In order to best make use of your defined benefit pension, it is important to understand how much is currently in your pension pot and much more you will need to top it up by in order to comfortably retire.

A defined benefit pension relates to that which is given to employees in retirement by a company until they are deceased.

This type of pension is fixed and the scheme will pay into a pension pot in addition to the pension offered by the State.

Ultimately, a defined benefit pension is put in place as a way to ensure the person’s quality of life remains the same throughout retirement.

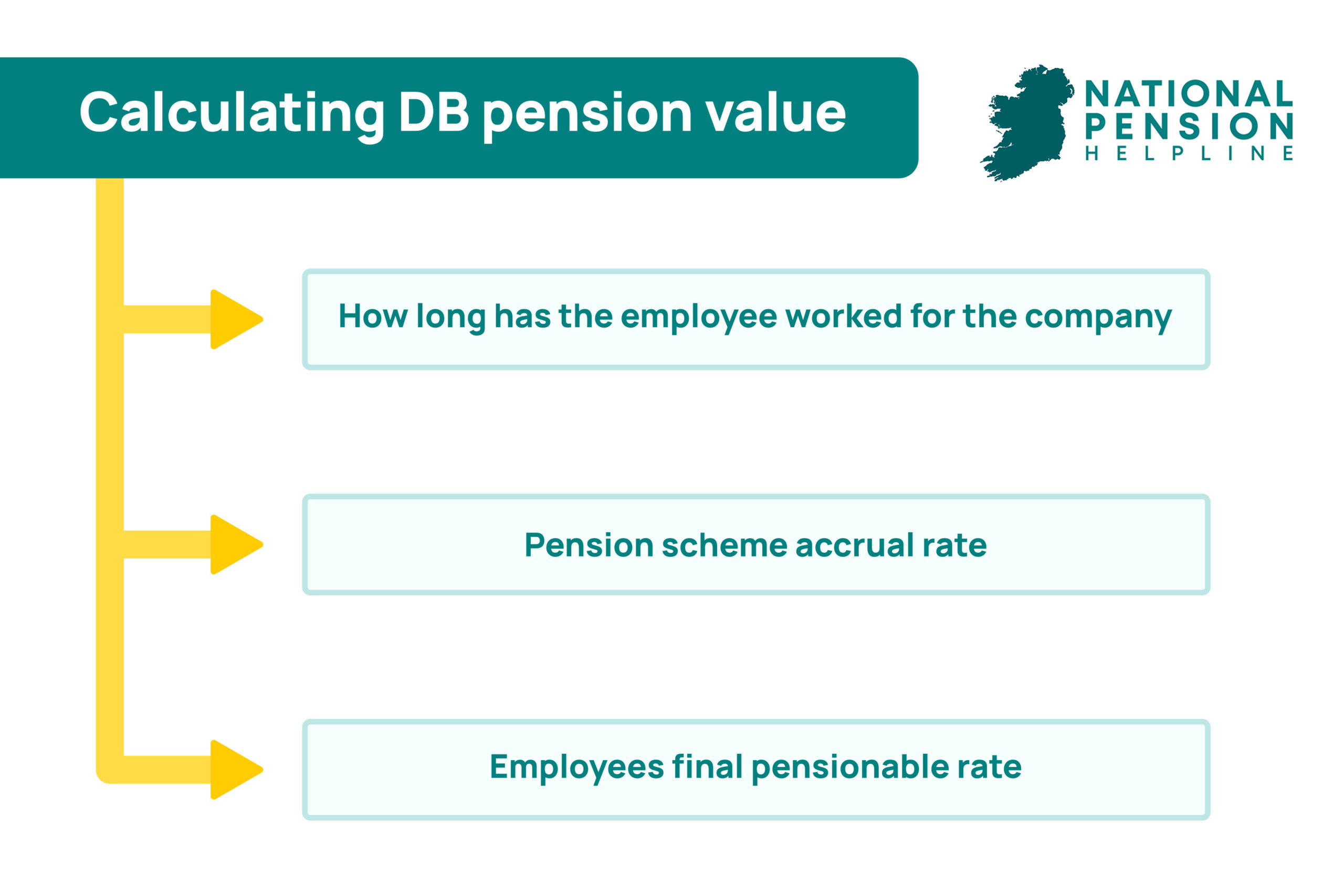

How to calculate a defined benefit pension

The best way to calculate your pension transfer value is by multiplying:

For example, the sum would appear as €20000 x 22 = €440,000 and will offer you an insight into the value of your pension on that exact day.

Some further things to note as you calculate your pension value under this type of fixed scheme is that most defined benefit schemes are not adjusted for inflation.

This calculator will draw conclusions based on the assumption that you withdraw the maximum amount possible each year from retirement.

In reality, following the numbers given by the calculator you should also factor in the possibility of exceeding the listed life expectancy of 90 years old. You can use our private pension calculator to better understand how these values will stack up and compound over time.

How does a defined benefit pension work

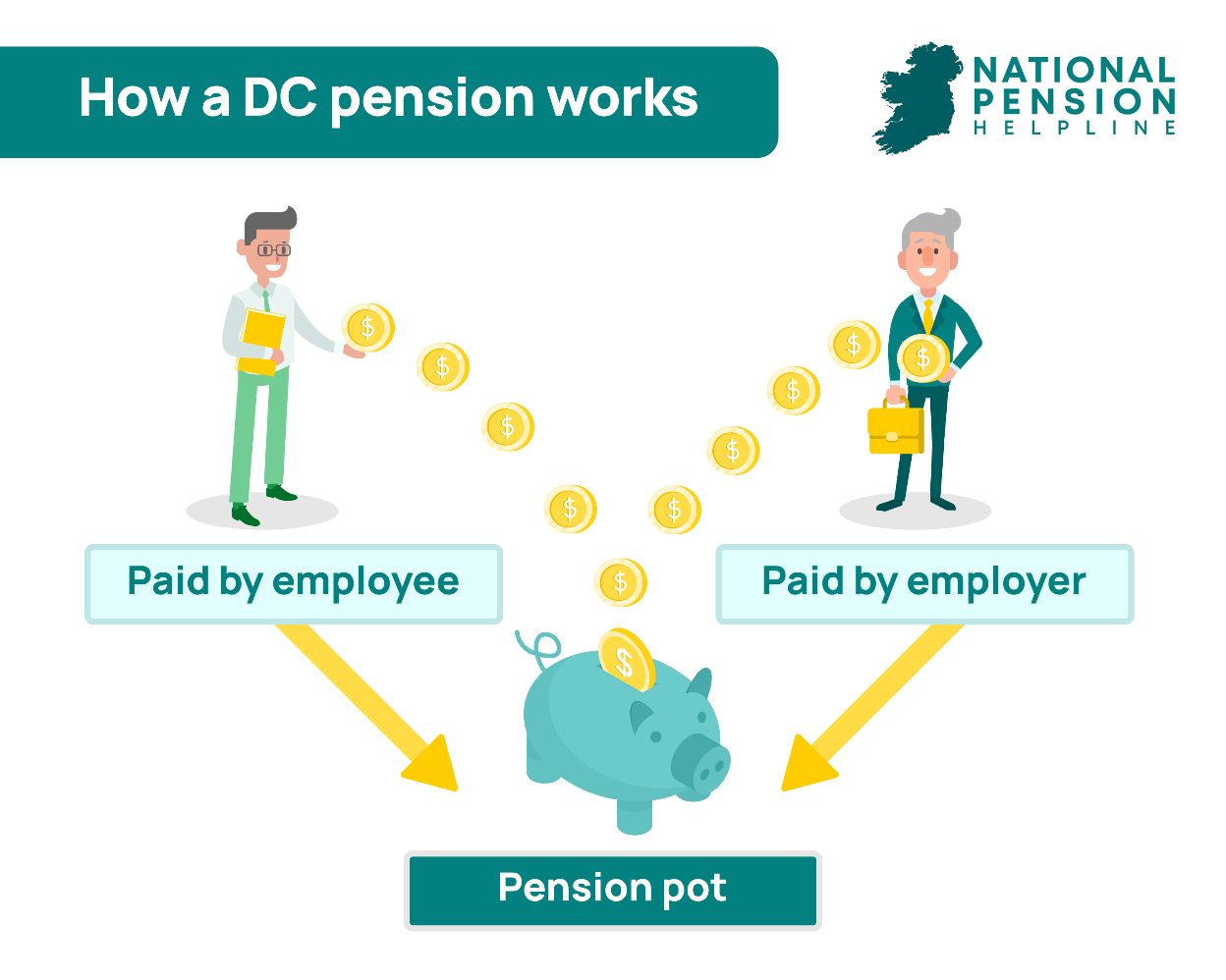

A defined benefit pension scheme works to ensure an employee is paying a fixed amount of funds into a pot that will then be paid out to them from their company once they reach retirement.

The amount you will pay out during your years of employment – and then ultimately what you will receive later – will depend on your level of service and your earnings at the time of retirement or in the years in the run-up to that age.

The contribution rate in a defined benefit pension is fixed (i.e. as a set percentage of a salary) and the employer rate usually increases or decreases as needed throughout the scheme’s term.

With this type of pension scheme, you must note that the benefits are not guaranteed.

It will depend on whether the scheme’s assets are sufficient enough to pay out the benefits and whether the employer has sufficient funds to meet the promised benefit amount.

In situations where this is not the case, benefits will be reduced to match the assets available.

Can I transfer my defined benefit pension

Transferring a defined benefit pension is a relatively straightforward process however it is important to seek professional advice before moving around pension funds.

It is also key to be aware of the fact that if you are considering transferring out of a defined pension pot, you can draw down 25 percent of your transfer value as a tax-free lump sum payment.

There are three main ways to transfer your defined benefit pension value:

Can I transfer my defined benefit pension

A defined benefit pension scheme works to ensure an employee is paying a fixed amount of funds into a pot that will then be paid out to them from their company once they reach retirement.

The amount you will pay out during your years of employment – and then ultimately what you will receive later – will depend on your level of service and your earnings at the time of retirement or in the years in the run-up to that age.

The contribution rate in a defined benefit pension is fixed (i.e. as a set percentage of a salary) and the employer rate usually increases or decreases as needed throughout the scheme’s term.

With this type of pension scheme, you must note that the benefits are not guaranteed.

It will depend on whether the scheme’s assets are sufficient enough to pay out the benefits and whether the employer has sufficient funds to meet the promised benefit amount.

In situations where this is not the case, benefits will be reduced to match the assets available.

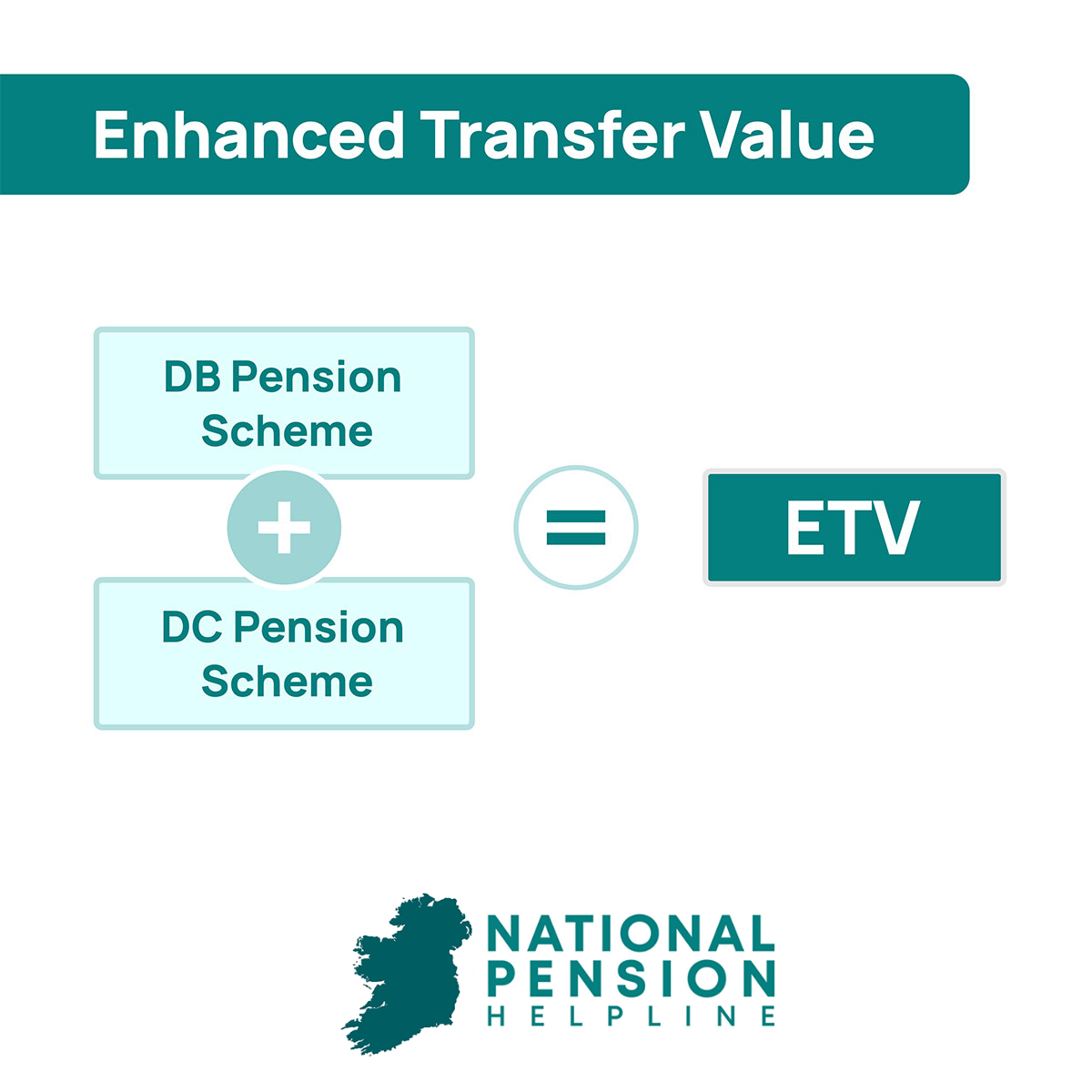

Enhanced Transfer Value

In order to encourage employees to transfer out of a defined benefit pension scheme, companies can offer their members an Enhanced Transfer Value (ETV).

This is ultimately a once-off offer to shift the exact value of a pension to another scheme with a better rate and gives members the opportunity to do so at a cost not available at any other time.

The value is calculated by adding the numbers of your defined benefit pension to the numbers of your defined contribution pension scheme.

Cash in your pension

Once you turn 50 years old you can begin to make decisions as to how to get the best from the pension you have built up over your years in private employment.

This includes an option to begin cashing in your pension – once you have generated a pension with an old employer, an executive pension or a PRSA.

Should you want to withdraw from your pension pot, some people will have access to a 25 per cent pension tax-free lump sum. This relates to anyone over the age of 65.

These exemption limits when it comes to tax allow people over the age of 65 to earn income up to a certain level before they face an extra tax.

At current, it is possible to draw down a maximum lump sum of €200,000 tax-free. This is a lifetime limit regardless of whether the pension is taken at different times or under different agreements.

Learn more about transferring your defined benefit pension

We understand making decisions about your pension can be daunting and complex.

That’s why we have a fully experienced roster of professionals on standby waiting to pick up your call and talk you through all of your options.

Learn all there is to know about transferring your defined benefit pension and get in touch with one of our qualified experts today.