Saving for a pension is an expense that factors steadily throughout working life. However, conversation is sparse around what will happen to that chunk of money once you are no longer here to spend it.

Understanding the ins and outs of pensions is incredibly important as it will end up being one of your strongest assets. Within that, it is key to know its inheritability.

Savings in the form of a pension can be passed down to family in the event of your death. Ticking the boxes and getting things in order will reduce one element of stress for those left grieving.

What happens to your pension when you die will depend heavily on your pension plans and the terms and conditions within it.

Table of Contents

Who can benefit from my pension after I die?

In order to understand which individuals the lump sum will be redirected to, beneficiaries and dependants need to be established.

Beneficiaries

Due to the nature of pensions being a beneficiary scheme, you will end up being the first beneficiary in this case. After that, there are clauses involved in pension schemes that allocate funds to other parties in certain circumstances.

That makes these parties the next in line to receive benefits from a pension scheme. These people usually include spouses and children.

However, being a beneficiary does not mean the individual has to be financially dependent on you.

Dependants

This term encompasses any person that finds themselves to be financially dependent on the holder of the pension scheme.

Typically, the dependant can expect to receive a percentage of a salary or that of the pension the deceased would have received at retirement age.

In the case of pension funds to be paid to dependants, the scheme you are under needs to be given a list of those dependants and be made aware of their identities.

Failure to do this could result in you not being covered to leave behind benefits you expected to have.

What happens to my pension if I die before I have retired?

Similarly to the above discussion, outcomes will ultimately depend on the type of pension scheme you are attached to. The rules enforced within those, dictates where your pension funds can be allocated in the event you die before claiming retirement.

Personal Pensions

If you are signed up to a personal pension plan, you can expect the full gross value of your plan to go to your estate. However, in this scheme you have options, one being to use the lump sum to top up a spouse’s pension in the event of your death.

As with most plans, personal pension funds will be subject to tax conditions that go as follows, depending on the beneficiary:

Workplace Pension Schemes & Death-in-Service

Should your pension be provided by your place of employment and you die whilst still under contract with that company, your pension fund will be paid to your estate under the guidelines of a ‘surrender value’.

This means they will receive the combined value of the employer and employee policy contributions.

However, there are conditions that accompany the payment of a pension as dictated by Revenue rules:

Death-in-service refers to the potential benefits offered by a company following the death of their employee.

This is technically aside from the workplace pension scheme, however in some cases this might not be guaranteed so it is always advisable to join the pension scheme on offer.

Pensions and death after retirement

This scenario will be governed by two cases – annuity or approved retirement fund.

Let’s break down both possibilities to understand how each will impact what happens to your pension when you die at a retirement age.

Annuities

An Annuity is a savings option offered by insurance companies that pays out in annual lump sums.

This offers the policy owner the chance to convert a lump sum into a guaranteed income until the day that you die.

An annuity falls under three branches:

It is worth noting the option to choose a guaranteed period whereby your pension continues to pay out during the chosen timeframe, even in the event of your death.

Most commonly, the single-life annuity is seen where the contract dies with its owner.

Approved Retirement Funds

An ARF model allows for funds to be transferred between your beneficiaries and dependents such as your children, spouse or civil partner.

Ultimately, if you have reinvested your pension in this way, your funds will be instantly inheritable by any beneficiaries.

In this case, funds will be left to your spouse or civil partner and they can then transfer those into an ARF tax-free into their own name.

As mentioned, this transaction will not be liable for tax deductions but any withdrawals after the fact will come up against usual income tax rates.

With regards to other beneficiaries that are not spouses or civil partners, their relationship to you will be assessed in order to determine whether they will pay tax or not.

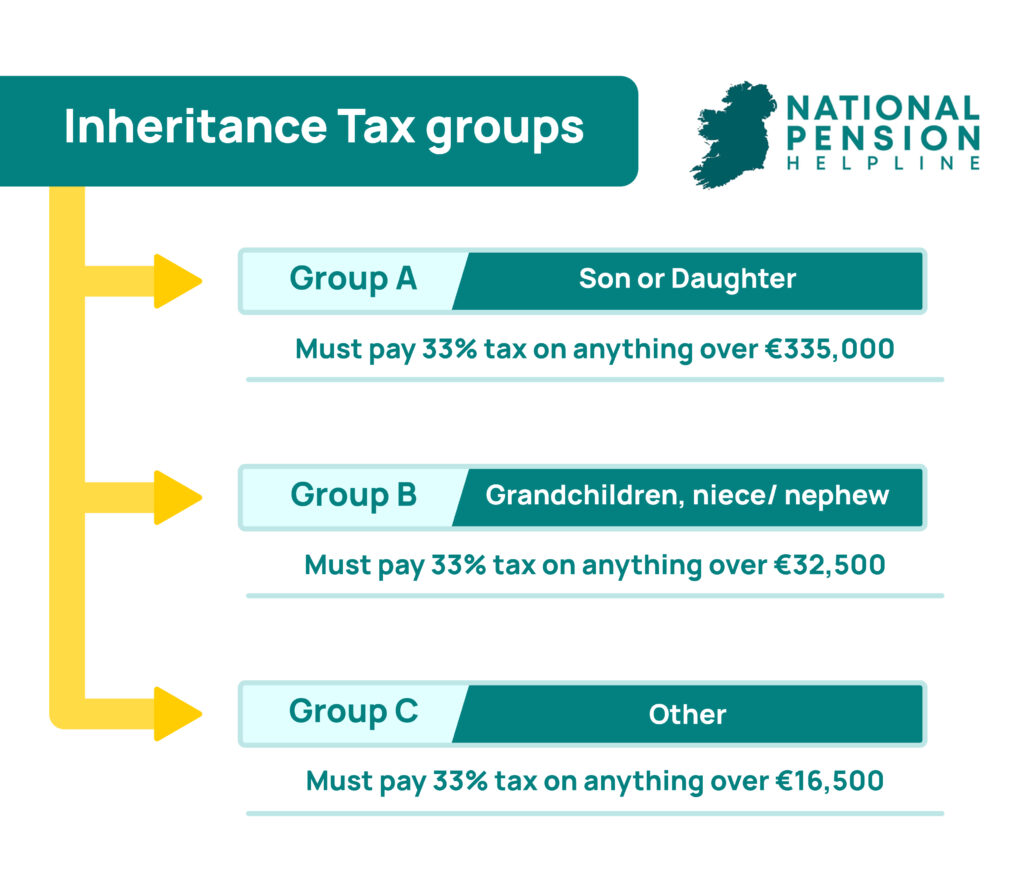

Is my pension liable to inheritance tax?

Mostly determined by the relationship to you and the type of pension scheme you have chosen to invest in, how much your pension will be taxed when inherited is specific to you as an individual.

Any liability for tax deductions that are attached to your situation will fall under income tax or Capital Acquisition Tax laws.

This can be overwhelming and confusing as it is case by case, so we suggest reaching out and organising a meeting with a financial advisor or professional to understand what category you fall into.

Get in touch and learn the full extent of what will happen to your pension when you die in a face to face meeting today.

Learn more

Pensions are confusing but we make them simple. Make an inquiry with The National Pension Helpline and one of our experienced Qualified Financial Advisors will be in touch to discuss your query.