If you are starting your pension, or you have been paying into an occupational or personal pension for a number of years, you may have concerns around the types of company that your pension savings are being invested into.

Pension savings or contributions are invested into a managed fund in order for them to make a return and provide an income for your retirement. Some of these pension funds may invest in companies that carry out activities that are not in alignment with your ethics or values.

If you are interested in ethical pension investing the National Pension Helpline can help you with advice and information, including ways to make your pension more responsible.

Ethical investing

Traditionally, it has been possible to exclude certain investments from an investment portfolio such as alcohol, tobacco, gambling , and weapons companies.

More recently, ethical investing (including pension investments) considers ethical or social concerns such as sustainability and climate change as well as, or even ahead of, financial returns in choosing a pension provider or fund.

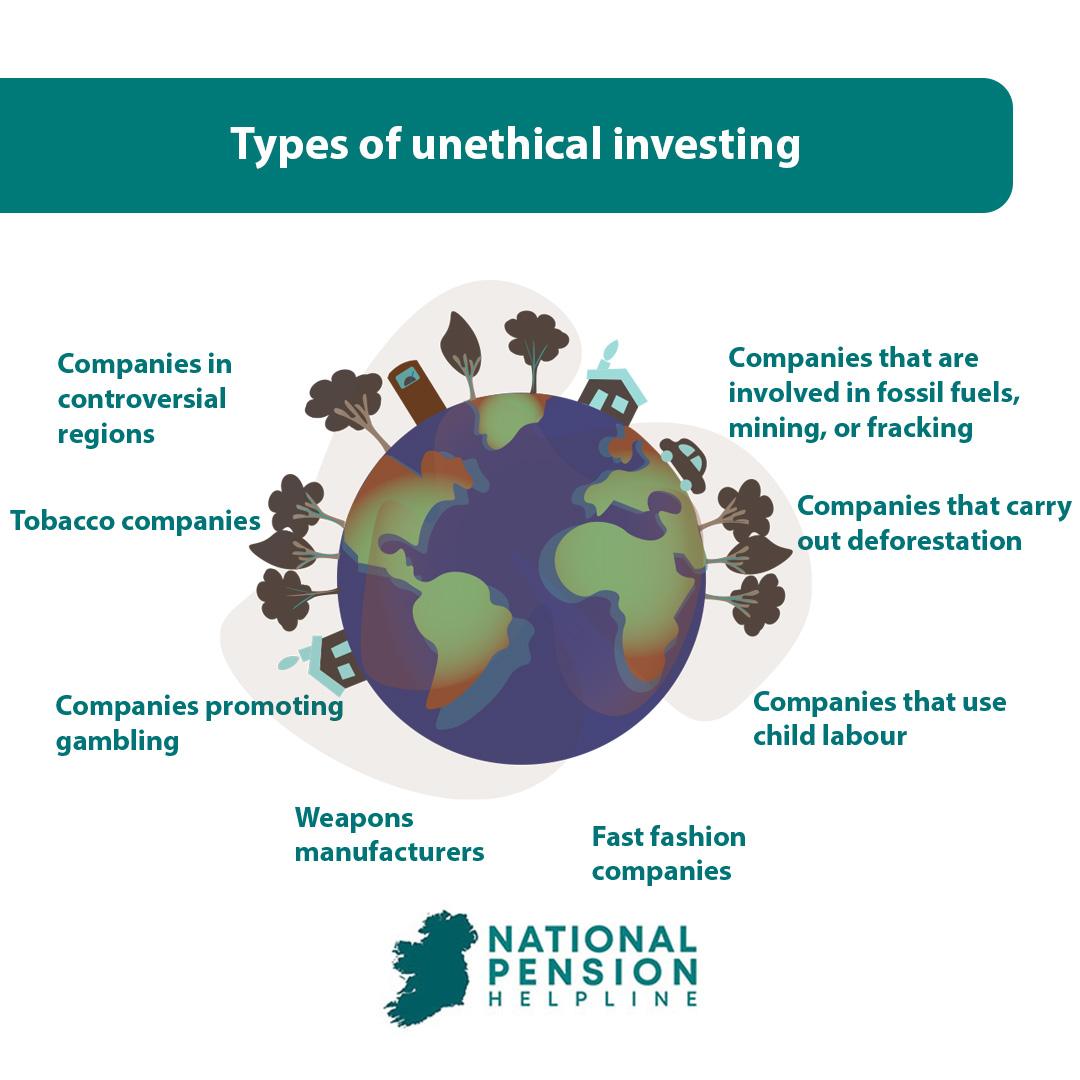

Examples of non ethical investing could be:

What is ESG investing?

ESG investing means that funds are ethically responsible in terms of environmental, social, and/ or governance concerns and that these funds do not invest in companies that are, for example, contributing to climate change.

ESG investing may also involve investing in ‘positive’ companies, such as those developing sustainable energy technologies, promoting worker welfare, or supporting gender diversity.

Why choose ethical investing for your pension?

Occupational pension funds in the EEA are estimated to have a value of €2.5 trillion, with Irish pension investments estimated at €138 billion.

Clearly there is a large amount of finance for potentially ‘negative’ companies involved and this may concern you.

A word of caution, ‘greenwashing’ occurs where companies’ environmental claims, such as using words like ‘sustainable’ or ‘green’, are not reflected in the reality of their operations. Beware of ‘greenwashing’ when choosing a pension fund for your pension savings.

The EU has started to introduce legislation to limit greenwashing and regulate ESG claims made by companies.

How will ethical investing affect my pension?

Pension fund managers may use the United Nations Sustainable Development Goals (SDGs) as a guide when choosing which companies to invest your pension in.

This may limit the diversity of options for the pension fund to invest in and you may have concerns that ethical investing will result in lower returns for you.

Typically, however, ethical pension funds invest in areas such as technology, financial services, and sustainable and innovative sectors which have seen strong returns in recent years.

How to choose an ethical pension

Ireland is not as advanced in terms of ethical pension investment options as some countries, but there are ways to find out about your current pension, or start a new pension that is more ethically invested.

If you have a workplace pension, you can make enquiries from HR or the person responsible for your workplace pension with regard to which company provides the pension and the pension fund’s investment policy in terms of ethical investment.

If you are contributing to a personal pension, you may choose or switch to a managed fund that excludes harmful industries. Pension providers’ websites may provide this information.

Aviva, Standard Life, and Irish Life offer a range of pension options, with all three providers offering Responsible Pension or responsible investment options so that you can choose a pension that includes ESG options, for example.

It is also possible, but not necessarily advised, to take your pension savings and self-invest in specialist ethical funds, with the help of a fund manager or using online tools or platforms that apply ethical and sustainability criteria to investments.It would be best to take the advice of a qualified financial advisor before considering this route.

Financial advice

It is absolutely essential that you get appropriate advice from a qualified advisor before you consider setting up a pension plan or switching your current pension provider or plan.

There are options for ethical investing and taking an interest in where your pension is invested, whether you have an employment pension or you have a personal pension plan, and taking an interest in how your pension is invested can pay off over time.

However, pensions can be complex and it is always best to get the right advice so you don’t lose out on this valuable source of income in retirement.

Contact National Pension Helpline

The National Pension Helpline has qualified advisors who can discuss your pension requirements with you, including ethical pensions and responsible pension investment.

We can help you to take control of your pension, including choosing ethical pension investment options, with a free pension consultation.

Call us or fill out our online form and we will contact you to discuss your pension and give you pension advice from a qualified advisor.