Anyone who has worked in Ireland will receive a State pension. It is based on reaching a threshold of PRSI payments (Pay Related Social Insurance payments) and there are contingencies for those who have not reached this threshold.

This could be because they were working abroad paying social insurance payments which have not been recorded or took breaks in their working life due to family commitments, illness or were required to provide care to another person.

The State pension is designed as a minimum amount of money to meet basic costs of living. It is not designed to match your standard of living while working. This is why a private pension is important so that you can maintain your lifestyle into retirement in combination with the State pension.

Table of Contents

Pension Age

The pension age is currently 66. Once a person reaches this age and has recorded the required amount of PRSI payments, they will be eligible for the State pension. If you retire from your job early you won’t be paid the State pension until you reach the age of 66.

However, you may be eligible for means-tested welfare benefits depending on your situation and whether you chose to retire early or were required to, due to illness or losing your job.

How much will the state pension age increase?

Due to the rising life expectancy in Ireland, the Irish government plan to introduce a flexible pension model.

The new pension model will allow you to retire at age 66 but will also encourage you to work until age 70.

Under the new proposed flexible model those who remain in the workforce until 70 will receive a 24% increase in their weekly state pension payment then those who choose to retire at age 66.

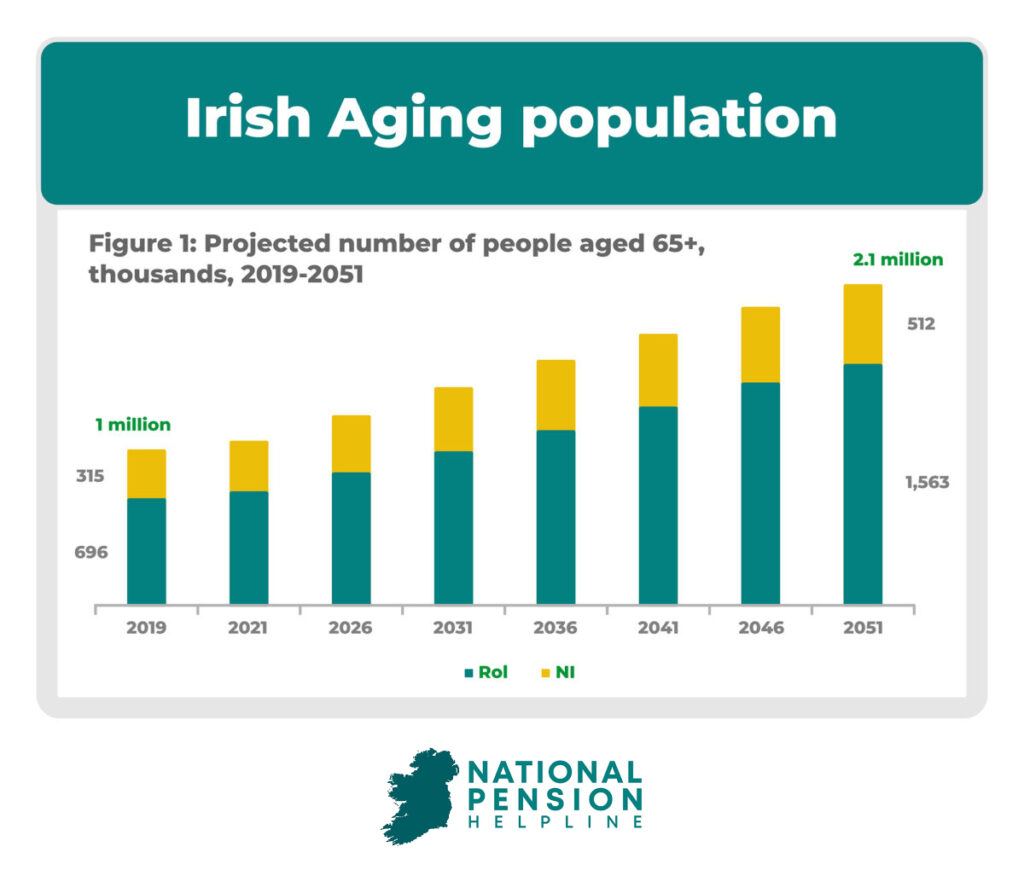

With over 637,567 people reaching pension age in 2016 (up 19.1% from 2011), the state Pensions Commission recommends this to relieve stress on the Irish pension system.

How old do I have to be to start receiving my pension?

Not surprisingly, age is a crucial aspect of qualification for the State pension. But it is not simply the age of retirement but also the age at which you started to pay PRSI payments while working.

To qualify for the State pension you must have started paying PRSI before the age of 56. This is known as your Entry into Insurance and the 56 years cutoff is to allow you adequate time in the rest of your career to pay enough payments before you retire.

To receive the full amount of the State pension you need to have paid 520 full rate of social insurance contributions before the qualifying year of state pension age, 66. This is equivalent to 10 years of PRSI payments.

What age can I access my Pension

From the age of 50 you are entitled to cash in your pension. You can access 25% of your pension (or €200,000). This is given as a tax free lump sum.

This lump sum can be used as you wish and is often used as a way to pay off a remaining mortgage or to retire early.

It is important to consider your retirement planning before making this decision as it may mean you have less pension funds later in life.

Can I make voluntary contributions to my State pension PRSI payments?

Yes, you are allowed to make voluntary contributions to meet your PRSI threshold of 520 full weeks, but there is a limit on how many you can make on a voluntary basis. While working, your PRSI contributions are automatically deducted from your pay.

If you stop working in a company, perhaps to work on a self-employed basis, you still need to keep your PRSI payments up to date in order to qualify for the State pension.

To do this you can opt to pay voluntary PRSI payments to match your work-related PRSI payments from previous employment. However, the cutoff of payments for the full rate of pension is 260 of the 520 PRSI payments required. The remaining 260 must come from employment.

If you are not self-employed and getting a welfare payment, then credits can be applied to your social insurance record to keep you up to date and not lose value in the State pension when you come to pension age.

Another reason to pay voluntary contributions is if you are working outside the EU in a country which does not have a reciprocal agreement with Revenue. In this way you can keep your PRSI payments up to date and if you return to Ireland in retirement you will qualify for the State pension.

How much is an old-age pension in Ireland?

The top rate of State pension is currently €277.30 for the personal rate. If you are responsible for a qualified adult under the age of 66 then you will also receive a payment of €168.70. This part of the payment is means tested. If you are responsible for a qualified adult over the age of 66 then you will receive an additional weekly payment of €227.

The State pension is often referred to as the old-aged pension. It is paid weekly and not means tested. This allows you to receive your state pension and also work on either a part-time or full-time basis. Receiving the State pension is based on your work in the past, not current employment.

The level of payment you receive is based on the number of PRSI payments you have recorded on your social insurance account. Your weekly payment is reduced if you do not have enough payments.

If you have an average of 48 payments-plus per year you will qualify for the full payment.

If you have an average of 40-47 payments then the weekly amount is reduced as per the table below. These reductions continue depending on the number of PRSI payments made.

| Average PRSI contributions per year | Personal rate per week | Increase for qualified adult under 66 | Increase for qualified adult over 66 |

|---|---|---|---|

| 48 or over | €277.30 | €184.70 | €248.60 |

| 40-47 | €271.90 | €175.80 | €236.10 |

| 30-39 | €249.30 | €167.20 | €223.90 |

| 20-29 | €236.10 | €156.50 | €210.70 |

| 15-19 | €180.70 | €120.40 | €161.40 |

| 10-14 | €110.80 | €73.40 | €99.90 |

I worked in the UK – can I get an Irish state pension after Brexit?

Yes, despite the UK leaving the European Union, the reciprocal agreements between Ireland and the UK remain in place, as they predate the European Union.

If you have spent a portion or all of your working life in the UK and aim to return to Ireland in retirement, your social insurance contributions in the UK will qualify you for the Irish State pension.

This also applies in reverse for UK citizens who have worked in Ireland. The PRSI payments made here will count as payment towards the UK State pension if they return to that jurisdiction.

I worked as a parent in the home for much of my life – will I qualify for the State pension?

Yes, since 1994, up to 20 years of your career spent working in the home as a parent or caregiver can be disregarded in order to calculate your average annual PRSI payments.

It includes anyone who has provided full time care for a child under 12 or an ill person with a disability aged 12 or over. Men and women are treated equally for the purposes of calculating the average number of payments.

It does benefit those who have a combination of working in and outside the home so it is useful to take advice on your specific situation from the Department of Social Welfare or Citizens Advice if you are unsure about how your combination of yours working will be treated.

What is a pro-rata State pension?

The concept of pro-rata pensions was created to benefit those people who might previously have been excluded from social insurance at particular times. Certain groups of people, such as the Gardai, did not have to pay into the PRSI system before April 1st 1974. Also, there was a previous arrangement in place that people who earned over a certain threshold did not have to pay PRSI.

These situations have changed but there may still be individuals reaching retirement age who are affected by them. This is what the pro-rata pension is designed to catch.

Irish pension calculator

Our pension calculator is an excellent way to establish if there will be a shortfall in your projected standard of living base don receiving the State pension and any other private pension entitlements you may be in line for.

Learn more about your retirement income

If you are approaching or already at retirement age and have any questions, make and inquiry below to be put in touch with a trusted Financial advisor today.