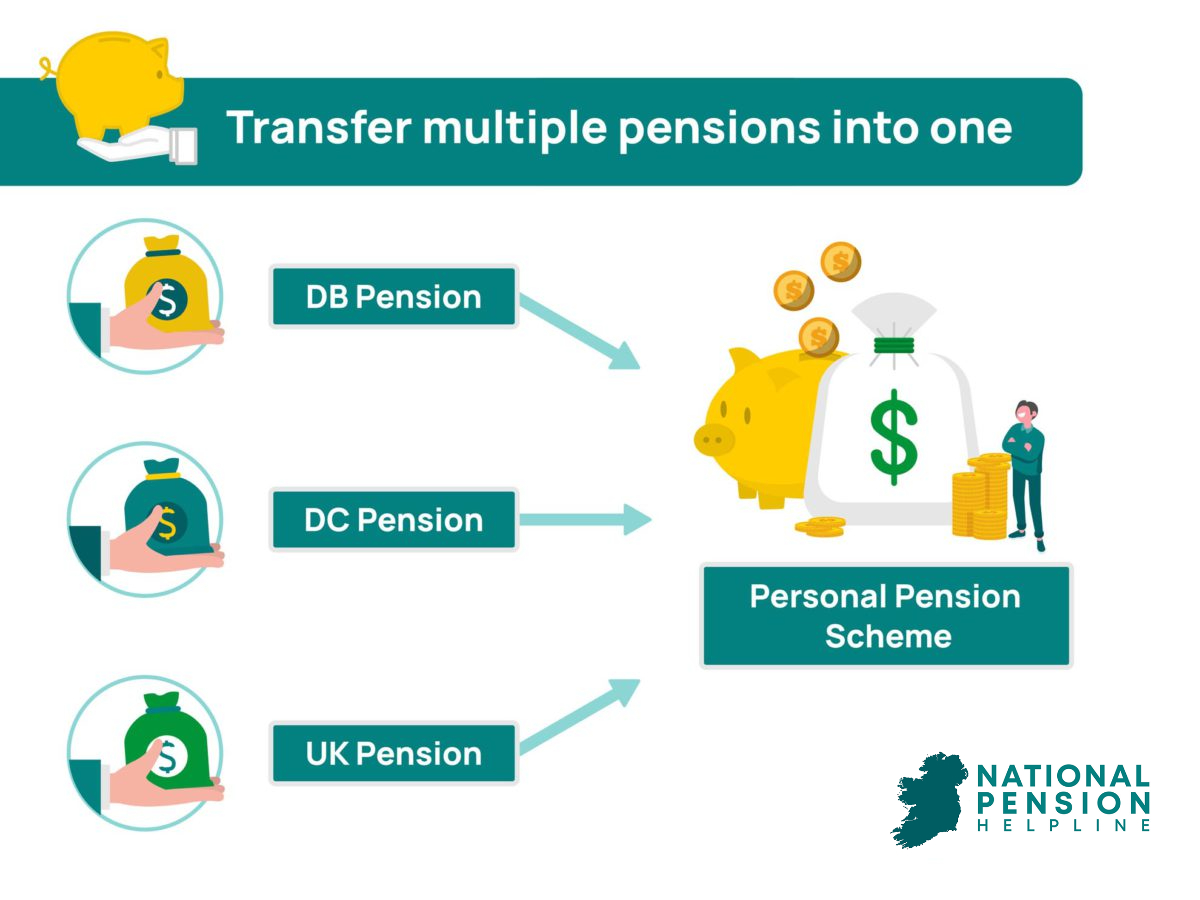

What is a pension transfer?

A Pension Transfer refers to the process of moving your pension fund from your current financial provider to a new one. You may choose to move from a Defined Benefit to a Defined Contribution or from either of these to a Personal Pension or a Pension Retirement Savings account.

This move might be prompted by a career move to a new company, the closure of an existing pension scheme or an attempt to reconcile a number of pensions from throughout your career.

What kind of pensions can be transferred?

The amount of risk involved in transferring your pension depends on a range of factors that are usually personal to your own circumstances. The first of these is understanding what kind of pension you have and what alternatives you have to transfer into.

A Defined Contribution pension, the most common type of pension, where you pay part and your employer pays part, can usually be moved at any time to another contributory pension or a PRSA or PPP (see below).

A Defined Benefit pension is based on paying you a fixed amount when you retire. These are more complicated to transfer because if you have been with a provider for a long time you will have built up benefits that you might lose by transferring. Always seek independent financial advice before you move a Defined Benefit pension.

Some companies with defined benefit pensions are offering employees very high transfer values, known as an Enhanced Transfer Value. However, when deciding if you should transfer your defined benefit (DB) pension you need to understand the pros and cons of doing so. You can learn about the pros and cons of transferring your DB pension here.

You may wish to move your defined contribution or defined benefit pension to a Personal Retirement Savings Account (PRSA). This is often an option taken by someone moving from being employed by a company to being self-employed and want to take on the management of their pension planning themselves. A PRSA is an off-the-shelf pension plan that can be started or stopped as required and can take lump sum payments as well as monthly contributions. It is considered flexible enough to match the more precarious income fluctuations of self-employment.

Another option for newly self-employed people is to transfer your company pension to a start a personal Pension or PPP. This type of pension can take both personal contributions as well as contributions from your own company. This will then receive tax relief at the marginal rate of 20% or 40%, depending on the amount. In some cases you will be required to make minimum payments to the fund but there are many fund types available and you will be assessed to determine how risk averse you want to be in terms of the funds that your pension is invested in. Once this is completed you will be offered funds that match the risk level you wish to take on.

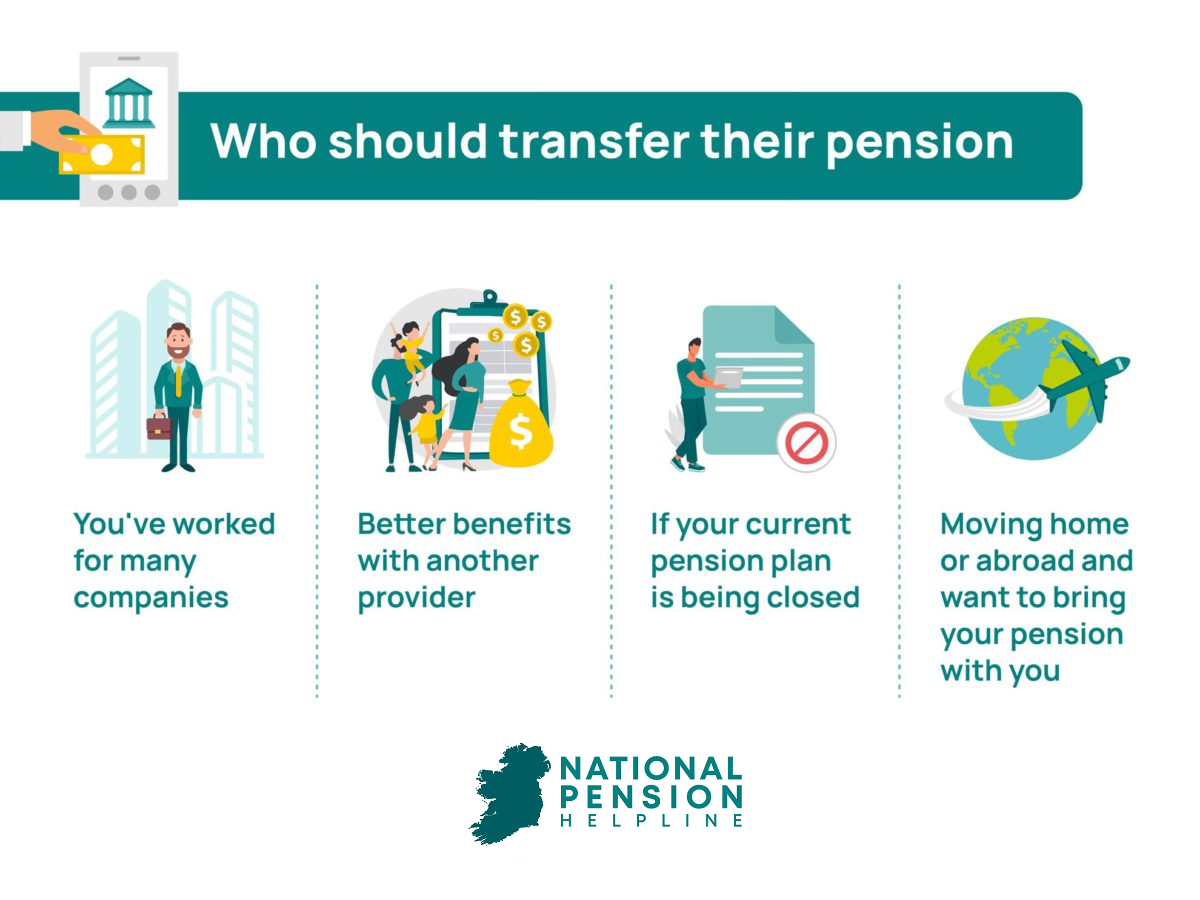

Why carry out a pension transfer?

There are a number of reasons why you might move pensions between pension providers.

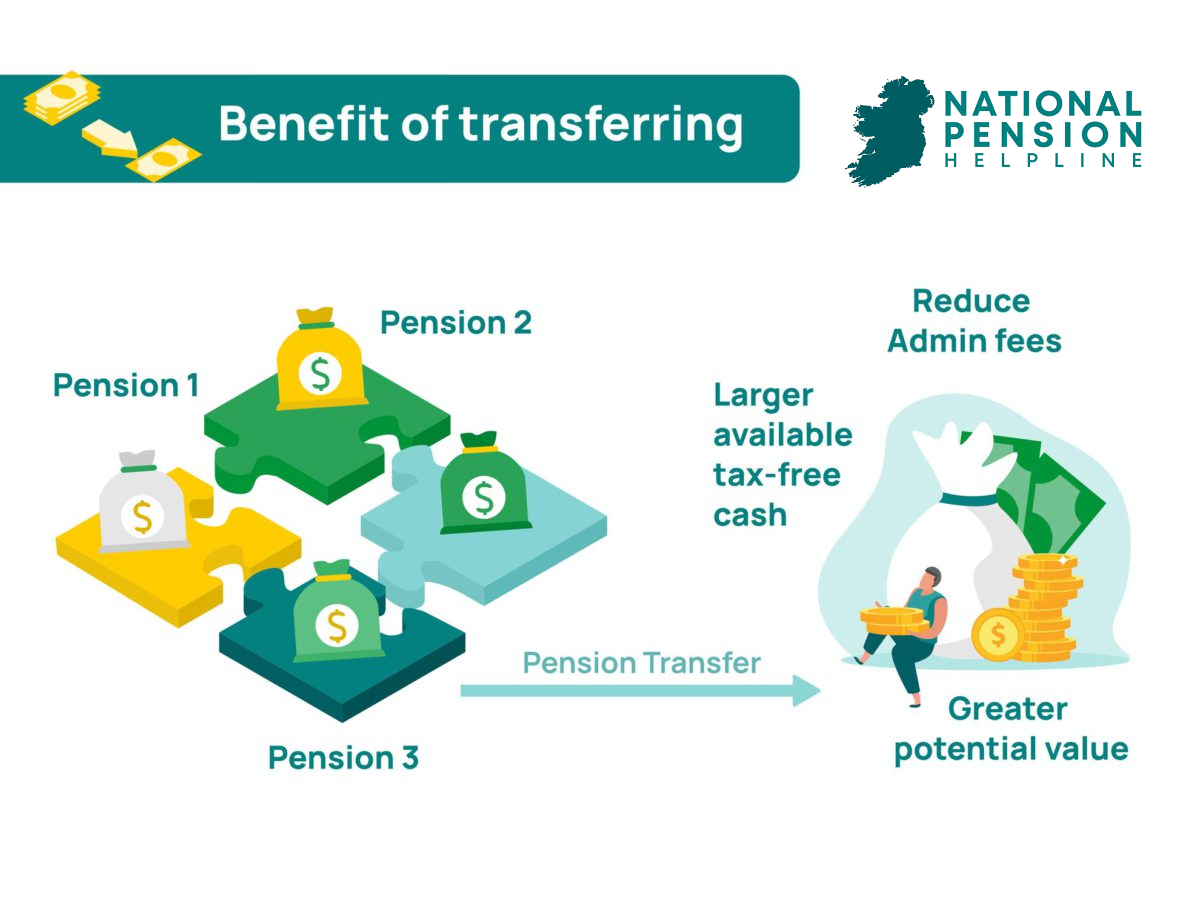

What are the benefits of combining a number of pensions?

The main benefit for many people is simplicity of process. If you have a number of pensions arising out of different jobs you may have had in our career, you may find it harder to keep track of the benefits across providers.

If you have a number of pensions you will be paying fees and charges for each of them. Bringing them together into one pension will reduce costs of administration.

By combining your pensions into one pot you will have a greater value that can potentially accrue more benefits over time.

Your tax free benefits at pay out are based on percentages of your pension. By combining them, you will have a larger value to take tax free and a simpler understanding of your options.

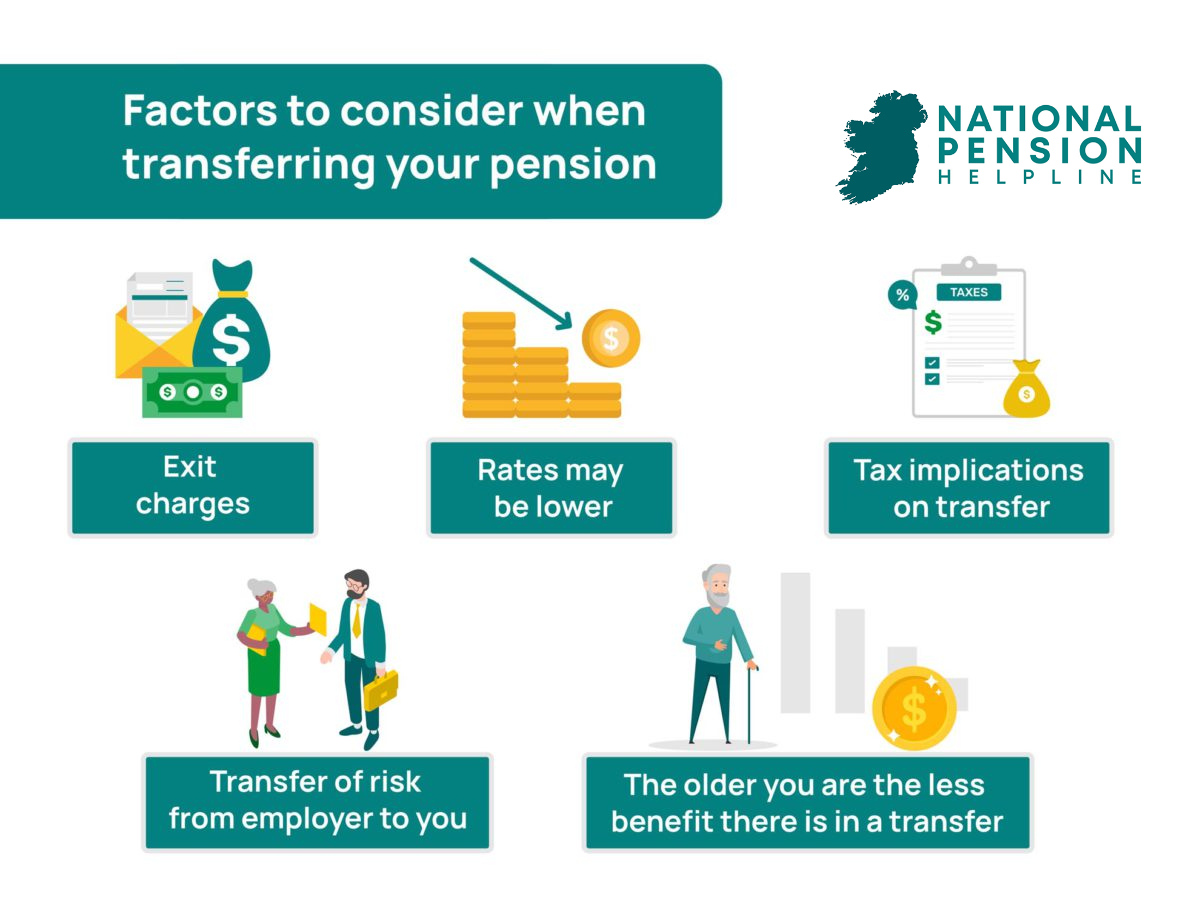

What do I need to consider before moving my pension?

Many pensions come with exit charges and penalties built-in to discourage transfer. Make sure and check what the exit penalties are for your plan before transfer or you may end up paying a lot more than you expect.

Check whether there are any guaranteed annuities or rates that will be significantly lower with your new provider. Often these are hard to identify at first reading of your pension options so make sure and seek advice from an independent advisor.

Make sure you are clear on the tax implications of our transfer and how they might affect your pension pot at pay-out. Not all pension plans have the same arrangements so take advice on this aspect of your decision.

Generally, your new provider will give you a period of time when you are free to change your mind about the transfer and usually communicate this up front to allay fear. However, before you move, make sure that you are entitled to return to your old provider and have the same benefits if you do decide to change your mind. Not all providers will take you back under the same arrangements you had before the transfer.

Some providers offer bonuses at pay-out to encourage people not to transfer. Check if your current provider offers bonuses and measure whether the transfer benefits will be greater than any bonuses you will lose by moving.

Be aware that if you are moving from a defined contribution pension to a personal plan then the entirety of the risk moves from your employer to you.

Consider your age and how close to retirement you are. The closer you get to the age you hope to retire the smaller the benefits are in moving as you are exposing yourself to risk. If you are close to retirement then it’s not always a good idea to move.

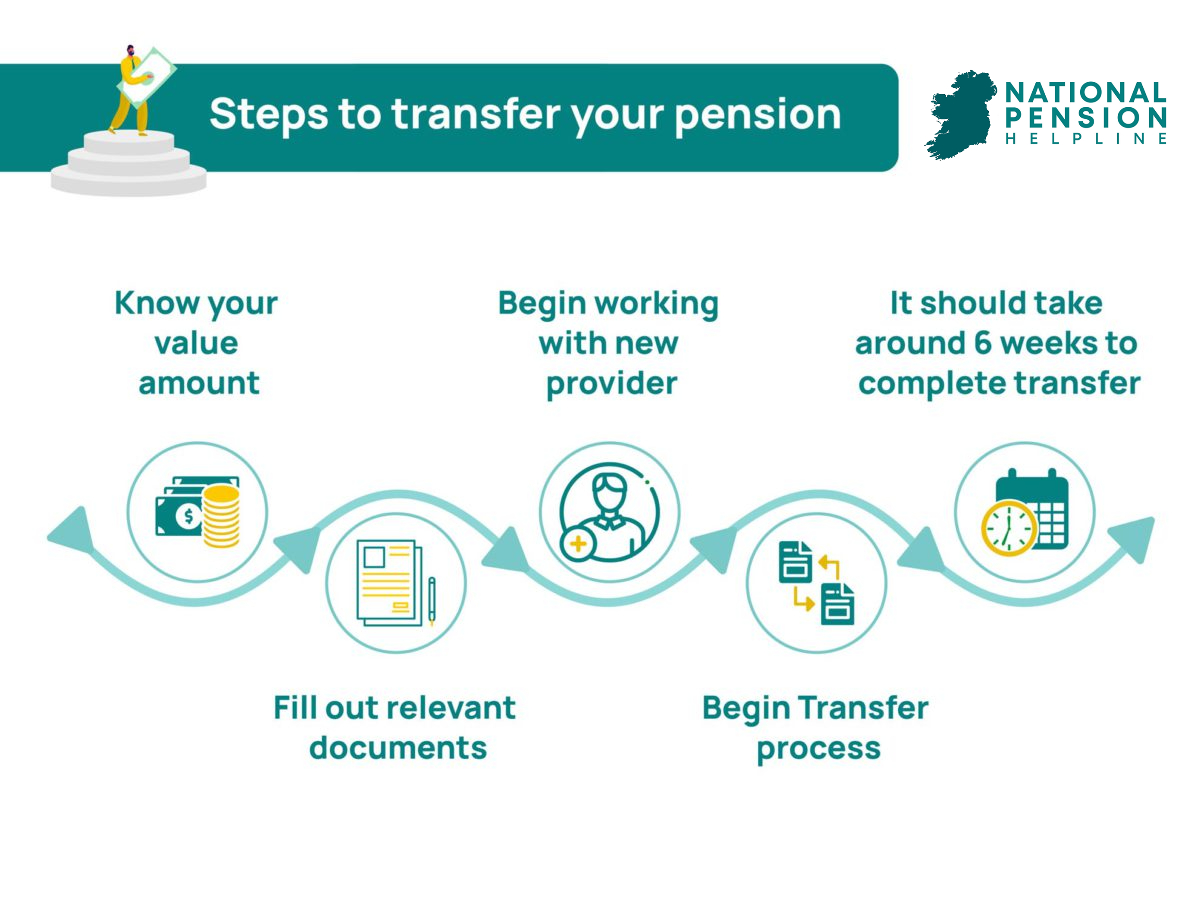

What are the steps involved in a pension transfer?

The process of moving your pension will involve a great deal of administrative work that your new pension provider can help you with, however you need to make sure that you are fully informed of every step in the process.

Is my pension transfer value a fixed amount?

The transfer value is not a fixed amount – it can fluctuate depending on performance over a given time period so the value you receive today may be different in six months’ time. It may have gone up or down. For this reason, it is important that if you are considering a move over a long period of time before making a decision, make sure and request updated transfer value data every few months.

What are the costs associated with pension transfers?

There are definite costs involved in transferring your pension but they may be outweighed by the benefits you receive from your new provider. In order to be sure that you are making a benefit through transfer you need to ascertain what your current providers exit costs are. These can include a penalty for transferring usually called an exit fee and which is often a percentage of your total value. Depending on the percentage levied by your provider this can be very high.

There is often an additional fee charged on top of this for processing the transfer procedure. These fees are built into your original agreement and you may not be aware of them. Make sure and identify all charges and, if you are unsure, then seek out independent advice from a financial consultant. Otherwise, the cost of transfer may wipe out any gains hoped for in the longer term.

Are pension transfers taxable?

You can transfer your pension from one recognised provider to another without it affecting the tax status of your pension. However, if you transfer your pension pot elsewhere, or take a lump sum before transfer, than this will be considered an unauthorised transfer and you will be taxed on it.

In general, in relation to tax, it’s important to remember that, in Ireland, you can take a maximum of €200,000 as a tax free pension lump sum in your lifetime. After this amount everything remaining between €200,000 and €500,000 is taxed at 20% with the remainder at your marginal rate.

Am I too old to benefit from a pension transfer?

Age is an important factor in determining whether you will benefit from a pension transfer. While the predicted pay out may seem attractive at first reading there are issues linked to your entire career so far that will affect it. For example, if you are close to retirement age there will be less benefit to moving. If you have had breaks in your pension plan during your career this may also affect your outcome. Your pension receives bonuses that are built up over time and these can be quite valuable. If you move your pension late in your career you risk losing these benefits without enough time left until retirement age to recoup them with your new provider.

If you do have to move to a pension provider late in your career, then ensure that you take expert financial advice from our approved independent pension advisor or the Irish Pensions Authority.