Defined Benefit Pensions and Transfer Values – do I stick or twist.

Companies who have a Defined Benefit (DB) pension scheme often offer a transfer value to employees who have left service in lieu of a deferred guaranteed pension. What does this mean, and what things should you consider before you decide. The first thing we need to understand is what is a defined benefit pension and what is a transfer value.

A DB pension scheme is an employer sponsored occupational pension scheme which offers to provide a member with a set income at retirement based on their final salary and their years of service. Quite simply, the higher the final salary and the longer the service the greater the member’s pension. Schemes can differ with how they calculate the members pension with some offering for example a pension of 1/60th of a member’s pensionable salary for each year of service while others (older public sector schemes for example) offering 1/80th of pensionable salary but also a lump sum of 3/80th’s of final salary for each year of service as a lump sum.

A transfer value is a single payment by the trustees in lieu of providing a guaranteed pension at Normal Retirement Age and this single payment can be transferred to another pension product and invested, albeit with no guarantees attaching.

In recent years DB schemes for new members of company schemes have been phased out by employers for several reasons. Including:

Defined benefit transfer values are in freefall due to inflation

The last c. 10 years of ultra-low rates were excellent for those who decided to take transfer values as defined benefit schemes offered attractive figures for those who wished to make the switch. As inflation started to creep up in 2021 so did government bond yields and this in turn has caused transfer values to fall. The era of large multiple transfer values came to an abrupt end and we have seen falls of up to a third in transfer offers this year and last compared to 2021.

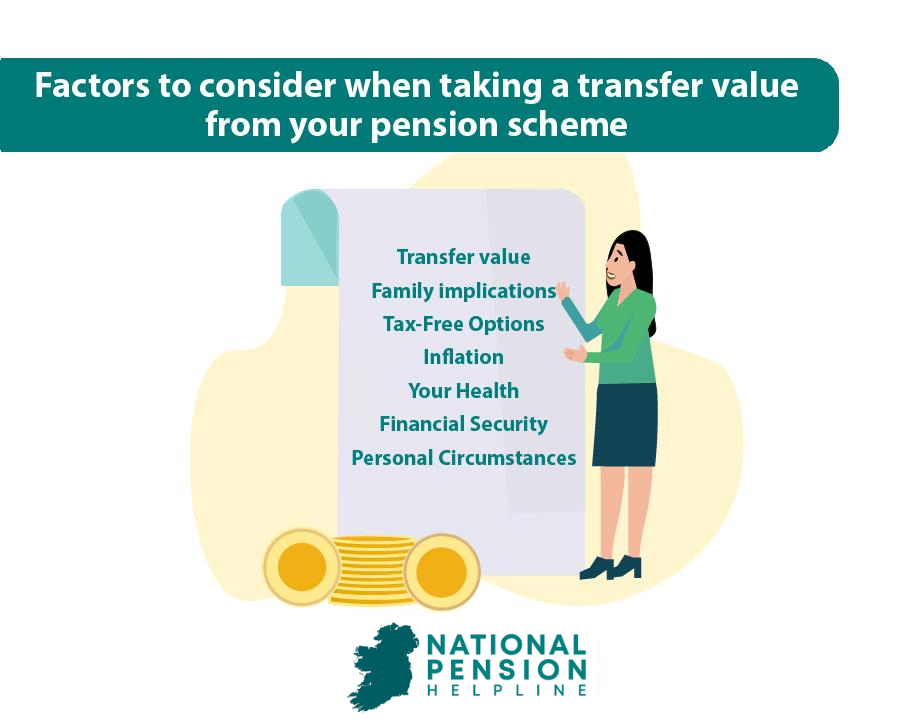

In deciding whether you should take a transfer value from your pension scheme there are multiple things to consider before you make a decision such as:

In essence, whether someone takes a defined benefit pension transfer or not is a personal decision and everyone’s circumstances are different.

While transfer values have fallen significantly in recent years one thing has not changed and that is that each person’s circumstances are unique, so it is important to get advice from a suitably qualified person to undertake a careful evaluation before you make the decision of sticking or transferring your Defined Benefit Pension.