In the words of Warren Buffett “investing is an activity in which consumption today is foregone in an attempt to allow greater consumption at a later date. “Risk” is the possibility that this objective won’t be attained.”

This statement equally applies to investing for retirement, as we’re putting money away today for the benefit of our future self.

But what’s most interesting about this statement is the definition of risk. Most people see ‘risk’, in the context of investing, as the likelihood of losing money.

But a better definition of investment risk, is the risk of our money not growing by a sufficient percentage to allow, as Warren puts it, “greater consumption at a later date”.

This is something that we as future retirees need to consider.

The reason why we’re putting money into a pension in the first place, is because we want to have enough money to maintain our standard of living in retirement when we stop earning a salary. But in order for that to happen, our money needs to grow by a sufficient amount over time.

With people set to live longer than ever before, we’ll need much larger pension pots than our predecessors to support us in retirement, therefore highlighting the importance of sufficient investment growth.

That brings us to our topic for this article: pension fund selection.

Pension Investing

‘Investing in a pension’ might sound like a very ambiguous term, but it’s a relatively straightforward concept.

Money is taken from your paycheque and is transferred to the organisation with whom you have your pension.

That money is then invested, in what could be, a wide variety of different assets.

You may have read our previous article on Pension Investment Options where we discuss the typical assets in which your pension contributions can be invested.

These include equities, bonds, property, commodities and cash, among others.

In Ireland, the most common setup is that your money will be ‘pooled’ together with other investors, in what’s known as a ‘collective investment fund’, and it’ll be used to invest in some or all of the aforementioned assets.

In most, but not all cases, you’ll have the ability to decide what assets your pension contributions get invested into. This is especially true for those of you using Personal Retirement Savings Accounts (PRSAs).

Pension Fund Selection

The term ‘pension fund selection’ refers to the action of selecting what pension fund(s) you’d like your pension contributions to be invested into.

PRSAs generally have multiple pension funds for you to choose from.

If you don’t actively select what fund(s) you’d like to invest in, your contributions will automatically be placed into the ‘default investment fund’ option for that PRSA.

It’s not that there’s anything ‘wrong’ with these default options, but it’s the opinion of the National Pension Helpline that if you’re serious about investing for retirement, you owe it to your future self to have an active interest in the selection of the pension fund(s) best suited to your current circumstances.

Otherwise, you risk being invested into a fund that won’t help you to achieve your retirement goals.

Pension Funds

Each pension fund will offer exposure to different asset classes (and varying degrees of exposure to each asset class) depending on the objectives of the fund in question.

For example, some PRSAs may have a pension fund that offers exposure to ‘North American Equities’.

By choosing to invest in this fund, your money would be invested across many different company stocks, specifically North American company stocks (for example Apple, Amazon, Google, Tesla etc.).

Another fund might provide exposure to European government bonds, emerging market equities, mixed exposure to multiple asset classes globally, the possibilities are endless.

The point is that there are many different options for you to choose from, and it would be naive to think that the ‘default investment fund’ option is going to be the best choice for everyone (spoiler: it isn’t!).

Pension Fund Performance

So that begs the question, which pension fund should you invest into?

Not all pension funds are going to deliver the same returns to investors – that fact is true over any given period of time, no matter how long or short.

Some funds will be more disproportionately impacted than others by wider economic factors like prevailing interest rates, inflation, unemployment and conflict.

Some funds will have higher fees, costs and expenses than others, which impact long-term investment returns.

But what’s critical to understand is that the performance of the pension fund(s), which you select to invest in, is going to directly influence how much money you have in your pension pot upon retirement.

There’s a lot to consider, and unfortunately, there’s no ‘one size fits all approach’ because personal finance is personal.

What pension fund you choose to invest in is a decision that should be made in the context of your own personal and financial circumstances as an individual.

However, here are some thoughts that you might find useful.

If you would like to see how different funds perform in the Irish market you can check out our article on the best pension funds in Ireland.

Generally speaking, the younger you are, the more risk you can afford to take on.

In classic investment terms, that would mean opting for a pension fund that provides you with more or less 100% exposure to equities.

Why? Well because equities have provided the best long-term returns to investors for decades. However, equities are typically presented as the ‘highest risk investments’ on any boilerplate marketing material provided by the investment firms, which usually results in the uninformed staying away from them.

But this, in the opinion of the National Pension Helpline, is the downfall of many people who are investing for retirement.

Yes, in the short-term, equities are riskier than the likes of government bonds.

But this is a pension we’re talking about – for someone in their twenties, they won’t be accessing this cash for 40+ years, and so there is no ‘short-term’.

What we should be talking about is the long-term, and over the long-term, equities are arguably the least risky investment in many ways.

Remember, Buffett implies investment risk to be defined as the risk of our money not growing by a sufficient percentage. Over long-term periods, equities significantly reduce that risk.

The real risk for you, as a future retiree, is your money not growing at an annual rate that at least keeps up with the rate of inflation.

By choosing to not invest in equities at a young age, that risk has a greater chance of becoming reality by age 60.

As I’m writing this article, inflation rates globally are at multi-decade highs, and while it won’t stay like this forever, these are the kind of economic situations which eat into your retirement savings.

So you need to be doing everything in your power to try and maximise your chances of having sufficient retirement savings to maintain your standard of living when you retire.

There is definitely a time and place for conservative investing, where you might transition your pension fund selection over to ‘safer’ assets like cash and high-grade bonds, specifically if you are approaching retirement.

But, in the opinion of the National Pension Helpline, your younger years are not such a time.

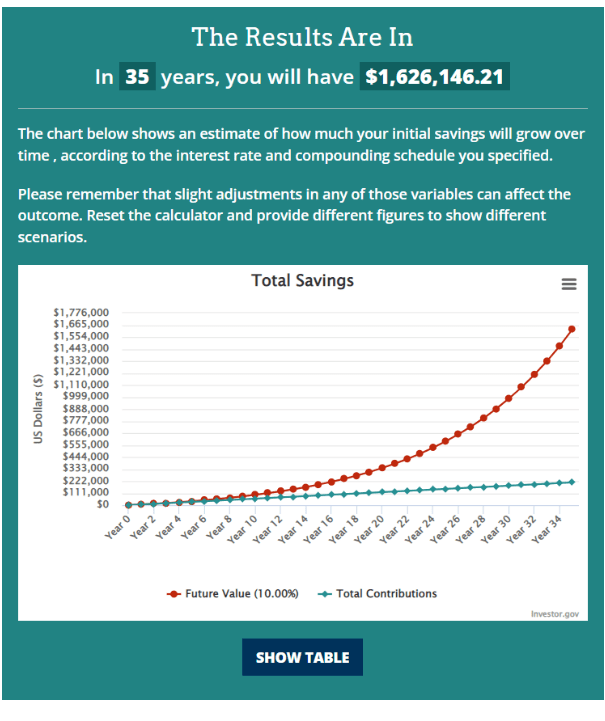

First Hypothetical equity investment scenario: $500 invested each month for 35 years at a 10% annual return

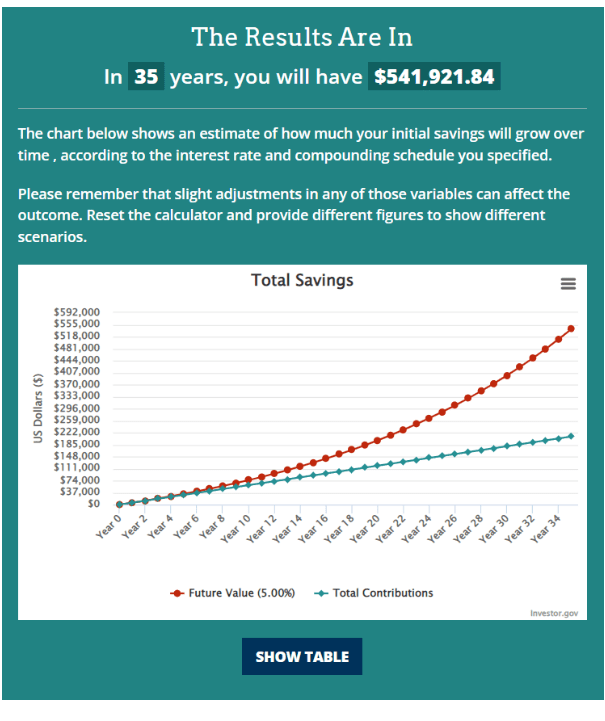

Second Hypothetical bond investment scenario: $500 invested each month for 35 years at an 5% annual return

Closing Words

I’ll close this article off just as I started it, with a quote from Warren Buffett, and it reads as follows: “It is a terrible mistake for investors with long-term horizons to measure their investment “risk” by their portfolio’s ratio of bonds to stocks.

Often, high-grade bonds in an investment portfolio increase its risk”.

Don’t take everything you hear about pension investing and risk at face value.

Think for yourself and make decisions that are best suited to what you want as an individual.

If you need help in making a decision around pension fund selection, the National Pension Helpline has a panel of vetted pension experts who can assist you.

Simply submit your information through the platform and you’ll be paired with the advisor best suited to your situation.