The State pension is designed to ensure that everyone in the Republic of Ireland has a basic level of income. It is paid on a weekly basis and to qualify for it you must have made enough PRSI payments during your career. If you have not then you are eligible for a non-contributory pension which you have to apply for and is means tested to confirm your eligibility.

For most people the State pension isn’t enough to maintain the standard of living that they enjoyed during their working career and so many people have a personal Pension and a State pension.

Table of Contents

How much is the state pension in Ireland?

The State pension equates to €14,419.60 per annum, paid on a weekly basis of €277.30. It is intended as a basic income to prevent individuals falling into a poverty trap.

In addition to the basic income there are additional benefits available for people who are carers, have an additional adult that they support or other dependents living with them. Further details on this are outlined below.

The State also pays a widow’s pension and offers free travel and once you reach the age of 70, a package that includes assistance with gas, electricity and TV license costs.

At what age can I access my state pension?

Currently the State pension is paid at age 66. You need to apply for it around three months before you reach your 66th birthday.

If you have worked overseas for some of your career you need to apply earlier to give ample time to process paperwork around gaps in your working life in the State.

Can I access my pension before 66?

No. The State pension is paid from a specific age and is not accessible before that period, irrespective of your personal circumstances. There are other welfare supports in place to assist people who need to manage their cost of living before they reach pension age.

Is the State pension age going to increase?

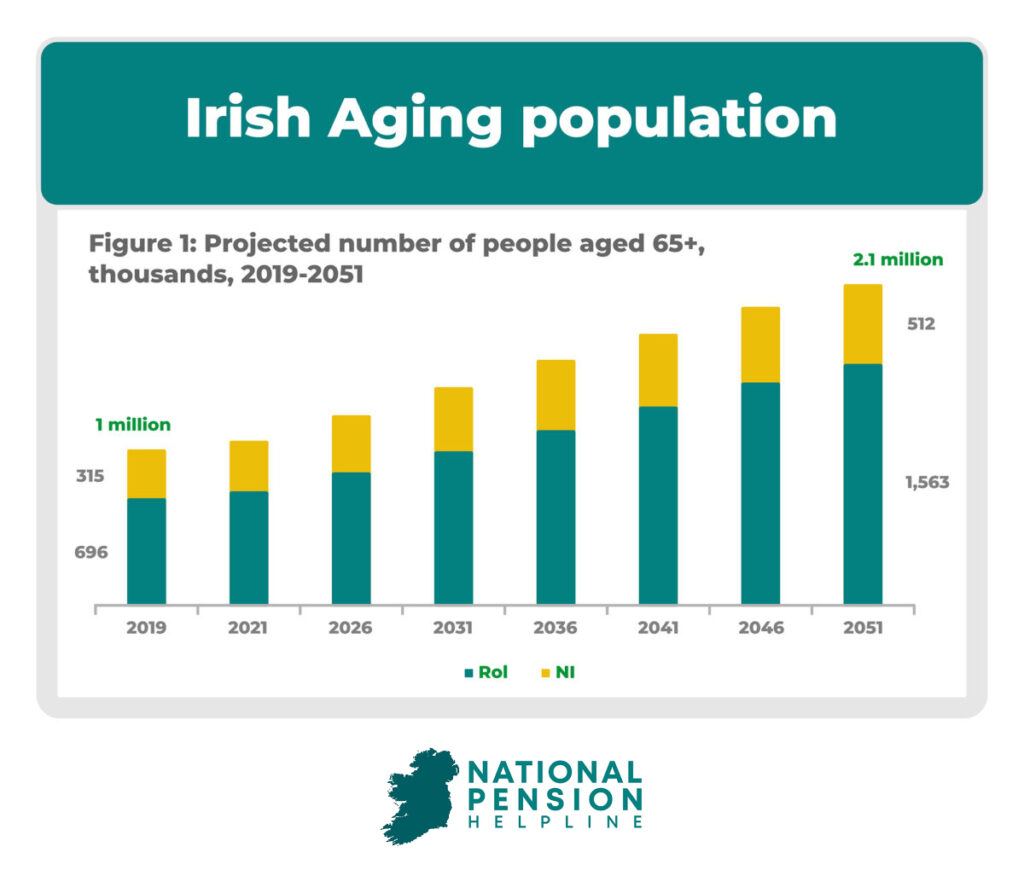

The State pension is extremely expensive for the State to maintain and it is only increasing. An improved healthcare system ensures people are living longer and as we have an aging population overall it is predicted that there will be a new peak in State pension recipients by 2050. To attempt to manage this, the Government has proposed raising the qualifying age from 66 to 67 initially, with a further increase to age 68 suggested to follow soon afterwards. How soon or if this might happen has not yet been announced.

How to qualify for a state pension?

Your opportunity to qualify for the State pension is based on the number of PRSI payments you have made during your working career. To qualify for the correct amount of payments you must have begun work in the State by the age of 56 or earlier. This will allow you to have made the mandatory 520 full-rate social insurance contributions (PRSI) required. Until 2012 this figure was 260 contributions to qualify.

Full rate employed social contribution

What is the full rate of PRSI – Class A

The term Full Rate Contributions was introduced in 1979 to refer to the PRSI payments scale used to verify whether you qualify for the State pension. They are also called Class A and indicate that each PRSI payment you contributed was equal to the correct value of payment.

Self-employed contribution

Self-employed people pay their PRSI contributions at Class S. This class is equal to a full rate contribution and the same qualifying arrangements exist as per Class A.

What happens if I paid PRSI in another county?

If you worked in another country for part of your career the payments made there may qualify for your State pension in Ireland. This is particularly the case if you worked in another EU country or in the UK. You will be asked to provide details of any gaps in your PRSI payment record in Ireland and this will help ensure you qualify for work carried out abroad.

Not all countries outside the EU have bilateral Social Security Agreements so it is important that you include as much information as possible to allow the teams involved to assess your case.

Can I receive my Irish state pension if I live in another county?

If you live outside the State or you intend to in the future your State pension can be paid directly into your account in Ireland, or abroad, allowing you freedom of movement.

Who can receive a higher rate of the state pension?

Many people qualify for additional supports depending on their personal circumstances. You should provide full details of all people who live in your household and for whom you are the main provider. This will allow the team assessing your claim to make sure you receive all the allowances you are entitled to.

Your own pension payment is called a Personal Allowance. Any other person that relies on you to support them may allow you to qualify for an increase for a Qualified Adult. This is means tested.

Qualified Adults

If you have an adult who is dependent on your care you can receive additional payments to support that person.

The adult must not already be receiving a social welfare payment, such as child benefit, disability benefit, domiciliary care allowance, foster care allowance, guardian’s payment, half-rate carer’s allowance, occupational injuries death benefit in respect of an orphan, basic supplementary welfare allowance.

If your dependent is receiving any of these payments then you do not qualify for an additional allowance.

They do not have to satisfy the requirement for habitual residence for you to qualify for this payment.

Payment level

For you to qualify for an adult dependent allowance the adult must not have an income of more than €310 per week.

If they have an income of less than €100 per week you will qualify for the full allowance rate. If they earn between €100 and €310 you will get a tapered or reduced rate of qualified Adult allowance.

Qualified Child

You may be entitled to an additional payment for a dependent child. They need to live in the State, be under the age of 18 and not be in receipt of other welfare payments. Foster children also qualify under this heading.

Living Alone

There are additional payments available to people who live alone. You need to be living completely alone but certain circumstances exist to widen this definition.

For example, if you live in what is known as a granny flat or an extended part of a family home that has its own cooking, dining and sleeping facilities then you may qualify.

If you need care during the night time that requires someone to stay in your home overnight you will still qualify.

If you stay with friends or family at night or at weekends you may also still qualify for the living alone allowance.

If you sometimes rent out a room for short-term stays you may still qualify for the living alone allowance.

I am moving into a nursing home soon – will I still qualify for the living alone allowance?

No. Since a nursing home is a mixed home living situation you will no longer qualify for the living alone allowance.

Over the age of 80

Once you reach the age of 80 you will receive an increase in your pension payment. You do not need to apply for this – it will automatically be increased on your 80th birthday.

Fuel allowance

The fuel allowance was introduced to support people on welfare payments, including the State pension, during the winter months. It begins in September and runs until April.

It is an additional payment of €33 per week and represents a payment towards your heating costs. It is means tested so you do not automatically receive it when you get the State pension.

You must apply for it. Once you do, you will be assessed base don your income and to qualify you must apply using the Fuel Allowance Scheme application form which you will find at your local post office or online. Only one person per household can receive the fuel allowance.

Telephone support allowance

The Telephone Support Allowance is a payment of €2.50 per week that is in addition to your State pension. You need to qualify for it. If you are receiving the living alone allowance and the fuel allowance you will automatically have the telephone allowance applied.

If you do not currently receive it and feel that you should qualify then you can apply for it with your local social welfare office. Telephone support is considered an important communication and security assistance that people on the State pension may need.

Living on a Specified Island

If you live on one of Ireland’s islands then you will also qualify for a payment to cover the cost of traveling between your home island and the mainland. It is an additional €20 per week.

How does the state pension work?

What are the two categories of State pension?

The State pension is an essential payment to ensure that no one in the State lives unsupported in retirement. It is a basic payment but a crucial one. There are two ways to qualify: contributory and non-contributory.

These terms refer to your career experience and payment or non-payment of PRSI. These are normal deductions that would have been made in your paycheck or salary each week or month.

A contributory payment is one that qualifies for the normal State pension by having the correct amount of PRSI social security payments made in the qualifying years.

A non-contributory pension is one which is paid to those people who do not qualify for the contributory pension because they have not paid enough PRSI payments through their life.

State Pension – Contributory

Will this category be means-tested?

No. The contributory pension is not means tested. It is automatically paid if you have paid the qualifying number of payments through your career.

The age at which you can begin to pay PRSI for the first time is 56, allowing you the requisite number of months to pay PRSI before you reach retirement age.

To receive it you must have finished working completely as well as meet the PRSI payments.

State Pension – Non-Contributory

No. The contributory pension is not means tested. It is automatically paid if you have paid the qualifying number of payments through your career.

The age at which you can begin to pay PRSI for the first time is 56, allowing you the requisite number of months to pay PRSI before you reach retirement age.

To receive it you must have finished working completely as well as meet the PRSI payments.

How is the state pension calculated?

The State pension is based on the number of PRSI payments you have made during your working career. They can include payments made abroad if there is a bilateral agreement between Ireland and the country you worked in.

The value of the full contributory pension is not means tested so if you qualify for it based on PRSI payments and reaching the required age threshold you will receive the payment. You should apply for it at least three months before your 66th year.

The full value of your pension will be calculated based on the value of the State pension plus your personal circumstances. This assessment will determine if you qualify for any additional payments such as caring for a dependent adult, child or whether you are living alone.

The current state of the Irish state Pension

Is the state pension going to increase?

The value of the State pension increases periodically and relative to wider economic changes. It is a huge annual cost to the State and so changes do not occur frequently or without very considered debate.

Is the age of retirement going to increase?

The age of retirement is likely to increase in the coming years. Ireland has an aging population who are living longer and consequently changes need to be made to ensure the State is capable of paying the State pension to all citizens. The most immediate change will likely be to the qualifying age.

It is currently set at age 66 but there is discussion ongoing to raise this to 67 or 68 years of age.

What impact will raising the retirement age from 66 to 67 have on the government?

Raising the qualifying age will create a saving for the Government in the short term. Ultimately it is tasked with managing the future outcome of the pension for all its citizens and the introduction of a new upper age limit to qualify creates a saving that buys them time in this process.

Planning on retiring on an Irish Pension?

The weekly average wage is much higher than the weekly State pension payment. At current estimates the average weekly wage is €867 while the State pension is €248, leaving a shortfall of almost €600 per week for many people.

The State pension makes some presumptions about the standard of living of a person in receipt of a State pension. They are presumed to own their own property or be close to finishing their mortgage payments, they are presumed to have no adult dependents living with them and have reduced living costs.

However , in modern Ireland this has all changed. Many people will enter pension age without owning their own home and with dependent adults still living with them.

Is the State pension enough to fund your lifestyle?

With increased health in the nation overall, many more pension-age people have a lot of ambition to do more with their retirement such as extended and frequent travel, create new business or take part in society in a more active way than their parents might have done.

All of this costs money and if its how you see your future then you need to plan to have additional income over and above the State pension.

Why should I start a private pension?

The State pension is an amazing support to have and isn’t common in many countries but unfortunately many people find it isn’t enough to fund their lifestyles. As we live longer and with more ambition we need more income to support ourselves. This is where private pensions come into their own and reveal just how important lifelong financial planning is.

It offers tax-free investment growth as well as lump sum payments at a crucial time of life that is incredible value for money.

Now is always the best time to start a pension so if you don’t already have one or have lost track of the benefits of the scheme you have entered into then contact a pension advisor for the very best independent advice.

When planning for your retirement lifestyle, it is important to calculate your pension to determine how much you will need to save to have the income you need.