Many Irish people have worked in the UK during their career, including in Northern Ireland, and hold personal pensions there. If this is your experience you may well have a pension scheme still active that would be easier to manage if it was transferred to Ireland. While the UK pension landscape has similar arrangements and terminology to Ireland, now that it has exited the European Union, the legislative and economic frameworks for pensions are quite distinct.

This is one reason why some Irish people with a UK pension are considering whether they should transfer it to Ireland.

Transferring could ensure you access improved benefits that might be available to you within the EU and the Eurozone – now or in the future.

Other reasons could be to simplify your pension arrangements since you are now fully resident in Ireland. It could be to simplify inheritance arrangements or the transfer could be to allow you to combine pension pots in one new pension arrangement.

Everyone’s decision is personal to them and, for this reason, it’s very important to seek the advice of a qualified pension advisor.

The following is a guide to helping you understand your options and to prepare to seek advice and assistance.

Table of Contents

How it works?

How do I transfer my UK pension to Ireland?

Transferring your pension can be a complicated business. Not least because not every pension in the UK is eligible to be transferred.

Each pension scheme will have been set up with its own rules and you will need to explore whether yours is eligible. To do this, you should start by contacting a pension advisor in Ireland.

They can assess your situation, outline the rules and ascertain where your UK pension scheme falls within them.

In order to make the transfer between jurisdictions, your pension will need to be eligible for a Qualified Overseas Pension Scheme (see below).

Are the rules of transfer governed by the UK or Ireland?

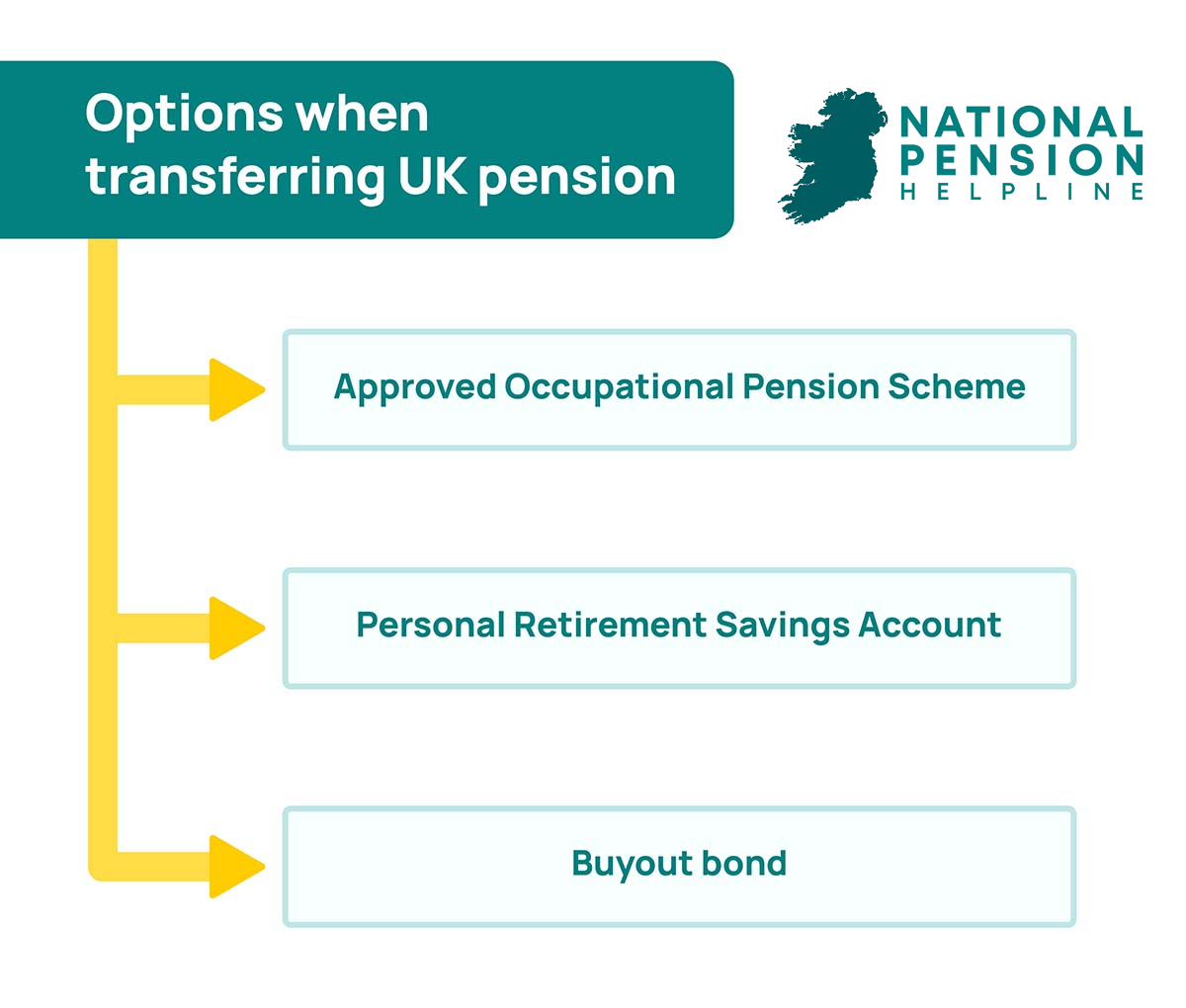

Any conditions or rules around your pension in the UK will be governed by that jurisdiction. However, the transfer procedures are fully recognised by Irish Revenue. Their main stipulations of Irish revenue are that the transfer happens before any payments are made; the beneficiary of the pension makes the transfer request; the rules of both Irish and UK pension schemes allow the transfer; the trustees of the pension in the UK make the transfer according to the rules and regulations of their jurisdiction and the revenue authority in the UK approves the transfer. Once these stipulations are followed, you are able to transfer your pension to an Approved Occupational Pension Scheme, a Personal Retirement Savings Account (PRSA), or a Buyout bond (BOB).

Are there any other rules?

The UK allows transfer to schemes with QROPS status – Qualified Recognised Pension Scheme. If you make the transfer without this status you will be liable to pay at least 40% tax on the transfer.

What is a Qualified Recognised Overseas Pension Scheme? (QROPS)

A Qualified Recognised Pension Scheme is a financial vehicle that has been created to facilitate the transfer of a pension from the UK. It meets criteria set by Her Majesty’s Revenue and Customs to manage transfers out of the UK and into other jurisdictions. It is essentially an offshore trust. It is used by British people moving their pensions abroad or non-British citizens who have returned to their own country and want to bring their UK pensions with them. Using a QROPS protects against unauthorised payments or heavy tax duties. Not all UK pensions are automatically eligible for a QROPS.

Can I move my UK State pension using a QROPS?

No, the QROPS cannot be used to transfer the State pension to another jurisdiction. The QROPS is designed for transferring defined benefit pensions, defined contribution pensions, self-invested personal pensions (SIPP), and self-administered pensions (SSAS) only.

Things to consider before transferring

Here are some questions you need to consider that are personal to your specific pension and are useful to discuss with your pension advisor:

Transferring your pension can be a complicated business. Not least because not every pension in the UK is eligible to be transferred. Each pension scheme will have been set up with its own rules and you will need to explore whether yours is eligible. To do this, you should start by contacting a pension advisor in Ireland. They can assess your situation, outline the rules and ascertain where your UK pension scheme falls within them. In order to make the transfer between jurisdictions, your pension will need to be eligible for a Qualified Overseas Pension Scheme (see below).

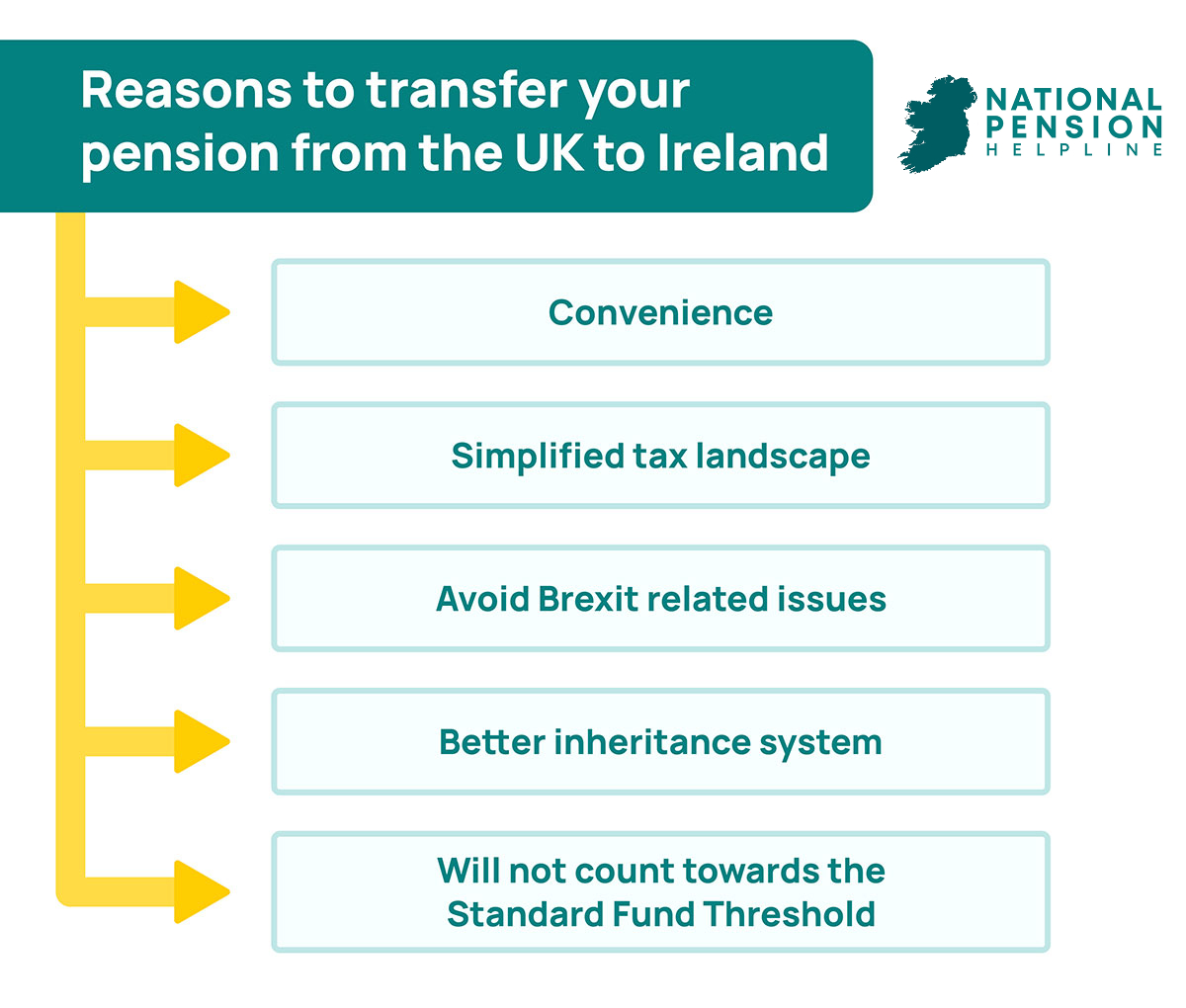

Why transfer your pension from the UK to Ireland?

What are the clear benefits of transferring my pension to Ireland?

Once you have worked out your personal situation and are satisfied that you can make a transfer it’s worth reminding yourself of the benefits.

Moving your pension to your primary country of residence is a much more convenient arrangement than dealing with another jurisdiction – especially if you have another pension pot here.

Generally, you should find the tax landscape to be one that is easy to navigate and find in your favour, although this differs depending on your own pension scheme.

Issues around inheritance have been well developed in Ireland and having your pension fund here will create stability and assurance in this area, making it simpler for you to understand and manage the outcome.

Brexit has created a currency risk and a changing economic landscape in the UK that is more complicated to predict, particularly in the investment and funds arena. Having your pension within Ireland and the eurozone eliminates much of the uncertainty that has been created by Brexit.

Transferring your pension to Ireland will not count towards the Standard Fund Threshold. This is the threshold in the Irish jurisdiction that limits your pension fund to €2 million before significant tax implications are levied.

How much does it cost to transfer my pension from the UK to Ireland?

The cost of your transfer is contingent on your pension type – whether it is a defined benefit or a defined contribution pension. The cost is also determined by the pension’s current value and the number of pensions you have. It is usually a percentage of the pension value and 5% is a common amount. However, this varies depending on the services you use and any new pension provider’s benefits to new customers. You pension advisor will be able to assist with understanding costs. There are also additional charges applied by your pension advisor and these should be outlined in your initial discussions.

How long will it take to transfer my pension from the UK to Ireland?

The process is complicated and highly regulated so don’t expect things to be fast. From beginning to end it can take up to four months to complete so do give yourself that amount of time in your planning. The time can be shortened by having all your documentation ready and by seeking help early from a qualified pension advisor.