Ireland’s new auto-enrolment pension savings scheme began on 1st January 2026, giving around 800,000 workers access to a workplace pension for the first time.

Auto-enrolment, officially called My Future Fund, addresses a major issue – that one in three workers in the State had no additional coverage outside the Irish State Pension.

This is a problem because the State Pension is currently just over €15,000 per year, which means many pensioners find themselves with a much lower standard of living upon retirement.

Essentially, auto-enrolment will make people more financially secure when they retire by providing them with a workplace pension.

Auto-Enrolment Pensions Ireland

Auto-Enrolment Pensions Ireland – A Complete Guide

Table of content

What is auto-enrolment?

Auto-enrolment is short for ‘automatic enrolment’ and will provide around 800,000 employees in Ireland with access to a workplace pension for the first time.

Previously, the onus was on employees in Ireland who did not have an occupational pension to set up a Personal Retirement Savings Account (PRSA).

This changed on 1st January 2026 when the scheme finally began after years of delays.

How does Auto Enrolment work?

Auto-enrolment in Ireland works like this:

- A percentage of your salary is taken out as a contribution each month

- Your employer must match this contribution

- The State tops it up by a smaller amount

In practice, this means that for every €3 that comes out of your salary each month, your employer matches it with a €3 contribution. Then the State tops this up with an extra €1.

So for every €3 you contribute, you receive €7 into your pension pot. Over many years, these contributions will amount to thousands of euros extra per year when you retire.

Auto-enrolment Contributions

From years 1-3, employee’s contributions will equal 1.5% of gross pay. In other words, if your salary is €20,000, in year 1 you will contribute €300.

Employers will match this with €300 of their own, along with €100 from the Irish state. This gives employees a total yearly pension contribution of €700 in year 1.

From years 4-6, the contribution rate will equal 3%, rising to 4.5% from years 7-9 before hitting 6% from year 10 onwards. This is subject to an earnings threshold of €80,000.

However, employees can opt-out of auto-enrolment if they wish, but they must stay enrolled for six months. They will then be automatically re-enrolled after 2 years.

Who is automatically enrolled?

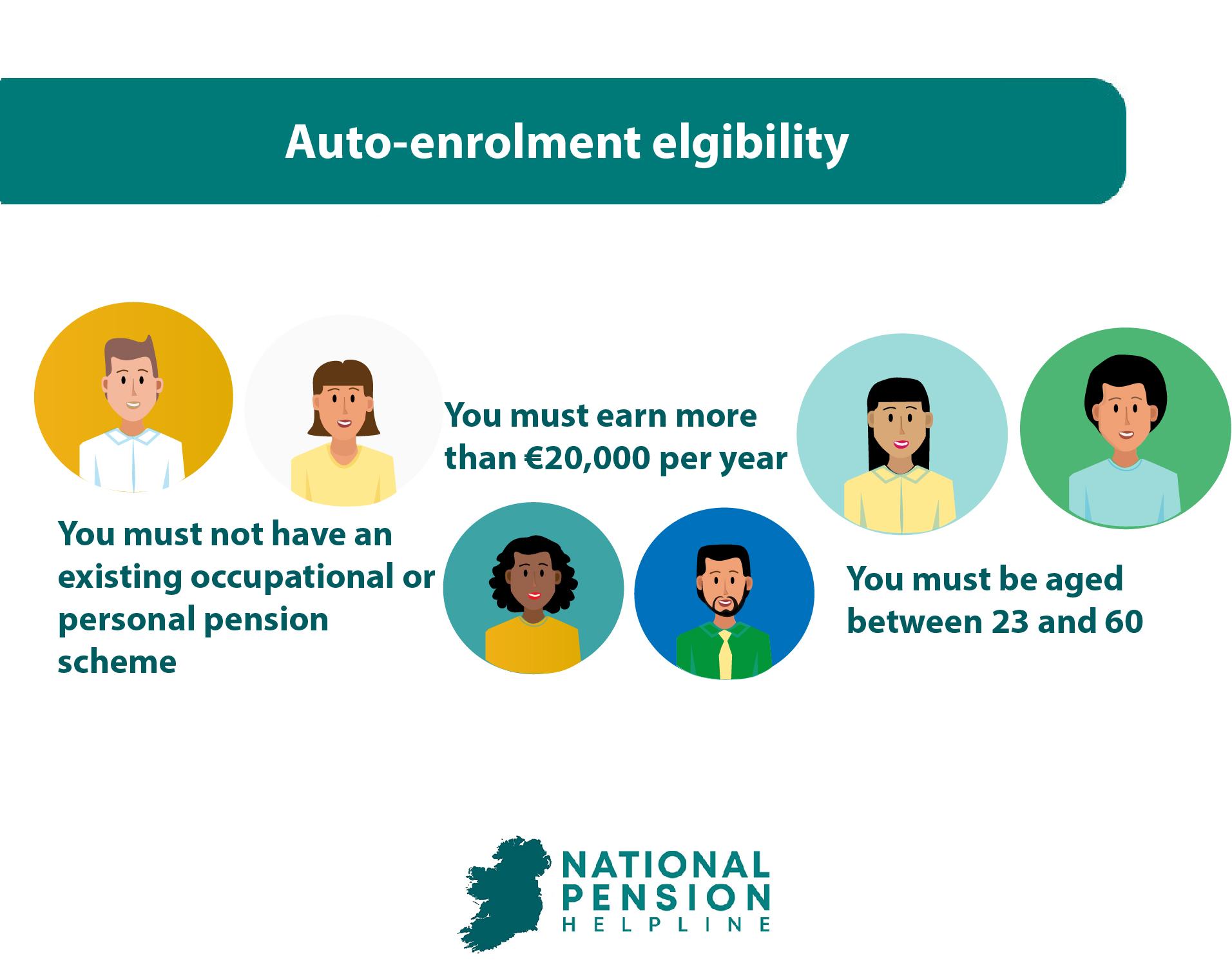

Not all employees are enrolled into My Future Fund – if you already have an occupational or private pension, you aren’t enrolled automatically.

The scheme also only applies to those aged between 23 and 60, and those earning over €20,000 per year.

If you are an employee, you will be auto-enrolled if you:

- Do not have an existing occupational or personal pension scheme

- Earn more than €20,000 per year

- Are aged between 23 and 60

If you earn less than €20,000 per year and/or are outside of the 23-60 age bracket, you can still choose to opt-in to the system.

Auto-enrolement for Employees

Hundreds of thousands of employees across the country are now enrolled in My Future Fund after the scheme came into effect at the start of 2026.

How does it work?

Auto-enrolment contributions work in much the same way as PRSI in that they come straight out of your salary automatically. Employers will match your contributions, and the government will also add a smaller amount to your pension pot.

This pot will follow you throughout your life, even if you change jobs, reach retirement age in Ireland, which is currently 66. Then you will begin to receive monthly payments on top of your State Pension, if you qualify.

Advantages of Auto-enrolment for Employees

- More money to spend in retirement

- Hassle free – contributions are automatic

- Employer and State contributions

Disadvantages of Auto-enrolment for Employees

- Percentage of contributions is fixed

- Limited investment options

- May be seen as a burden for lower earners

- May still not be enough to fund a comfortable retirement

Auto-enrolment for Employers

Auto-enrolment has been delayed on numerous occasions, and the most recent postponement announced in April was to give employers time to get their ducks in a row.

The scheme will benefit hundreds of thousands of employees, but it will also affect employers. If employers fail to meet their auto-enrolment obligations, they will be subject to penalties, and possibly even prosecution.

Key things for employers to consider:

- Employers must match all eligible employees’ contributions

- Contributions are based on a percentage of an employee’s salary

- The Year 1 contribution for employers is 1.5%

- Contributions will increase in first 10 years of the scheme

- Employers must match each employees’ contribution of 6% in Year 10

- Employees without a pension, who are aged 23-60 and earning over €20,000, will be enrolled

Auto-enrolment has been delayed on numerous occasions, and the most recent postponement announced in April was to give employers time to get their ducks in a row.

The scheme will benefit hundreds of thousands of employees, but it will also affect employers. If employers fail to meet their auto-enrolment obligations, they will be subject to penalties, and possibly even prosecution.

Key things for employers to consider:

Benefits of auto-enrolment for employers

If you are an employer in Ireland, there are several benefits of automatic enrolment, including:

- You don’t have to pay to set up a company pension scheme

- You don’t have to administer a company pension

- Your employees will be better looked after upon retirement

- Contributions are deductible for corporation tax purposes

How are auto-enrolment contributions collected?

If you are an employee, your contribution comes out of your paycheck each month.

For employers, NAERSA send an Automatic Enrolment Payroll Notification (AEPN) through payroll software, detailing the contribution amounts an employer (and their employee) must pay.

There are several ways to pay the contribution amounts to NAERSA, with a variable direct debit being the easiest option. This can be set up through the auto-enrolment employer portal.

Contributions must be paid at the same time as the employee is paid, and information must be provided to NAERSA and included on an employee’s payslip.

Auto-enrolment vs PRSAs – Which is better?

While the benefits of auto-enrolment are numerous, giving people access to a workplace pension for the first time, other options exist which allow you to make higher contributions.

A Personal Retirement Savings Account (PRSA) allows you to contribute a much higher percentage of your salary with tax relief.

However, there are no plans to force employers to contribute to personal pensions, which means that whether an auto-enrolment pension or PRSA is right for you depends on how much you wish to contribute.

Auto-enrolment Providers

The three companies chosen to manage assets for the auto-enrolment scheme are Irish Life Investment Managers, BlackRock and Amundi.

ILIM had €131 billion of assets under management (AUM) at the end of 2024. Amundi is Europe’s largest asset manager, with €2.24 trillion of AUM in December, while BlackRock is the world’s largest, with $11.6 trillion AUM.

Frequently Asked Questions

Auto-enrolment was introduced in the UK in 2012, and it has been hugely successful, with only around 10% of people opting out. By making pension participation an “opt-out” choice rather than “opt-in”, more people end up participating.

Yes, your salary will be affected by this scheme, however in years 1-3, the percentage of your salary that will be taken out will be only 1.5%. Another 2% will be contributed by your employer and the State.

You can choose to opt out after an initial mandatory period of 6 months. If you decide to either leave the plan or suspend your contributions, you will be automatically re-enrolled after 2 years, if you are still eligible.

You will be automatically re-enrolled 2 years after you decide to opt out, and you can rejoin the plan at any time during these two years.

Your auto-enrolment pension pot follows you if you change jobs, which means that employees don’t need to worry about having several pots.

In May 2025, it was announced that Irish Life, Amundi and BlackRock were chosen to run Ireland’s auto-enrolment scheme.

A lookback period of 13 weeks will be used by NAESRA to determine whether an employee meets the earnings threshold.

Yes, employers will be required to match the percentage of all eligible employees’ contributions, which is determined by the government and being phased in over the first 10 years of the scheme.

While a percentage of your salary will be taken out, auto-enrolment is not a tax – in fact, it is a positive thing due to additional contributions from your employer and the State.

Many counties have an automatic enrolment workplace pension system so that people are more comfortable in retirement. The UK introduced workplace pensions in 2012, and EU countries with auto-enrolment include Germany, France and the Netherlands.

The maximum contribution from both employees and employers will be 6% in Year 10 of the scheme. This means that 6% of an employee’s salary will go towards their pension, and this will be matched by their employer, and a 2% contribution from the government.