The Irish old age State Pension is a vital support for retirees, funded by the Social Insurance Fund (your PRSI contributions). However, with changing demographics and an aging population, the sustainability of the system is in question.

In this article, we’ll explore the key issues and potential solutions to ensure a stable and equitable pension system in Ireland.

The Problems with the Current System

The Irish pension system operates on a pay-as-you-go model, where current workers’ contributions finance the pensions of retirees.

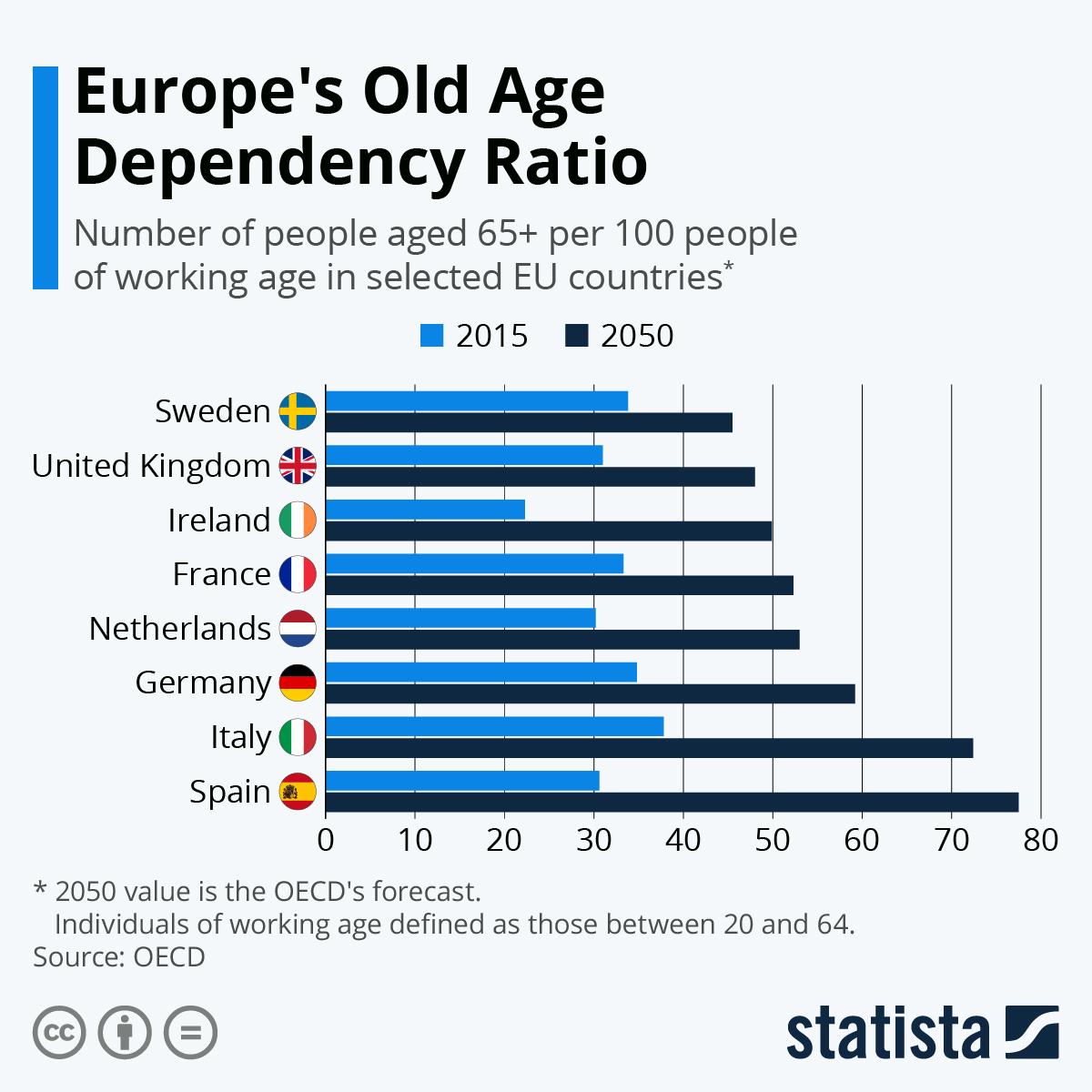

Currently, Ireland has a low old age dependency ratio, with four workers for every retiree. However, this ratio is projected to increase significantly by 2050, resulting in only two workers per retiree.

This imbalance poses a financial challenge as there won’t be enough funds to cover future pension payments unless changes are made.

What is the Solution to the Pension Problem?

To address the challenges and achieve a sustainable pension system, several solutions have been proposed.

The Commission on Pensions recommends adopting Package 4, which includes gradually increasing contribution rates, raising the state pension age, and increasing government contributions to the Social Insurance Fund.

These changes would be implemented gradually, aligning with the changing old age dependency ratio.

The Steady State PRSI Rate:

The Irish Fiscal Advisory Council suggests establishing a separate State Pension Fund to ensure financial stability. Instead of gradually increasing PRSI rates over many years, a steady state PRSI rate would be introduced by 2027.

“Steady-state funding involves a steady-state contribution rate which is the lowest rate sufficient to ensure the long-term financial stability of the plan without recourse to further rate increases” – Office of the chiefs Actuary 2007

This rate, estimated at 18.52%, would be sufficient to sustain the fund for the next 70 years, accounting for changing demographics. Implementing this steady rate early would generate surpluses that could be invested to further grow the fund.

Challenges

Implementing changes to the pension system faces challenges, particularly in terms of politics and public perception.

While mathematically sound, increasing PRSI rates may not be politically favorable in the short term. Additionally, uncertain economic factors, such as indexation of benefits and potential economic downturns, could impact the sustainability of the system.

In Conclusion

The Irish pension system requires immediate attention to address its sustainability issues. Delaying necessary reforms will only exacerbate intergenerational inequality.

Increasing PRSI rates and the state pension age are essential steps, and the government should also encourage private pension investments.

Educating and incentivizing individuals to secure their financial future is key to success.