Heather Humphries, the Minister for Social Protection, has announced the new name for Ireland’s long awaited auto enrolment pension scheme.

My Future Fund has been chosen as the “easy to remember” moniker, a move intended to make clear the purpose of the pension savings scheme ie. to save and invest for the future of the contributor.

Minister Humphries has said: “My Future Fund, the new name for auto-enrolment, will help hundreds of thousands of hard-working people save for their futures with the support of employers and the State. By ensuring people have more money when they retire, we are investing in the future of Ireland and in the people living and working here.”

National Pension Helpline provides up to date pension information and advice to help you to plan for your retirement including your auto enrolment pension options.

My Future Fund

A commencement order has also been signed for My Future Fund which will pave the way for the scheme to open for contributions on 30th September 2025.

On this date, NAERSA will begin collecting contributions from the various stakeholders in the scheme, workers, employers and the State, in order to invest them on employee’s behalf.

Under the new scheme, employees will make contributions, which will be matched by their employers and topped up by the Government.

For every €3 contributed by employees and employers, the Government will contribute €1. Further investment of these contributions will mean participants’ funds will grow further.

This will allow an estimated 80,000 workers to benefit from an occupational pension on top of or in addition to their State Pension.

National Automatic Enrolment Savings Authority (NAERSA)

Minister Humphries has also secured government approval for the establishment of the National Automatic Enrolment Retirement Savings Authority (NAERSA), the new state agency responsible for managing the pension scheme. NAERSA is intended to be in place by the end of next March.

The six month time frame will ensure that the Board and Executive Management of NAERSA will have sufficient time to ensure the implementation of various arrangements and systems before the commencement of auto enrolment in September 2025.

Administration of My Future Fund

NAERSA will have a role in identifying employees eligible, through payroll data, for the scheme, as well as minimising administration for employers and business via a highly automated system with automated payroll instruction.

The contract has also been signed with Tata Consultancy Services (TCS) to act as the managed service provider for My Future Fund. TCS will provide administration services to NAERSA, having administered pension schemes in other countries including the UK where it administers the NEST Auto Enrolment system.

What does this mean for me?

With these developments in place, My Future Focus pension auto enrolment is about to become a reality for employees in Ireland come September 2025.

This means that employees who are aged between 23 and 60 and are earning above €20,000 who are not currently enrolled in an occupational pension scheme will be automatically enrolled in My Future Fund. Eligible employees who earn less than €20,000 can voluntarily opt in.

Contributions will be phased in over the decade to 2035 with initial employee contributions of 1.5% rising to 6% by this time, employers will match these contributions and they will be topped up by the Government.

After 6 months, employees will have the option to opt out of the scheme and have their contributions returned to them. If they remain eligible for My Future Fund, they will be automatically re-enrolled after 2 years. Any employer and State contributions in their fund will remain invested.

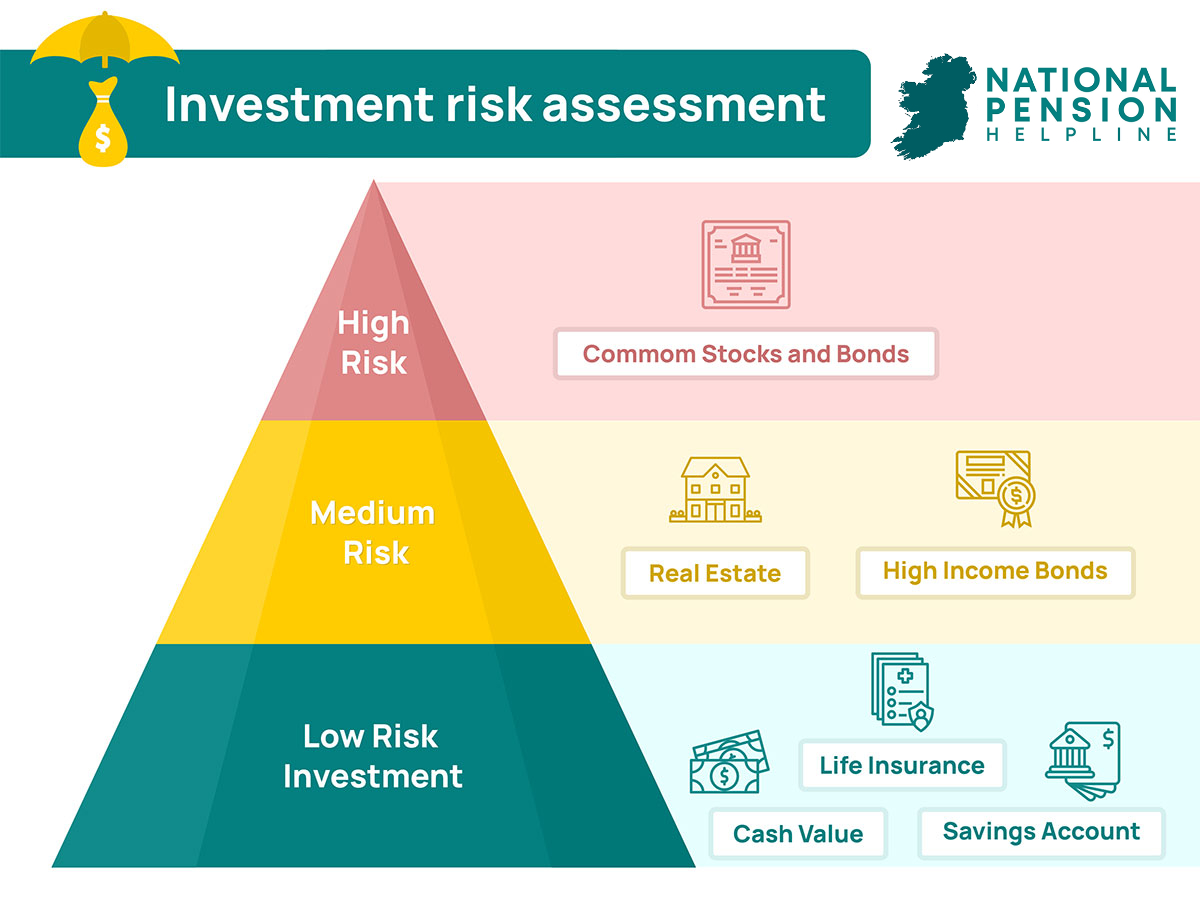

Risk strategy

NAERSA will also contract up to four investment management companies to invest the contributions with low, medium, and high risk strategies.

There will be a default risk strategy on a lifecycle basis, where participants are moved to lower risk funds as they near retirement. However, you can choose which risk strategy you prefer, low, medium, or high , if you do not wish to choose the default strategy.

Retirement Age

It is envisaged that retirement age for My Future Fund will be linked to the retirement age for the State pension of 66, with participants initially receiving a lump sum based on their contributions and the investment return on retirement.

There may be alternative drawdown options available as the scheme evolves.

Employers and employees will have access to an online portal to check contributions and administer auto enrolment pensions.

National Pension Helpline

National Pension helpline offers a free service with reliable pension information and services for your financial future. We are Ireland’s leading provider of pension information and support.

If you have questions about your current occupational pension arrangements and how they will be affected by My Future Focus, contact us today.

We can also help you to compare pension funds and options, keep up to date with other Government policy and updates, and improve your retirement outlook with free consultations with qualified pension advisors.

Contact us today online or by phone or sign up for our monthly newsletter and secure your financial future in retirement.