Defined Benefit pensions give employees a fixed pension payment each year in retirement, until they die. It is less and less common to see DB schemes, but they can be very valuable.

DB schemes pay into a pension pot that is in addition to the state pension and attempts to ensure that a person’s standard of living is maintained into old age.

There are a number of different types of occupational pensions such as a Defined Contribution pension (DC), a Defined Benefit pension (DB) pension and a hybrid model based on delivering the benefits of both DC and DB.

The following will look at Defined Benefit pension schemes in more detail.

Table of Contents

What is a Defined Benefit pension scheme

A Defined Benefit pension scheme is set up by an employer to benefit an employee and represents a fixed payment each year that an employee will receive once they retire – their payment is defined.

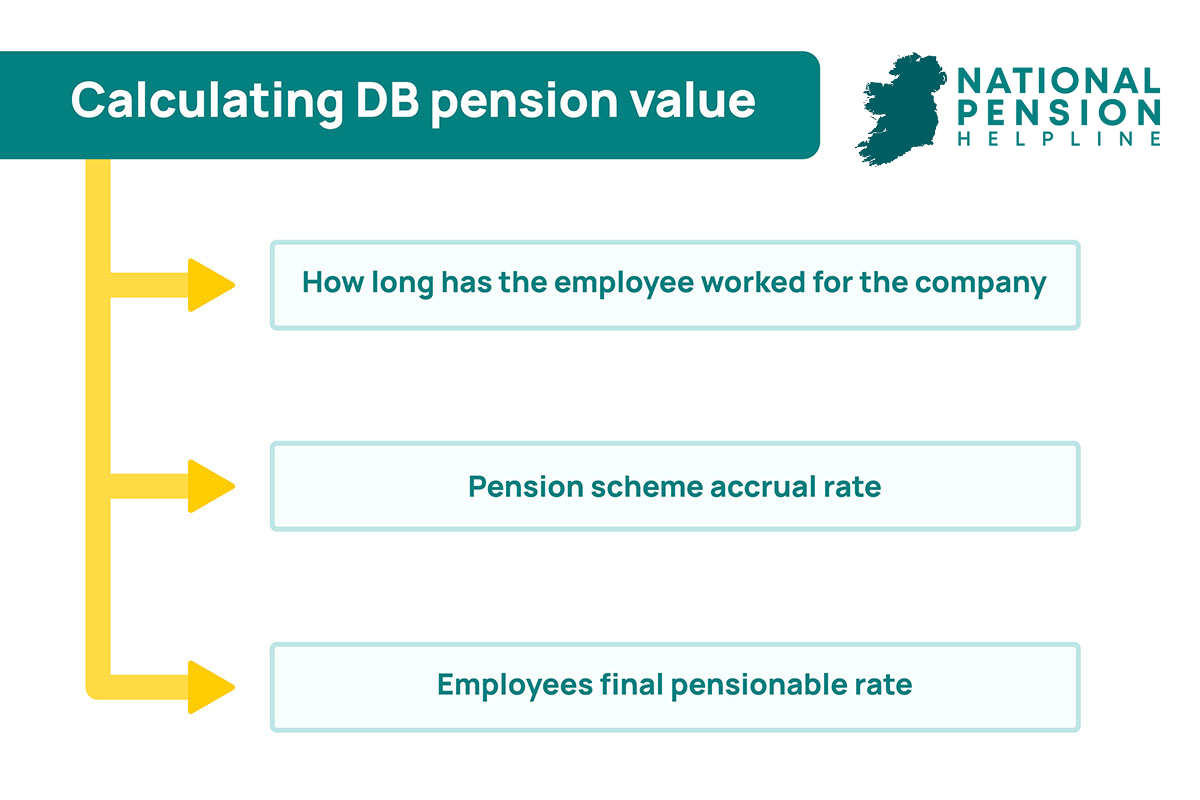

These types of pensions are also know as occupational pension schemes and the amount of pension an employee receives in their pension pot is based on the amount of years they have been in employment and the salary that they received during this period.

If a person’s salary increases or decreases during their employment, then the amount that will be paid in retirement increases or decreases incrementally also.

If you have been part of a DB pension plan in a previous job that you no longer work for it is worth noting that legislation was introduced in 2016 to make transferring out of these schemes to a new pension arrangement more flexible and reflective of modern working patterns.

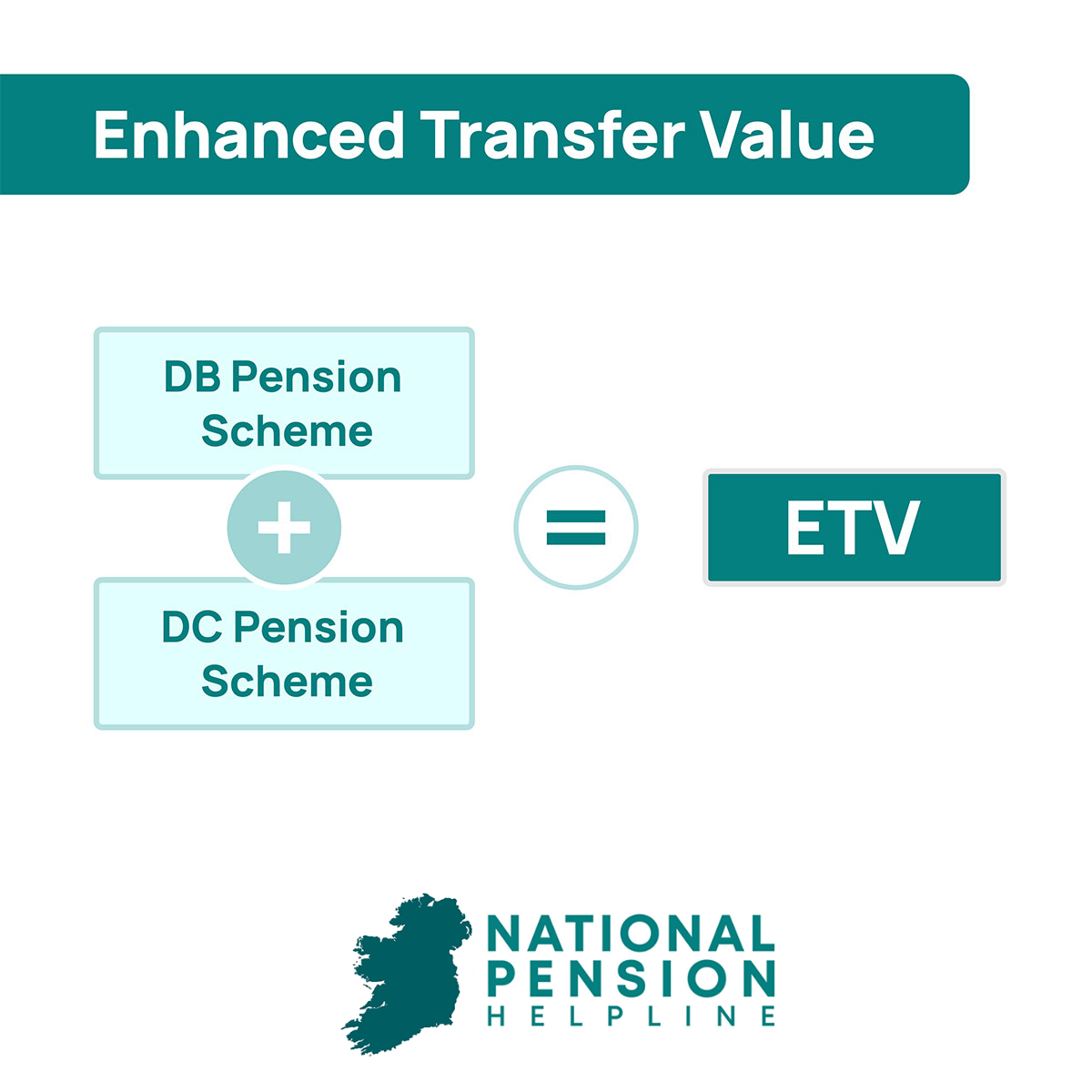

When transferring from a defined benefit pension, there is a term called Enhanced Pension Transfer Value (ETV) – this is the amount your full DB pension is worth in today’s money.

According to advisors, a typical Enhanced Transfer Value will be 20-30 times your DB in retirement. However, not all DB pensions have an enhanced transfer value – if you want to

For example: if you are promised €30,000 in retirement then your Enhanced Transfer Value would typically be worth €400,000 – €600,000.

Should you transfer your defined benefit pension?

This is a deeply personal decision with pros and cons. Some factors to consider are listed below.

Benefits of Transferring |

Drawbacks of Transferring |

|---|---|

| ✅ You may be able to access 25% tax free as a lump sum at age 50 | ❌ You are taking on additional responsibility |

| ✅ You have control over where and how your pension is invested | ❌ Certain schemes may have exit fees |

| ✅ In the event of your death, your pension is easier to pass on to your loved ones | ❌ Finding good pension advisors can be a challenge |

| ✅ If the employer who manages the DB cannot make repayments your money is secure | ❌ Loss of benefits in existing DB scheme (such as disability benefits) |

If my employer managing the DB scheme runs out of money – is my Pension at risk?

Defined benefits pensions are not guaranteed. If the scheme’s assets are not sufficient to pay the benefits, and the employer is not in a position to meet the shortfall, promised benefits may have to be reduced.

What isn’t defined in a defined benefit scheme is how much it will cost your employer to provide you with that benefit in retirement.

With a defined benefit scheme, your employer holds all of the risk associated with your retirement benefits.

Where there is a difference between what your employer has promised you and what’s available in the pension fund, your employer has a liability to make up for the difference.

This is why defined benefit schemes are becoming increasingly uncommon, in favour of less risky defined contribution schemes, which shift the pension risk onto the employee

If your employer becomes unable to make up the difference, this can become a major issue for pensioners.

Take a look at the Waterford Crystal Case to see the risks associated with DB schemes in practice –

Example of a defined benefit pension plan

To calculate the value of a DB retirement pension you need to know:

How to Transfer a Defined Benefit Pension

Transferring out of a Defined Benefit pension plan is relatively straightforward. There are 3 main ways to transfer a pension:

1. Transfer value to Buy out Bond (most common)

2. Transfer value to PRSA

3. Transfer value to new scheme

Note: It is extremely important to seek advice before deciding which method you use to transfer your pension. You can claim a free pension consultation via our online pension transfer assessment.

The scenarios why you may need to transfer out of a DB scheme are varied.

For example, you may leave to take up another job which has its own defined benefit plan, you may become self-employed, you may leave the workforce for a period of time, the scheme may be winding up or you may simply want to move to a more personal pension arrangement.

It’s useful to contact a pension advisor at this point as they can give you the very best advice on your options. A pension cash-out can also be used to retire early in some cases.

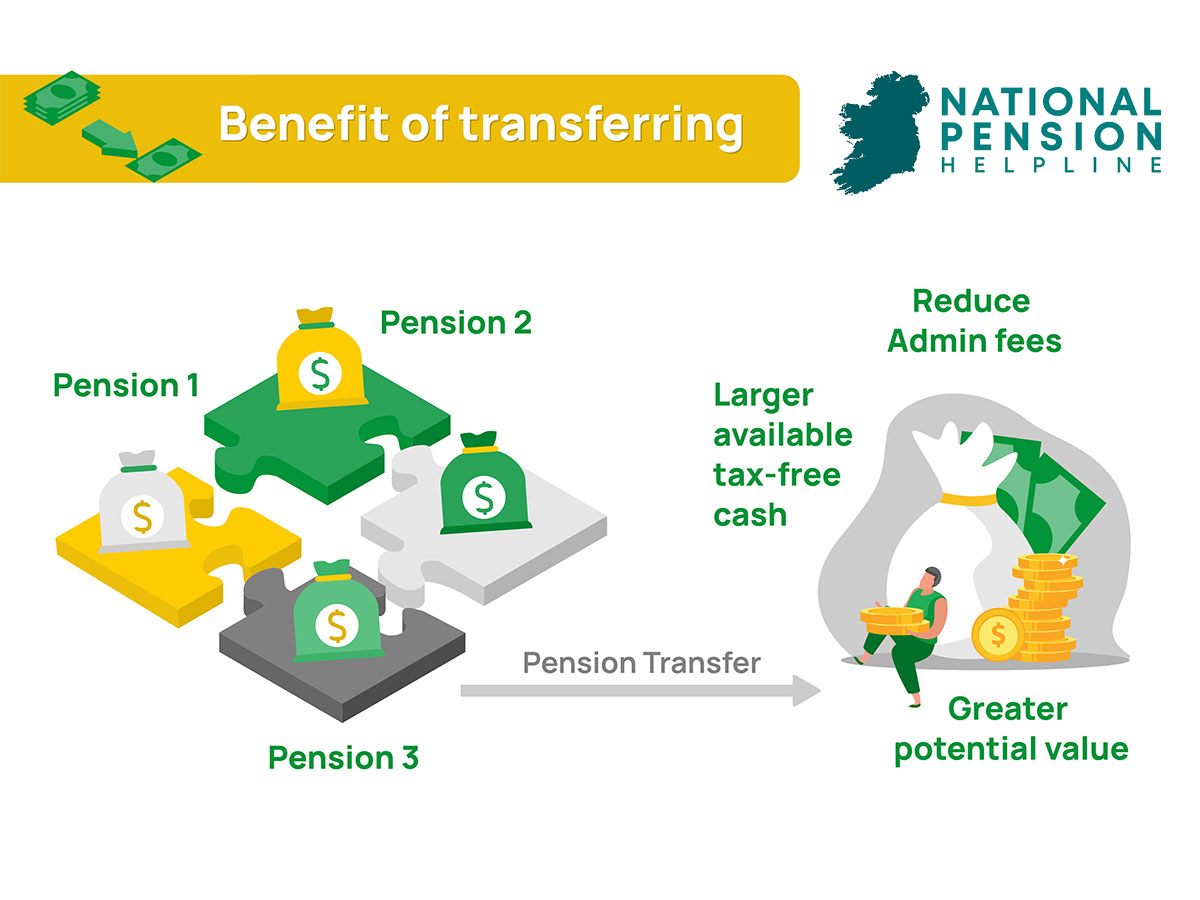

It’s also worth noting that you can draw down 25% of your pension transfer value as a tax-free lump sum payment after transferring out of a DB scheme.

The remaining 75% needs to be reinvested in a new scheme such as a Buy out Bond a.k.a. Personal Retirement Bond (PRB) or a Personal Retirement Savings Account (PRSA). These are personal pension policies created to allow you to have full control of your pension fund.

Will my old company allow me to transfer my pension?

The DB scheme could wind up in your lifetime with little notice if the company operating it chooses to do so and this can reduce the value of transferring.

With the number of defined Benefit plans on the decline this is a real possibility so the assurance of being in control of your pension scheme is also attractive.

Currently, many companies will assist you in transferring out of a Defined Benefit scheme as it is usually in their financial favour to reduce the number of people within it.

To encourage transfer, companies can offer an enhanced transfer value to make it more favourable for individuals to transfer out.

However, it is also worthwhile noting that you must have been a member of the scheme for at least 2 years in order to be entitled to a ‘preserved retirement benefit’ within the scheme (i.e. you won’t have anything to transfer unless you’re there for 2 years in the scheme)

What is an Enhanced Transfer Values (ETV)?

Companies offer members of the Defined Benefit schemes an enhanced transfer value (ETV) to encourage them to transfer out of the scheme.

It is, essentially, a one-time opportunity to transfer the value of your pension to another scheme with a more attractive rate than if you were to do it at any other time.

It is generally offered so that companies can divest themselves of members and thereby reduce risk for the scheme.

If you have been offered an Enhanced Transfer Value then it’s advised that you get in touch with a pension advisor so that you can fully understand the implications, benefits and options of using it.

Who is eligible for an ETV?

Generally, companies offer an Enhanced Transfer Value to members in order to de-risk their pension scheme. In other words, they’re attempting to reduce the cost of future pension payments and any liabilities associated with such. Any scheme member can be offered an ETV.

Additionally, deferred members of the scheme, that is anyone who has left the company but is not yet eligible for retirement benefits, can be offered an enhanced Transfer Value to exit the scheme ahead of normal retirement age.

What happens if I die as a deferred member of a DB scheme?

Each pension fund will have its own rules around death in service arrangements. Many schemes have a policy in place to transfer the benefits of your pension to your next of kin. Usually for a married person this is their husband or wife.

For an unmarried person, or a widowed person, this can be one of their children.

It’s important to note that if you die and the benefits are transferred to your next of kin and then they die, the benefits do not necessarily transfer onward.

If you are concerned about the death in benefits policies around your Defined Benefit scheme then get in contact with a pension advisor and seek assistance.

They can help you understand your specific situation, as well as offer advice on changes that you might want to implement with your scheme.