A Defined Contribution (DC) pension scheme is one of the most commonly used pension arrangements.

It is based on both the employee and the employer investing in the future pension fund of the employee.

Both parties agree to sign up to the DC pension scheme and the percentage to be deducted from salary and the percentage to be matched by the employer are agreed in advance.

These do not have to be equal amounts. Often an employer will make a larger percentage payment as an incentive to the employee to remain with the company.

However, the employer contribution is entirely based on the arrangements with each individual company.

The employer does not have to match the employee contribution for a DC pension scheme to be a valid DC scheme. It is simply common for the employer to do so.

This article will explain Defined Contribution (DC) pension schemes in more detail.

Table of Contents

How does a DC pension scheme work?

An example of a Defined Contribution scheme would be where an employee agrees to pay 4% of their salary each month into their company pension scheme.

Their employer then matches this 4% with the same figure (for example), doubling the amount of money going into the pension pot.

This increases the level of investment being put into the pension fund and, consequently, the opportunity to earn higher dividends on that investment increases too.

Note: the actual percentage of salary and employer contribution is not fixed. Each employer and scheme will set their own percentage. The 4% mentioned here is just an example.

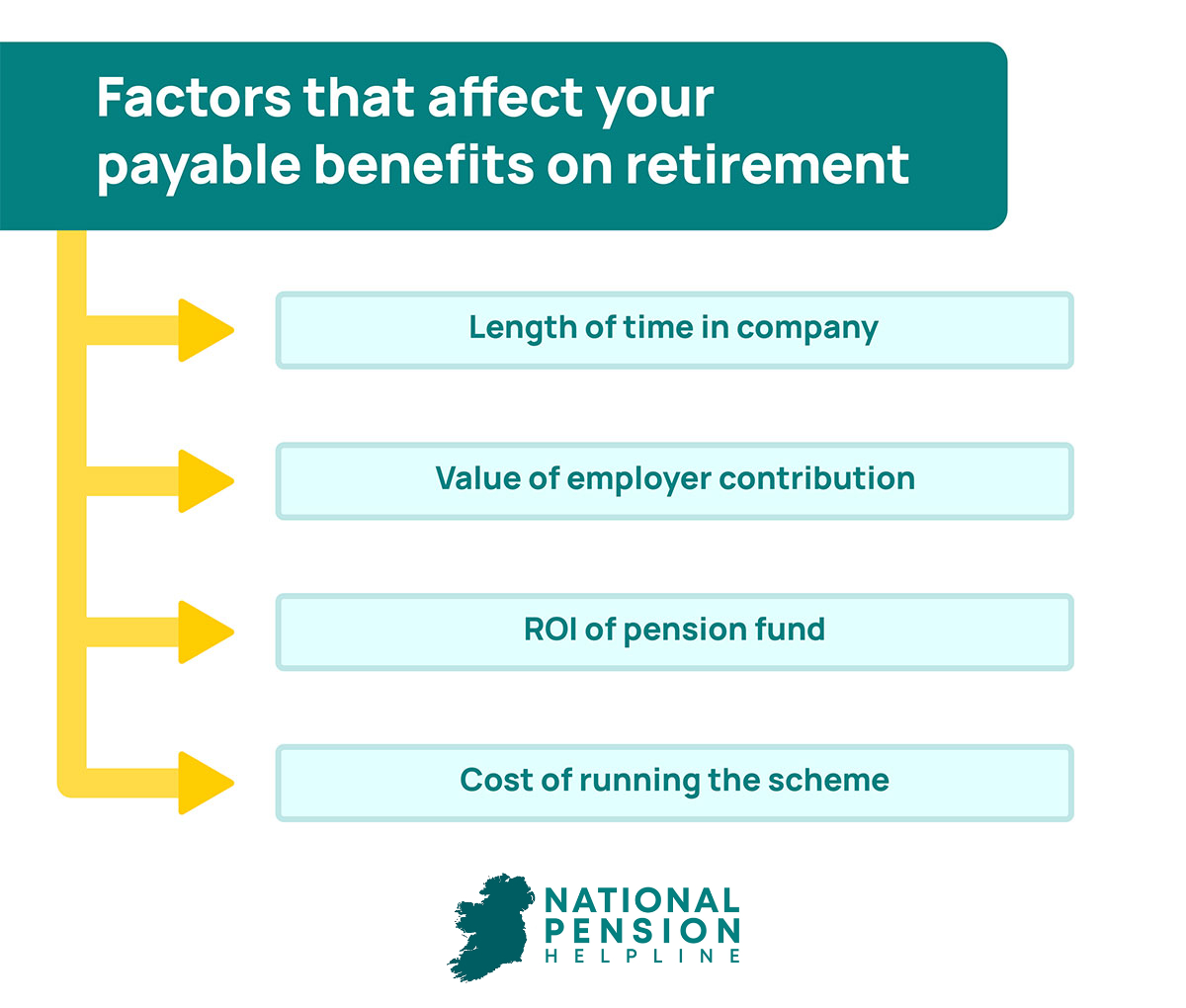

Factors that will affect the value of your payable benefits on retirement

Your final pension pot is built on:

In addition, a strong controlling factor in determining your pension pot is the level of risk your fund engages with.

Pension funds are an investment just like any other and operate according to a level of risk.

Each pension scheme is based on an accepted level of risk. This risk level is agreed by the trustees of the scheme and the financial institution that operates it. It is not negotiated on an individual level.

A high risk fund has the potential to pay out a greater value, if it performs well.

However, if it does not perform as expected the risk of losing money is much higher also.

A low risk investment will return a lower yield but your investment will be safer over time.

The majority of company pension schemes are conservative take on a low or medium amount of risk.

What is the difference between a DB and DC pension scheme?

Company pension schemes generally take one of two approaches. They are either a defined contribution or a defined benefit scheme.

A Defined Benefit (DB) scheme sets out a figure at the outset which the employee will receive in retirement. This figure is calculated based on the number of years worked and the salary of the employee.

Unless an employee’s salary changes or the number of years worked changes then the defined benefit will not change.

The employee can rely on receiving this amount in retirement.

A Defined Contribution (DC) on the other hand is an accumulation of funds that make up a person’s pension pot.

Each salary period, an employee pays an agreed portion of their salary to the pension scheme. This is generally (but not always) matched by an employer’s contribution.

These two payments (employee and employer) are combined and invested in a fund to build retirement benefits for the employee. The value of the eventual retirement fund can change, depending on the performance of the fund it is invested in.

A person with a DC pension will be updated annually on how their fund is performing and the predicted value of their pension at retirement.

Can you have a hybrid of a DB and DC?

A Hybrid scheme is a middle-ground approach that shares the risk of realising value with both the employer and the employee.

With a Defined Contribution pension, the risk is held mostly by the employee – the final value of the pension will be determined by the performance of the pension fund.

With a Defined Benefit scheme the employer carries most risk as the value to be paid is stated in advance. A hybrid shares the risk and has elements of both types of approach.

Can I transfer my Defined Contribution pension scheme?

Yes, a Defined Contribution scheme can be transferred. The scenarios that necessitate a transfer include the follow. You can read more about transferring your pension here.

Changing jobs

if you change jobs you can normally transfer your DC scheme to your new employer’s scheme.

It will not lose its value but it will have to come under the rules of your new employer’s existing scheme, which may change the percentage of your salary that is paid in as well as the percentage that your new employer pays.

There may be a fee or other charges incurred for transferring it.

Moving to a PRSA – in cases such as a person moving to a self-employed role or other change of job you can move your DC pension into a Personal Retirement Savings Account.

This is a personal investment fund, usually sold by a financial organisation such as an insurance company, that will allow you to make tax free contribution.

Deferred member arrangement: If you cease your employment you become known as a deferred member, which allow you to retain benefits of the scheme but you contributions will stop.

Refunding contributions: If you leave your employment and have been working there for less than two years, the rules of Revenue determine that you can withdraw your contributions to a DC pension fund, less 20% tax.

Personal Retirement Bond: A person leaving employment can choose to transfer their DC pension to a Personal Retirement Bond. This is a unit-linked pension plan that allows you to invest single contributions rather than regular ones. It is also known as a Buy Out Bond.