In 2022, the Commission on Taxation and Welfare published a report entitled “Foundations of the Future”.

That report analysed many aspects of Ireland’s taxation system and made recommendations to the Government based on the Commission’s objective to “examine the suitability and sustainability of the taxation and welfare systems in Ireland”.

Among many other things, the Commission’s report analysed the taxation of investments in Ireland.

This article, in the context of the Commission’s report, seeks to examine three aspects of Ireland’s investment taxation landscape that could be “fixed” to better suit the objectives and needs of Irish investors.

Exchange-Traded Funds

An Exchange-traded fund is a type of investment fund that is traded on the stock exchange.

How Exchange-Traded Funds Are Taxed In Ireland

Irish tax residents are liable to tax at a rate of 41% on both gains made from the sale, and income earned from the holding of exchange-traded funds (ETFs). For every €100 gain you realise from an ETF, €41 will go to the Exchequer, whereas for every €100 gain you realise from a company stock, €33 will go to the Exchequer. In other words, Irish investors pay 24% more tax to the Exchequer on their ETF gains as compared to gains made on company stocks.

Conversely, for higher rate taxpayers, Ireland’s investment fund taxation regime is actually favourable from an income tax perspective. Reason being, investment income (i.e. dividends) received from ETFs are liable to tax at a flat rate of 41%. Both USC and PRSI do not apply.

With company stocks on the other hand, dividends received are liable to marginal rate income tax, USC and PRSI which, for higher rate taxpayers, will typically result in a tax rate of either 48% or 52%.

For standard rate taxpayers the opposite is true, as the flat rate of 41% on ETF investment income could mean paying as much as 57% more tax on dividends from ETFs as compared to company stocks.

Tax rates aside, the most well-known and controversial aspect of investment fund taxation in Ireland, which extends to the taxation of ETFs, is the deemed disposal rule.

On the 8th anniversary of the purchase of shares in an ETF, and on each subsequent eighth anniversary thereafter, if the shares have not been sold and the value of the shares exceeds the share price originally paid, then the investor will be “deemed” to have sold and immediately repurchased the shares on that date. In effect, this gives rise to a charge to 41% tax on an unrealised gain.

This treatment is very unique as it’s more or less a globally recognised principle of taxation that unrealised gains should not be subject to tax.

However, there is method to the madness, as the deemed disposal rule was originally introduced to prevent long-term investors from investing in “accumulating funds” and holding these investments for multiple decades which, in turn, would mean that the Exchequer would collect no tax during the interim period at either the investor level or the fund level (as collective investment schemes are only taxed at the investor level in Ireland). Regardless, retail investors have a negative perception of this long-standing rule.

To make matters worse, losses on ETF investments are ringfenced under Irish tax law i.e. the loss cannot be used to reduce your taxable gains on other investments. Conversely, in the case of company stocks, losses can be used to offset realised gains on other investments.

The Potential For Change

Fortunately, in the Report of the Commission on Taxation and Welfare entitled “Foundations of the Future”, the following recommendation was made to the Government:

“Calls have been made for the tax regime for investments to be simplified in order to increase certainty, reduce the risk of error and support tax compliance.

Furthermore, while public debate has historically focused on tax rate differentials across products, this has broadened to a discussion on the neutrality of the taxation system with respect to the form of savings or investment chosen.

Differences in tax treatment can potentially lead to distortionary behaviour, with investors choosing between equivalent investments based on the tax treatment rather than on the investment outcome.”

“The Commission recommends the establishment of a working group to examine and make recommendations for modernising the taxation and administration of investments. This working group should include officials from Revenue and the Department of Finance and should consult with relevant experts and stakeholders in the industry.”

“The main goals or guiding principles forming the basis of the working group should be:

a) how to simplify the tax treatment of investment products generally, to give greater certainty to taxpayers, reduce the administrative burden, reduce the risk of error and support tax compliance.

b) identification of opportunities for greater promotion of horizontal equity and neutrality in the taxation system when it comes to investment decisions….

this is a large undertaking and it is essential that appropriate time and resources are allocated to the working group to achieve this outcome”.

It was this recommendation that led to Paschal Donoghue mentioning the establishment of the working group in Budget 2023, Michael McGrath’s subsequent takeover of responsibility of the working group and, now, Jack Chambers’ responsibility to bring forward the results of that working group.

It’s important to bear in mind that the Commission also recommended that any considerations “should also have regard to fiscal sustainability and be net revenue-raising, or at least revenue neutral, in terms of their impact on the Exchequer”.

In other words, any changes that are made should either generate more tax revenue or, at a minimum, the same amount of tax revenue that was generated under the old policies.

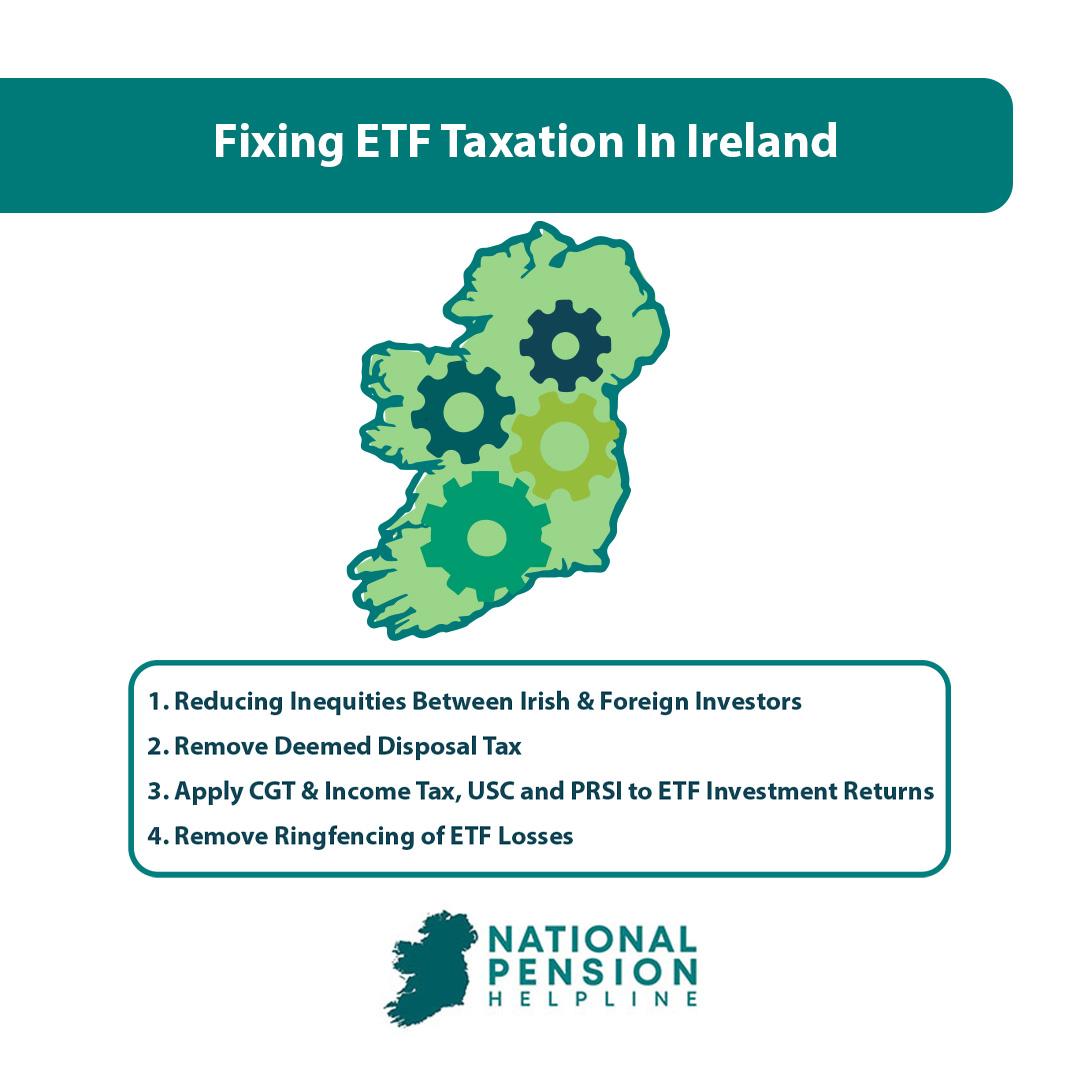

Fixing ETF Taxation In Ireland

While we can only speculate on what changes (in any) will come from the working groups recommendations and the actions taken by the Minister for Finance, it’s worthwhile highlighting some areas for improvement with regards to the taxation of ETFs in Ireland:

1. Reducing Inequities Between Irish & Foreign Investors

Investing in Irish domiciled ETFs is much more attractive to foreign investors than it is to Irish tax resident investors as foreign investors aren’t liable to deemed disposal taxation.

Therefore, foreign investors can invest in Irish domiciled accumulating ETFs and enjoy decades of tax free growth.

2. Remove Deemed Disposal Tax

There are five reasons why deemed disposal tax on ETFs needs to be eliminated:

Worked Example Assumptions:

| Growth per Annum | 8% |

| Total Expense Ratio | 0.10% |

| ETF Type | Accumulating (Irish Domiciled) |

| Initial Investment | €10,000 |

Example 1 – Covering Deemed Disposal With External Cash

| Year | Opening Balance | Growth | Fees | Closing Balance | Unrealized Gain | DD Tax |

| Year 0 | 0.00 | 800.00 | -10.80 | 10,789.20 | 789.20 | |

| Year 1 | 10,789.20 | 863.14 | -11.65 | 11,640.68 | 1,640.68 | |

| Year 2 | 11,640.68 | 931.25 | -12.57 | 12,559.37 | 2,559.37 | |

| Year 3 | 12,559.37 | 1,004.75 | -13.56 | 13,550.55 | 3,550.55 | |

| Year 4 | 13,550.55 | 1,084.04 | -14.63 | 14,619.96 | 4,619.96 | |

| Year 5 | 14,619.96 | 1,169.60 | -15.79 | 15,773.77 | 5,773.77 | |

| Year 6 | 15,773.77 | 1,261.90 | -17.04 | 17,018.63 | 7,018.63 | |

| Year 7 | 17,018.63 | 1,361.49 | -18.38 | 18,361.74 | 8,361.74 | |

| Year 8 | 18,361.74 | 1,468.94 | -19.83 | 19,810.85 | 9,810.85 | 4,022.45 |

| Year 9 | 19,810.85 | 1,584.87 | -21.40 | 21,374.33 | 11,374.33 | |

| Year 10 | 21,374.33 | 1,709.95 | -23.08 | 23,061.19 | 13,061.19 | |

| Year 11 | 23,061.19 | 1,844.90 | -24.91 | 24,881.18 | 14,881.18 | |

| Year 12 | 24,881.18 | 1,990.49 | -26.87 | 26,844.80 | 16,844.80 | |

| Year 13 | 26,844.80 | 2,147.58 | -28.99 | 28,963.39 | 18,963.39 | |

| Year 14 | 28,963.39 | 2,317.07 | -31.28 | 31,249.18 | 21,249.18 | |

| Year 15 | 31,249.18 | 2,499.93 | -33.75 | 33,715.37 | 23,715.37 | |

| Year 16 | 33,715.37 | 2,697.23 | -36.41 | 36,376.18 | 26,376.18 | 6,791.79 |

| Year 17 | 36,376.18 | 2,910.09 | -39.29 | 39,246.99 | 29,246.99 | |

| Year 18 | 39,246.99 | 3,139.76 | -42.39 | 42,344.37 | 32,344.37 | |

| Year 19 | 42,344.37 | 3,387.55 | -45.73 | 45,686.18 | 35,686.18 | |

| Year 20 | 45,686.18 | 3,654.89 | -49.34 | 49,291.74 | 39,291.74 | |

| Year 21 | 49,291.74 | 3,943.34 | -53.24 | 53,181.84 | 43,181.84 | |

| Year 22 | 53,181.84 | 4,254.55 | -57.44 | 57,378.95 | 47,378.95 | |

| Year 23 | 57,378.95 | 4,590.32 | -61.97 | 61,907.30 | 51,907.30 | |

| Year 24 | 61,907.30 | 4,952.58 | -66.86 | 66,793.02 | 56,793.02 | 12,470.90 |

| Year 25 | 66,793.02 | 5,343.44 | -72.14 | 72,064.33 | 62,064.33 |

In the above example, in years 8, 16 and 24, the Irish investor will incur an expense for deemed disposal tax on the unrealized gain of their ETF holding. It is assumed that he/she will cover this expense by utilising cash held in their bank account. This amounts to €23,285.14 worth of deemed disposal tax over the period. As the unrealized gain at the end of period is equal to €62,064.33, the Irish investors true net position can be taken to equal €38,779.19 after accounting for the cost of deemed disposal. A foreign investor on the other hand would have a true unrealized gain of €62,064.33 as he/she would not be liable to deemed disposal taxation.

Example 2 – Covering Deemed Disposal With ETF Sale

| Year | Opening Balance | Growth | Fees | Closing Balance | Unrealized Gain | DD Tax |

| Year 0 | 0.00 | 800.00 | -10.80 | 10,789.20 | 789.20 | |

| Year 1 | 10,789.20 | 863.14 | -11.65 | 11,640.68 | 1,640.68 | |

| Year 2 | 11,640.68 | 931.25 | -12.57 | 12,559.37 | 2,559.37 | |

| Year 3 | 12,559.37 | 1,004.75 | -13.56 | 13,550.55 | 3,550.55 | |

| Year 4 | 13,550.55 | 1,084.04 | -14.63 | 14,619.96 | 4,619.96 | |

| Year 5 | 14,619.96 | 1,169.60 | -15.79 | 15,773.77 | 5,773.77 | |

| Year 6 | 15,773.77 | 1,261.90 | -17.04 | 17,018.63 | 7,018.63 | |

| Year 7 | 17,018.63 | 1,361.49 | -18.38 | 18,361.74 | 8,361.74 | |

| Year 8 | 18,361.74 | 1,468.94 | -19.83 | 19,810.85 | 9,810.85 | 4,022.45 |

| Irish investor sells €4,025 worth of ETF to cover DD tax | ||||||

| Year 9 | 15,785.85 | 1,262.87 | -17.05 | 17,031.67 | 7,031.67 | |

| Year 10 | 17,031.67 | 1,362.53 | -18.39 | 18,375.81 | 8,375.81 | |

| Year 11 | 18,375.81 | 1,470.07 | -19.85 | 19,826.03 | 9,826.03 | |

| Year 12 | 19,826.03 | 1,586.08 | -21.41 | 21,390.70 | 11,390.70 | |

| Year 13 | 21,390.70 | 1,711.26 | -23.10 | 23,078.86 | 13,078.86 | |

| Year 14 | 23,078.86 | 1,846.31 | -24.93 | 24,900.24 | 14,900.24 | |

| Year 15 | 24,900.24 | 1,992.02 | -26.89 | 26,865.37 | 16,865.37 | |

| Year 16 | 26,865.37 | 2,149.23 | -29.01 | 28,985.58 | 18,985.58 | 3,761.64 |

| Irish investor sells €3,765 worth of ETF to cover DD tax | ||||||

| Year 17 | 25,220.58 | 2,017.65 | -27.24 | 27,210.99 | 17,210.99 | |

| Year 18 | 27,210.99 | 2,176.88 | -29.39 | 29,358.48 | 19,358.48 | |

| Year 19 | 29,358.48 | 2,348.68 | -31.71 | 31,675.45 | 21,675.45 | |

| Year 20 | 31,675.45 | 2,534.04 | -34.21 | 34,175.28 | 24,175.28 | |

| Year 21 | 34,175.28 | 2,734.02 | -36.91 | 36,872.39 | 26,872.39 | |

| Year 22 | 36,872.39 | 2,949.79 | -39.82 | 39,782.36 | 29,782.36 | |

| Year 23 | 39,782.36 | 3,182.59 | -42.96 | 42,921.99 | 32,921.99 | |

| Year 24 | 42,921.99 | 3,433.76 | -46.36 | 46,309.39 | 36,309.39 | 7,102.76 |

| Irish investor sells €7,105 worth of ETF to cover DD tax | ||||||

| Year 25 | 39,204.39 | 3,136.35 | -42.34 | 42,298.40 | 32,298.40 | |

In this example, we assume that the investor cannot afford to cover the cost of deemed disposal out of external funds and, as such, is forced to dispose of part of their ETF holding in order to pay the tax owed. As we can see, deemed disposal charges equal to €14,886.85 arise over the life of the investment. The investor is left with a net unrealized gain of €32,298.40 in year 25. Notably, this net position is approximately €6,480.46 worse off than covering the cost of deemed disposal with external cash. Reason being, the sale of ETF shares limits the effects of compound interest, thus stunting the growth of the investor’s ETF position over time.

3. Apply CGT & Income Tax, USC and PRSI to ETF Investment Returns

Applying 33% capital gains tax to ETF gains and marginal rate income taxes, USC and PRSI to ETF dividends will result in a simplification of the taxation of investments, which was recommended by the Commission.

This would also result in the extension of the annual CGT exemption of €1,270 to ETF gains.

4. Remove Ringfencing of ETF Losses

Investors making losses on ETF investments should be allowed to offset those losses against other investment gains, including ETF gains.

Ringfencing ETF losses creates inequities and it encourages distortionary behaviour. It also doesn’t capture the true economic position of the investor i.e. whether or not he/she has made a net gain or net loss on investments.

Pension Contributions

In the Report of the Commission on Taxation and Welfare, the following recommendation was made with respect to both the existing age-related and annual earnings pension contribution limits in Ireland:

“The Commission recommends the removal of age-related contribution rates to be replaced with a single annual contribution rate. The Commission also recommends the removal of the annual earnings cap on contributions subject to appropriate lifetime limits remaining in place.”

Both of these changes would be highly beneficial to Irish investors.

As is highlighted in the table below, as things currently stand, Irish investors are restricted with regards to how much they can personally contribute to a pension in a given tax year based on:

a) their age

b) their earnings.

As we know, contributing to a pension is one of, if not the best way to save and invest for the future in a tax efficient manner. Therefore, by having a single annual contribution rate that is applicable to all investors and by having a lifetime contribution limit, inequities between investors are eliminated and higher pension contributions are encouraged.

Table 1: Age-related contribution and annual earnings limits

| Age | Max % of total annual earnings* |

| Under 30 | 15% |

| 30 – 39 | 20% |

| 40 – 49 | 25% |

| 50 – 54 | 30% |

| 55 – 59 | 35% |

| 60 + | 40% |

*Subject to maximum annual earnings of €115,000

Granted, that depends on both the single annual contribution rate and the lifetime contribution limit being high enough to facilitate meaningful pension contributions. The Government will no doubt be looking to strike a balance here as the higher the limit, the more income tax foregone.

This is due to the fact that personal pension contributions are not subject to income tax (representing a tax saving of 40% and an automatic return on investment of 67% for higher rate taxpayers).

However, given the colossal challenges facing the Irish State Pension and the inadequacies of the upcoming system of pension auto-enrolment, it’s in the best interest of the Government, the State and the taxpayer, both present and future, to ensure that our citizens have adequate private pensions to support themselves in retirement.

One improvement that has been suggested, in lieu of a single lifetime contribution limit and in keeping with the age-related and annual earnings limits, would be to allow pension contributions to be backdated.

For example, if a person only starts contributing to a pension at age 30, they could be allowed to contribute the amount that they would have been entitled to based on their salary in each year up to age 30.

In other words, maximum allowable contributions in a given tax year are carried forward to future tax years if unused. This would reduce inequities and facilitate higher private pension provisions.

Capital Gains Tax

Interestingly, while Ireland has a comparably high rate of capital gains tax (CGT) relative to, say, the United States and the United Kingdom, as well as high marginal income rates (income tax, USC and PRSI) levied on investment income, the Commission, with respect to CGT, noted:

“The Commission recommends that overall yield from wealth and capital taxes, including property, land, capital acquisitions and capital gains taxes should increase materially as a proportion of overall tax revenues.”

The reference to “materially” in that sentence is somewhat cause for concern as it indicates that the Commission believes that the level of Ireland’s capital-related tax take, relative to the total tax take, is inadequate. Indeed, Ireland’s current tax take is heavily reliant on both corporation tax and the income taxes paid by the top 25% of earners which poses a significant risk to the sustainability of the tax system as a whole.

Undoubtedly, the Commission’s recommendation dampens the prospects of any future increases to the annual CGT exemption of €1,270, a reduction in Ireland’s CGT rate of 33% or introductions and/or expansions to new/existing CGT reliefs.

However, it is not guaranteed that the Government will adopt the Commission’s recommendations, as oftentimes what’s in the best short-term interest of the polls surmounts the medium to long-term interest of the State.

Conclusion

The taxation of investments in Ireland is not perfect, no tax system is.

The tax system and the rules which compose it are designed to encourage particular economic activities at a certain point in time and to discourage other economic activities at another. It’s important to remember that tax rules which are perceived to be “broken” by one group of taxpayers, in this case investors, might prove to be inconsequential to another group of taxpayers i.e. non-investors.

The tax system as a whole is essentially a giant balancing act, as the best interests of different groups of taxpayers must be weighed against the income of the Exchequer and the sustainability of Ireland’s taxation and welfare system as a whole at any given point in time.

That said, there are definitely aspects of Ireland’s taxation of investments that are in need of change, not least of which is the taxation of ETFs.

Investing, be it pension or personal, is crucial to the creation of wealth and the attaining of financial independence.

In light of Ireland’s looming State Pension Crisis, there is arguably no more important time in Irish history than now for the Irish Government to be incentivising participation in investing.

A big part of the problem is financial literacy and the overall lack of awareness around the importance of investing within the general Irish public. This is a problem that the National Pension Helpline is hoping to play a role in solving. Regardless, one can only hope that positive change comes sooner rather than later.