A 2023 study from the Banking & Payments Federation Ireland revealed that only 1 in 3 or 33% of adults in Ireland own an investment product other than a pension and/or a residential property.

Of the 67% of adults without an investment product, a whopping 33% stated that they had no interest in owning one!

These statistics suggest that, when it comes to personal investing in Ireland, many people don’t seem to have much interest. However, when it comes to pension coverage, data from the Central Statistics Office (CSO) shows that 67% of adults in Ireland have private pension coverage – a much better coverage statistic than those with personal investment products.

Granted, participation in occupational pension schemes is mandated by many employers which would explain a large percentage of the total coverage.

The average pension size in Ireland is only €111,000! So, while pension coverage in Ireland is decent (but not great), pension adequacy (i.e. the sufficiency of pension pots) is far from where it needs to be.

In any case, it’s fair to say that adults in Ireland need to be more proactive with their investments. The question is whether that proactivity should be directed towards personal investment portfolios (outside of a pension and/or the principal private residence) or private pensions. This article seeks to explore that question.

Table of Content

Rule of Thumb for investing

To make the National Pension Helpline’s position clear from the outset:

For most long-term investors, the best time to consider investing in equities, bonds or investment funds (i.e. a “personal investment portfolio”) using an online brokerage platform is when their annual tax-efficient pension investment allowance has been fully expended and they have excess cash available for investment purposes.

Therefore, in the opinion of the National Pension Helpline, any proactive investing behaviour by adults in Ireland should be first directed at private pensions and second at personal investment portfolios only if there remains sufficient capacity for investing after full utilisation of the private pension.

Personal Investment Portfolios

Let’s be clear – there is nothing ‘wrong’ per se about investing via personal investment portfolios.

In fact, the technology that’s available to retail investors in 2024, enabling them to seamlessly invest in financial securities, is, frankly, game changing.

The European e-brokerage market alone is estimated at more than €5 Billion in 2023 and is estimated to grow to over €7 Billion by 2028.

It’s just that there are so many positives associated with private pension investing in Ireland that place it in a priority position over personal investment portfolios. This is best explained by discussing various aspects of personal investing.

Investing Post-Tax Money

When you invest via personal investment portfolios you nearly always do so using ‘post-tax money’.

In other words, the money you invest has already suffered taxation at source.

For example, as an employee in Ireland, you will be subjected to the PAYE system whereby your employer automatically deducts income tax, USC and PRSI from your gross salary and pays the tax owed to Revenue before paying the remaining balance into your bank account.

Your bank account, which contains your post-tax money, is what will be linked to the online brokerage platforms that you will use to access the financial markets.

Therefore, you’re investing in the financial markets using post-tax money. One of the rare exceptions to this in Ireland is where you’re availing of the Employment Investment Incentive (EII) which provides income tax relief on investments made in certain companies.

The problem with investing using post-tax money

It isn’t very efficient – especially when there are options available to invest using pre-tax money!

In Ireland, employees who choose to make personal contributions to a pension (be it an occupational pension scheme or a personal retirement savings account (PRSA)) are afforded tax relief at source via the PAYE system.

This tax relief comes in the form of an exemption from income tax up to specified limits depending on your age.

Your employer will transfer your personal pension contribution, after USC and PRSI but before income tax, to your relevant pension provider who, in turn, will allocate that contribution towards the investments that you’ve specified (or, in many cases, the investments that are part of the “default investment strategy”).

The effect of this is that you’re using pre-income tax money to invest and the value of this is best explained by using an example.

Example

Let’s say you’re 34 years old earning €80,000 per annum.

Under the tax legislation, you’ll be able to personally contribute 20% of your income per annum (i.e. €16,000) to a pension and avoid income tax on the contributed cash.

As you’re a higher rate taxpayer, the value of this tax relief to you is €6,400 (i.e. €16,000*40%).

But what’s most insightful is that the tax saving of €6,400 actually represents an automatic 67% return on investment (ROI) by simply choosing to direct your money into a pension.

Why?

Well if you had received that €16,000 into your bank account from your employer (instead of investing it in a pension) Revenue would have taken €6,400 so you’d be left with €9,600.

That €6,400 was never yours to begin with, it was the Exchequer’s, and it only became yours because of your decision to invest in a pension. So, in effect, we’ve turned a €9,600 investment into €16,000 overnight which represents an ROI of 67%!

In other words, if you alternatively chose to invest the €9,600 worth of after-tax money in a personal investment portfolio, you would need to achieve a 67% ROI just to get to the point where you would have been had you chosen to invest using a pension. For context, the average annual return of the S&P 500 since 1957 has been 10.26%.

Taxation of Investments

The tax efficiency of pensions (and the tax inefficiency of personal investment portfolios) doesn’t end with the initial investment either.

Investing via a pension is also more tax efficient throughout the life of the investment itself. That’s because as per Irish tax law, under s774(3) TCA 1997 (income tax) and s608 TCA 1997 (capital gains tax) investment income and capital gains respectively arising from pension investments are exempt from tax.

Conversely, in the case of stock investments, capital gains will be liable to Capital Gains Tax (CGT) at 33% and dividends will be liable to income, USC and PRSI and the marginal rate of tax.

In the case of investment funds, such as exchange-traded funds (ETFs), which are the recommended investment product of choice for the vast majority of retail investors, both income and gains will be liable to tax at a rate of 41%.

So, clearly, having to pay tax on investment returns is a major drawback to utilising personal investment portfolios as compared to pensions.

That’s before you even consider that Irish tax law permits a tax-free lump sum at age 50 to be taken from one’s pension upon retirement!

So, there’s no question that investing via a pension is highly tax efficient and that tax efficiency can add on tens, if not hundreds of thousands of Euros worth of value to your pension for your retirement. In this article about starting a pension in Ireland, we delve into more detail about the opportunity cost associated with not starting a pension. Let’s just say the numbers add up very quickly!

Lack of Matching

Unfortunately, when you invest in financial assets outside of a pension, your employer typically won’t be putting their hand in their pocket to match your investment with cash of their own either.

In case you hadn’t heard, ‘employer matching’ is a practice within pension investing whereby your employer ‘matches’ your personal contributions to a pension with contributions of their own (up to a specified percentage).

Think of this as additional “free money” on top of your base benefits package that you’re receiving as a reward for choosing to invest in a pension.

Employer matching can be extremely valuable to one’s pension pot.

For example, say you’re twenty years old on a salary of €30,000. If we assume;

a) Your salary will increase by 3% per annum

b) A 3% employer matching policy is available

c) You fully utilise your tax-efficient contribution allowance

d) An investment return of 5% per annum and

e) You stay invested for 40 years

Then your employer will have contributed €90,482 to your pension which will be valued at €238,011 at the end of year 40. None of that extra money is available when investing via a personal investment portfolio!

Key: The taxation benefits of pensions plus the additional benefits of employer matching is what makes pension investing superior to personal investment portfolios (specifically, when it comes to long-term investing). Therefore, it makes sense to fully utilise your tax-efficient contribution limit (based on your age) and then, and only then, consider investing any available excess in a personal investment portfolio.

The Pros of Personal Investment Portfolios

Now, we’d be remiss if we failed to mention the upsides of personal investment portfolios as compared to pensions:

1. Investment Selection

Unfortunately, pensions in Ireland, both occupational and personal, still do little in the way of offering a wide selection of investment options to investors in a manner that’s both accessible and cost-efficient.

With an online brokerage platform like:

Irish investors can access a wide range of options including;

Conversely, the investment selection within most pensions in Ireland is confined to collective investment schemes (i.e. investment funds) that offer exposure to different asset classes at varying levels of concentration.

We’re still waiting for the day that workers in Ireland can easily direct their pension contributions into any of the assets that are available on modern online brokerage platforms.

2. Fees

When it comes to fees and charges there’s no contest: pensions in Ireland are, comparatively, expensive to invest in and own.

For example, it’s possible, using Trade Republic or DEGIRO, to invest in a low-cost S&P 500 ETF that charges a total expense ratio (TER) of just 0.06%.

In fact, you could even make that investment with zero trading charges with Trade Republic when utilising the automated investing functionality.

In plain English, a €10,000 investment in the top 500 companies in the United States could cost you just €6 per annum in fees. Conversely, an Irish pension may only invest, for example, 98% of the contribution received and they may charge an annual management fee of 1%.

If that was the case, in the year of investment, you’d pay €298 worth of fees to make an equivalent investment in an Irish pension – nearly 50 times more than the low cost ETF!

Now granted, the above is a relatively extreme example which highlights a rock bottom fee for personal investing and a relatively high fee for pension investing.

Certain pensions, typically occupational pensions, may charge no allocation fee and an annual management charge equal to less than 1%.

Regardless, you can be relatively confident in saying that for every investment made via a pension in Ireland, an equivalent investment could have been made for lower fees and charges via a personal investment portfolio. Fees and charges have a big impact on your investment returns over the long-term and so the goal should be to get exposure to the financial assets that are best suited to your personal circumstances at the lowest cost.

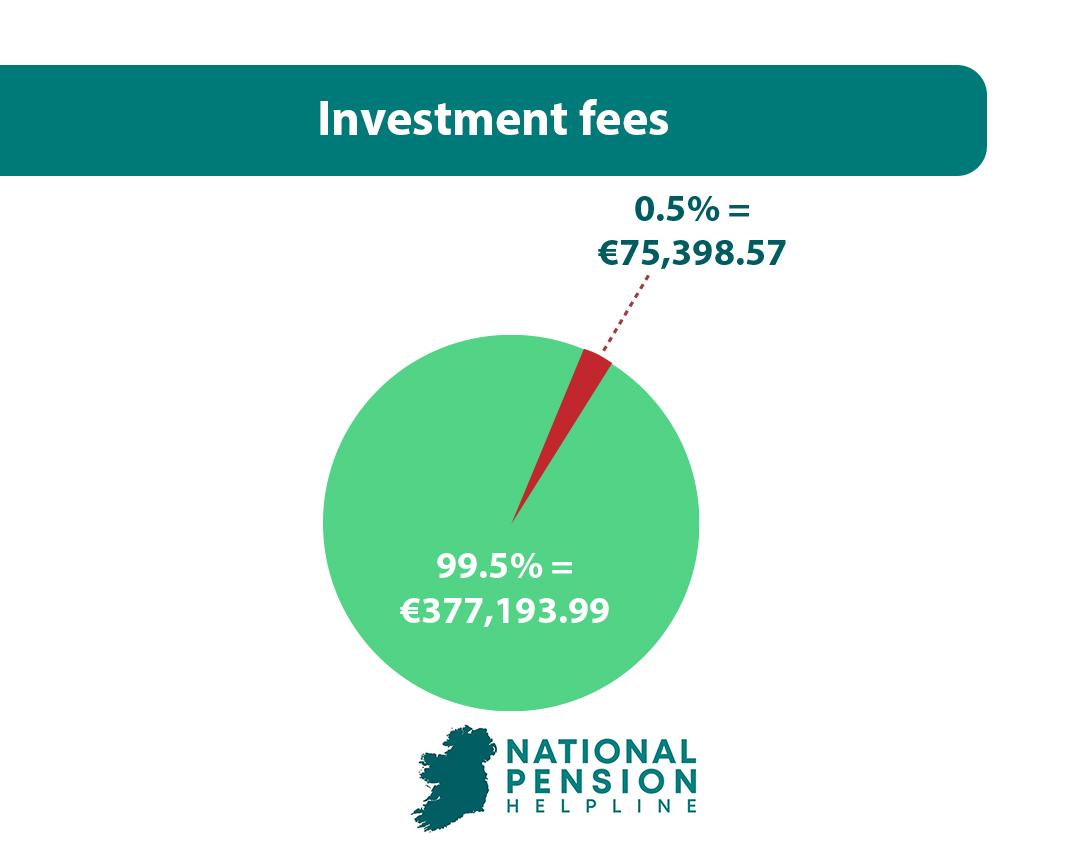

For example, a €10,000 investment made today and held for 40 years at an annual return of 10% with 0.5% worth of annual fees would be worth €377,193.99 at the end of the period – net of fees of €75,398.57.

When we increase the fee percentage by just 0.5% to 1%, we’re left with €314,094.20 at the end of the period – net of fees of €138,498.36. Moral of the story: those <1% percentage fees add up!

3. Technology

Technologically speaking, the difference between investing via a pension and investing via a personal investment portfolio in Ireland is night and day.

The big pension providers in Ireland are not developing the kind of modern investment tools that European fintechs are developing – and that’s unlikely to change any time soon.

Unfortunately, if anything, the lack of modern technology is likely discouraging younger investors from participating in the Irish pension market and it’s those younger investors who would be best served by participating as soon as possible.

Speak the a pension expert today

In conclusion, investing via a pension in Ireland is, and will likely continue to be, the most tax efficient way to invest for the long-term. That said, for those who have the capacity to invest beyond their annual tax-efficient pension contribution limit, the wide investment selection, low fees and advanced technology associated with personal investing should certainly be taken advantage of!

NPH Start A Pension Tool

If you’d like to start your pension online quickly and conveniently then you can do so trying out our new start a pension online system.

The National Pension Helpline has a team of vetted pension experts who can assist you in getting started with the best pension for you.