A recent report comparing pension systems in 48 countries has placed Ireland at 18th, down 5 places in a year.

While Ireland still ranks highly, Ireland’s index value fell from 70.2 to 68.1 in the report by the Mercer CFA Institute Global Pension Index, which covers almost two thirds of the global population.

The retirement income system in Ireland was ranked higher than France, Spain, Germany, Portugal and Italy in the report.

Of the 18 countries analysed in Europe, Ireland ranked 10th for its pension system, 3 places behind the United Kingdom.

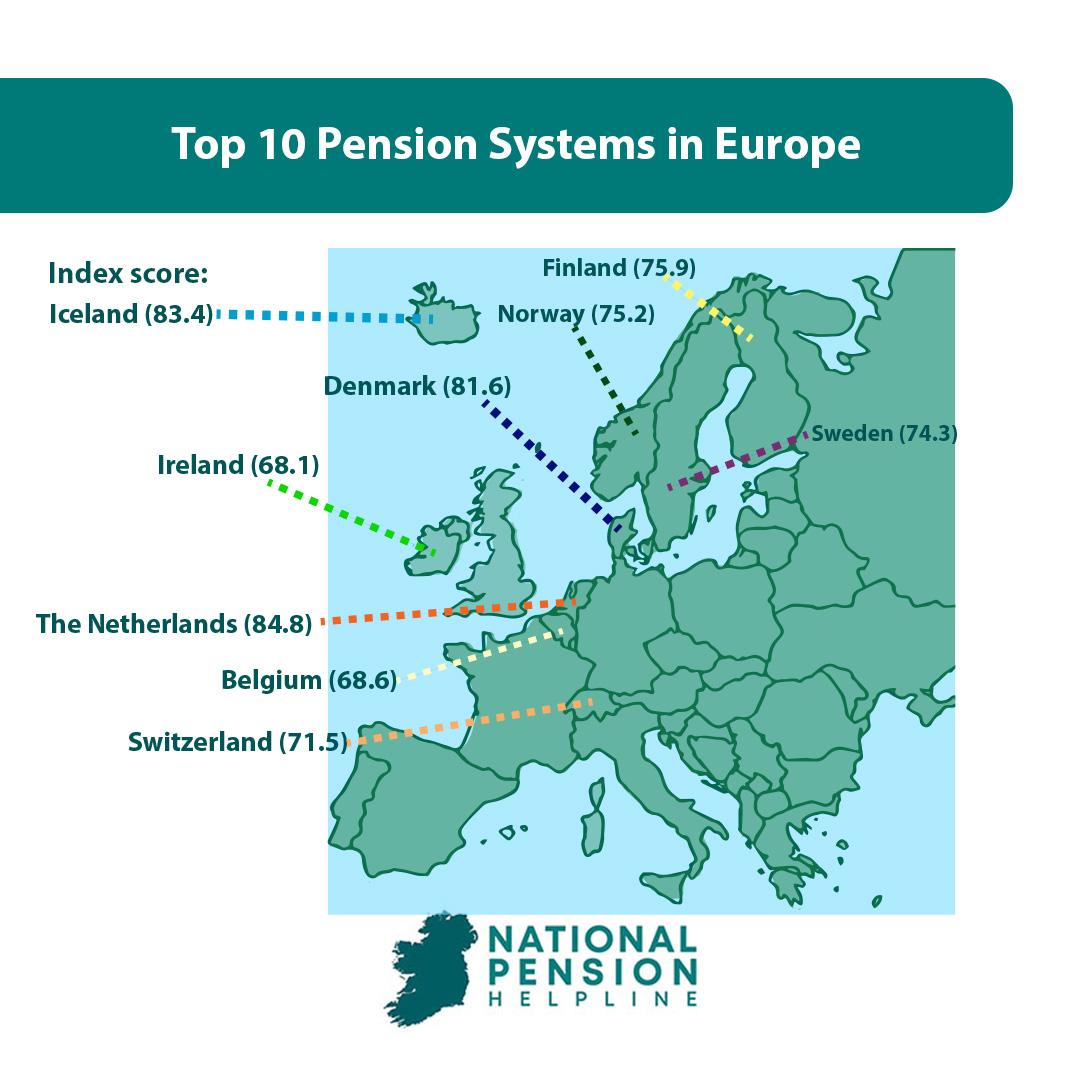

Top 10 Pension Systems in Europe

- The Netherlands (Index score: 84.8)

- Iceland (83.4)

- Denmark (81.6)

- Finland (75.9)

- Norway (75.2)

- Sweden (74.3)

- United Kingdom (71.6)

- Switzerland (71.5)

- Belgium (68.6)

- Ireland (68.1)

Ireland’s index value decreased partly due to the value of the State pension relative to the average national wage, as well as a fall in net pension replacement rates and the household saving rate being reduced.

The report highlighted the need for improvements to the pension system as a result of our ageing population.

The top three pension systems remained unchanged, with the Netherlands securing top spot again, followed by Iceland at number 2 and Denmark at 3.

Auto-enrolment, beginning in September 2025 will improve Ireland’s index score in future reports.

The auto-enrolment system, called My Future Fund, will bring about 800,000 workers into a pension scheme who were previously without additional pension coverage.

Under the scheme, employees will receive €7 into their pension pot for every €3 contributed. This is because their €3 contribution is matched by their employer, and the government adds €1.

With the introduction of auto-enrolment this year, Ireland could overtake the United Kingdom in next year’s report.