Women are much less likely than men to put money towards their pension pot, partly because they earn less on average, leading to a major disparity between the amount of retirement income received by men and women.

This has led to calls for the new auto-enrolment pension scheme to include provisions to address this issue, as despite its benefits, it could actually negatively impact women and young workers.

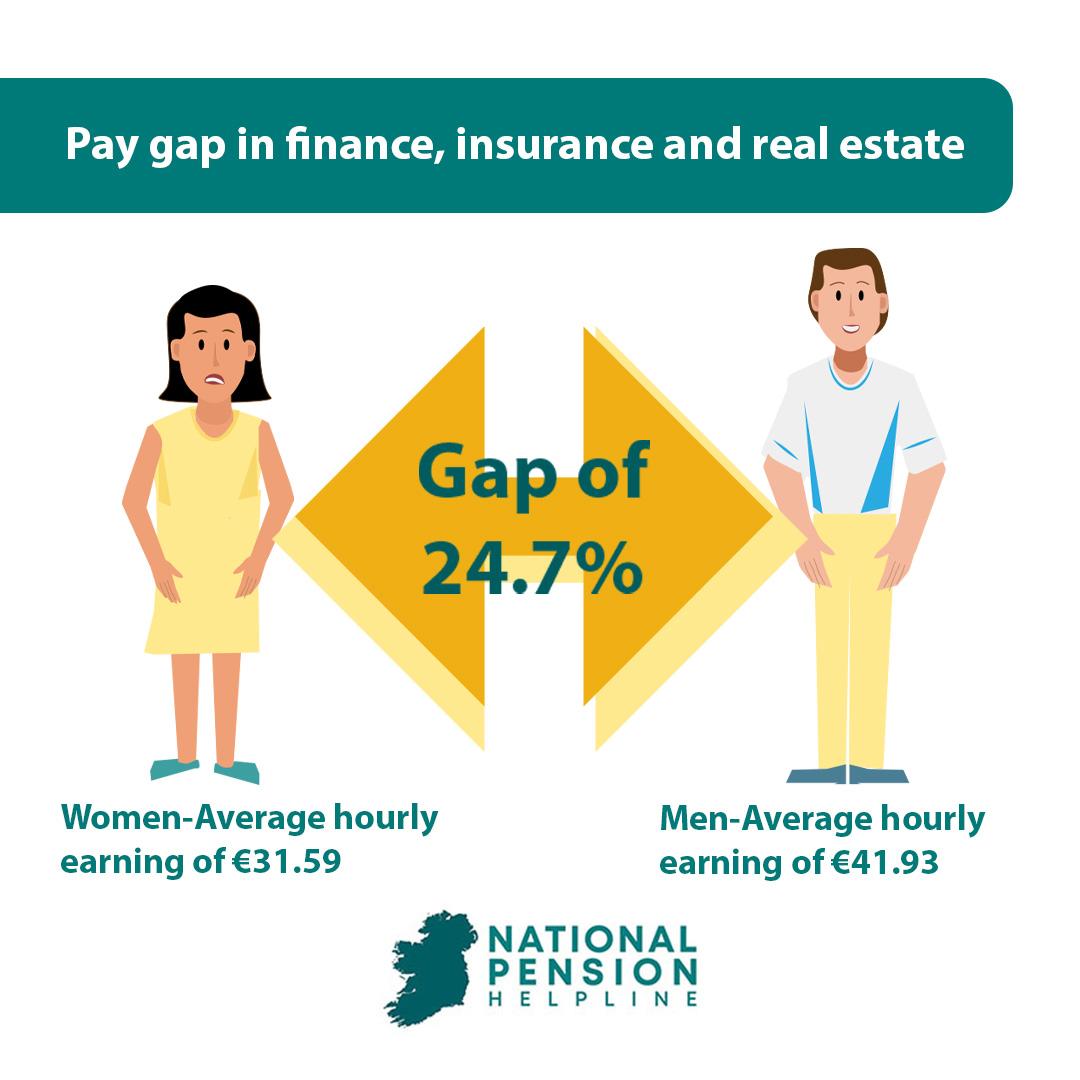

The most recent Central Statistics Office (CSO) report into pay discrepancies between men and women revealed that the gender pay gap in Ireland is 9.6% i.e., the average female earned 9.6% less than the average male.

The sector with the highest gender pay gap was finance, insurance and real estate, at 24.7%, with average hourly earnings of €41.93 for males and €31.59 for females, according to the CSO.

In March 2024, the PwC put the gender pay gap at 11.2% – higher than the CSO – down 1.4% from the year before.

This figure was arrived at after more than 550 Irish companies submitted their gender pay gap reports at the end of 2023.

The PwC report revealed that the sectors with the largest gender pay gaps were found in the legal profession (35.1%), the aviation sector (33.5%), and the insurance and banking sectors (22.9%and 18.9% respectively).

Women earn less on average due to a combination of factors, which include motherhood, and their increased likelihood of taking a career break or working part-time.

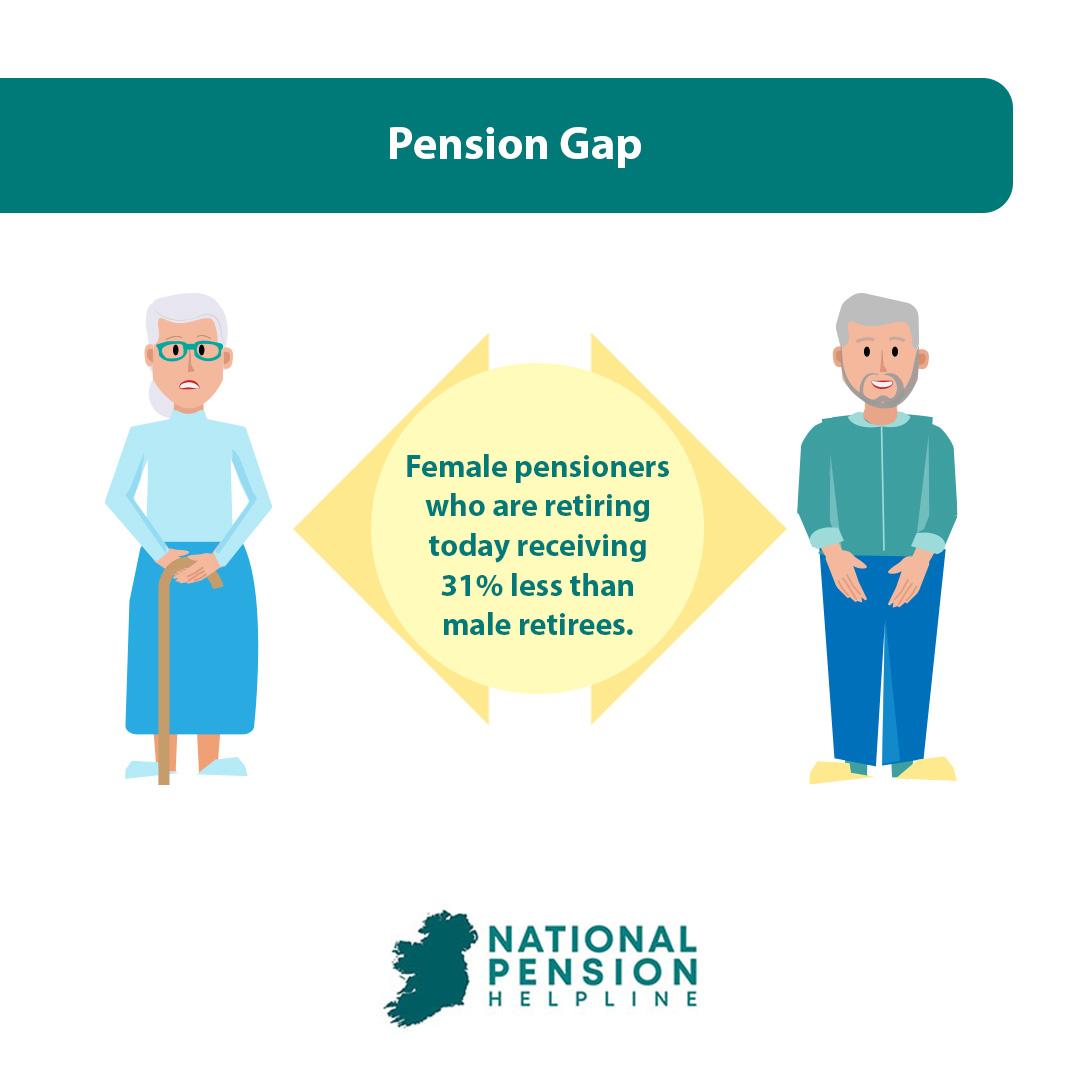

So what does this mean for pensions? Simply put, if women have some extra cash, they are less likely than men to put it towards their pension.

This has resulted in a significant gender pension gap, with female pensioners who are retiring today receiving 31% less than male retirees.

Based on these figures published by Future Laboratory and AIB, it is estimated that it could take around 25 years to tighten the retirement income disparity.

However, auto-enrolment – the biggest shake up of Ireland’s pension system since the 1960s – will bring hundreds of thousands of workers into an additional pension scheme for the first time, increasing female participation.

It will also raise awareness and promote the benefits of additional pension coverage, which around a third of workers currently lack.

But despite the benefits of auto-enrolment, its introduction this year may have some downsides – with concerns being raised that it could negatively affect female employees.

It will also not close the disparity between the pension income received by men and women.

The Irish Women’s Council (IWC), in a report published in December 2024, highlighted this fact, arguing that My Future Fund “will not address the structural inequalities faced by women in our pension system and may even make them worse”.

My Future Fund will automatically enrol those who do not have a pension scheme, earn more than €20,000 per year, and are aged between 23–60.

The IWC called on the new Government to focus pension reform on the structural inequalities within the pension system, by increasing both coverage and participation, ultimately developing a Universal Pension that is adequate for all citizens.