Inflation is the rise in prices for goods and services over time. Everyone remembers a heyday of their youth when the prices paid for items were a fraction of what these items cost today. This is inflation in action.

Inflation can have an impact on your pension in that inflation will erode the real value of your pension as costs rise over time.

As inflation leads to an increase in the cost of living, good retirement planning is crucial to ensure that your pension will continue to provide sufficient income to fund your retirement plans.

The National Pension Helpline can help you with free and impartial information and services to plan your retirement income online or over the phone with 24/7 customer support.

Example of how inflation affects your pension

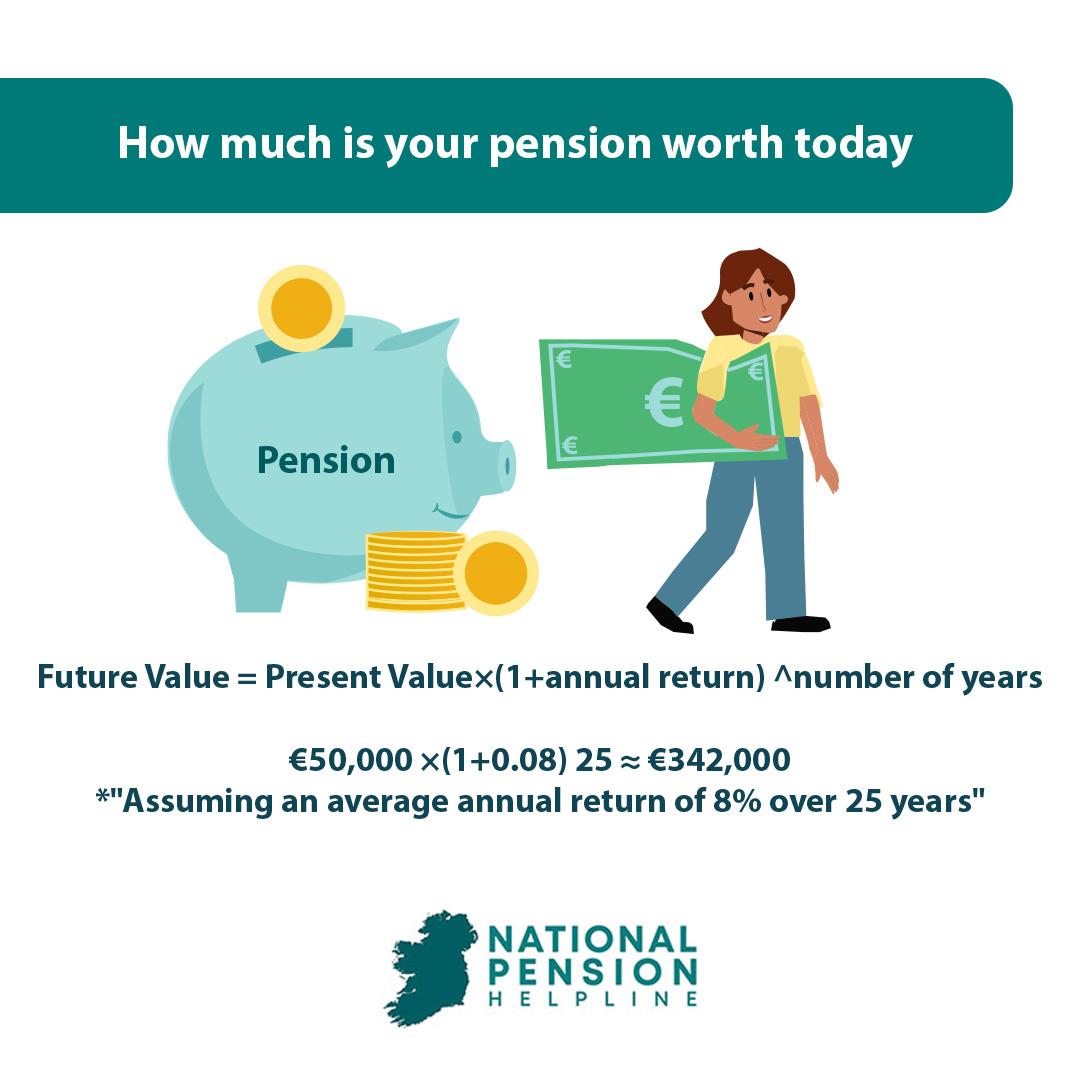

What is a pension of €50,000 in 2000 worth today?

It may be worth a lot less than you think as this example will demonstrate.

To show how inflation can erode the real value of your pension over time, here is a simplified example of how inflation can affect the purchasing power of an investment over a certain period.

An investment of €100 is made monthly for 25 years in an investment fund with a medium growth rate of 5%.

Following the 25 year investment period, the fund will be worth approximately €55,700 after charges.

It is easy to translate this example to the value of your pension pot over time and see that it is essential to allow for the effects of inflation over time when planning your retirement finances.

Pension planning to counter inflation

Your pension may be the largest asset you own, aside from your home, but inflation could have a significant impact on the purchasing power of any lump sum on retirement or your annual retirement income.

Maximise pension contributions

Everyone has seen the effects of inflation on the cost of living in recent years, with higher energy bills, rent and mortgages, and everyday bills such as groceries all seeming to make contributing to a pension an unattainable goal.

In order to ensure that you have sufficient income in retirement it is a good idea to maximise your pension contributions in order to benefit from the income tax relief available for doing so.

Get financial advice today

A qualified financial advisor can help and advise you on whether your current pension provision is in alignment with your retirement plans and needs and is sufficient to allow for the effects of inflation over time.

Whether you have questions about your current pension provision or you have yet to start saving for retirement, the National Pension Helpline can help you navigate the complexities of pension planning.

Fill in our online assessment and get a free pension consultation with a pension assessment or a full pension review or just browse our website for advice and information on all aspects of pensions and retirement planning.