Table of Contents

What is an Auto Enrolment ?

Auto enrolment is an system of automatic pension enrolment that is co-funded by employers and the state.

In order to encourage people to take up membership of the scheme, the Irish system will operate an opt-out approach rather than an opt-in system.

What this means is that everyone who meets the income threshold to take part in the scheme who doesn’t already have a private pension membership will automatically be enrolled in it through their company’s payroll. They have the option to opt-out if they feel they cannot afford it but can also return to it at a later stage if their income improves.

People who choose to remain in the system will have their pension savings matched on a one-for-one basis by the employer. The State will also provide a top-up of €1 for every €3 saved by the worker. So for every €3 saved by the employee they will receive €7 in their pension.

What age group is covered by auto-enrolment?

The scheme targets everyone in the workforce from the age of 23 to 60 who is currently outside the private pension system. As long as you are earning more than €20,000 per year you will be automatically enrolled in the pension scheme.

The threshold of €20,000 was set in order to reach the widest group of people possible.

There is a very large number of people within the Irish workforce who don’t have a private pension and without this scheme they would be obliged to live on the State pension alone in retirement.

This scheme does not replace the State pension but will work in tandem with it. People who reach pension age will receive the benefits of this scheme plus the State pension.

Does every industry require auto-enrolment for pensions?

Yes, all workers who reach the income threshold and membership eligibility will be automatically enrolled. It is not dependent on the kind of work you do or the industry you work within. All employers will be expected to facilitate the scheme for all their eligible staff.

Does it matter if I work part-time or full-time?

The threshold for membership is dependent on a salary level of €20,000 per annum. This is fixed whether you are employed on a full-time or part-time basis.

If you earn over this threshold in part-time work you will become a member of the scheme through your company’s payroll.

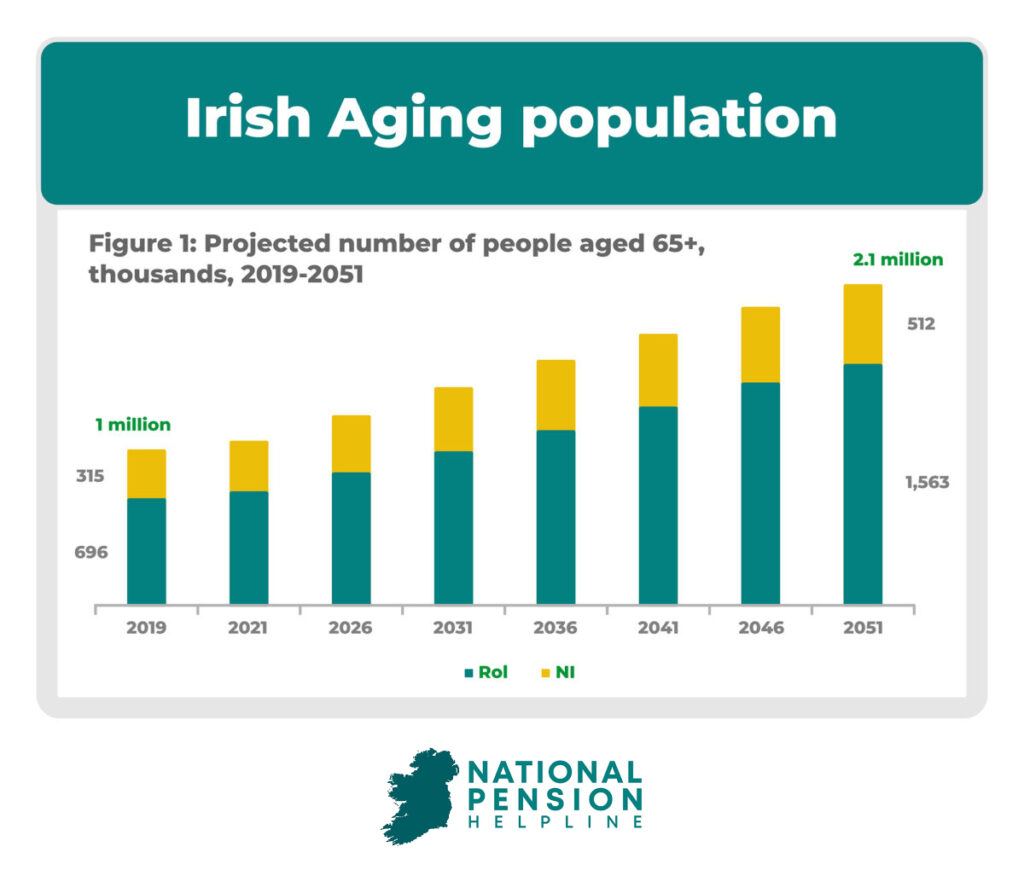

Why is Ireland introducing auto enrolment pension?

Across all western countries, health systems and nutrition have improved dramatically over recent decades. This means that more people are living much longer than our grandparents’ generation. In order to be able to provide for these people when they leave the workforce the Government was tasked with creating a scheme which would support those who are not already in a private pension scheme. It is estimated that there are 750,000 people in the Irish workforce who fall into this category.

At the moment the State pension is available to all people in the State who reach retirement age and have made enough PRSI payments through their working life to qualify. Retirement age is currently 66 years of age.

However, the State pension is only around €277.30 per week, which isn’t necessarily enough to maintain the lifestyle a person has enjoyed while at work. The auto-enrolment system is designed to allow workers to plan for their future retirement by allowing them to save for this State-supported pension based on their employment in addition to their State pension. This will raise their standard of living overall.

How does the Auto Enrolment pension scheme work?

Auto Enrolment is based on a percentage of your salary or wage. Your employer will be tasked with making a deduction through payroll for each of their employees. It will be introduced in a tiered way.

In the first three years, employees will contribute 1.5% of their salary. This will be matched by the same amount by their employer. The State will then add an additional 0.5% on top of this.

In years four to six, employees will contribute 3%. Again this will be matched by the same amount by their employer while the State will add an additional 1% into the pension scheme. From years seven until nine, the employee will contribute 4.5% of their salary and have this matched by their employer. The State will increase their portion of the contribution to 1.5%. From the 10 year mark onward the employee and employer will pay 6% each and the State will add 2%.

This cumulative approach makes it easier for people to start the scheme when they are younger and delivers more value as the individual ages and, usually, as their salary increases.

On a simple monetary basis it can be understood that for every €3 saved by an employee, the total amount saved will be €7 as their employer will match their payment and the State will add an additional €1. These matching payments are designed to incentivize the employee to remain with the system and to continue to save for their retirement.

If I already have a private pension can I transfer to the auto enrolment scheme instead?

Yes, you can transfer to the auto enrolment scheme if you close your current private pension. You cannot operate both at the same time. The auto enrolment scheme is designed as an alternative for those who do not have a private pension scheme.

How does Auto Enrolment pensions work for Employers?

The main responsibility for employers is to ensure that the contributions can be deducted from payroll. There will be a central administrative body established in the State to manage the process so that employers will not have to invest in managing the system. Administrative costs will be kept to a minimum.

How does Auto Enrolment pensions work for Employees?

The scheme is hugely beneficial for employees. In addition to the savings made, it allows members to change jobs and bring their pension pot with them from job to job rather than having to move to a new scheme with each job. Administration for the scheme is designed to be simple and straightforward and as it works through payroll employees will not have to spend a great deal of time managing it.

Can employees opt out of auto enrolment

An employee will have the right to opt out of their auto enrolment pension, following a 6 month mandatory participation period.

If an employee decides to opt out of their auto enrolment pension, they will be reinstated back into the scheme following 2 years, and can decide to opt out again following another 6 month mandatory participation period.

What countries already have auto enrolment

Ireland is not the first country to introduce auto enrolment for company pensions. A number of countries have begun to implement auto enrolment since 2018.

Denmark, Georgia, Lithuania, Poland and Thailand all currently have an auto enrolment system for company pensions in place.

Each of these countries have their own rates of contributions and returns.

In Denmark, employees only contribute 0.25% of their income but this is to be increased to 2% by 2025.

In Georgia, employees, employers and the government all contribute 2% which leads to a combined rate of 6%

In Lithuania, you must be under the age of 40 to qualify for auto enrolment. The employee then contributes 4% and the government contributes 6%.

In Poland, employees contribute 2% and employers contribute 1.5%.

In Thailand, contributions for employers and employees start at 3% but plan to increase to 10% over the next 10 years.

Learn more about Auto Enrolment pensions

If you have questions about the auto-enrolment scheme, how it might impact your specific situation or whether you would be better off transferring from your private pension to the auto-enrolment scheme then contact a trusted pension adviser here.