When it comes to generating funds for the Construction Workers’ Pension Scheme, a group scheme method has been adopted.

Affiliated with the employer trade body, Construction Industry Federation, nearly 50,000 members have offered up financial contributions under this model.

However, is this option feasible when it stands up against other open market alternatives?

What is a group scheme members’ fund?

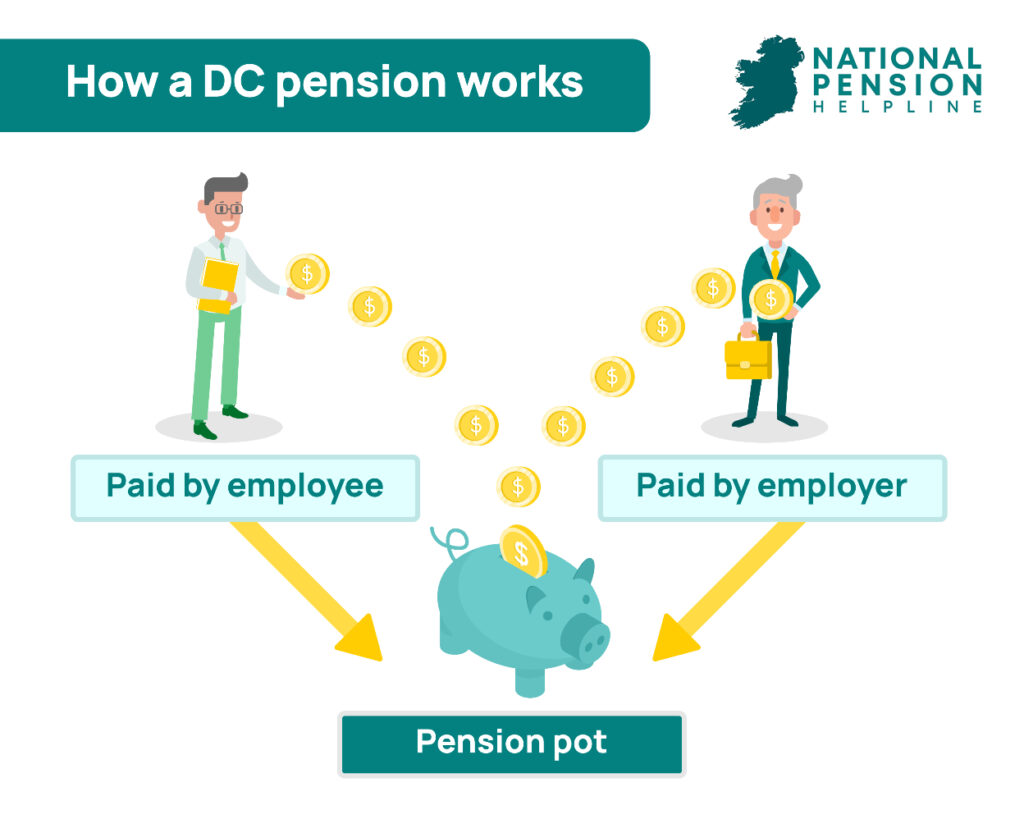

This type of model is a workplace pension run by an employer.

Most commonly falling into a category known as the defined contribution scheme, it is set up as a group personal pension that follows the government’s automatic enrolment duties for such benefits.

Essentially, a group scheme is a collection of individual pension plans set up by your employer that will be allocated to each individual employee.

How does it relate to the Construction Workers’ Pension Scheme (CWPS)?

In terms of pensions and benefits in the construction industry, employers are allowed to grant workers valuable add-ons at a low cost.

Officially, this type of pension scheme is outlined as a multi-employer occupational scheme offering solutions for workers in the construction and related industries, at an affordable entry price point.

One of the largest of its kind in Ireland, the plan also covers the conditions of the Sectoral Employment Orders with regards to sick pay and death in service benefits for all registered with CWPS.

CWPS versus open market alternatives – the basics

With plenty of options out there when it comes to choosing the right pension plan, it is important to understand the difference between each company’s benefits.

In the case of the Construction Workers’ Pension Scheme, its loyal customers and captured audience means there can be cost reductions on operational, marketing and trustee legal efforts.

Another major difference between the two is in how investment is allocated. For CWPS members, return is based on age whereas in other open market schemes, members choose their level of risk/reward instruments.

It also sets itself apart from other players in the market by excelling in the following areas:

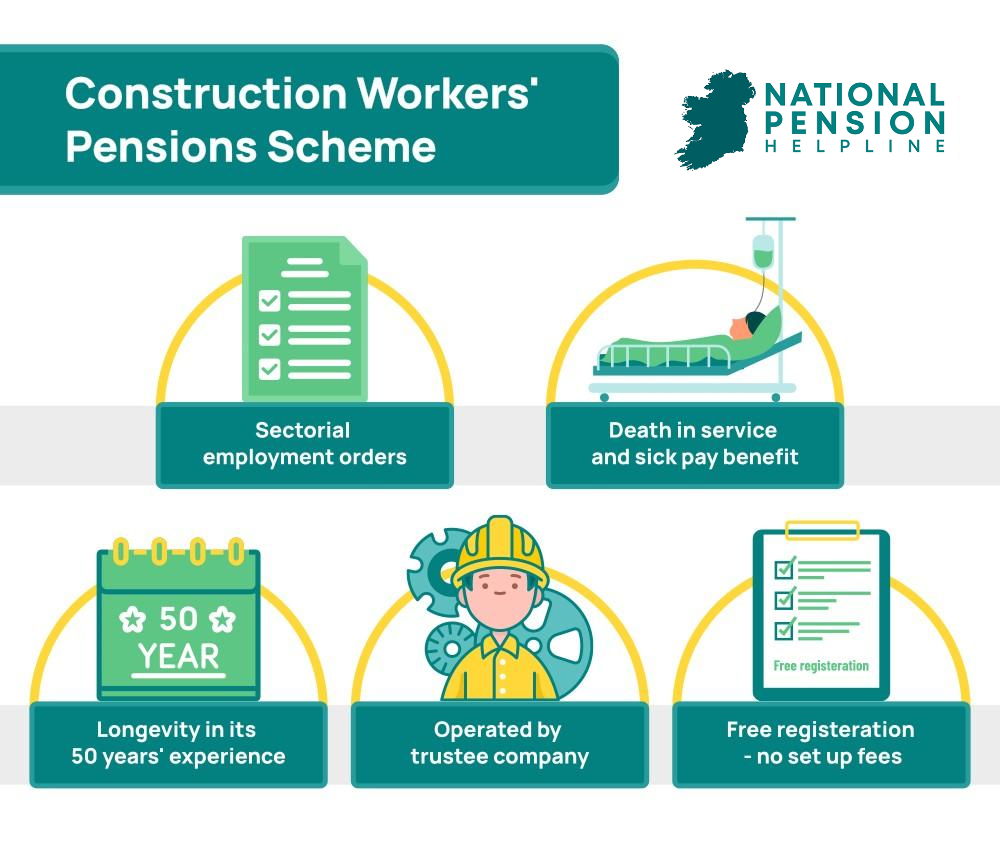

Sectoral Employment Orders

This is the regulatory body for rates of pay, sick pay and pensions across the construction sector, mechanical engineering sector and Electrical Contracting sectors.

They legally bind a flat rate alongside non-negotiable obligations in the above industries.

Ultimately, all employees covered by the Construction Workers’ Pension Scheme are to expect compensation within the guidelines of these orders.

Death in service and sick pay benefit

Active members of CWPS are covered automatically when such an issue occurs.

Compensation to be expected follows the below pattern:

These benefits are granted as an extension of building up a retirement fund under the scheme.

Trustee company regulations

CWPS Trustee DAC operates the scheme on behalf of the industry and is responsible for ensuring everything is carried out to the letter of the legal document that governs it.

Benefits of having a trustee company overseeing operations includes the hiring of investment advisors and investment managers to make sure the overall fund achieves optimum returns for its members.

In addition, a professional pension administration company is brought on to administer the scheme on their behalf.

This is at no additional cost for these full-service solutions and employers can enjoy handing over the duty of care of the pension fund to the company.

Longevity – 50 years of CWPS

CWPS has been proving itself as a reputable option for over 50 years.

With global recognition and plenty of awards behind them, the evidence is in its longevity as one of Ireland’s largest and most trusted pension schemes.

Contributions of Construction Workers’ Pension Scheme members

At current, the contribution rates (that mirror the recommendations of SEO) for CWPS members are as follows:

Negative aspects of defined contribution pensions

It is important to note that as a private sector employee, this type of pension scheme is not your only option.

There may be another model that is more cost effective to employees and employers that increases return on investment.

After analysis of returns over the previous five years, it is clear another avenue may be more favourable. For example, 2021 only saw funds deliver an aggregate of 6.35% despite being a blockbuster year.

This depreciation in returns could be due to a compounding effect of outlier annual management charges and allocation rates, amongst other factors.

Placement fees

Charged at entry point to some fund schemes, this is an added withdrawal that sways the vote in favour of ditching CWPS routes.

Where unit costs are low, this immediate dilution of initial capital could be detrimental. Where high fees are implemented here, ‘buying the dip’ becomes ineffective and will disrupt your returns.

Annual management charges

This is pretty much guaranteed to be attached to every fund because one way or another, the money manager has to earn his cheque.

Despite each party needing to benefit, this fact may be leaving employers and employees more out of pocket than they ever intended to be. The spread is considerable, usually amounting to as much as four percent.

Moreover, during this process often finances end up being channelled via a series of manager intermediaries into very similar if not identical stock market instrument models.

Allocation rates

Finally, analysing the amount of pension that is actually invested into performing assets is important before making decisions and locking in with any one company.

Fund managers are present for this action to be completed and will, in many cases, hold back a percentage (this can vary from one – four %) as a non-deployed cash carry.

The cash carry effectively operates as an additional fee and therefore will pose a threat as a compounding drag on your policy performance.

In the arrival of allocation rates, a decrease in return will happen no matter what the market chooses to do.

Therefore, it is important to understand the pros as well as the cons when deciding to opt into a Construction Workers’ Pension Scheme and not overlook the factual evidence that points at its inability to offer a fair return, in some circumstances.

Other options for your pension fund

There are available options for pension funds if you do not choose to be a part of a CWPS.

These options include:

Need help with your Construction Workers’ Pensions?

The National Pension Helpline is here to help you with any pension related topic you may need help with.

Fill out our assessment form below and a member of our team will be in touch to help and offer expert advice on your situation.