Table of Contents

Can a parent gift a house to a child in Ireland?

Gifting a house to a child seems like the most natural way to pass on your family home or other property asset within your immediate family circle. However, doing so isn’t as simple as you might imagine. Property has become the main driver of wealth in Ireland and therefore there is strong desire to keep property within the family circle.

Rules around how this can happen and why were amended in 2016 and this significantly changed the landscape for the transfer of home ownership within a family group. It affects gifting a property when the owner (such as a parent) is still alive as well as inheritance through a will after the death of a parent.

Revenue proposed these changes as it was believed that the previous system, which was much freer and allowed relatively easy transfer of property ownership within families, to be abused.

As a consequence , there are now much stricter rules in place to control how and who can make a property transfer of ownership or gifting to a family member, particularly a child.

Do my children have to pay inheritance tax?

The main reason changes to the rules around gifting property to a child were introduced was for Revenue to better control the tax implications for the recipient of a gifted or inherited property.

Capital Acquisition Tax is a tax on gifts and inheritances. It determines that a recipient can receive gifts or inheritances up to a certain value through their lifetime before having to pay tax (CAT). That certain value is known as the Threshold. Once that threshold is reached then tax is paid at a rate of 33% on the remaining value.

In order to determine the threshold that is applicable to the children of the person gifting the property you need to identify which tax group they fall into.

What inheritance tax group are children in?

There are a number of different groups that exist depending on the value of the property, the relationship the recipient of the property has to the person gifting it and whether you have received additional gifts or inheritances within the same threshold grouping.

(Note: The term used to refer to the person who is gifting the property or who has died and left an inheritance in their will is a disponer.)

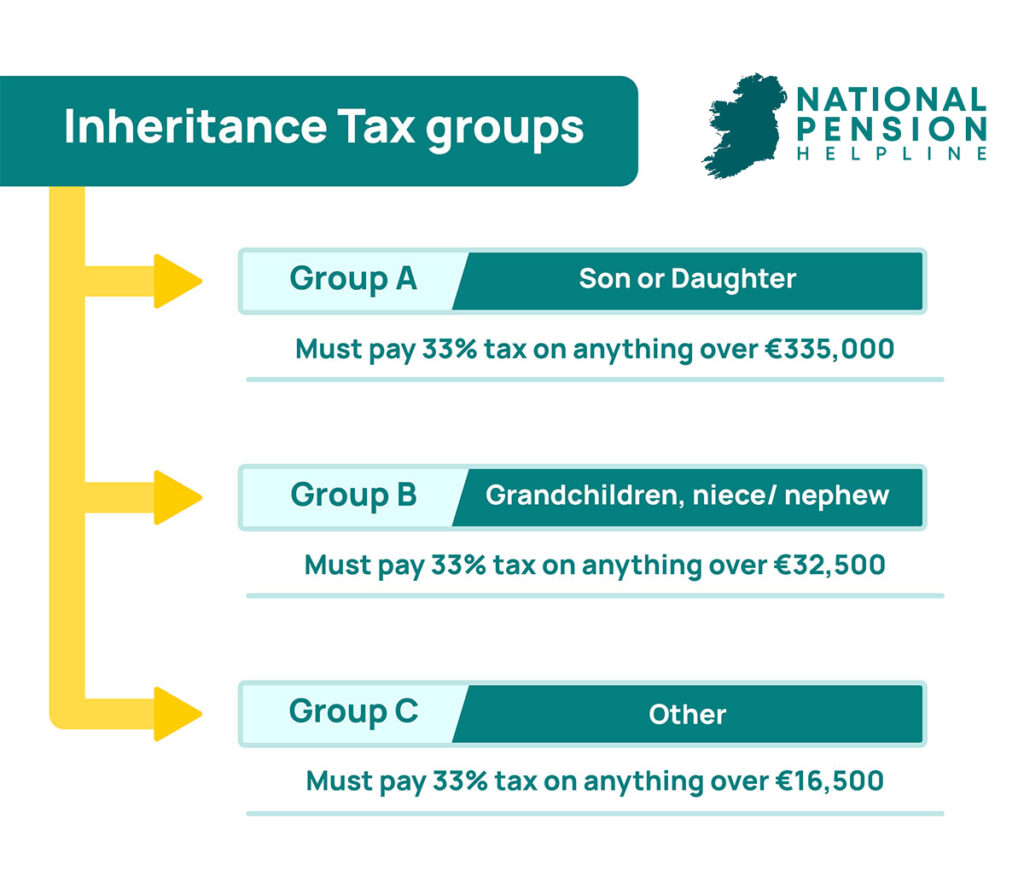

There are three tax groupings: A, B and C.

Group A

- You are a child of the disponer of the property

- You are a spouse or civil partner of the disponer.

- You are a grandchild under 18 years of a deceased child of a disponer.

- You are a step-grandchild by connection to the disponer’s spouse or civil partner.

- A minor child of the souse or civil partner of a deceased child of the disponer or their civil partner or spouse.

- You are a parent of the disponer and you take an absolute interest of an inheritance on the death of your child.

Group B

Individuals who do not have a direct child/parent relationship with the disponer such as: a brother or sister of the disponer; a grandparent of the disponer, a grandchild of the disponer.

Group C

Any other connection with the disponer that is not covered by Group A or B.

Each of the groups face different tax scenarios.

How is inheritance tax calculated?

Once you have determined which group applies to you, the relevant tax implications are clear. If

you are in Group A you will have a threshold of €335,000 before tax is due. If you are in Group B the threshold since 2019 is €32,500. Group C threshold is €16,250

How much does a child get tax free?

For the purposes of this article we are interested in Group A tax implications. Group A receives a Capital Tax threshold of €335,000. Anything above this threshold is taxed at 33%. So, if a property is valued at €500,000 at the time of transfer, the child of the disponer will be liable for Capital Acquisition Tax of 33% on the value above the threshold: €165,000.

Is the tax free amount life time or every time?

The threshold of €335,000 is a lifetime calculation. If you have received previous gifts from a disponer then these will be included in the value of the property and so the CAT you pay will be on everything in the inheritance or gift that is above €335,000. It is not calculated on a gift by gift basis.

Are there any exemptions on Capital Acquisitions Tax?

Yes, you are exempt from Capital Acquisitions Tax on the inheritance of a property which is the principal home of the disponer if you meet certain conditions.

Since 2016 you will be exempt under conditions including:

- The house was the principal home of the deposer.

- You lived at the same property for the three years before the date of the inheritance.

- You do not have any other home or property.

- The house continues to be your only home for six more years after the inheritance.

- You are a dependent lative of the deposer because you are physically or mentally infirm.

- You are 65 years of age or over at the date of the gift.

What is the best way to pass on your assets to under 18s after you die?

If you are making a will and you have children under the age of 18, it is good practice to set up a trust for them. This allows you to set a date whereby you consider the child to be mature enough to receive their inheritance. This doesn’t necessarily have to be when they turn 18. It can be a later age such as 25 and this can be stipulated in the will and the particulars of the trust itself.

A trust can ensure that the child has adequate income to cover their cost of living, education and maintenance while protecting the core assets of the inheritance.

There are tax implications of a trust that affect the inheritance tax that a child may pay on maturity so the age that is chosen for the child to receive the inheritance is very important.

If you are considering setting up a trust for a child in your will then ensure you receive expert legal advice. A trust is not simply for the very wealthy. Any person with property to dispose will have value that could be held in trust.

What is a Trustee?

In order to make a trust you need to select a number of trustees who are responsible for the trust until the child matures. This is an important choice as they will have power over the control of the assets of the trust if you die. They will also be able to restrict access to the trust and extend the age of maturation if for example they judge the recipient to not be ready to receive the inheritance. An example of when this can happen is if a child becomes dependent on drugs or alcohol then a trustee can judge that it would be better to restrict the inheritance until such time as the recipient has sought help with their dependency.