Auto-enrolment, finally coming into effect in 2026, is the most monumental change to pensions in Ireland since the 1960s.

Around 800,000 employees, who would previously have had to rely on the State Pension, will have a workplace pension for the first time.

The State Pension will likely increase to €350 per week by the end of this decade, and the retirement age is likely to be increased in the coming years.

A decrease in birth rates and longer life expectancy has resulted in top-heavy population pyramids in Ireland and across Europe. These factors are putting a strain on pensions, with governments having to rethink what the pensions of the future will look like.

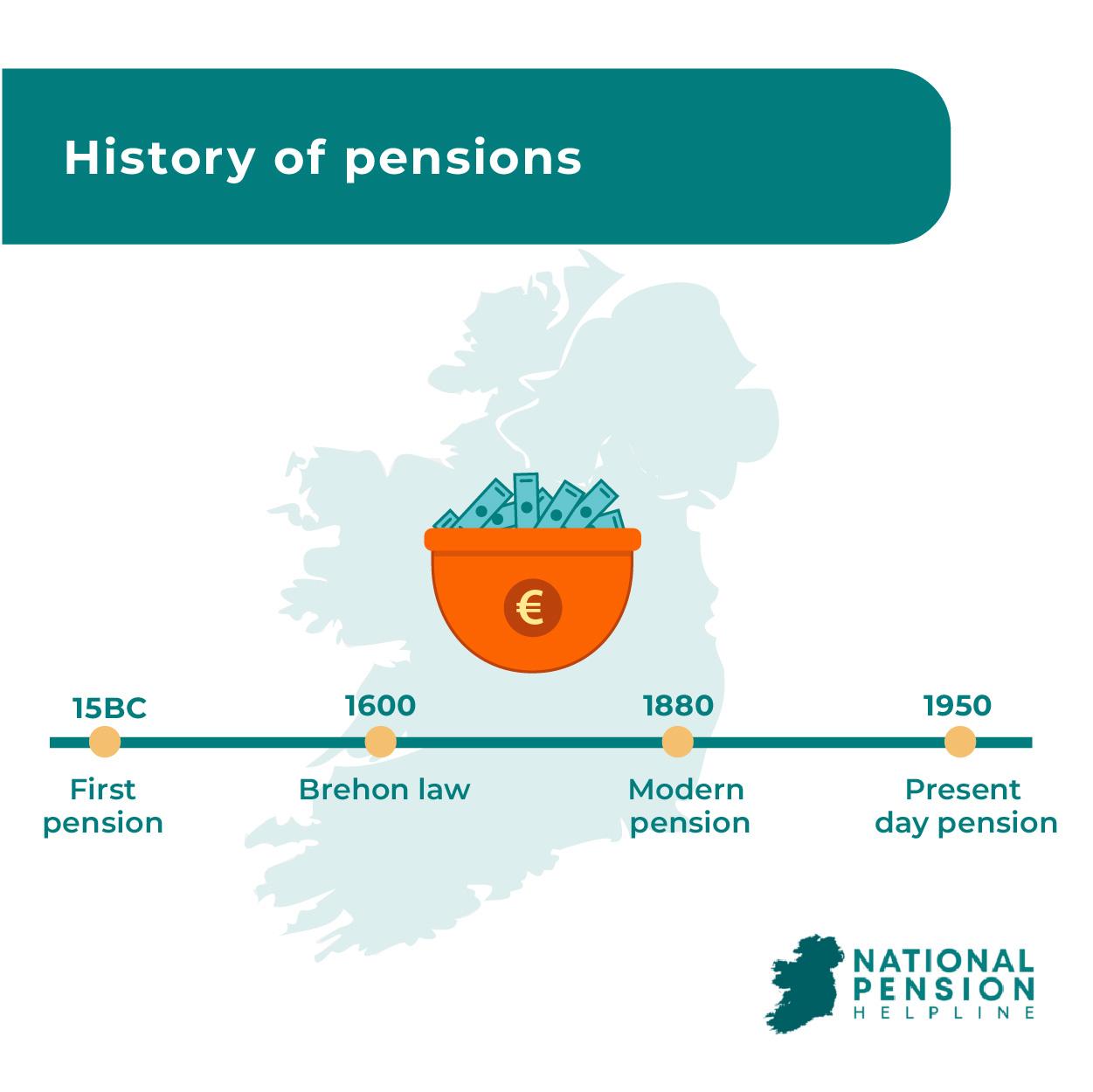

But what are the origins of the pension? Let’s travel back through the decades, centuries and millennia to explore the history of the pension, from its military roots in the Roman Empire to the introduction of auto-enrolment in Ireland.

Roman Pensions – c. 15 BC

Like the word ‘salary’, which comes from the Latin for salt money, salarium, ‘pension’ comes from pensio, meaning payment. The first pensions, aerarium militare, were introduced in the Roman republic under Augustus Caesar.

Augustus awarded payments 3,000 denarii to those who had served in the military for 20 years.

Although Ireland was never a part of the Roman Empire, social responsibility for taking care of the elderly in Ireland can also be traced back to ancient times, probably hundreds of years before the Romans introduced aerarium militare.

Brehon Law – c. 1000 BC – c. 1653 AD

Brehon Law – the Gaelic legal system – dominated life in Ireland and the everyday lives of those on the island for centuries. Old age was respected under these Gaelic laws, with special provisions for elderly people who were unable to support themselves.

Upon old age, people could retire by passing on their headship and land to their son, who would be required to maintain their father for the rest of their life.

If the retiree chose not to live with their son and his family, they were entitled to a separate house, the dimensions and furniture of which were set out in the Law.

Elderly men with no children could alternatively make an arrangement with a stranger and receive the same conditions.

Those without land were also supported, with the responsibility of their care falling to their children. In cases where care was not provided, the children could be punished by law. If an elderly person had no children, the responsibility for their maintenance was the responsibility of the tribe.

Pensions in the Middle Ages – c. 1100 AD – c. 1500 AD

Among the first examples of actual pension payments can be found in the monasteries and religious houses of the Middle Ages – where corrodies were commonplace.

These lifetime food and clothing allowances which also included shelter and care are among the first recorded social welfare payments and preceded the modern pension by hundreds of years.

Unlike the more general social responsibility for the care of old people under Brehon Law, corrodies were awarded as a reward for work, or as a form of charity for the elderly, sick, or poor. They could also be purchased with donations of money or land.

However, before the 18th century, people had an average life expectancy of under 40 years, which meant that few people reached an age where physical restraints obstructed their ability to work.

For this reason, the majority of elderly people lived with one or more of their children in multigenerational homes until relatively recently.

Modern Pensions Introduced in Prussia – 1880s

In fact, it wasn’t until 1881 that in the German state of Prussia, the idea of modern old-age pensions was first presented along with a host of other social welfare advancements.

These progressive ideas were presented by the conservative chancellor Otto von Bismarck, as an appeasement tactic to maintain a hierarchical society as liberal and socialist ideas were spreading across Europe.

In 1889, the old age pension programme was introduced to give a pension annuity for workers who reached 70 years of age.

United Kingdom Old Age Pensions Act – 1900s

It would be another 20 years before people in Ireland gained access to financial security in old age – with the introduction of the Old Age Pensions Act of 1908 under Liberal Prime Minister H.H. Asquith. The 1908 Pensions Act is one of the foundations of modern social security in Ireland and Britain.

The Old Age Pensions Act provided for non-contributory pension payments of 5 shillings for those over the age of 70 and these payments were paid for by taxes. The pensions were means tested and were not paid to those with an annual means of £31 and 10 shillings.

Those who were British subjects for 20 years and resident in Great Britain or Ireland for 20 years were eligible.

However, incomplete and often incorrect record-keeping by the British authorities in Ireland during the 19th century made proving eligibility difficult, if not impossible – and many poor people were entirely undocumented.

This led to problems In 1909, newspapers reported that there was a suspiciously high number of pension claimants in Ireland – 74,000 more than Scotland which had a higher population at the time.

All of those claiming the pension in Ireland should have been born at least 5 years before the beginning of the Great Famine – however the Times in London suggested that 128 percent of Ireland’s over 70 population were claiming the new pension.

Following independence, the Irish Free State’s financial difficulties led to the Old Age Pension being cut by 1 shilling – or 10%. Decades passed before drastic changes to the pension system were made in the second half of the 20th century.

The Modern-day Irish Pension – 1950s – Present

The Irish government began to refine the pension with the introduction of the contributory pension in the early 1950s. Government spending on social security increased as the economy improved in the 1960s and 70s.

Between 1973 and 1974, the eligibility for the state pension was reduced from 70 to 66, and by 1980 social welfare expenditure had increased to 10.7% of GDP.

The latest major shake up to Irish pensions is auto-enrolment – which has been in the making since the early 2000s.

Finally coming into effect on 1st January 2026, the My Future Fund automatic workplace pension scheme will mean that people will no longer have to rely solely on the Irish state pension – which is insufficient for most people to maintain their standard of living upon retirement.

Further changes to Irish pensions will include both the retirement age and pension payments being raised over the coming years.