Defined benefit pension transfers in Ireland in 2026 are increasingly being offered to deferred members of defined benefit pension schemes with transfer values that are very attractive and higher than in previous years.

As employers seek to phase out defined benefit pensions due to the financial and administrative demands placed on them, the transfer values offered to their former employees are improving.

If you have a defined benefit pension from an old employer, you may wish to consider accepting a pension transfer if it is offered. However, it is really important to understand what is involved and weigh up your options carefully.

The National Pension Helpline can offer you information and advice on defined benefit pension transfers, and all other aspects of pensions and retirement planning, to help you make this important decision.

Defined benefit pensions

Defined benefit (DB) pension schemes are usually based on your final salary on retirement and offer a guaranteed retirement income for the rest of your life after you retire.

Defined benefit pension schemes are declining in availability with some closed to new entrants, and some closing down as employers cannot continue to maintain them due to the burden of administration and financial demands.

Generally, employers make the decisions around the investment and administration of the fund and are responsible for ensuring that the pension pot is sufficient for your retirement without input from you as an employee.

Defined benefit pensions are now usually more associated with public sector employment with defined contribution pensions (DC) pensions generally available to those who work in the private sector.

Defined benefit pension with an old employer

When you are no longer in the employment of an employer with whom you have previously had a defined benefit pension, but you have not reached retirement, you become a deferred member of the scheme.

You can still draw down your defined benefit pension on retirement, but some former employers and trustees of DB pensions are offering deferred members the option of transferring out of the defined benefit pension scheme.

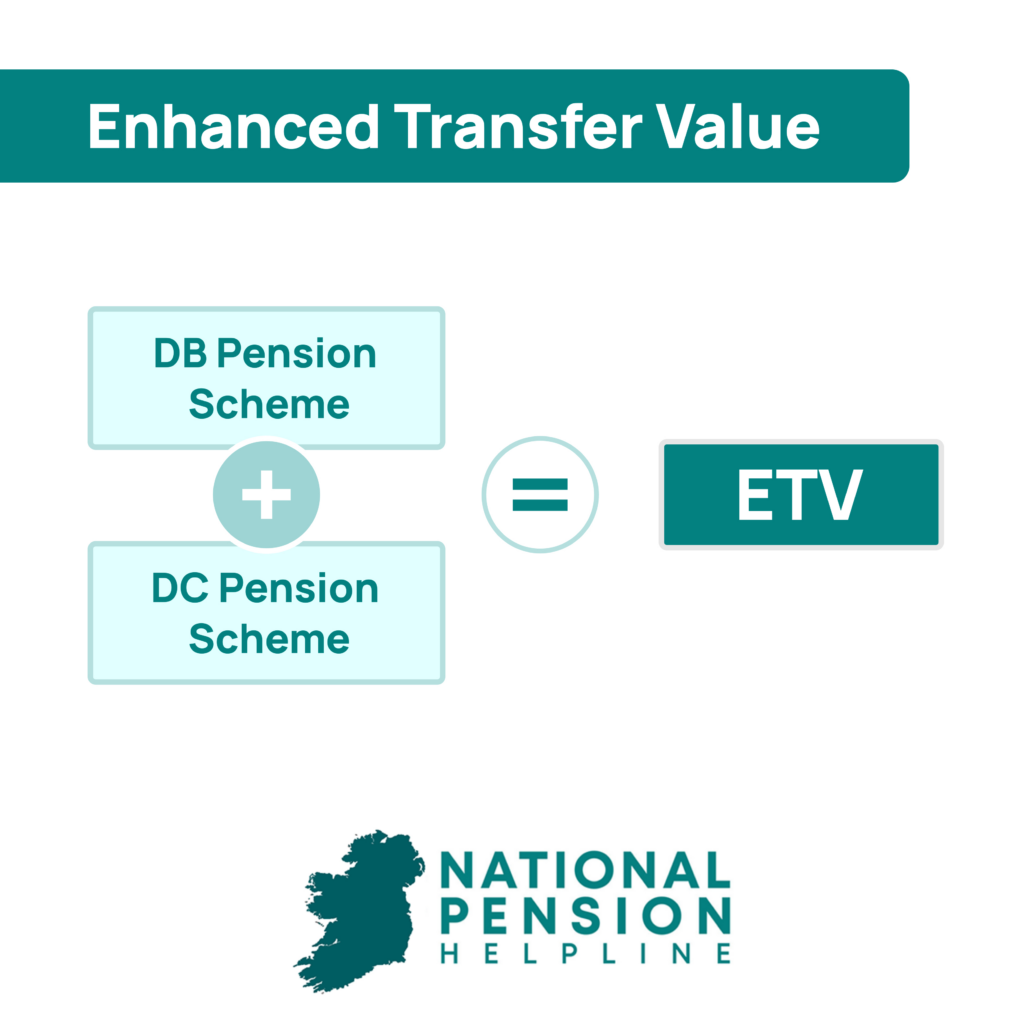

Enhanced Transfer Values

An enhanced transfer value (ETV) means that the pension transfer value that you are offered to switch from your DB pension scheme is often significantly higher in order to incentivise former employees to transfer out of the scheme.

Former employers or pension trustees may contact you as a deferred DB pension member and offer a pension transfer value to transfer into another pension scheme.

You may be offered a cash value to make another pension arrangement. The incentives offered can be significant with the ETV being higher than the usual pension transfer value.

However, you may have limited time to make this decision and it is important to look at your options very carefully.

Benefits of a defined benefit pension

A defined benefit pension will pay you a set income in your retirement (an annuity). The money in your retirement fund is paid as a guaranteed income for your lifetime. You do not have to make decisions about how the fund is managed and there is a lower degree of risk.

If you die before your spouse, it may also pay your spouse an income after your death for their lifetime. This may be 50% of the annuity (annual income).

However, no balance from the fund will be passed to your estate for your dependents to inherit when after you (and your spouse if applicable) die.

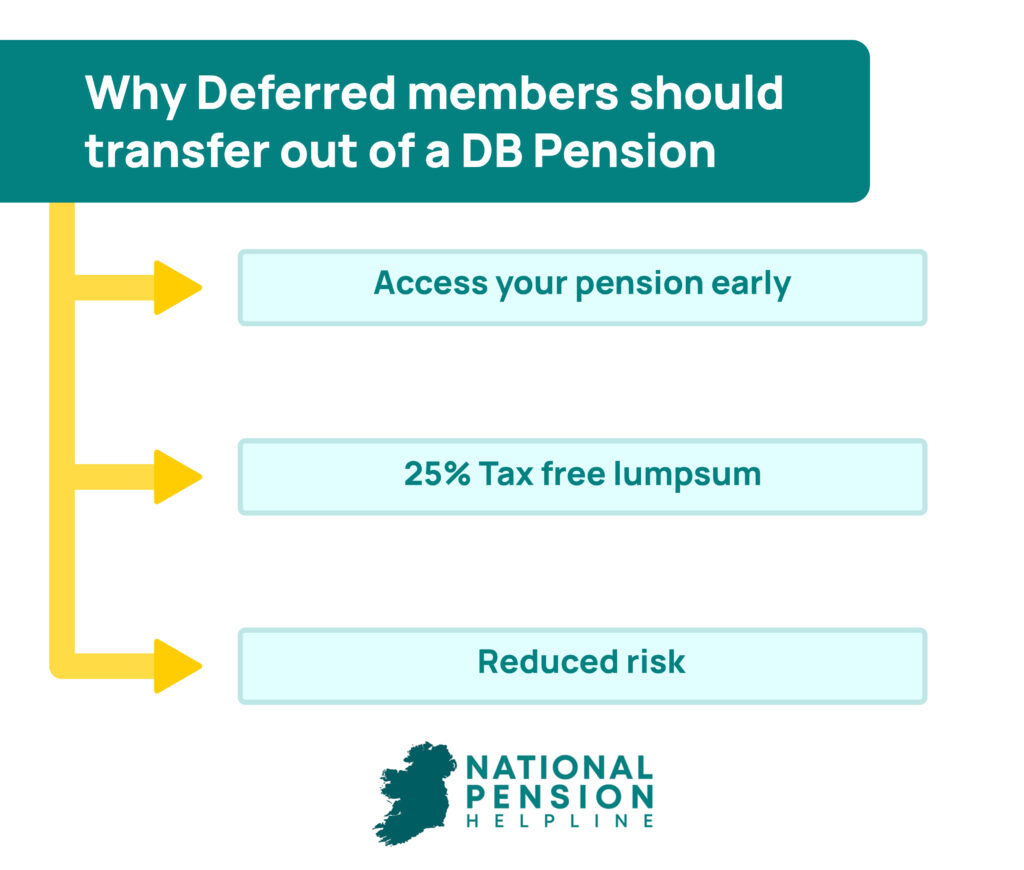

Benefits of taking an ETV

If you take the enhanced transfer value then you can take up to 25% of the overall fund as a tax free lump sum. You can then transfer the balance into an annuity or an approved retirement fund (ARF).

An ARF is a post retirement investment vehicle whereby the funds are reinvested rather than providing a set regular income. This option allows you a degree of choice in how the funds are invested and also more flexibility in how you draw down income for your retirement.

While an ARF offers more flexibility than a defined benefit pension, there is also a higher degree of risk involved as the value of the fund may fall and there may be higher management charges.

On your death, the balance in your ARF may be inherited by your dependents, this may be an attractive option if you wish to leave something in your will for your dependents or to pay inheritance tax.

National Pension Helpline

If you have been offered an enhanced transfer value (ETV) by a former employer it is really important to consider all the options and seek advice as to the option that best suits your personal circumstances.

There are also tax and inheritance implications of the various options that need to be considered.

The National Pension Helpline can offer you information and advice regarding your ETV. You can avail of free consultations with qualified advisors who can give you personalised advice based on your situation and circumstances.