The government has passed a landmark law which will create a new automatic enrolment pension scheme to address a deficit of pension savings in the country.

The Automatic Enrolment Retirement Savings System Bill 2024 has been sent the President to be signed into law after being passed by both houses of the Oireachtas.

This is a monumental shift in the pension system in Ireland, with up to 800,000 people expected to be enrolled in new retirement savings plans in 2025.

Ireland is the only OECD country that does not yet operate an Auto Enrolment or similar system as a means of promoting pension savings.

Commenting on the passing of the Bill, Minister Heather Humphreys said, “Auto-enrolment is a truly transformative policy that I am proud to deliver for Ireland.”

“It will make sure that hard working men and women across the country will be able to save for their future, with help from their employers and the State.”

“I am delighted that this historic legislation has now passed both Houses of the Oireachtas and look forward to it being enacted shortly.”

New Pension Scheme

The new pension scheme will automatically enrol all employees between the ages of 23 and 60 who are not already part of an occupational or equivalent pension scheme, and who earn over €20,000 across all of their employments.

The first enrolments will begin in 2025, with the scheme being phased in gradually over the next decade.

Contributions by employees and employers will start at 1.5%, and increase by another 1.5% every three years until they eventually reach 6% by 2034.

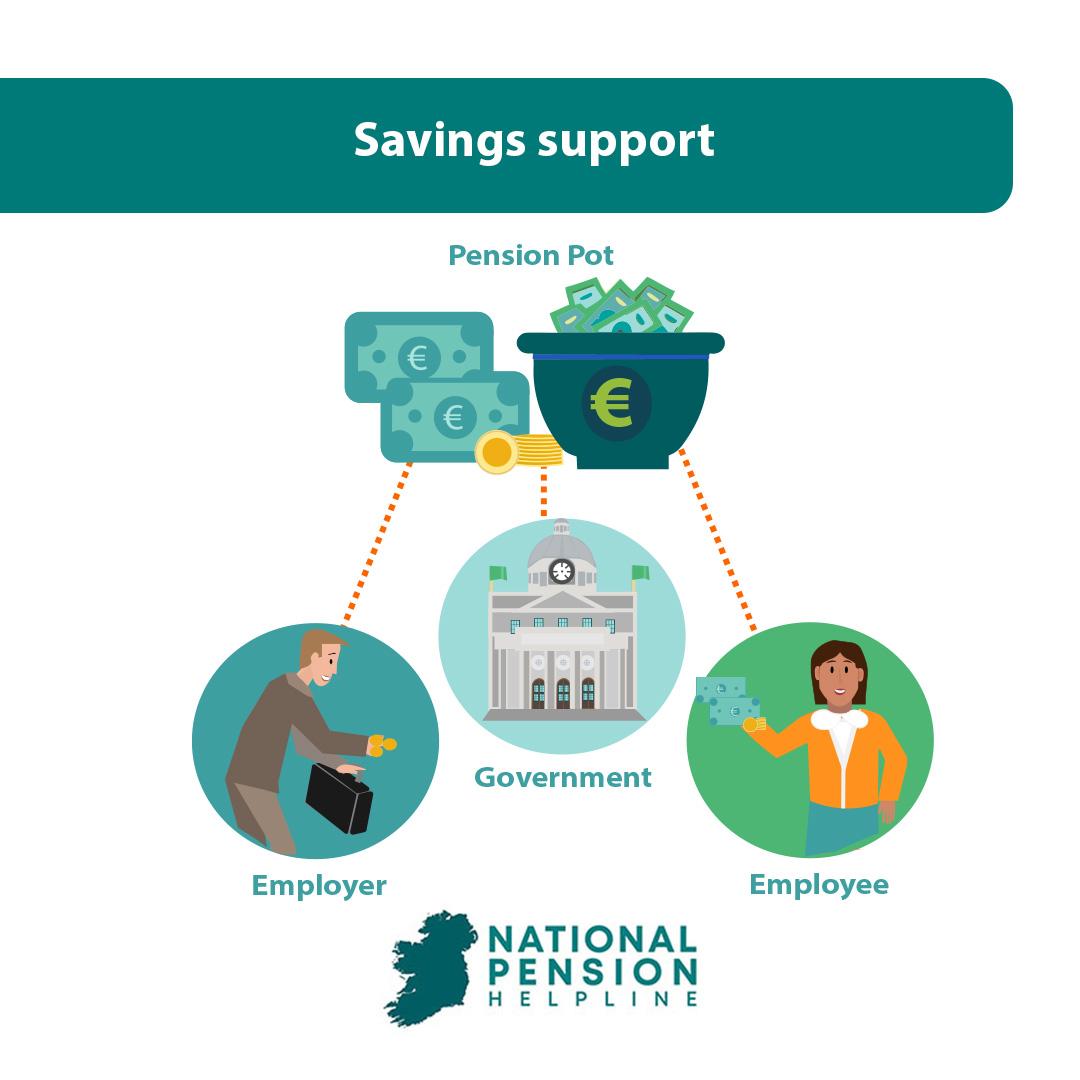

Matching contributions will be made by employers to those contributions made by employees up to a maximum of €80,000 of earnings.

The state will also top up contributions by €1 for every €3 put in by the employee, on top of the employer contribution, up to a maximum of €80,000 earnings.

This means that for every €3 saved by an employee, a further €4 will be contributed to their pension pot by their employer and the State.

While this scheme is voluntary, it is on an ‘opt-out’ basis rather than choosing to opt-in. Eligible employees will be enrolled automatically, but can opt-out or suspend their participation after six months.

There will be four different retirement plans to choose from based on different risk/return profiles, along with a default ‘life-style’/’life-cycle’ investment profile for those who do not express a preference.

Minister Humphreys added, “Auto Enrolment has been talked about for decades – now it is finally happening. With the completion of these two major milestones, the AE train is fast approaching its destination and we are very much on track for delivery of this landmark initiative for the people of Ireland.”

Managing Pension Services

A new National Automatic Enrolment Retirement Savings Authority is also being established as part of this law, which will administer the system and ensure compliance, under the aegis of the Department of Social Protection.

This authority will handle all of the work involved with identifying eligible employees, enrolling them, collecting and investing contributions, administering all accounts, and facilitating payments at the time of retirement.

This means that employers will have minimal administrative work in relation to Auto Enrolment.

Tata Consultancy Services (TCS), a leading global IT services, consulting, and business solutions organisation, has been selected as the preferred bidder to provide this administration as a managed service.

Since 2011 TCS has managed the National Employment Savings Trust (NEST) in the UK, their equivalent auto enrolment scheme which currently serves approximately 13 million people.

TCS has a global delivery centre based in Letterkenny, Co. Donegal, which employs close to 1,400 people and provides a variety of services including pension administration, cyber security, IT support, and customer service.