Everything Irish Pensioners Need To Know [2025]

The taxation of pensions in Ireland at retirement is not “one size fits all”. Rather, each retirees tax position will depend on the pension(s) that they’ve accumulated and/or become entitled to over the course of their working life and what they choose to do with the pension(s) upon reaching the relevant retirement age(s). This article seeks to provide Irish pensioners with a comprehensive overview of how pensions are taxed in Ireland.

Income Tax, Universal Social Charge (USC) & Pay-Related Social Insurance (PRSI) As They Relate To Pensioners

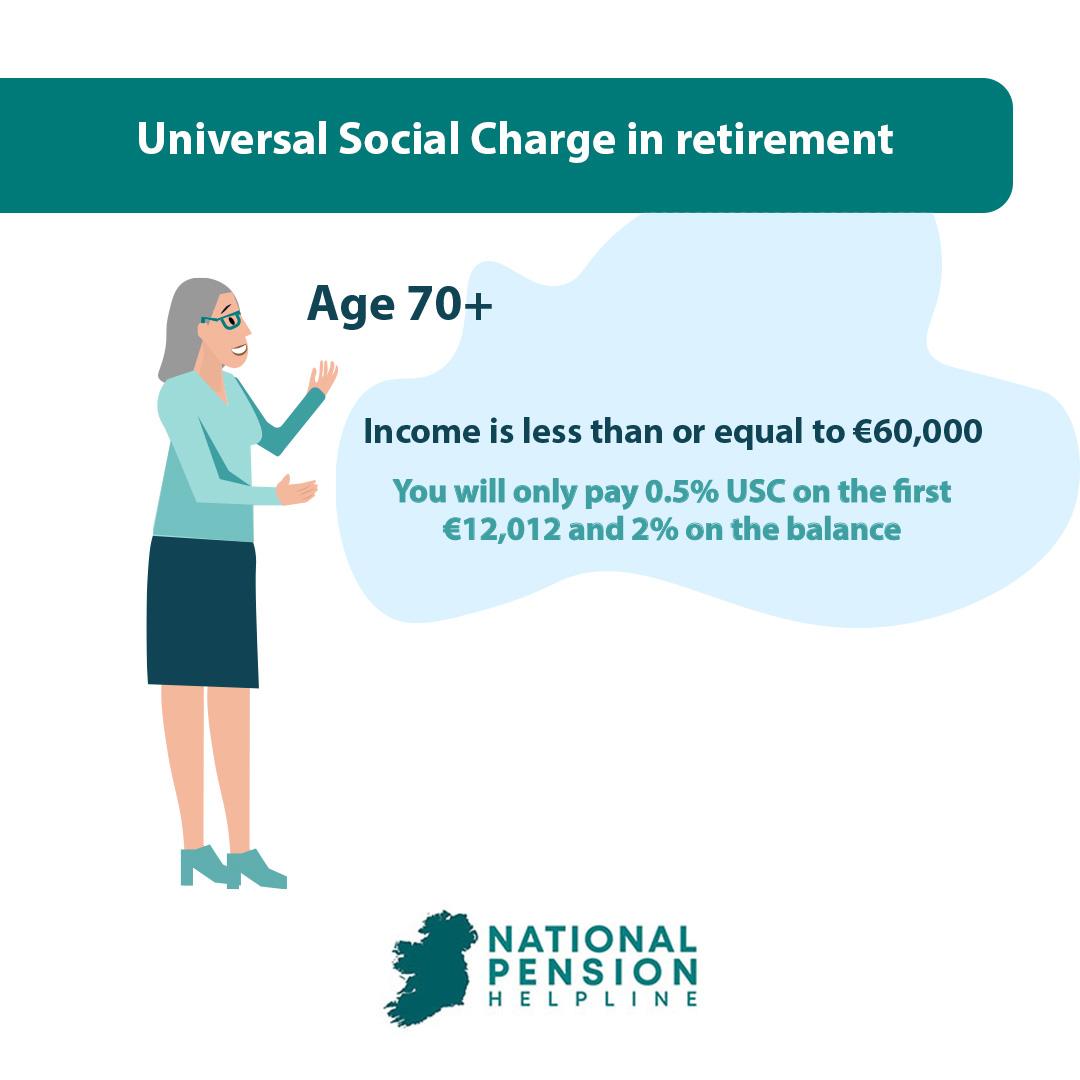

The core tax heads of income tax, universal social charge (USC) and pay-related social insurance (PRSI) can continue to be relevant for pensioners in retirement depending on their personal circumstances. If you need a refresher on the current rates for each of these taxes:

Before we talk about pensions, we’re going to focus on some the more notable tax rules as they relate to pensioners in Ireland more generally:

Pension Drawdown Options At Retirement

Your total pension(s) tax liability in retirement is dependent on

a) the type of pension(s) that you have

b) what you decide to do with your pension(s) once you reach retirement.

In this section, we will cover the drawdown options that you have upon reaching retirement for two types of pensions:

i) occupational pension schemes

ii) personal pension schemes. In the following sections, we will discuss the taxation treatment of these drawdown options.

Tax-Free Pension Lump Sum

In accordance with s790AA Taxes Consolidation Act, 1997 the aggregate amount of lump sums that can be taken tax-free from a pension(s), both domestic and foreign, is capped at a lifetime value of €200,000.

Taxation of Excess Lump Sums

The value of any lump sums taken from a pension(s) in excess of €200,000, but less than €500,000, will be taxable at the standard rate of tax (i.e. 20%). The value of any lump sums taken from a pension(s) in excess of €500,000 will be liable to marginal rate income taxes and universal social charge (USC).

Taxation of ARFs & Vested PRSAs

In accordance with s784A(2) Taxes Consolidation Act, 1997 the investment income and gains accrued within an ARF are exempt from both income tax and capital gains tax.

Likewise, in accordance with both s787I Taxes Consolidation Act, 1997 and s608 Taxes Consolidation Act, 1997, the investment income and gains accrued within a PRSA are exempt from both income tax and capital gains tax.

Once the relevant age has been attained, an individual can make a withdrawal of any amount from an ARF or vested PRSA. Alternatively, the individual may choose to leave their funds to grow within the account throughout retirement.

In accordance with both s784A(3) Taxes Consolidation Act, 1997, for ARFs, and s787G(1) Taxes Consolidation Act, 1997, for PRSAs, withdrawals from such shall be taxed as emoluments under Schedule E and subjected to marginal rate income taxes, universal social charge (USC) and pay-related social insurance (PRSI) (where applicable)^ under the PAYE system.

^if you are aged under 66, your account administrator must deduct PRSI on all withdrawals from ARFs and vested PRSAs. The current rate of PRSI at Class S is 4.1%. You will continue to be liable to PRSI until you are either a) in receipt of the State Pension (Contributory) or b) 70 years of age, whichever comes first.

Please note: the rules dictating the taxation of ARFs & vested PRSAs are equally as applicable to PEPPs, albeit with separate references under the Taxes Consolidation Act, 1997.

Annual Imputed Distributions

There is an anti-tax avoidance measure applicable to both ARFs and vested PRSAs which is designed to ensure that an individual cannot avoid a charge to tax by not drawing on the funds contained within their account in retirement. This measure is commonly referred to as the “annual imputed distribution”.

In accordance with s790D Taxes Consolidation Act, 1997 where an ARF or vested PRSA holder is aged 60 or over for the whole of a tax year, an annual notional distribution or “imputed distribution” will apply to the value of the assets held within the account at 30 November each year. The relevant percentage used to calculate the imputed distribution is determined as follows:

| Age for whole of tax year | Where value of ARF & vested PRSAs ≤ €2M | Where value of ARF & vested PRSAs>€2M |

|---|---|---|

| Under 60 | Nil | Nil |

| 60-70 | 4% | 6% |

| 71 and over | 5% | 6% |

Actual distributions (i.e. withdrawals) from an ARF or vested PRSA during a given tax year may be offset against the imputed distribution calculated above. If the value of the imputed distribution exceeds that of actual distributions, then the excess will be treated as a withdrawal in the February following that tax year and PAYE must be operated by the administrator by March 14th.

Top tip: there is no tax credit available for tax suffered on imputed distributions. Thus, where a tax liability arises due to an imputed distribution, the ARF or vested PRSA holder will effectively pay tax twice i.e. once on the imputed distribution and again later on the actual distribution. As such, it’s in the best interests of the account holder to make withdrawals from an ARF or PRSA that are at least equal, in totality, to the imputed distribution expected to arise in that tax year.

Deemed Distributions

In accordance with s784A (1A) & (1B) Taxes Consolidation Act, 1997 certain transactions can trigger a “deemed distribution” to the ARF or vested PRSA holder which is liable to tax under Schedule E. Please refer to the link above for a list of transactions that will give rise to a deemed distribution.

Not only will these transactions be liable to tax under Schedule E, but the assets which are subject of the deemed distribution will no longer be considered to form part of the ARF or vested PRSA, thus removing them from the scope of both the income tax and capital gains tax exemptions. Furthermore, deemed distributions may not be used to offset the value of the imputed distribution for that tax year.

Tax treatment of ARFs on death

In accordance with s784A Taxes Consolidation Act, 1997 inheritances from an ARF are taxed as follows:

| Paid To | Tax Treatment |

| ARF in the name of the deceased’s spouse | Exempt from CAT and income tax on transfer^ |

| Child under 21 at date of death | Exempt from income tax but classified as a taxable inheritance liable to CAT as per s85 Capital Acquisitions Tax Consolidation Act, 2003 |

| Child over 21 at date of death | Liable to 30% income tax |

| Any other individual | First subjected to PAYE at the deceased’s marginal rate of tax in the year of death and then CAT in the hands of the recipient |

^subsequent withdrawals from the ARF will be liable to tax under Schedule E

Please note: the tax treatment applicable to ARFs on death is equally as applicable to PRSAs and PEPPs

Taxation of Annuities

Where you use some or all of your pension at retirement to purchase an annuity for life, the income received from that annuity will be liable to marginal rate income tax and universal social charge (USC) under Schedule E. Payments from annuities fall under scope of PRSI Class M which means there will be no PRSI liability on the annuity payments.

Tax treatment of Annuities on death

In the case of standard annuities, once you die, annuity payments from the life company will cease. As such, there should be no taxation implications for your estate or your beneficiaries. However, it is possible to include additional features in your annuity which can extend the period for which payments are made, and the value of the payments, post-death. These features can result in taxation implications for those benefiting from them. Optional annuity features include, but are not limited to:

Payments made from an annuity post-death, i.e. “death benefits”, may be subjected to income tax and/or inheritance tax in the hands of the beneficiary.

Taxation of State Pension (Contributory)

State Pension (Contributory) payments are liable to income tax, but not universal social charge (USC) or pay-related social insurance (PRSI).

The Department of Social Protection does not deduct tax at source from your State Pension payments. Instead, how you pay tax depends on whether you’re a PAYE taxpayer or self-employed.

If you’re a PAYE taxpayer, Revenue will reduce both your annual tax credits and your available tax-rate band on your Tax Credit Certificate in order to account for the tax that is due on your State Pension payments. In effect, the tax due is collected from your other income.

If you’re self-employed, you’re required to include your State Pension payments on your ‘Form 11’ income tax return and self-assessment and pay Revenue any tax that is due.

Standard Fund Threshold (SFT)

It is important to ascertain whether the ‘Standard Fund Threshold (SFT)’ and the rules governing such are applicable to your own personal circumstances. Namely, whether your pension(s) in retirement will exceed the SFT. If you expect the value of your pension(s) to exceed €2,000,000, please refer to our dedicated article on the topic here for further information.

Conclusion

If you would like to learn more about your tax position as it relates to pensions in retirement, the National Pension Helpline has a panel of vetted pension experts who can assist you.

Speak with us today for expert advice on your pension.