Company pensions are rewarding pension schemes where employers provide a straightforward way for their employees to save for retirement.

Not only do company pensions boost an employee’s retirement savings, but there are also tax benefits for both employees and employers who contribute.

Table of Contents

How Company Pensions Work in Ireland

Company pension schemes are set up by an employer to allow employees to contribute a percentage of their salary towards their retirement savings.

The employer may also decide to contribute a percentage towards the pension, and in many cases they match their employee’s contributions 1-to-1. These contributions are invested in a fund which aims to grow over time.

Employees can then access these funds when they retire in addition to the State Pension, and they may take out a tax-free lump sum of up to €200,000 from 60 years (or 50 in some cases).

Types of Company Pensions Available in Ireland

There are two main types of company pensions in Ireland:

Group PRSAs

Group PRSAs are company pensions that are set up by the employer, but are structured under PRSA rules. These are commonly used by small and medium businesses which have no formal scheme. In recent years they have increased in popularity.

The benefits of Group PRSAs include:

Master Trusts

Master trusts are more uncommon than traditional workplace pensions, but they are also growing in popularity. They are defined contribution savings schemes which can be used by multiple employers, reducing costs and simplifying management.

Master trusts are particularly attractive to smaller businesses because of strong governance standards, low member costs, and a range of investment options.

When can employees cash in their company pension?

Employees can usually cash in company pensions from the age of 60, accessing a 25% tax free lump sum of their total pension pot up to €200,000.

After this ceiling is reached, you are taxed at the 20% rate for the next €300,000. Anything that remains must be invested in an Approved Retirement Fund (ARF).

In some cases, early access may be allowed from age 50 for those who have left employment.

Benefits of Company Pensions for Employers

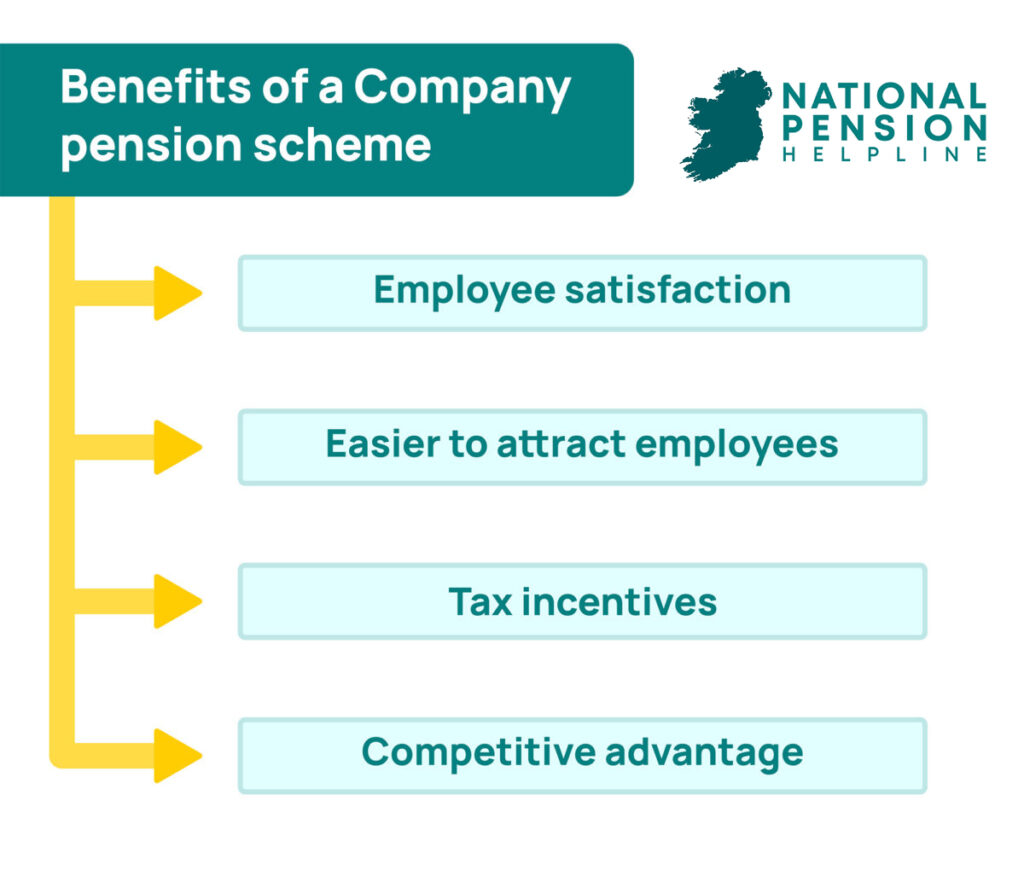

There are many benefits of setting up a company pension for employers in Ireland including worker satisfaction and retention, recruitment, tax incentives, and gaining an advantage over competitors.

Benefits of Company Pensions for Employees

Company pensions also offer a number of benefits for employees, such as tax relief, employer contributions and regular, automatic contributions.

Auto Enrolment

Auto-enrolment was brought in on 1 January 2026, bringing hundreds of thousands of workers into workplace pension schemes for the first time.

Employees who were not contributing to a company pension have been automatically enrolled in this scheme, officially titled MyFutureFund. They contribute a percentage of their salary which must be matched by their employer, with the State topping up contributions.

Read more about automatic enrolment here.