What is an ARF (Approved Retirement Fund)?

An Approved Retirement Fund (ARF) is a post-retirement financial product that offers the opportunity to reinvest your pension value after retirement and after you draw down the initial tax-free lump sum.

It allows you to take a portion of, or the entire remainder of, your pension fund and invest it in the new fund to accrue additional value through your retirement years providing additional retirement income.

Investing your pension in an ARF is often attractive as it allows a lot of flexibility in how your fund is invested. Any funds you accrue through the investment are allowed to grow tax free. You do pay income tax on any withdrawals you make however. It will be treated as normal income and you must pay income tax, USC and PRSI (if applicable in your case).

Table of Contents

If you have any of the following types of pension, you are eligible for an ARF

Advantages and Disadvantages of an ARF

| Advantages | Disadvantages |

|---|---|

| ✅ The value of an ARF on death is preserved and paid out to the ARF holder’s estate | ❌ An ARF does not provide insurance against the risk of outliving the value of your pension |

| ✅ An ARF has the potential (but is not guaranteed) to provide retirement income in excess of what an annuity could provide | ❌ Can be subject to unfavourable tax treatment if certain minimum ARF withdrawals are not made each year |

| ❌ ARFs are heavily reliant on investment performance when it comes to their ability to help the retiree to maintain their standard of living throughout retirement |

Conditions to invest in an ARF

An ARF pension comes with certain conditions that must be fulfilled before you can invest in one. The main factor is that you need to already be in receipt of a guaranteed income of at least €12,700. Luckily, the State pension in Ireland will ensure you receive that amount so the majority of people are covered.

Your additional pension fund then will add to that amount. In addition to the threshold amount of €12,700 (now covered by the State Pension) you will need to be a member of a contributory pension, a personal pension, a personal retirement bond and be at retirement age or be about to take early retirement.

What is an AMRF? (no longer in existence)

In 2021, central bank legislation was enacted to remove the AMRF this no longer exists.

What about an Annuity instead of an ARF?

Should it be considered instead of an ARF?

Advantages and Disadvantages of an Annuity

| Advantages | Disadvantages |

|---|---|

| ✅ Pays a fixed amount per month | ❌ Your estate will lose out if you die early |

| ✅ No worry of running out of funding | ❌ Subject to inflation risk as payouts are fixed |

| ❌ Subject to timing risk (ie. when the annuity is agreed) |

Withdrawing from an ARF

How often can I withdraw from my ARF?

You can withdraw mooney from your ARF as often as you need to. This is one of the benefits of this type of fund as it allows you complete flexibility and freedom to withdraw as required.

However this is also one of its downfalls for some people. Because you can withdraw money at will you need to manage your fund carefully to ensure that you don’t use up its value too early, leaving you without an income at a late stage in life.

What is imputed distribution and what does it mean for my ARF?

Imputed distribution refers to the mandatory withdrawal of at least 4% per annum. This withdrawal is subject to income tax, PRSI and USC. It becomes active at the age of 61 with an increase to a minimum of 5% at the age of 71. I

f you have a particularly high value fund that goes over the €2,000,000 mark then the initial minimum withdrawal or imputed distribution is set at 6% at the age of 61.

The taxes imposed by the imputed distribution system are in addition to the taxes you suffer when you do eventually make a withdrawal from the ARF, with no tax credit available for offset. In effect, this means your ARF is being taxed twice on the same income. Therefore, it’s in the ARF holders best interest to meet the minimum withdrawals each year.

What happens when ARF fund value exceeds €2 million?

There is a €2 million threshold for large value funds. Once your fund reaches or surpasses this amount it changes the imputed distribution rate. In these high-value fund cases the entry rate is 6% at the age of 61. As outlined by revenue here.

Cashing in my ARF

Can I cash in my ARF?

An ARF is designed to allow you to withdraw from its value at any time. It is completely flexible in its withdrawal procedures, even to the point of allowing risk. If you don’t manage your withdrawals carefully you may end up bleeding your ARF dry much too early and affecting your retirement income.

It’s important to consult with an independent pension advisor regularly to assess where your fund stands, how much impact your withdrawals are having and to help you manage your fund value into the future.

Many individuals decide to take an early pension withdrawal from their ARF in the form of a 25% tax-free lump sum. This can be done from age 50.

How much guaranteed income do I need to cash in my ARF?

Taking out an Approved Retirement Fund in the first place is based on a guaranteed financial threshold of €12,700 per annum plus your contributory pension pot. Your State pension generally will cover the minimum threshold allowing you to withdraw from your fund to above that level.

Where can I get advice on what to invest in?

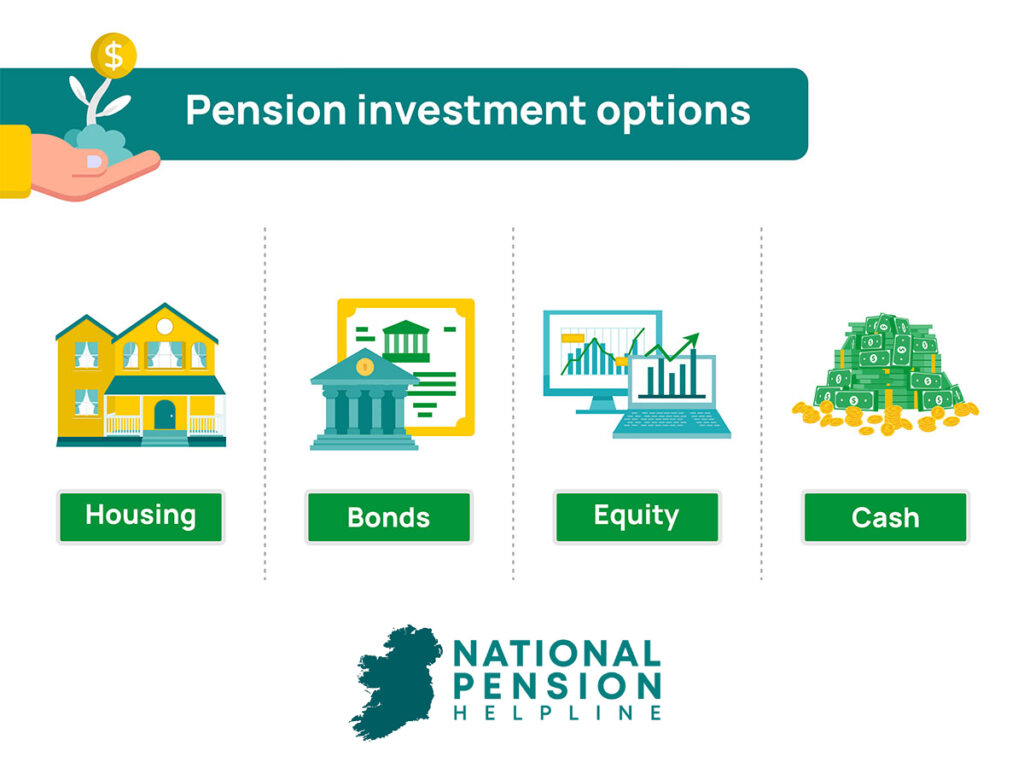

ARFs are set up and managed by financial institutions such as insurance companies.

There are many avenues for advice but the best first step is to contact an independent financial advisor who can outline your options and draw up choices based on your personal circumstances.

Everyone’s pension landscape is different, depending on your years in service, the pension type that you have been a member of and the number of dependents and other outgoings that you need to provide for.

If I receive a windfall can I add it to my ARF?

The short answer is no.

An ARF is a post-retirement fund that is built upon your retirement package. The value you have left in your pension fund after you draw down your tax free lump sum is the value that is invested in the ARF.

It then has the opportunity to grow depending on the amount of risk you have chosen to take when setting it up.

If you have an unexpected sum of money, for example from an inheritance or a property sale, that you want to invest you will need to find another investment vehicle for it as it cannot be easily added to your retirment savings. A pension advisor can help you with this.

What happens to my ARF after I die?

Does my retirement fund pass onto my spouse or children?

An ARF is a retirement fund and you are free to leave it to a dependent such as a legal partner or one or more of your children. They are retirement savings and are treated similarly to other savings.

While it is not always pleasant to consider what might happen to your fund when you die it is important to plan for it.

There are different tax implications for people who are not your immediate dependents so if you plan to leave the value of the fund to another person or entity then make sure and take advice on the implications of this.

If you don’t then you may also be leaving a hefty tax situation that might negatively affect the value of the fund to the recipient.

Here are the tax implications of your ARF should you pass away:

- Spouse: ARF can be passed to your spouse upon death free of income tax and capital acquisition tax

- Child over 21: income tax is charged at a flat rate of 30%. There is no further liability to tax and it does not eat into the child’s capital acquisitions tax threshold from their parent

- Child under 21: liable to tax under capital acquisitions tax as per any normal inheritance

- Anyone Else: treated as a distribution to the deceased, with marginal rate income taxes operated at source via PAYE. Inheritance will subsequently be taxable under capital acquisitions tax

Unsure of how best to invest your ARF?

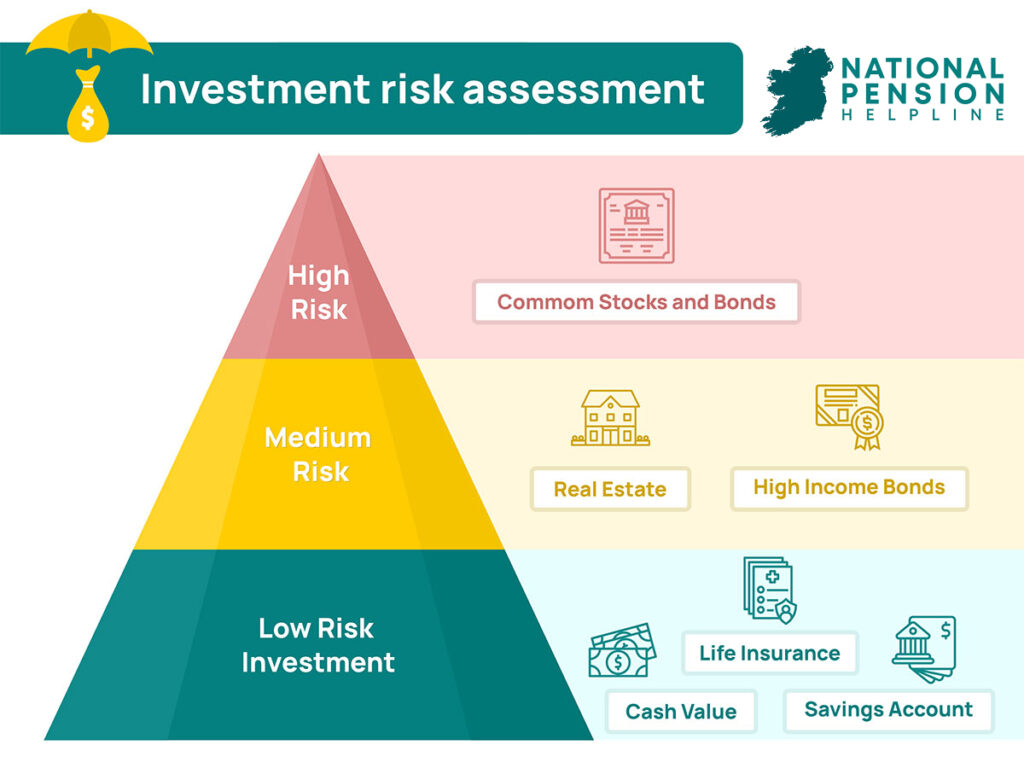

The European Risk Rating is a scale that determines risk in investment.

An Approved Retirement Fund is an investment vehicle like all others. Its value can rise or fall depending on the performance of the markets it trades within.

When you are setting up your ARF you will have the freedom to choose a risk level that suits your appetite for risk and your personal drive to achieve greater value in your fund.

The higher the risk, the higher the potential for profit and growth. However, the higher the risk, the higher the chance of losing money also.

Consequently, the risk levels available and the opportunity to offer them to customers is highly regulated at the EU level.

To better understand risk we use the European Risk Rating. It is a sliding scale of risk that clearly illustrates the potential and pitfalls of taking on greater risk.

It helps a potential investor make an informed decision around the type of risk they are entering into with their ARF.