Tracking down my pensions – a guide to pension tracing in Ireland

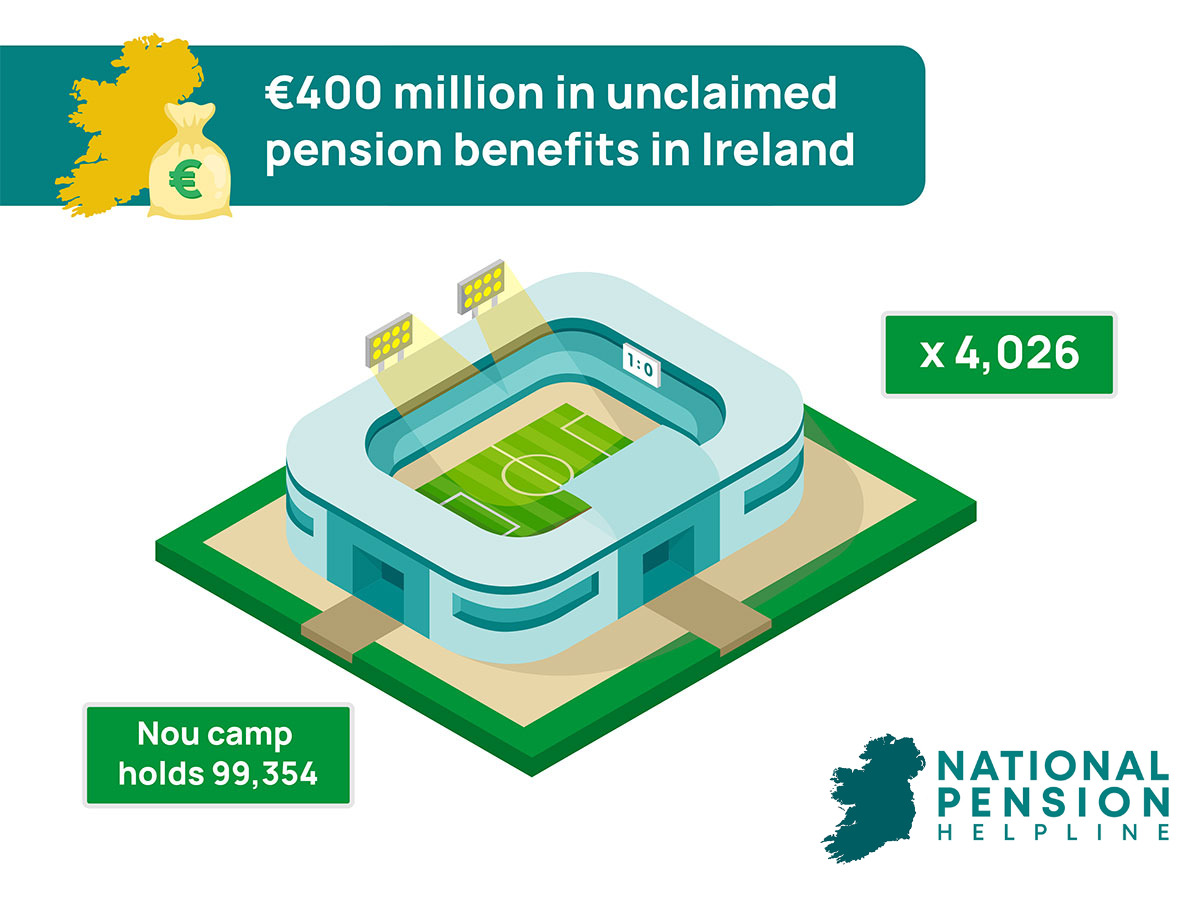

Estimates suggest that there is more than €500 million in unclaimed pension benefits in Ireland in 2024. Could you be due to cash in?

In many cases, particularly when we are early in our career, we don’t always pay attention to our payslips and where deductions from jobs might be going. Many employers automatically make pension deductions on our behalf and, where older jobs are concerned, these can be forgotten by the employee over time.

We very rarely take note of our pension details and keep documentation about them across jobs and decades. For that reason, many pension pots have been lost in the paperwork of our careers and remain unclaimed. However, they aren’t lost. You are entitled to the outcome of any pension payments you have made in any jobs and all you have to do is locate them. The following is an overview of the steps you need to follow to cash in or combine your pension pots.

Table of Contents

What is pension tracing?

Pension tracing is the process of tracking down pension payments that you may have made in jobs throughout your life and may have lost track of. The value of any payments made remains – they are valuable and worth tracing. The process can be complicated but there is expert help available through a pension advisory service.

Why do I need to find my old pensions?

If you have had more than one job in your career, or moved around between professions, there is a likelihood that you may have contributed to a pension as part of one of those roles and forgotten about it. This would also apply if you have lived and worked in another country outside Ireland at any time.

Who is eligible to track down old pensions?

Anyone who has paid into a pension scheme is entitled to reclaim the value of any pension pot amassed. Very often, employers automatically deduct payments from your wages and you may not have been aware of them. This is also the case with jobs in other countries and specialist pension advisors can help you track these down across other jurisdictions.

What do I need to find my lost pensions?

To locate any missing pension plans an advisor will need your name, date of birth, your current address and your PPS number. If you have previously worked in another country, such as the UK, you will need your UK National Insurance Number. Each of the EU countries will have its own equivalent of the PPS or national insurance number so, depending on where you have worked, try and track this down.

If you can’t find it, don’t worry. It’s not the end of the road. Usually, if you can identify your employer and your address at the time you worked there, you can often reverse-engineer the process to locate your identity number overseas. A specialist pension advisor can help you with this process. They can use your information to search databases and financial records to identify any pension pots in your name and secure them safely for you.

How can I find my UK pension?

If you are trying to find a UK pension, the process is slightly more complicated. You can ask one of our team to help you find a lost pension or learn more about How to Transfer your UK pension to Ireland. We have close relationships with the UK pension providers, so no matter how little information you have on hand, we should be able to help.

You will need the following information:

- Your full name, Date of birth and PPS number

- Your address at the time of the pension (optional)

- The companies you worked for and for how many years

Once you have this information, schedule a callback with an advisor here

What kind of questions will I be asked in order to track down my old pension?

Our pension advisors will need to gather as much information as possible about your past jobs. This is a confidential discussion that is designed to help them identify gaps in your pension information. In addition to your basic identity information, they will ask about your previous employment, the amount time you worked in each role and your addresses at them time. They will ask you to sign a letter of authority in order to give them permission to access information from your pension provider.

Some of the questions an advisor might ask will include:

Don’t worry if you don’t have the answer to all or any of these. There are avenues to discover the answer if you’re unsure. But if you do, then it’s very useful to have this information gathered before you talk to an advisor, just to speed things up.

What happens once my pensions are located?

The first major step is identifying where your pensions are, their value and any rules that exist in terms of cashing in your pension in or transferring your pension them to a new provider. Some of these issues are time or age-related and some are fixed by the provider managing the pension.

Once all of this is established, you have a number of options around what you should do next. You can choose to leave them as they are and manage each individually or you can choose to combine one or all of your pensions into a new pension plan. This could be a Personal Retirement Bond which is often referred to as a Buy-out Bond. You may also be eligible to transfer your pension into a Personal Retirement Savings Account (PRSA). You may also have the option of transferring the value of the old pension(s) into your existing pension with your current employer. This will be determined by the rules of that scheme.

The pension advisor you choose to work with in locating your pensions can advise you on all of your options, the risks involved with each, if any, and what the next steps are. It’s common for people who find they have more than one existing pension to combine these into one pension plan to simplify managing and maintaining their finances.

If I do trace a pension can I cash it in?

Whether the pension has matured and qualifies for a cash payment depends on your age and the rules of the policy itself. Normally, with a defined contribution-style pension you are eligible to withdraw a percentage of your pension value tax free if you are over 50 years of age.

However, it’s important to establish the specific rules around your pension scheme before this can be a guaranteed outcome. Our independent pension advisors can determine if cashing in your pension is the right move for you.