Occupational pension schemes are the main way in which most Irish workers are currently engaging with private pensions in Ireland. According to the Central Statistics Office (CSO), nearly 70% of those with private pension coverage in Ireland have occupational pension coverage only.

This means that the majority of those with occupational pension coverage are not engaging with a separate personal retirement savings account (PRSA). Whether this is a good thing or a bad thing depends on whether a) the employee is permitted to make additional voluntary contributions (AVCs) to their occupational pension scheme and b) the extent to which AVCs are permitted to that scheme.

It’s recommended that you read the National Pension Helpline’s article on PRSAs in Ireland before continuing so that you clearly understand what PRSAs are and who they’re intended for. This is to avoid confusion with occupational pension schemes, which are a different type of pension wrapper in Ireland.

Table of content

Occupational Pensions Explained

Occupational pension schemes are set up by employers to provide retirement benefits for their employees. In Ireland, since the introduction of the IORP II regime, occupational pension schemes have been increasingly set up by employers using a master trust. Under a master trust, multiple occupational pension schemes from multiple employers are bundled together under a single trust. The funds of these schemes are kept separate. The benefits of this structure for employers include regulatory compliance, reduced cost and a reduced administrative burden.

Putting jargon aside, for employees, an occupational pension scheme can be thought of as an account for the money that you’ve set aside for retirement. How does money get placed into that account? There are a number of ways that this could happen:

1. Your employer contributes money to the account but you do not.

In this instance, it’s likely that the occupational pension scheme in question is a “non-contributory scheme”. If this is the case, you need to be aware of both occupational pension schemes and PRSAs.

2. Both you and your employer make contributions to the account.

This type of occupational pension scheme is known as a “contributory scheme”. Some employers may not permit additional voluntary contributions to be made by the employee beyond what is specified in the employment contract. If this is the case, you need to be aware of both occupational pension schemes and PRSAs.

3. Both you and your employer make contributions to the account and additional voluntary contributions are permitted to be made by you to the occupational pension scheme.

This is the most liberal of scenarios for workers. In certain cases, employers may agree to ‘match’ an employee’s additional voluntary contributions to the occupational pension scheme up to a specified percentage. This is the closest thing an employee will come to ‘free money’.

After the contributions to the occupational pension scheme are made, the employee may or may not have control over how those contributions are invested. Yes, contributions made to an occupational pension scheme are invested in what could be a wide range of assets. Knowing what your pension contributions are being invested in is crucially important to the retirement planning process.

Occupational Pension Performance

Given that master trusts are increasingly becoming the de facto way in which employers choose to offer occupational pension schemes to their employees, in this section, we’re going to take a look at the master trust offerings of four of Ireland’s largest master trust providers:

Zurich

Zurich Life has one of the best managed fund returns in Ireland over the last twenty years. In 2022, Zurich won both the Investment Provider Excellence award and the Pension Provider Excellence award as presented by Brokers Ireland.

Zurich Master Trust

According to Zurich, the Zurich Master Trust ‘Personalised Guidepath’ (Zurich’s lifestyle investment strategy) is underpinned by Zurich’s Prisma multi-asset funds. A lifestyle investment strategy is one which provides for the automatic switching of pension savings from one fund(s) to another as you approach retirement age. As such, employees can expect to avail of some or all of Zurich’s Prisma funds where their employer has opted to utilise the Zurich Master Trust. The National Pension Helpline has carried out analysis on the Prisma funds which can be found below. If you want to learn more about the Zurich Master Trust you can find the brochure here.

Graph 1 - Comparing the annual returns of Zurich’s Prisma funds from 2014-2022

Irish Life

Irish Life are Ireland’s #1 pension provider. Based on market share data from 2019, more people in Ireland choose Irish Life for their pension than anyone else. Irish Life offers access to both award winning investment managers and innovative investment strategies for those looking to set up a pension.

Irish Life Master Trust

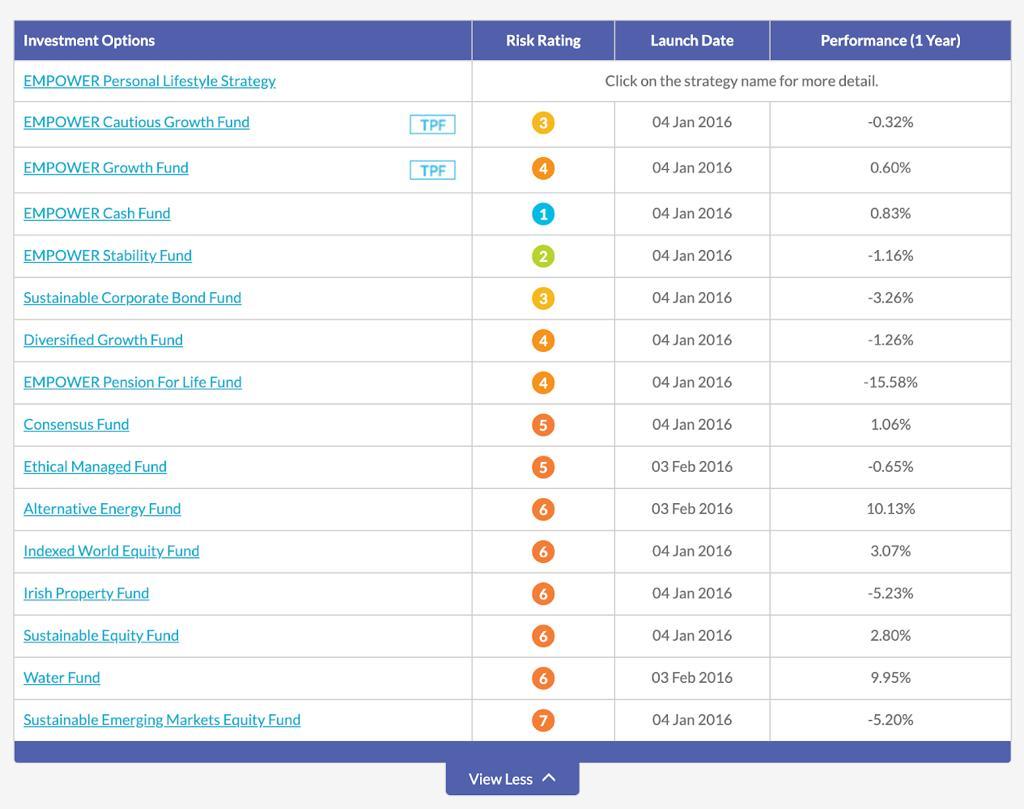

According to Irish Life, their EMPOWER Master Trust is the largest master trust in Ireland with over 110,000 plan members. Employees who have retirement benefits under the EMPOWER Master Trust can expect to have access to a suite of investment options similar to those listed in Image 1 below. The Irish Life Employer Master Trust offers a ‘Personal Lifestyle Strategy’ whereby you’re automatically moved to lower risk funds as you approach retirement and are then switched into funds best suited to how you’ll draw down your pension benefits in retirement.

The Personal Lifestyle Strategy is underpinned by the EMPOWER suite of Irish Life funds. Looking at the information document, we can see that the strategy works as follows (assuming that the employee in question is of a young enough age to avail of all automatic phases):

Graphic 1

Source: Irish Life Pension Planet Interactive

The National Pension Helpline has carried out analysis of the aforementioned range of funds which can be found below.

Graph 2 - Comparing the annual returns of Irish Life EMPOWER funds from 2017-2022

Aviva

Aviva describes their pension offering as straightforward, flexible and cost-effective. They seek to reduce and eliminate pension charges where possible and focus on pension simplicity.

Aviva Master Trust

Within Aviva’s Retail Master Trust, employees can either actively select funds for their contributions to be invested in or, as an alternative, they can utilise the My Future Default Investment Strategy which manages the investment selection process for them. As is illustrated in this document from Aviva with respect to the My Future Default Investment Strategy:

For those who wish to actively choose their investments within the Aviva Master Trust, Aviva offers a wide number of funds that can be selected. The National Pension Helpline has performed analysis on a selection of these funds below.

Graph 3 - Comparing the annual returns of Aviva funds from 2018-2022

New Ireland

New Ireland is one of Ireland’s longest standing pension providers. Operating since 1918, New Ireland is one of Ireland’s leading pension providers with over €16.8 billion in assets under management as at December 2018.

New Ireland Master Trust

As per New Ireland, their master trust is administered on their market leading MyPension365 digital platform and offers a number of investment solutions including:

Looking at the New Ireland fund centre, we can identify two Passive IRIS funds: Passive IRIS Fund 2029 and Passive IRIS Fund 2039 Onwards. The National Pension Helpline has performed analysis on these two funds below.

Graph 4 - Comparing the annual returns of New Ireland Passive IRIS funds from 2016-2022

Analysing The Data

The best performing pension funds

There is no “best pension fund” that will consistently and reliably deliver the best returns to investors year after year. If there was, we’d all be in Puerto Rico sipping piña coladas!

However, that’s not to say that there aren’t funds which, historically, have provided stronger investment returns than others. Bear in mind that “the best fund” for a particular investor at a particular point in time might not be the fund which has the greatest capacity for investment returns. It all comes down to what the investor is trying to achieve.

Taking a look at the fund performance data, we can isolate some strong performing funds:

What do each of these funds have in common? They all have a high asset allocation towards equities (i.e. stocks). Within the Zurich Prisma Max fund, 92% of the asset distribution within the fund is towards equities as at 31/10/2023. This information can be found in the fund factsheets which are linked above. Within the Irish Life EMPOWER High Growth Fund, the asset allocation towards equities stands at 81.2% as at 30/09/2023. Within the Aviva High Yield Equity Fund, the asset allocation towards equities stands at 97.09% as at 29/11/2023. Finally, within the New Ireland Passive IRIS Fund (2039), the asset allocation towards equities stands at 69.80% as at 30/09/2023.

Out of all of these funds, the Aviva High Yield Equity Fund provided two of the strongest single year annual returns over the past decade. A big part of the reason why is because ~97% of the fund is allocated towards equities. The question is what was going on with equities in 2019 and 2021? Because in each of the ‘strongest performing years’ for each provider, it was the funds which had a majority holding in equities in 2019 and 2021 which consistently stood out. Well, it just so happens that both 2019 and 2021 were both incredibly strong years for the global equity markets and, by proxy, for pension funds which held a lot of equities!

However, while historical data shows that, over the long-term, equities will usually deliver superior investment returns over other asset classes such as bonds and cash, that doesn’t mean that equities are the right investment for every investor all the time. This is best illustrated by looking at some of the worst performing years for the funds noted above:

What’s notable here is that the Aviva High Yield Equity Fund not only delivered two of the best single year returns, but it also delivered the lowest losses in 2022!

Regardless, the point is that an employee who was invested in, say, the Zurich Prisma Max fund in 2022, would have lost 19.1% of their pension pot if they were fully invested in that fund. If that employee was close to retirement, that would be a not so favourable outcome.

This is an important point to understand about equities, they typically come with high relative volatility compared to other asset classes. That’s why many ‘lifestyle pension funds’ gradually transition investors out of equities and into bonds and cash – because the yearly volatility is typically lower.

Low volatility and a greater certainty of outcome is attractive to many individuals as they approach retirement. However, as we’ll now see, asset classes such as bonds and cash aren’t always safe bets for investors.

The worst performing pension funds

Now let’s take a look at some of the worst performing pension funds that are included within our dataset.

Right away you can see that both the Irish Life EMPOWER Pension for Life Fund and the Aviva Long Bond Fund performed woefully in 2022, losing 32.77% and 31.64% of their value respectively.

So, what happened?

Interest rates happened.

Both of these funds have a 100% exposure to long-term bonds. In the case of the Irish Life fund, the exposure is split 59% towards Eurozone >15 year Government bonds and 41% towards Euro >10 year Large Corporation bonds as at 31/10/2023.

Similarly, in the case of the Aviva fund, the exposure is allocated nearly 100% (98.64%) to long-term Euro Government bonds as at 29/11/2023.

In 2022, the European Central Bank started to increase interest rates for the Euro Area in a bid to control inflation. Interest rates and bond prices have an inverse relationship. When interest rates go up, bond prices go down and, conversely, when interest rates go down, bond prices go up.

So, when the European Central Bank started its campaign of increasing interest rates, the price of bonds tanked – and that’s especially true for long-term bonds. As a result, the long-term bonds that were held by both the Irish Life and Aviva funds in 2022 would have lost a significant portion of their value, hence the abysmal returns.

There’s a really important point to consider here. All of the risk rating classifications will tell you that bonds are ‘riskier’ than equities. But here you have the Irish Life EMPOWER Pension for Life fund, which is largely composed of AAA-rated Government bonds (generally considered ‘risk free’), that has lost 32.77% of its value in a single year.

Conversely, the Irish Life EMPOWER High Growth Fund, a fund predominantly composed of equities, lost just 12.92% of its value in the same year and the Aviva High Yield Equity fund lost just 2.82%!

So, ‘riskiness’ is less about the asset class itself as it is about the current macroeconomic context in which that asset class exists i.e. risk shouldn’t be seen as fixed but rather existing on a variable scale.

Separately, if historical data shows that equities consistently provide superior returns to that of bonds and cash, then surely, over the long-term, bonds and cash are ‘riskier’ investments. Because what is risk if not the chance of missing out on our future investment goals?

Speak with the National Pension Team Today

One of the biggest takeaways here is that the pension fund(s) which are best suited to you entirely depends on your own personal circumstances. There is no ‘one size fits all’ approach.

Yes, the average annual return of the equity markets is in the region of 10% before taxes and inflation. But that doesn’t mean that every investor should be 100% invested in equities all of the time. There are many more factors to consider outside of historical returns. Plus, past performance isn’t indicative of future results.

Feeling overwhelmed?

No problem, you can avail of the National Pension Helpline’s team of vetted pension experts to help you find your perfect pension.