It’s apt to begin this article with the full context around why Additional Voluntary Contributions (AVCs) are fundamentally important to your financial security in retirement.

All will be explained in due course, but first, it’s absolutely crucial to understand why AVCs will be the difference between financial comfort and financial distress in your retirement.

Why are AVCs so important?

What Are Additional Voluntary Contributions?

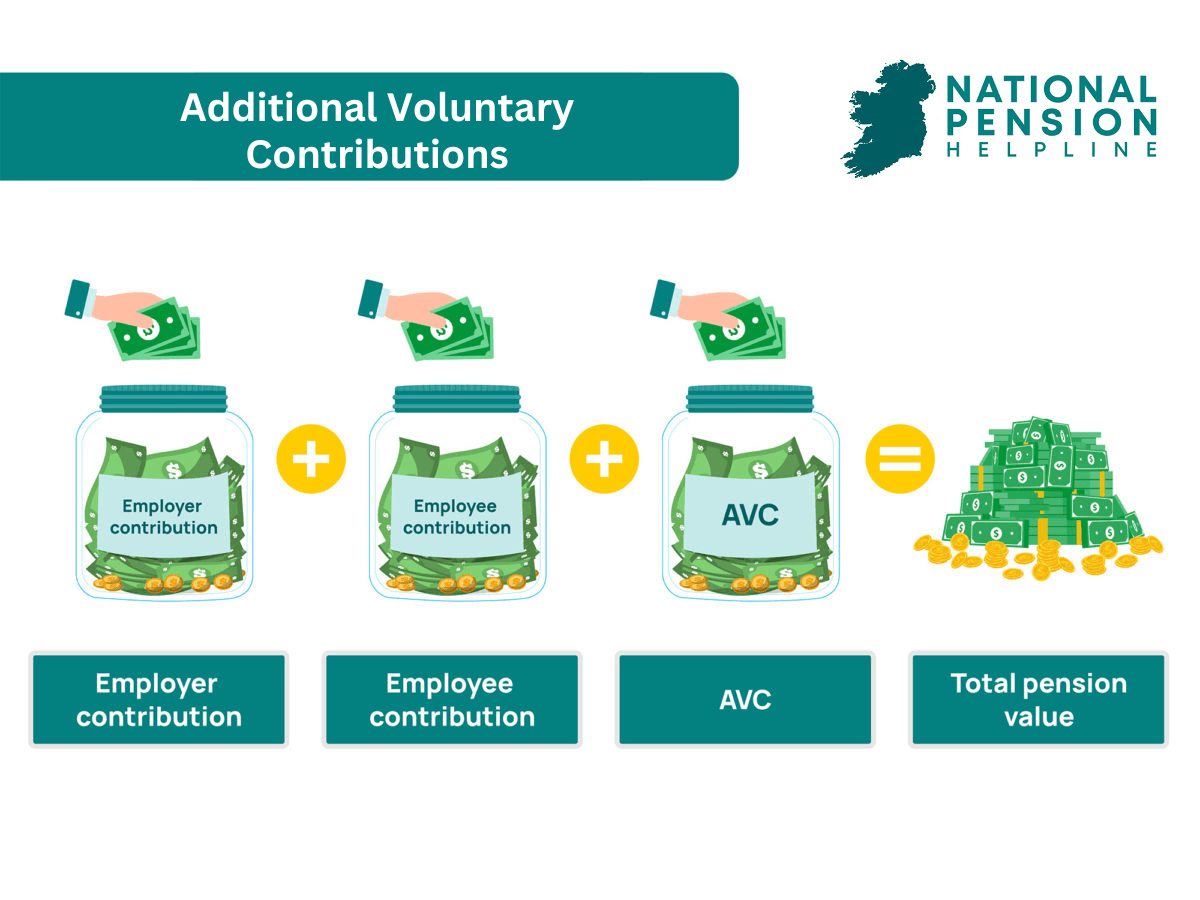

Additional Voluntary Contributions are exactly what they say on the tin – they’re additional pension contributions that you voluntarily make on top of your existing pension contributions.

AVCs are normally referenced in the context of occupational pension schemes i.e. where you are part of your employer’s pension scheme. Your employer will typically mandate a certain contribution rate in your contract which is the percentage of your income that you personally contribute to the pension scheme.

In addition, your employer will also contribute or “match” your own personal contribution with a contribution of their own up to a maximum specified percentage.

AVC Contribution Example

As an example, if your employer mandated a personal contribution of 2% to an occupational pension scheme and you’re 34 years old, then you could contribute a further 18% of your total income as additional voluntary contributions (AVCs) tax-efficiently to a pension scheme.

The reason why we refer to “tax-efficiently” here is because Irish tax law provides relief from income tax on pension contributions made in a given tax year within the limits specified above. This tax relief is worth 20% for standard rate taxpayers and 40% for higher rate taxpayers. You can read more about the taxation of pensions in Ireland here.

Note: The total percentage of your income that you can contribute to your pension tax-efficiently, inclusive of AVCs, is determined based on your age. Learn more about maximum pension contributions and the age-related percentage limits for tax relief on contributions.

| Age | Max % of total pay |

|---|---|

| Under 30 | 15% |

| 30 – 39 | 20% |

| 40 – 49 | 25% |

| 50 – 54 | 30% |

| 55 – 59 | 35% |

| 60 + | 40% |

How To Make Additional Voluntary Contributions

How you make your additional voluntary contributions can vary from employer to employer.

Scenario 1 – Your employer permits additional voluntary contributions to be made to the occupational pension scheme without limit

Scenario 2 – Your employer permits additional voluntary contributions to be made to the occupational pension scheme subject to a specified limit

Scenario 3 – Your employer does not permit additional voluntary contributions to be made to the occupational pension scheme

In the case of scenarios two and three, i.e. where a limit is placed on the employee’s ability to make additional voluntary contributions then, the employer must make a nominated personal retirement savings account (PRSA) available to the employee for the purpose of facilitating additional voluntary contributions.

This is mandated by the Pensions Authority. You can learn more about how PRSAs work and you can also learn about how to cash in a PRSA early.

If you’re not part of an occupational pension scheme then the concept of “additional voluntary contributions” isn’t necessarily as relevant to you. Rather, the entire act of allocating money towards your pension, which in this case will likely take the form of a personal retirement savings account (PRSA), can simply be thought of as “contributions” in the general sense.

The term “additional voluntary” comes from the fact that you’re contributing more than what is mandated for in your employer contract, but if no such mandate exists (due to the non-existence of an occupational pension scheme), then technically the whole act is classified as just “contributions”. Regardless, all of this is just semantics.

The bottom line is that in every scenario you can, and likely should, seek to maximise your tax-efficient personal pension contribution via additional contributions.

Where To Invest Additional Voluntary Contributions

Beyond actually making the additional voluntary contributions to your pension, the next most important thing is to ensure that your contributions are being invested in a way that aligns with your own personal circumstances and attitude towards and tolerance for risk.

Many pension investors in Ireland unknowingly have their contributions being invested in the default investment strategy (DIS) of the occupational pension scheme and/or personal retirement savings account (PRSA). While the DIS might be suitable for some investors, it is certainly not the most suitable option for every investor.

The National Pension Helpline would encourage you to read more about PRSA pension performance in Ireland here in order to get an idea of what’s possible when allocating your contributions towards different asset classes.

Closing Words

Maximising contributions to a private pension, and doing so as early as possible, will oftentimes be the difference between a financially comfortable retirement and a not so financially comfortable retirement. An individual who hypothetically has a salary of €60,000 for life (i.e. 40 years) will have contributed just €48,000 to their pension over the course of their working life should he/she choose to allocate just 2% per annum.

At a rate of return of 4% per annum, he/she will have €114,030.62 in the pot for retirement. But if that individual contributes, say, 15% of their income per annum, they will contribute €360,000 over the course of their working life and will have €855,229.64 at retirement assuming a 4% annual return.

Imagine what’s possible in the context of annual tax-efficient contribution rates going as high as 40% by age 60 and with some asset allocation optimisation towards “higher risk” assets for extended periods of time?

The sky’s the limit, but the starting point is increasing contributions as early as possible and ensuring that those contributions are being invested efficiently. The National Pension Helpline has a panel of vetted pensions experts who can advise you on additional voluntary contributions and what strategy is best for you.