In February 2023, a headline appeared in the Irish Independent which read as follows:

“crippling 41% exit tax on funds to be reviewed, says Michael McGrath”.

At the time, Michael McGrath was Ireland’s Minister for Finance and he, following on from an initial announcement made by Paschal Donohoe the previous winter, had just commissioned a public consultation into Ireland’s Funds Sector.

As part of this review, aspects of Ireland’s investment fund taxation regime would be challenged to see if they were in the best interests of the Funds Sector through to 2030. This sparked widespread optimism among Irish retail investors who have long called for an overhaul to the current system of funds taxation in the country.

Anyone could make a submission with their thoughts as part of the public consultation up until 15th September 2023, after which point submissions closed.

This culminated in a total of 194 submissions, including 140 from individuals responding in a private capacity. In addition, the Review Team met with over 100 firms and attended over 30 industry events in the course of its research.

Many Irish personal finance commentators made detailed submissions to the Government appointed review team outlining the current problems with the taxation of funds in Ireland (more specifically the taxation of exchange-traded funds (ETFs)) and some proposed solutions to these problems.

Crucially, these submissions were being made from the perspective of the average retail investor, not the large life assurance companies or other major stakeholders.

Since the closure of submissions last September, with not much else other than the occasional update, the Irish investing community had been eagerly awaiting the results of the review. Many speculated that changes would be adopted as part of Budget 2025.

However, it became apparent that the results of the review would be accounted for as part of Budget 2025, much to the dismay of Irish investors. However, it wasn’t all gloom and doom. Current Minister for Finance Jack Chambers published the review on October 22nd 2024 and went on record saying that he has backed recommendations from the report to be adopted as early as next year.

Let’s take a look at the findings and observations of the report as they relate to exchange-traded funds (ETFs).

Key Findings

Below are the primary recommendations of the report as they relate to exchange-traded funds in Ireland which, in the words of the report, are to “bring the regime into closer alignment with the taxation on other savings and investment products”:

Let’s take a look at each of these suggestions in more detail.

1. Removing Deemed Disposal

Deemed disposal was originally introduced as a means for Revenue to increase the rate at which they were collecting tax from Irish tax resident fund investors while simultaneously avoiding a scenario where an Irish investor could theoretically avoid paying tax on their fund investments for an indefinite period of time.

However, the policy was introduced in 2006 and has long been antiquated and in dire need of reassessment. The proposed removal of deemed disposal could benefit Irish ETF investors in 5 key ways:

i) Promote Sensible Investment

Globally, ETFs have become a staple of every investor’s portfolio due to the fact that investing consistently in low-cost, passively managed index fund ETFs has been proven by historical data to be the single best way to invest for the long-term.

With online brokerage platforms like Trade Republic and Trading 212 democratising access to the financial markets for Irish investors, there has never been a better time in modern history to be an investor in ETFs than right now, but deemed disposal has been holding Irish investors back.

Its removal will encourage Irish investors to engage with what is, for 99.9% of the population, the most suitable investment vehicle for long-term investing.

ii) Improve Investment Outcomes

Historically, on the 8th anniversary of an investment in a product such as an exchange-traded fund, an Irish investor would have to account for a charge to taxation under the deemed disposal regime (assuming said investment had accrued an unrealised gain during the holding period).

From an economic perspective, there is an opportunity cost associated with deemed disposal. Reason being, an Irish investor would have two options to choose from when paying their bill for deemed disposal taxation:

In the case of the former, the cash set aside could have been used to make further investments. Instead, the investor is forced to utilise it to account for tax on an unrealized gain.

In the case of the latter, by selling a portion of the ETF holding, the investor is foregoing the additional gains or losses that would have accrued had the holdings been kept intact.

Thus, in both circumstances, a real opportunity cost presents itself. The elimination of deemed disposal will remove this opportunity cost and improve investment outcomes for investors.

iii) Reduce Distortionary Behaviour

A key finding from the report was that “there was strong and consistent feedback from many stakeholders that the current taxation regime is overly complex and that the disparity of treatment with other savings and investment products distorts decision-making for investors”.

Deemed disposal does absolutely nothing, from both a simplicity and attractiveness perspective, to make ETF investing more accessible to Irish investors who want nothing more than to make smart financial decisions for their financial futures.

When beginner Irish investors see the minefield that is the ETF taxation regime in Ireland they will either do a full one-eighty and give up on ETF investing altogether OR they’ll opt for another product like stocks, bonds or cryptocurrencies (all of which have been found to underperform ETFs over the long-term).

Neither of these outcomes are favourable. Removing deemed disposal will simplify ETF taxation for Irish investors, thus reducing distortionary investment behaviour.

iv) Eliminate Administration Burden

Nowadays, investors seldom make one single investment in a particular product throughout the course of a year. Rather, most investors deploy some form of euro-cost averaging investment strategy whereby investments are made every week, month or quarter as opposed to a single point in time.

In fact, many online brokerages encourage this style of investing by offering zero fees to investors who choose to avail of it.

While this strategy can be beneficial from an investment perspective, from an Irish tax administration perspective, this means that Irish tax resident ETF investors utilising euro-cost averaging will have a deemed disposal tax liability every year after the first 8-year anniversary of their first investment.

That is a lot of deemed disposal shenanigans to keep track of – ain’t nobody got time for that!

Again, this has a distortionary effect on investor behaviour because it encourages lump sum investing over euro-cost averaging in order to reduce the administrative burden of ETFs. This is not the basis on which investment decisions should be made and the removal of deemed disposal will ensure that this is not the case.

v) Improve Estate Planning

Unlike for regular shares, the death of individual holding ETF investments is a taxable event under the deemed disposal regime in Ireland.

This results in the value of the deceased’s estate being lower to the tune of the unrealised gain taxable at 41%. As such, the existence of a deemed disposal on death complicates estate planning. Its removal will simplify the process for both disponers and executors.

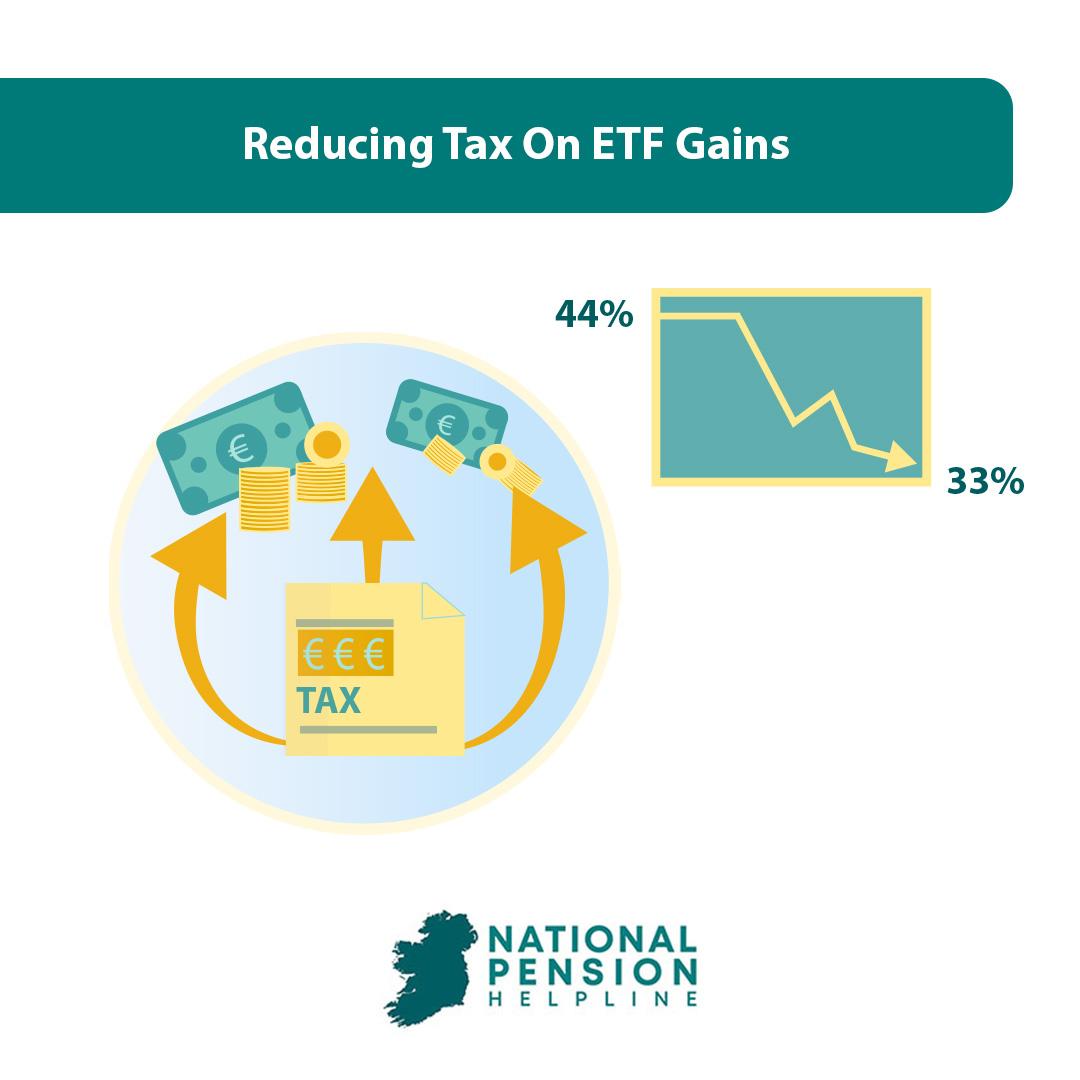

2. Reducing Tax On ETF Gains To 33%

One of the key recommendations from the Commission on Taxation and Welfare in their report “Foundations for the Future” was the simplification of the taxation of investments in Ireland.

By aligning the rate of tax applicable to ETF gains with that of capital gains tax (CGT), there will be a significant simplification of investment taxation in Ireland.

This could be taken one step further by levying marginal rate income taxes, USC and PRSI of ETF investment income (which could also result in higher receipts for the Exchequer in the case of higher rate ETF taxpayers).

Interestingly, a decision to align the taxation of ETF gains with capital gains tax will very likely be net revenue raising for the Exchequer despite it representing a 19.5% real decline in tax rate. Reason being, for all of the reasons listed above, there’s an argument to be made that more people will start investing as a result of this change, thus resulting in larger receipts for the Exchequer over the long-term through indirect capital market participation.

This is especially true when you consider that an individual’s capital is much more valuable to the Exchequer when it’s invested, as compared to being left on deposit in a bank account.

According to the report, “at the end of 2023 roughly €178 billion was held on deposit in banks and credit unions, as well as in ‘State Savings’ products”.

The tax-take from deposit interest retention tax (DIRT) is inherently linked to both

a) the value of household deposits.

b) the rate of deposit interest offered by Irish banks to consumers.

With the latter being lacklustre to say the least, it’s undeniable that invested capital is more valuable than deposited capital to the Exchequer.

This is especially true when you consider that the equity markets have returned, on average, about 10% annually over the past century. The Exchequer can participate in this appreciation to the extent that taxable persons participate in the equity markets.

3. Allowing ETF Loss Relief

As it stands, if an Irish investor makes a loss on an ETF investment that loss cannot be set against other investment gains, including ETF gains.

Ringfencing ETF losses creates inequities and it encourages distortionary investment behaviour.

It also doesn’t capture the true economic position of the investor i.e. whether or not he/she has made a net gain or net loss on their investments across the board.

Conclusion

Let’s be clear, the report of the review team amounts to nothing more than just recommendations for the time being. It will be the responsibility of a future Minister for Finance and his/her Government to implement these recommendations into tax law.

Despite Fine Gael’s Paschal Donohoe and Michael McGrath commissioning the report and Fianna Fail’s Jack Chambers seeing it across the line and supporting its findings, it’s likely that none of these individuals will be in a position to see the actual implementation of the recommendations in the next Budget.

We are now staring down the barrel of a general election. Who knows if the next Government will share the same ambitions to bring about positive change to the taxation of ETFs as the current Government.

Even though the recommendations have been made and even though they’re in line with the general recommendations of the Commission on Taxation and Welfare, there’s no surefire guarantee that change will happen next year.

It simply may not be a pressing priority of the next Government, especially if that Government wants to differentiate themselves from the current Government and its own priorities. Still, we at the National Pension Helpline remain cautiously optimistic.

Let’s hope it doesn’t take some 20 years for positive change to come about (unlike a certain ‘auto-enrolment’ initiative!).