Introduction

When people imagine retirement, they either see themselves enjoying leisure activities, often in the sun, or spending time with their families and grandchildren.

Others see themselves staving off loneliness or indeed boredom by taking part in new activities and exploring the world. If either of these scenarios match your image of retirement then you need to prepare for it, because none of this comes cheap.

Table of Contents

Retirement planning

It’s hard to put an exact figure on how much a person might need, but it’s fair to say that you will need at least 40% of your current salary to ensure your standard of living is maintained in retirement.

This, of course, presumes that you won’t have a mortgage to pay by then, which is often the biggest part of our monthly expenditure while working, as well as being free of any children or other dependents living with us.

Lifestyles are changing though. With the current housing difficulties and the rising cost of living many people are predicted to be entering retirement before they have finished paying their mortgage and often with the fear that adult children may still be living with them as they struggle to get on the housing ladder.

Additionally, the cost of living is rising too and in parallel with rising life expectancy. People are living longer than ever but the cost of enjoying that life has never been more expensive. If you want to enjoy your retirement, now is the time to start panning for it.

Life expectancy in Ireland

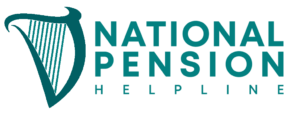

The increase in life expectancy is higher than ever and this is an amazing outcome of a more modern society with improved healthcare, nutrition, social protection and social care.

We can now confidently predict that we will live longer than our parents and grandparents. However, it comes with the added burden of planning to have an income to provide for our lifestyles during these years.

Between 1960 and 2019 data reveals that life expectancy has increased by an average of 12.5 years. This jump in our life expectancy needs to be budgeted for. While the State will provide a basic income for all retired people in the form of the State pension, generally this will not be enough to provide for the cost of living.

At €277.30 per week, it is designed to be a basic income to cover fuel, food and essential provisions. It is not designed to match the costs of your usual lifestyle while working. For this reason people take on a private pension plan to supplement this payment. Very often your cost of living can increase in retirement, especially if you plan to travel regularly.

Working out what you need to retire

There are a lot of factors to consider when deciding how much you need saved in your pension to retire.

Factors include, dependent children, post retirement expenses, do you still pay your mortgage, are you entitled to a state pension.

To calculate how much you will have in your personal pension, use the National Pension Helpline pension calculator.

Our calculator will give you an idea of your retirement income and how much more you need to save to retire comfortably.

40% of people retire on a state pension alone. Is that enough for you?

The first question you need to ask yourself is whether you will be comfortable living on the State pension alone. This payment is made to all retired people based on the PRSI payments through their working life. It is a set amount that is designed to cover a basic cost of living.

It is currently €277.30 per week. The majority of people will need more than this to service their standard cost of living, particularly if you plan to be active in retirement and enjoy these more leisure-focused years.

How long do you expect to live and how much do you want to live on a year?

While life expectancy is linked to many personal factors such as health, genetics, lifestyle and attitudes to nutrition throughout your life you can predict a life expectancy based on your parents, your grandparents and your current state of health.

Research suggests that most people can confidently predict that they will live at least 16 years after retirement. Many others live much longer than that and it is not uncommon to meet increasing numbers of people living into their 90s. This is only set to grow.

Are you confident that any savings you may have will match the cost of living for these years?

If you hope to continue your current standard of living with additional travel, eating out, and leisure activities you need to plan for it.

How much do you expect to live off a year in retirement?

The average salary in Ireland is currently around €44,000. In retirement you can usually make some assumptions around outgoings that will allow you to predict how much you will need to live on each year. If you assume your mortgage is paid off and that your children have left home you can usually maintain your normal lifestyle on half of the salary that you needed before retirement. With a salary of €44,000 you will need to have an income of €22,000.

The State Pension works out at around €14,419.60 per annum, leaving you a shortfall of €8,828 to maintain your standard of living from year to year. You need to plan to bridge this shortfall in your retirement income.

What kind of retirement lifestyle do you want?

For many people your retirement years are considered to be the years when you get something back. You have worked all your life and now want to be able to retire and enjoy a lifestyle that has been well earned.

Consequently, your annual budget may increase if you plan to travel or take up new leisure activities in retirement.

So the idea of half your current salary being enough to maintain your lifestyle may not be enough. In order to get a true picture of the cost of your personal retirement, make a clear and honest plan for what you hope to do with those years.

With this you will be able to predict how much you will need each year and whether your current pension provision will match that.

Will you have all your expenses paid off? (Mortgage, kids college, Kids still living at home)

Retirement is built on presumptions about your lifestyle that are not always in tune with modern lifestyles.

For example, not everyone will have their mortgage paid off by the time they retire.

Adult children can often still be tied to the home either by living in it or other offspring related expenditure like extended college life or requiring you to look after your grandchildren in retirement.

It’s important to factor in all these additional and often unexpected expenses when planning ahead for our retirement.

The 4% rule

What is the 4% rule?

In retirement you want to spread your pension pot over the duration of your lifetime.

To set out to achieve that experts recommend that you withdraw only 4% of your pension pot in any one year.

This idea is based on a scenario whereby you invest your retirement savings equally between stocks and bonds.

It’s a rigid approach that must be carefully managed but an annual 4% withdrawal with an adjustment for inflation should allow enough to remain across your investments to spread the same value across each year.

It’s based on a worst-case scenario whereby you don’t have any other income other than your pension.

How long will a 4% rule last?

The 4% rule is based on reaching a 30-year pension lifetime span and can actually extend beyond that depending on your investment return during its lifetime.

Does a 5% rule also work?

A slightly riskier approach is suggested by other experts who claim a 5% withdrawal rate.

It allows you to withdraw more of your pension each year and spread it across a similar amount of time but it is based on a premise that you aren’t carrying any debt whatsoever – this includes credit cards, mortgages or car loans.

These debts would eat into your 5%, essentially reducing it to the 4%.

What other people consider enough to live on

How much money do I need to retire?

Discussing your retirement plans with others can be a useful way to gauge real experience from their decisions.

This is particularly helpful if they are ahead of you in their career path and closer to retirement age.

They can outline what they believe to be a correct cost of living and income during retirement that you can use as a benchmark for your own decisions. Ultimately though, everyone’s retirement scenario is different and while friends and acquaintances can give you an idea of their experience they rarely divulge all the facts around their costs, savings and outgoings.

It’s vital to seek out expert help from a pension advisor who can talk you through the options, opportunities and solutions for your own retirement plan.

Many people consider an income that matches the equivalent of 50-75% of their pre-retirement salary as being the appropriate percentage to aim for on a monthly basis. But for others this is a lot more than they will need. Try our calculator to get a suggested figure for what you might need.

Inflation – The silent killer of your retirement savings:

Predictions for retirement income should always factor in the rate of inflation. In recent years the rate of inflation and interest rates have been relatively low but that isn’t predicted to stay that way for much longer.

Inflation is constantly under pressure from national and world events and current political and economic crises in the world are threatening inflation rates. It is sensible to include an increase in inflation rates when you are calculating your retirement income so that you can get a more accurate reading of what your pension can buy you reach retirement age.

Inflation represents a decrease in the purchasing power of money. What you can buy for €1 today will not be the same in 20 years. Factor this potential decrease in value into all your calculations.

Inflation

- €1 euro in 1997 = €1.54 euros 2022

How much do I need to retire abroad?

For European citizens, the opportunity to live abroad in another EU state for some or all of your retirement is a very real option.

Some people choose to spend the winter months in a warmer climate such as the south of Spain while others buy a property and live there year round.

Your pension is determined for tax reasons by your normal country of residence. You will be taxed on all income according to the tax rate of the country you choose to live in.

For this reason, before considering moving to another EU state or a country beyond the EU, it’s important that you take advice on what your options are and how each country’s tax scenario will affect you.

Do I pay tax in Ireland when retiring abroad?

Countries like the United states and all the EU states have a double taxation agreement with Ireland and so you will only be taxed once. If you move to a country that doesn’t have a double taxation agreement you will need to understand in detail how your taxation might change in that country.

Advantages of retiring abroad:

The cost of living for retired people in some EU countries such as France, Spain and Greece is lower than in Ireland for certain things such as healthcare, day to day expenses and property. For these reasons, considering a partial or total move to another country is attractive.

Where are the top retirement destinations in Europe?

The top countries to retire in from Ireland include: Portugal, Slovenia, France Italy and Spain.

Your standard and cost of living will be determined by where in these countries you choose to settle. The most popular places tend to be near coastlines or, in the case of Slovenia, near the city of Ljubljana or on Lake Bled.

Each of these countries offer a cheaper general cost of living than in Ireland and you will find that your pension pot will go much further in these countries.

Can I use my pension to buy a holiday home?

In Ireland you can invest in property using your pension. However, there are limitations to how you can use this property. One stipulation is that you can not live in the property.

This unfortunately means, you can not use your pension to buy a holiday home to live in for retirement.

Conclusion

Retirement can be one of the most exciting parts of your life if you plan for it. There is no better time than now to examine your current pension plan and make sure it fits with your ambitions for your future retirement.

To do this the best first step is to contact a pensions expert who can take you through your potions, help you to understand the choices you need to make and bring you towards a more confident retirement plan.