A pension adjustment order (PAO) is a court order which enforces the entitlement of a former spouse or partner or their dependents to a share or proportion of the pension arrangement of their former spouse or partner.

PAOs are complex and there are a number of different aspects to consider.

The legal context for Pension adjustment orders (PAOs)

During a legal or judicial separation or divorce, or dissolution, a pension will be considered an asset and a former spouse or partner may be entitled to a proportion of their former spouse or partner’s occupational or self-employed pension or retirement benefits on the division of assets.

The former spouse can be allocated or designated some or all of the pension benefits by the court.

A decree of judicial separation agreement or divorce can divide the assets of a former couple but cannot make any change to pension arrangements, a pension adjustment order (PAO) is also required. A pension adjustment order is a legally binding court order which can be granted at the time of the divorce or separation or applied for subsequently.

The former spouse or partner of a marriage, civil partnership, or cohabitation or a dependent child (except in the case of cohabitation) may apply for a pension adjustment order. Either spouse or partner (or a representative of a dependent child) may apply to the court for a pension adjustment order.

Separate pension adjustment orders are required for each private or occupational pension arrangement.

What is a pension adjustment order?

A pension adjustment order (PAO) is a court order which enforces the entitlement of a former spouse or partner or their dependents to a share or proportion of the pension arrangement of their former spouse or partner.

This share or proportion of the pension benefits of their former spouse or partner is their designated benefit. A pension adjustment order may be used as a means to make financial provision for a former spouse or dependent children of the marriage.

In the same way that other assets eg. family home are divided during a divorce, legal or judicial separation, or dissolution, a former spouse or partner may receive a share of their former spouse or partner’s pension or retirement benefit following negotiations on the division of assets.

Who does a Pension Adjustment Order apply?

A pension adjustment order can apply to a former spouse, civil partner, or cohabitee (in some circumstances).

How much of my pension is my spouse entitled to?

Whether the former spouse or partner is retired or still working, a pension adjustment order can be put in place by the court. A Retirement Benefit Order applies to pensions or retirement benefits, lump sum, and death in retirement benefits.

A Contingent Benefit Order applies to any contingent benefits ie. lump sum payments or dependents pensions payable on the death during employment of the member that apply under the rules of the pension scheme. This is a separate court order.

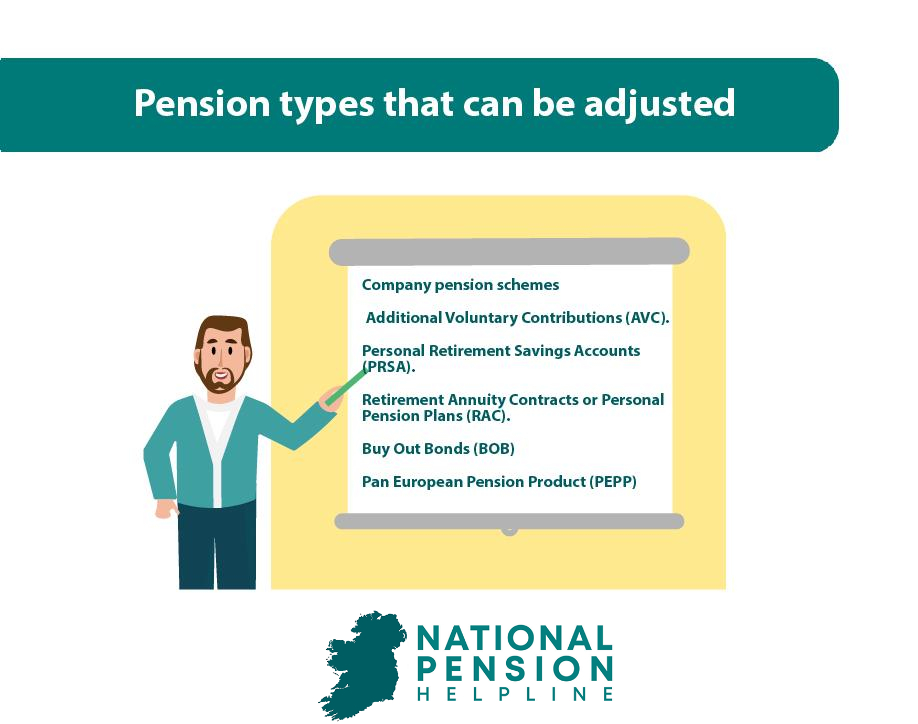

Which pension arrangements can be the subject of a pension adjustment order ?

Pension arrangements that may become the subject of a pension adjustment order include:

Company pension schemes

A company pension scheme or occupational pension schemes is a pension scheme set up by an employer for the benefit of its employees and run by a trustee.

Additional Voluntary Contributions (AVC).

Additional voluntary contributions are additional payments made to a company pension or occupational pension schemes in order to build up additional retirement benefits.

Personal Retirement Savings Accounts (PRSA).

A PRSA is a long term savings account with the purpose of providing for retirement.

Retirement Annuity Contracts or Personal Pension Plans (RAC).

A retirement annuity contract or personal pension is an insurance contract approved by revenue which may provide a lump sum and retirement benefit on retirement.

Buy Out Bonds (BOB).

A buy out bond or personal retirement bond is where you can transfer funds from an occupational pension to a scheme with another pension provider.

Pan European Pension Product (PEPP).

A PEPP is a European rather than a national pension scheme where a member can contribute to provide for their retirement.

How is the allocation of the PAO determined?

Two things are determined in the decision regarding the allocation or designated amount of pension benefits following judicial separation or divorce.

Firstly, the relevant period of service of the member prior to the divorce or legal or judicial separation. Secondly, the percentage of benefit to which a former spouse or partner may be entitled.

The relevant period of service is usually (but not always) the time of the marriage up to the separation of divorce. Benefits prior to or further benefits following this time cannot be shared.

A former spouse or partner or dependent child may be entitled to a designated amount or designated retirement benefit that is a nominal percentage (.001%) of their former partner or spouse’s pension benefits or to 100% of the pension, depending on the pension adjustment order and their individual circumstances.

What other factors are considered by the court?

The court will take into account the spouses respective financial resources, as well as the length of the marriage, civil partnership, or cohabitation.

For example, if one spouse or partner was a stay at home parent and did not have their own pension, this would be taken into account by the court. A pension adjustment order can be used to make financial provision for a former spouse and/ or any dependent children.

If their former spouse or partner should retire early and receive a lower level of benefit, the other former spouse or partner is entitled to the same proportion of the lower pension benefit as determined in the pension adjustment order.

A pension adjustment order cannot be made in favour of a former spouse or partner who has since remarried.

Are you entitled to share of pension if you only lived together and were not married / civil partners ?

Cohabiting couples have rights in respect of property, custody of children of the relationship, maintenance, and inheritance.

If a couple has lived together or cohabited for a period of over 5 years or had dependent children together and lived together for over 2 years, then a former partner may be entitled to a proportion of any pension if the cohabitation comes to an end.

How to find a spouse’s pension information.

In the course of court proceedings for any of the orders under The Family Law Act, 1995 and the Family Law (Divorce) Act, 1996 & The Civil Partnership and Certain Rights and Obligations of Cohabitants Act, 2010, each spouse or partner must provide information about any property or income they may have to the other spouse.

Details of any pension schemes of which either spouse is a member must be included in this information. Under the Pensions Act 1990, the court can direct the pension scheme trustees to provide this information if one spouse or partner does not disclose this information.

What pension information must be provided by the trustee?

What happens after the pension adjustment is granted ?

A pensions adjustment order is served on the trustees of the former spouse or partner’s pension scheme. A trustee cannot make changes to a pension scheme without the court order but will make the adjustments outlined in the pension adjustment order.

When a pension adjustment order has been granted, retirement benefit can commence immediately if the former spouse has already retired.

What happens if the former spouse has not yet retired?

If the former spouse has not yet retired, the former spouse has the option of retaining their proportion in the members current arrangement and receiving their proportion of the benefit when their former spouse retires – independent benefit in the same scheme or ‘ear marking’.

Transfer of benefits

If a former spouse or partner wishes their benefits to be independent of decisions made by their former spouse, they may transfer the benefits to their own, independent pension scheme (‘splitting’) The amount that the former spouse or partner is entitled to is known as the transfer amount, which is used to set up their own, independent pension arrangement.

Independent benefits in another occupational pension scheme may apply if the former spouse or partner’s pension is a company pension scheme and a separate pension is established for the former spouse.

Independent benefits in an approved insurance policy or pension retirement saving account (PRSA) may be established where the transfer amount is used to establish an insurance policy or PRSA.

Revenue requirements and implications

All arrangements made under a pension adjustment order must comply with Revenue requirements.

Pension benefits for the former spouse or partner under a pension adjustment order are liable to income tax. Separated or divorced spouses are taxed as single people.

Capital acquisitions tax may apply to any inheritance, contingent benefit, or lump sum received under a pensions adjustment order.

There are also limits to the maximum allowable benefits and maximum contributions to any pension scheme. Any additional tax liability as a result of the Pension Threshold Limit is shared by both parties in the proportions agreed in the pension adjustment order.

Getting expert advice from a tax consultant or solicitor

It is essential that advice is sought regarding tax treatment of any benefits received under a pension adjustment order as well as maximum thresholds around contributions and benefits. The Revenue website also has detailed information regarding Pension Adjustment Orders and a PDF specifically covering pension adjustment orders

Learn more about pension adjustment orders today

Pension adjustment orders are a complicated and complex area of family law. If you would like more information about any rights and entitlements in this area, contact the National Pensions Helpline for support or advice.