What is a Personal Retirement Bond? (PRB)

A Personal Retirement Bond is a policy that is set up by the trustees of a company pension scheme to allow a member to leave the scheme and take the value of their pension fund with them. It is an essential pension vehicle when releasing a member from the fund because they have chosen to move to a different job or stopped working with the company that administers the pension scheme for another reason.

Table of Contents

Who is a pension scheme trustee?

A pension scheme trustee is a person who has been appointed to the board of a company pension scheme to manage and determine decision making around the scheme. They are generally not your employer but people within the company or associated with it who have knowledge of the pension landscape who take on this role. They are expected to work impartially and by the rules and governance of the scheme.

In the context of a Personal Retirement Bond they are involved in transferring the value of your pension fund to this bond so that you can then decide how best to reinvest it. The bond allows you to have complete control over your pension pot and to take advice from a pension advisor who can help you to reinvest it after you have left the scheme.

Can a trustee transfer my pension without my permission?

In general, a trustee cannot transfer your pension value into a bond without your consent. You have to give permission. You cannot be forced out of an existing and ongoing pension by choice of the trustee. However, if the company pension scheme is being wound down then it needs to be transferred to a bond so that you don’t lose control of it. This can be done without permission as it is a necessary step if the existing scheme will not exist in the near-future.

Transfer to a bond can also occur without your consent if you have left the pension scheme more than two years ago and have not made any arrangements around what should happen to your pension pot. However, you will be notified at least two months in advance if this is going to happen.

Why start a PRB?

The main reason to start a personal retirement bond (also known as a buy out bond) is to allow you to transfer the value of your pension pot out of a company that you are leaving. It gives you better control over what you can do with this value and how you can reinvest it.

A Personal Retirement Bond allows you control over your pension pot, the opportunity to grow it in any way you choose in terms of future investment and choice over the kind of risk you want to open your investment to and the type of bond or bond provider.

Depending on which type of pension you have (defined benefit or defined contribution) the process for moving your pension may vary. Defined contribution pensions have a clear value from the outset, such as €100,000. While defined benefit pensions require a transfer value to be calculated.

Now is quite a good time to move you old DB pension into a PRB as there are some excellent enhanced transfer value opportunities available.

Can I cash in my Personal Retirement Bond when I want?

No – a Personal Retirement Bond (PRB) can not be cashed in until you reach 60 years of age. The only alternative to this is if you retire early due to ill health or more commonly if you have moved jobs.

If either of these situations occur you can to take pension a 25% tax free lump sum at 50 in Ireland. The tax free lump sum can be any amount up to the 25% limit (subject to a tax-free lump sum lifetime limit of €200,000 across all pensions) and is determined by you – the pension holder.

What happens if I die before the Personal Retirement Bond matures?

If you die before the age of 60 (or 50 in the case of leaving service) your PRB value will be transferred to your named next-of-kin or other dependents.

How does a PRB work?

You are eligible to open a Personal Retirement Bond (PRB) if you have an old company pension to transfer, if you are ordinarily resident in the Republic of Ireland and over the age of 18.

It is important to note that personal retirement bonds are used to transfer old occupational pensions i.e. not your company pension with your current employer.

What can a Personal Retirement Bond invest in?

What types of investments can be made?

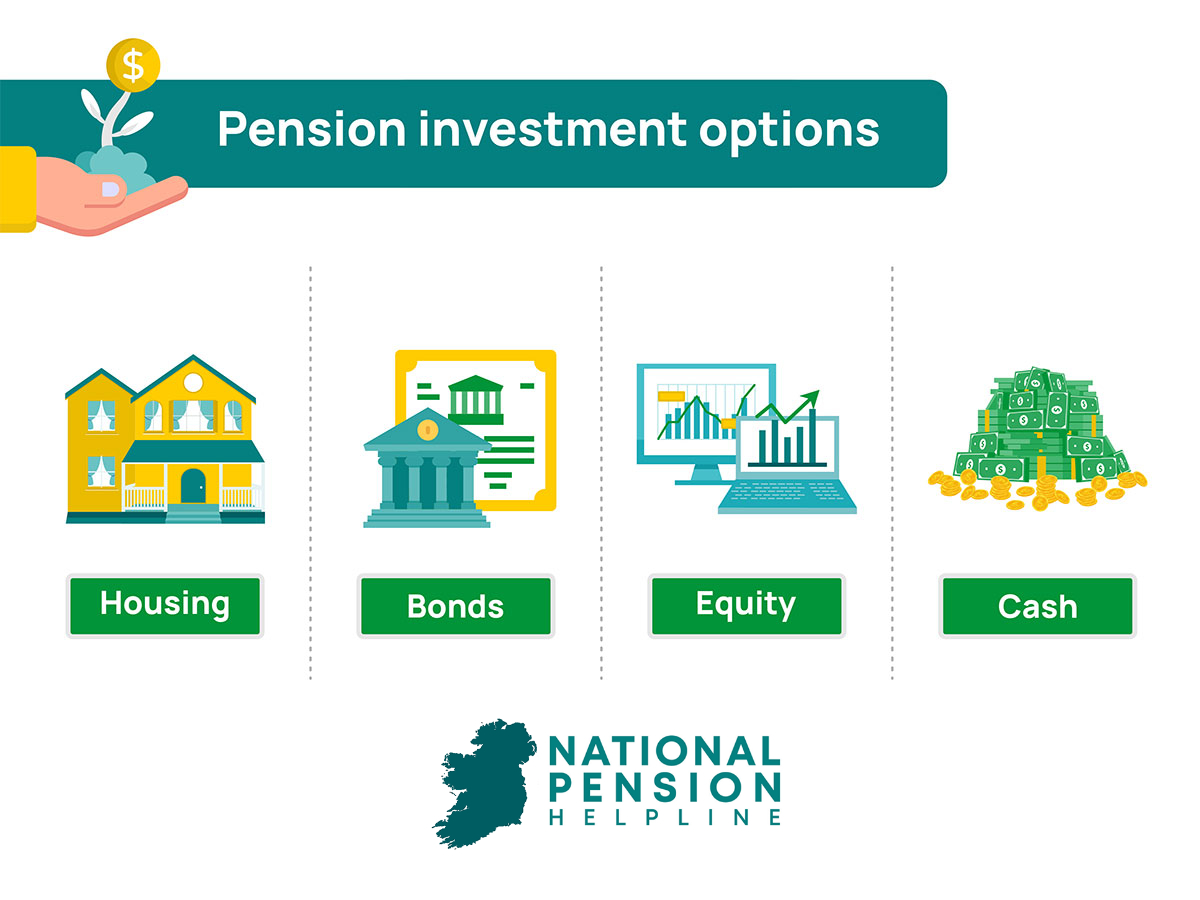

Investment is based on risk and the amount of risk you want to open your pension fund to. The general rule is that the greater the risk the greater the opportunity for profit but the inverse is true also. The greater the risk the greater the chance of you losing money.

Many people take advice from a pension advisor to choose the type of funds they want to invest in which match their personal attitude to risk. The main asset classes that pension funds are invested in include equities, properties, bonds and cash.

Your pension advisor can walk you through each of these and give you the very best information for your personal situation.

Can you make a loss by investing your PRB?

All investment comes with the risk of making a loss. This is why it is so important to take advice from an independent pension advisor when deciding to make any changes to your pension provision. You open yourself and your pension pot value to the prospect of losing money just as much as the prospect of making money.

What risk levels are available with a PRB?

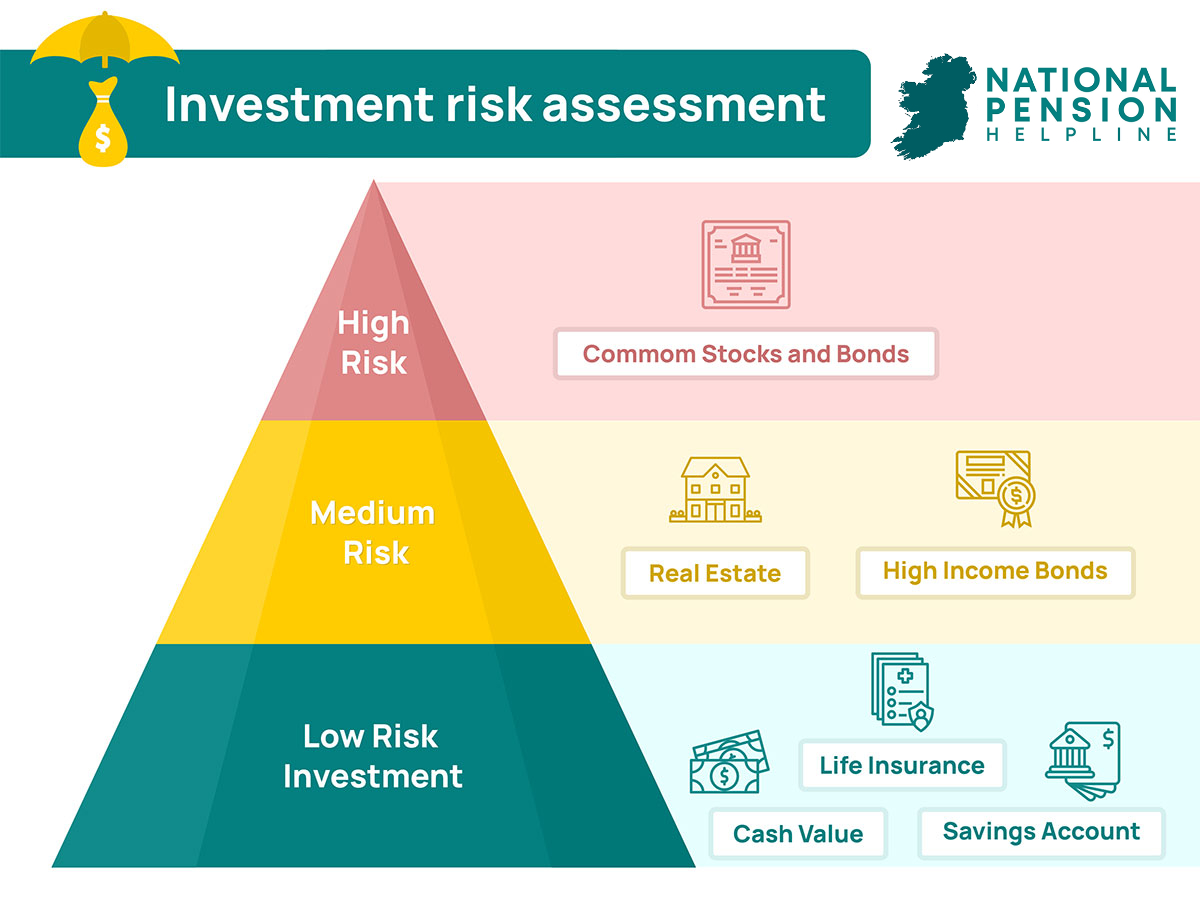

The European Risk Rating is a scale that determines risk in investment. A Personal Retirement Bond is an investment vehicle like all others. Its value can rise or fall depending on the performance of the markets it trades within. When setting up your PRB you will have the freedom to choose a risk level that suits your appetite for risk and your personal drive to achieve greater value in your fund. The higher the risk, the higher the potential for profit and growth. However, the higher the risk, the higher the chance of losing money also.

Consequently, the risk levels available and the opportunity to offer them to customers is highly regulated at the EU level, with the help of the Irish central bank. To better understand risk we use the European Risk Rating. It is a sliding scale of risk that clearly illustrates the potential and pitfalls of taking on greater risk. It helps a potential investor make an informed decision around the type of risk they are entering into with their personal retirement bonds.

Planning for the future & maximising tax benefits

In order to have the kind of retirement lifestyle you enjoy during your career, it is vital that you plan for it.

The earlier you start the better but, no matter where you are on your career path, you can increase value and create stability for your retirement by taking advice from an independent pension advisor.

They will be able to help you make decisions and recognise opportunities in the pensions market that suit your particular circumstances.