What do I need to know about buying property through my pension?

Buying property with your pension is a stable and successful investment option for many people.

As we enter retirement and begin to consider our options around how we will use our pension pot into the future, we are presented with several options.

Some people choose to simply draw down funds from their pension to live off and have a quiet and enjoyable life.

Others begin to look at how best we can use the income from our accumulated pension to improve our financial status overall.

One of the options that many people consider is to use their pension fund to buy property as an investment.

The following article will take you through what you need to know if buying property in retirement is an investment option that you would like to pursue.

Table of Content

Can I cash out my pension to buy a property?

Yes, you can use your pension to buy property but, since your pension fund was built on tax-breaks to incentivise saving for your retirement, there are quite a few rules around how this happens.

This is to ensure that you don’t use this valuable source of income unwisely, leaving you short of income in retirement or in a way that would devalue the tax breaks you received through your career.

Can my pension be cashed out to pay off my mortgage on my existing residence?

No, cashing your pension to pay the mortgage or part of the payment of a property you currently live in is not allowed under current legislation.

This is to protect the value of your pension and ensure that you have an income in the future which is separate from the value of your home property.

Can I use my pension to buy residential and commercial property?

Yes, you can choose to purchase either residential, industrial or commercial property with your pension fund. Many people choose residential as it is easier to rent out on a long-term basis, but a commercial property can offer the same gains. The important thing is to be sure that the property you purchase has an immediate market. The last thing you want is to have your property sitting without tenants and therefore not gaining value for your investment.

Can I buy a property to develop and sell on?

No, you cannot use your pension to buy a property that you intend to sell again in the short-term. Property investment must be on a long-term basis and not for short-term gain.

Can I buy a property for my children to live in?

No, your property purchase must be disconnected from your immediate family’s living arrangements.

It is an investment designed to create additional value in your overall pension landscape. It cannot be used to purchase property or benefit friends, family or other people in your life.

Can I use my pension to buy a property from a friend or family member?

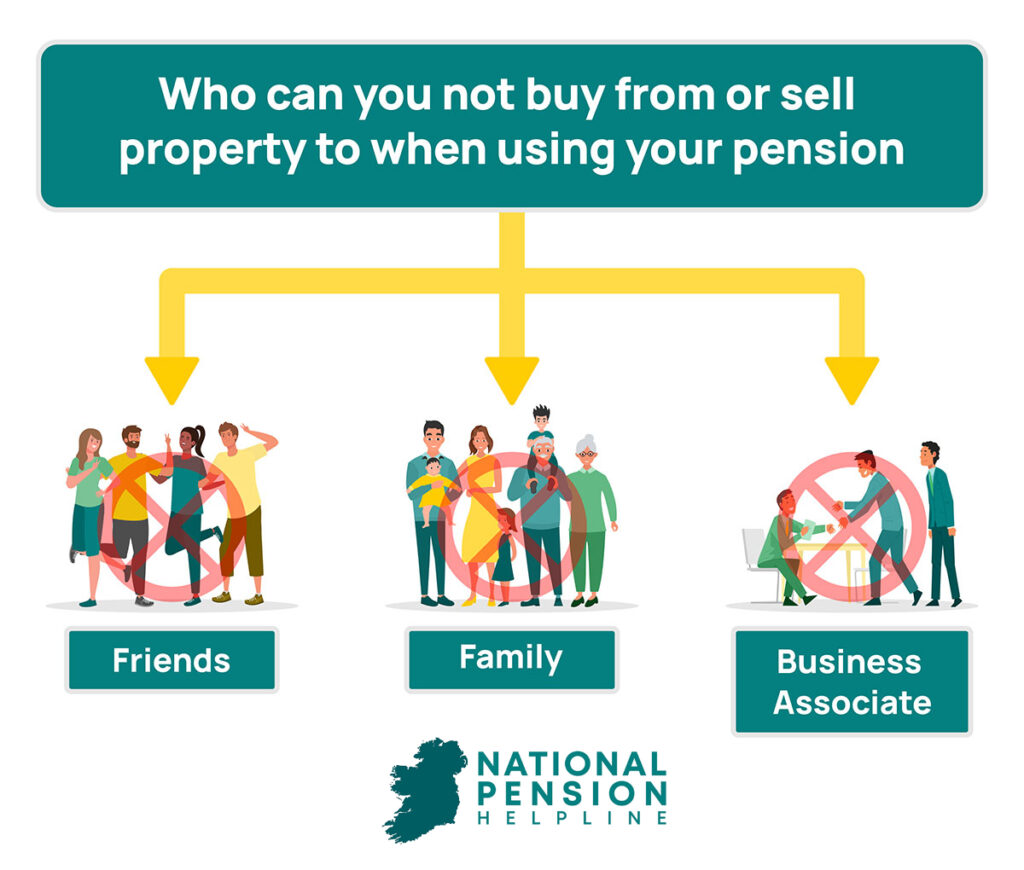

No, you cannot use your pension to buy a property from a friend, acquaintance or family member.

This is the arm’s length rule which maintains that all purchases with your pension fund must be from people who are wholly independent from you.

How much of my pension can I use to purchase property?

Usually, you will have to leave between 5-10% of your pension value in your pension fund as liquidity. So, if your pension is worth €400,000 you can cash in around €360,000 to purchase a property.

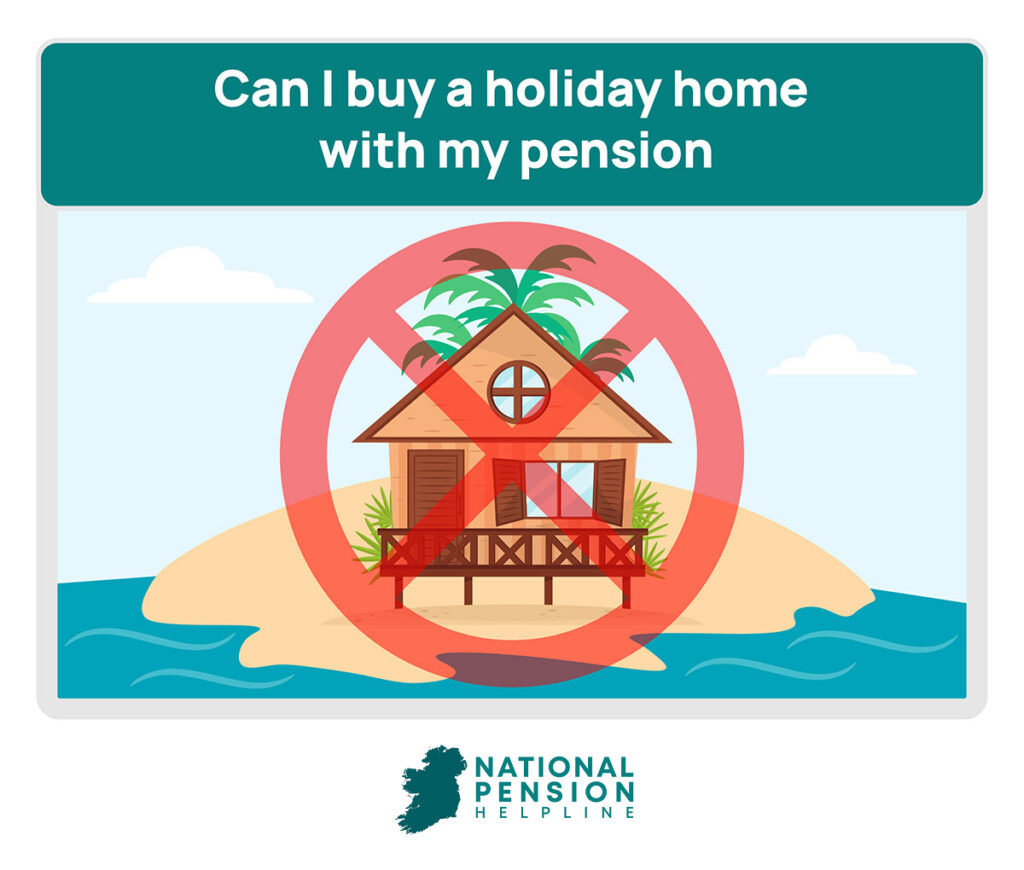

Can I buy a holiday home with my pension?

There are rules are in place to ensure that people do not buy a holiday home with their pension. The property you buy must be an investment option with clear rental capacity.

What is IORP II and does it affect how I purchase property with my pension?

In 2021, the EU brought in a directive that is known as IORP II and it became part of Irish law. It is designed to legislate for pensions and property purchases.

It does not apply to ARFs, PRSAs or buy-out bonds. The legislative arrangements for these types of pension vehicles remain unchanged. It only affects the rules around occupational or company pensions.

Am I eligible to buy property using my pension?

In order to cash out your pension to buy property, you need to establish whether you have the correct type of pension product. Legislation determines the pension types that are eligible for property investment.

For example, if you are a member of a Defined Benefit or a Defined Contribution pension scheme you can not use this pension fund to invest in property. You will have to transfer your pension into an approved scheme type.

The following are the fund types that can be used to invest in property:

An Approved Retirement Fund (ARF):

An Approved Retirement Fund is a personal pension fund set up by a financial company such as a pension provider. It allows you to pay into it with contributions of varying sizes and these contributions are used to invest in your future pension pot. It differs from a contributory pension in that it is not tied to a job and you control the size of your contributions.

Many people take out an ARF in addition to their normal pension arrangement with their company to ensure that they access the very best benefits in the pension market.

Small Self-Administered Schemes (SSAS):

A Small Self-Administered Scheme is a scheme that has been approved by Revenue and has been set up by a company for an employee or in some cases a company director. It is managed and administered by the individual it was created for. It is a very flexible scheme type and allows the member to have a high degree of control over their pension investment, including how they reinvest its value, such as in property.

Personal Retirement Savings Account (PRSA):

A Personal Retirement Savings Account is an investment fund or account that allows you to make regular payments or lump-sum payments. A PRSA is an option irrespective of your employment type or status. It is often used by self-employed people or those moving between jobs and want to have the flexibility of having their own pension arrangements, either instead of or alongside their employer’s pension scheme.

Personal Retirement Bond (PRB)

A Personal Retirement Bond is a pension policy that is used to allow a person who is leaving their employment to bring their pension value with them.

The individual’s pension pot is invested in a bond by your former employer’s pension scheme trustees and it gives you complete control of the pension value.

You then have the option to put this bond into another pension scheme or reinvest it into other investments such as property.

Are there restrictions to the property you can buy using your pension?

As already outlined, there are several restrictions on buying property with your pension. It’s useful to group them all here.

The property cannot be bought from someone who is connected to you – either through family, business or personal friendship. You must be at a distance from the purchase.

Similarly, you cannot sell or give the property you do buy to a family member or close business or personal acquaintance.

The property must be for investment uses – it cannot be your primary home. Nor can you use it as a premise for your own business.

You cannot buy a property for development and quick resale. You must be buying for long-term investment rather than what’s known as “flipping”.

However, once those considerations are met, the property market for pension purchasers is very attractive. For example, you can buy as part of a group, you can buy residential or commercial properties, and, in some cases, you can take a loan to help fund the purchase of your property if your pension pot doesn’t completely cover the cost of the purchase (see below).

Can I take out a loan to add to my purchase price?

Yes, in some cases you can do this. Individuals with their pension in a SASS or a PRSA (see above) can take out a loan to add to their pension value to make a property purchase. It is strictly controlled and the type of loan you take is subject to specific rules such as whether you can take an interest-free loan or the duration of the loan.

You also need to have income to cover the repayments on the loan which do not include the predicted future rental value of the property. If you are considering this option, then make sure and contact an independent pension advisor who can help you navigate any complications with this option.

Is using my pension to buy property a good idea?

Buying a property with your pension is a proven and stable investment option. In the current property market in Ireland demand for housing outstrips supply and premiums on rental income are very high. While this creates a difficult market for tenants it creates an ideal market for investors to maximize their pension value.

One of the most attractive benefits of buying property with your pension fund is the opportunity to avail of beneficial tax arrangements. For example, any rental income that you receive and is paid directly into your pension fund is tax free.

If you sell the property in the future, there is no Capital Gains Tax payable. You can also keep the property after you reach retirement age and transfer the income into an ARF.

Your pension fund can be used to pay expenses incurred such as auctioneer fees or refurbishment of the property.

You can buy a property and lease it to a local authority on a long-term basis and thereby guarantee yourself a State-guaranteed income.

However, as with all investments, buying a property comes with its own risk and just because the market is healthy and thriving today does not mean that it will always be like that.

If you are unsure of the level of risk that you want to enter into with your pension investment, then make sure and consult with an independent pension advisor before you make any decisions.

I have decided to buy property with my pension – what should I do next?

Once you have researched the area and made the decision to purchase an investment property you have several steps to follow.

The first one should be to take independent pension advice. While the property market in Ireland shows no signs of reducing and it may seem easy to predict demand for a rental property in a particular area, it is always important to take advice from an expert in the area.

Confirm eligibility

When you do that, they will be able to help you assess your current pension arrangement and confirm your eligibility to make a property purchase.

Choose a location

You should then make decisions around where you plan to buy. For example, if you are interested in managing a rental property yourself in an area that you are familiar with then the choice of location is easier.

However, if you are interested in leasing your property to a local authority to manage then you need to make sure that the local authority has demand in that area. If this is your preferred route then make contact with the local authority housing department and assess demand.

If you prefer to work through a private management company, paying a fee to have them manage your property rental and deal with tenants, then ensure that the area you are looking at has plenty of choice in terms of management firms willing to take it on.

Find a property

Once the location has been selected you then enter the normal property purchase cycle of identifying and bidding on a property. In the current market this can take a lot longer than you imagine so give yourself plenty of time.