The government is carrying out a review of the Standard Fund Threshold for pension funds, which could potentially have a big impact on pensions in Ireland.

Part of this review process is a public consultation which is now open and will run into next year, with submissions accepted until January 26.

Minister for Finance Michael McGrath announced that independent expert, Dr. Donal de Buitléir will lead the review with support from the Department of Finance.

What is the Standard Fund Threshold

The Standard Fund Threshold (SFT) is a significant piece of the rules governing large pension pots in Ireland.

Specifically, it is the limit to the size a tax-relieved pension fund can reach before being subject to additional taxation. Any amount of your fund in excess of the SFT is subject to upfront income tax at the marginal rate of 40%.

The government created the Standard Fund Threshold due to concerns about some people using pension rules to accumulate huge amounts of tax-relieved pension assets.

The SFT was introduced in 2005 and was initially set at €5 million. However, it was reduced in the years after, and since 2014 it has been set at €2 million.

Why Might the SFT Limit be a Problem

The level the SFT is set at plays a big role in determining how much income a person can have at retirement, and how long that fund can be stretched out for.

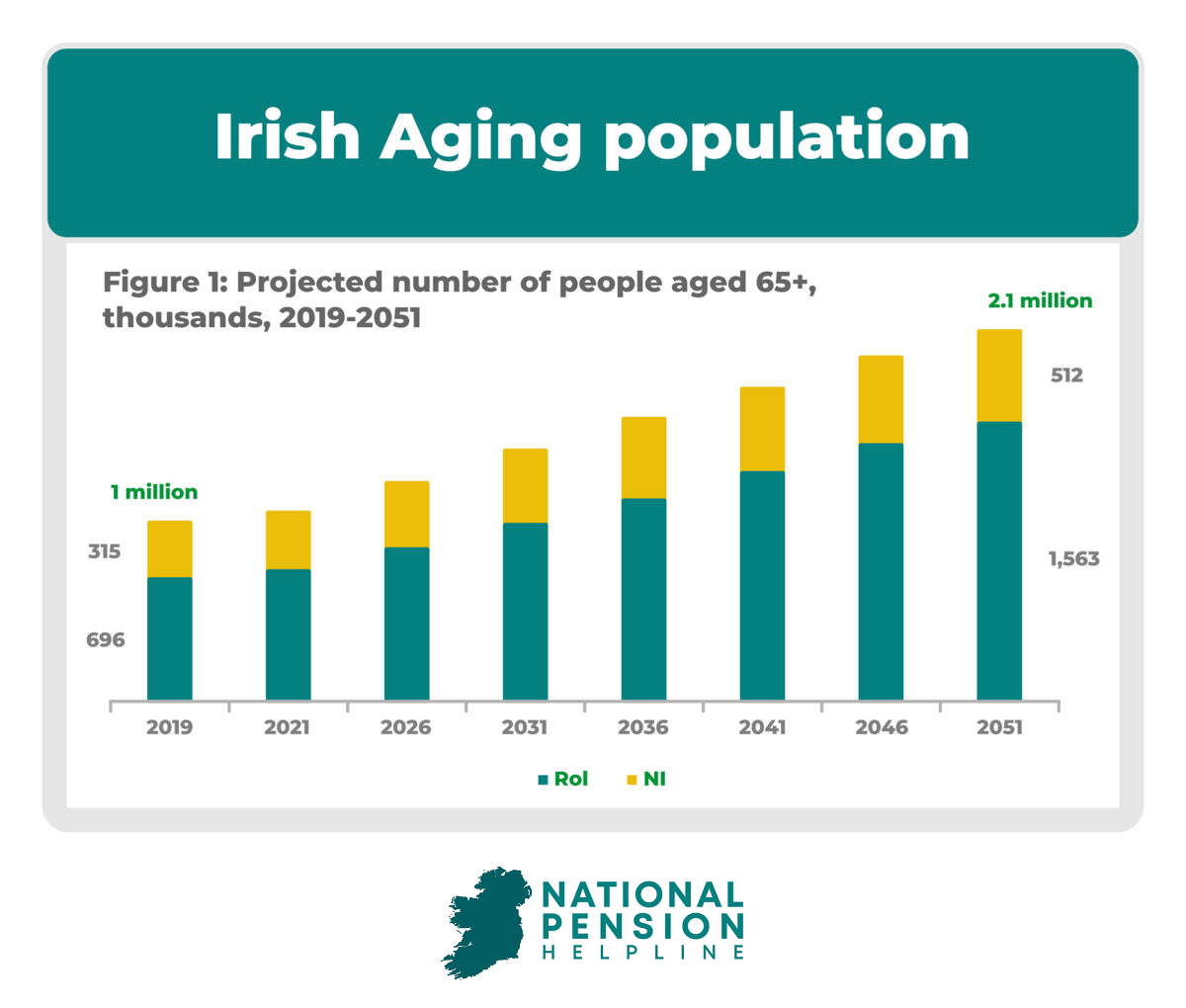

People are living longer than ever, which is good news overall but also poses a problem from a pension perspective. A longer lifespan means more time spent after retirement, and that pension fund will have to be stretched out longer.

There is also the simple fact of inflation and the rising cost of living in Ireland in all areas. What might have seemed more than adequate for people to retire on in 2014 doesn’t have the same purchasing power now.

Standard Fund Threshold Review

The government has set the following terms of reference for this review, determining what will be examined and areas where changes might be brought in.

The recommendations made by this review process will be presented to the Minister for consideration in the Summer of 2024.

Minister McGrath said, “I am pleased to announce the commencement of this examination of the Standard Fund Threshold regime and in particular the opening of the public consultation.”

The Minister added that it was “timely” to carry out a review of the SFT regime, as it has remained unchanged since 2014.

“The public consultation will be an important opportunity for interested parties to express their views in relation to the operation of the SFT and put forward their proposals for any amendments. I encourage all stakeholders to participate in the public consultation process.”

“I am delighted that Dr. Donal de Buitléir, with his relevant skills and expertise, has agreed to lead the examination. I look forward to receiving the results of the examination next summer.”

You can have your say in this public consultation by sending in submissions by email or post. Emails should be sent to TaxPolicyUnit@finance.gov.ie, and submissions by post should be addressed to:

Examination of Standard Fund Threshold Regime

Taxation Division

Department of Finance

Government Buildings

Merrion Street

Dublin 2

All submissions should include your name, contact address, contact details (including telephone number and e-mail address) and details of any organisation being represented.