According to the Central Statistics Office, 1 in 3 Irish workers aged between 35-44 have no additional pension coverage outside of their pension entitlement under the State pension system.

In other words, if nothing changes for those individuals between now and their eventual retirement, they will be fully reliant on State payments for funding their lifestyles.

In this article we explore why this is a problem and why it’s critically important to have private pension coverage in addition to your entitlements under the State pension system.

Table of Contents

The State Pension

Ireland’s State pension is the equivalent of what American citizens might call ‘social security’ in the United States.

But most Irish workers are unaware about how the State pension actually operates. The basic premise of the State pension system is that the workers of today pay for the retirement of the retirees of today.

They do so in the hope that when they themselves reach retirement in the future, the workforce of tomorrow will pay for it.

But how are Irish workers paying for the retirement of Irish retirees?

Pay related social insurance (PRSI). PRSI is a form of tax which you pay alongside taxes such as Income Tax and Universal Social Charge (USC).

But unlike Income Tax and USC, the PRSI contributions made by Irish workers go into what’s known as the Social Insurance Fund.

It is out of this Social Insurance Fund that State pension payments are made to eligible Irish retirees, among a slew of other general benefits which can be found here.

That’s why the tax is called ‘social insurance’, because you’re effectively paying premiums on a social insurance policy (alongside the Irish workforce) which will pay-out in the event of certain circumstances.

For the purposes of this article, we’re only concerned about State pension benefits.

A retiree who is eligible for the full State pension can expect to receive €277.30 per week or €277.30 per year in retirement according to the Pensions Authority.

Insufficient Funds

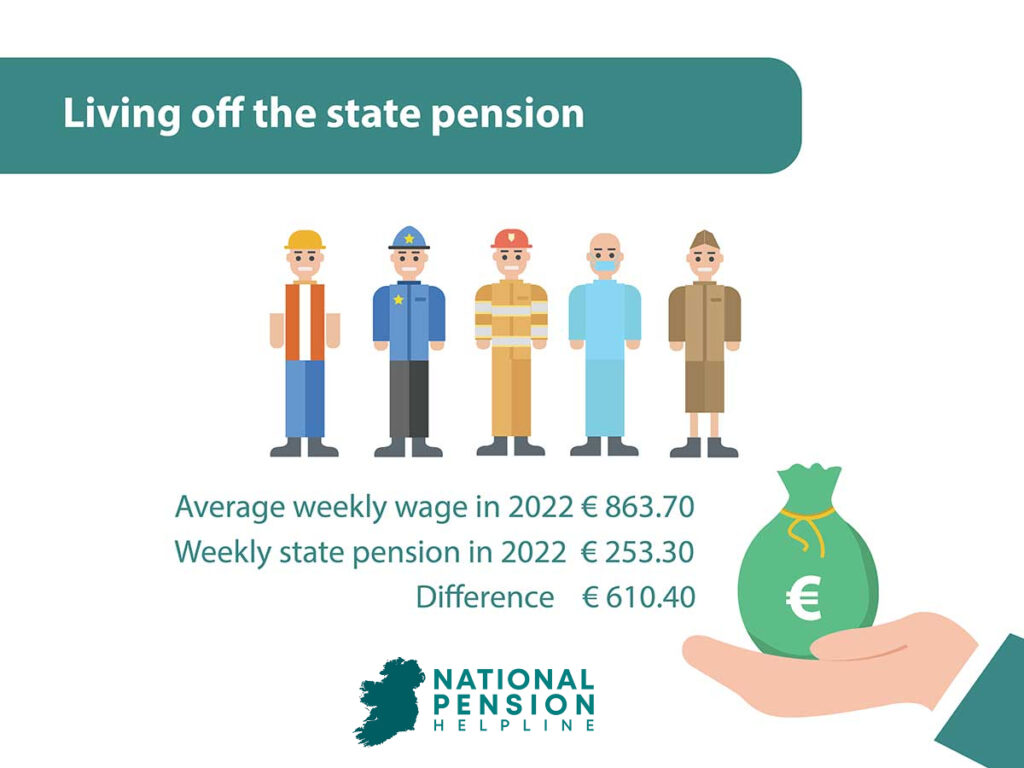

The first reason why solely relying on the State pension for income in retirement is a bad idea is because it doesn’t provide you with enough money.

The goal of retirement planning, in the opinion of the National Pension Helpline, is to accumulate enough money throughout your working life, so that when you retire and stop earning a salary, you have enough of a nest egg available to help maintain your standard of living into retirement.

Read that sentence again: you want to do everything you can to maintain your standard of living in retirement.

According to the Central Statistics Office, the average salary of an Irish worker is €45,760.

So, if an average Irish worker plans to rely solely on the State pension system to support him/her in retirement, then he/she will experience a 71% drop in his/her income as soon as he/she retires. Try to fathom that – 71% of your income gone overnight.

How exactly do you intend on maintaining your pre-retirement standard of living with less than 30% of your pre-retirement income? It’s just not going to happen.

This phenomenon where your income drastically reduces and therefore plunges you into a much lower standard of living and life is known as “Pension Poverty”.

The Unsustainable State Pension

Unfortunately, even though the State pension only provides a fraction of the average Irish salary as retirement income, things get worse. The State pension system itself is unsustainable.

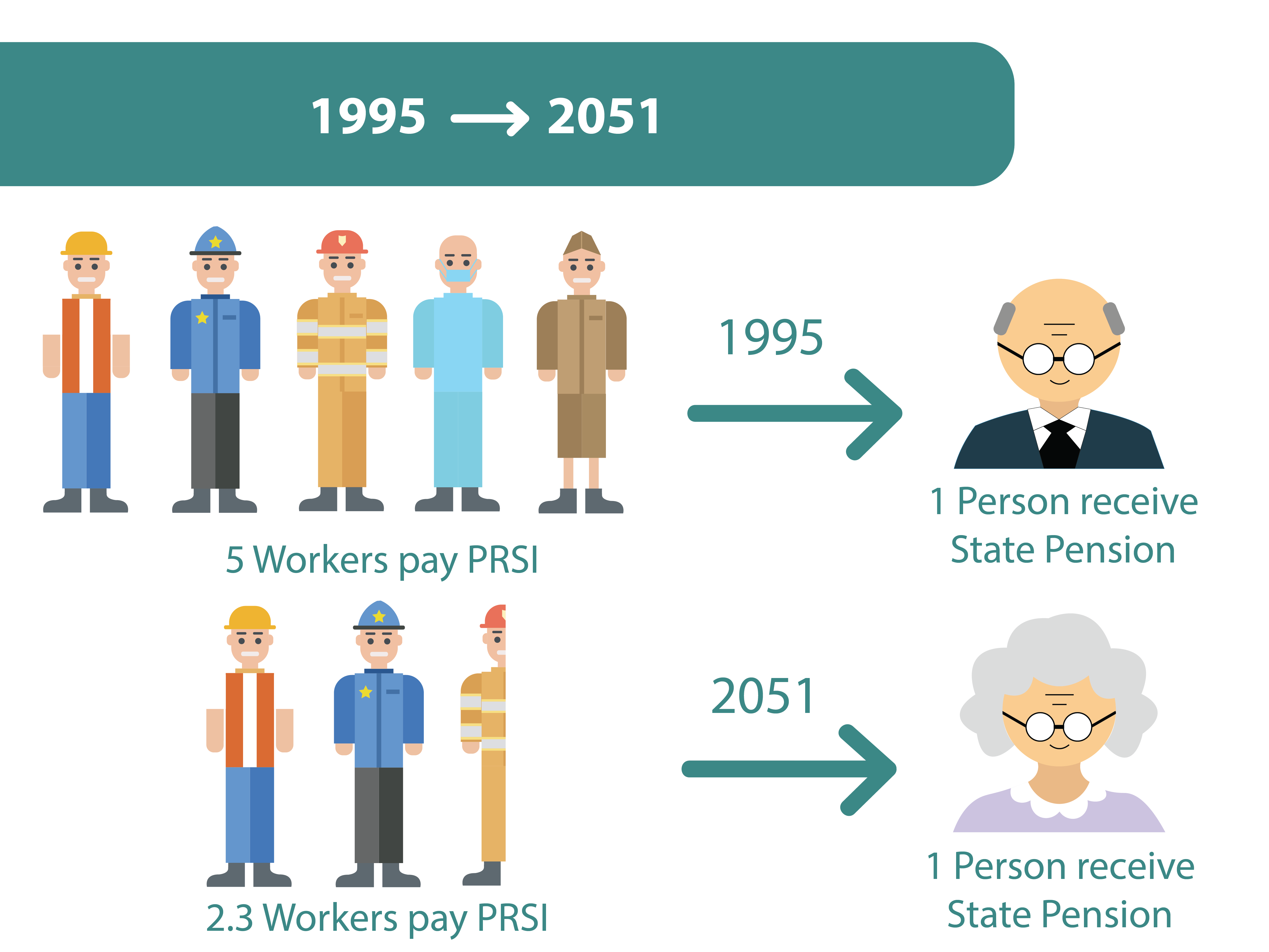

We mentioned earlier that the Social Insurance Fund is funded by Irish workers paying PRSI. Payments are then made to Irish retirees from this fund. However, this is a delicate system that relies on a certain balance between the number of workers in the workforce and the number of retirees in retirement.

A recent article in The Independent highlighted some of the issues facing the State pension system which we will now discuss. The number of Irish retirees is set to double by 2050.

That’s a by-product of advances in medical science which has allowed global populations to live longer. While that’s great from a ‘living perspective’, it presents a financial problem.

More people in retirement means more people drawing on the State pension (and for longer time periods). That money has to come from somewhere, and under the current system, not enough will come from Irish workers to pay for it.

In 1991 there were five workers for every pensioner in Ireland. That ratio is expected to decline to 2.3 workers for every pensioner by 2051. What’s the result of that?

The Tax Strategy Group has estimated a shortfall in the Social Insurance Fund of €2.3bn in 2030, €13bn by 2050 and up to €21bn by 2070. Compounded, this could lead to a cumulative shortfall of €335bn by 2071.

Translation: It’s a dire situation which will cost the State billions if left unchecked.

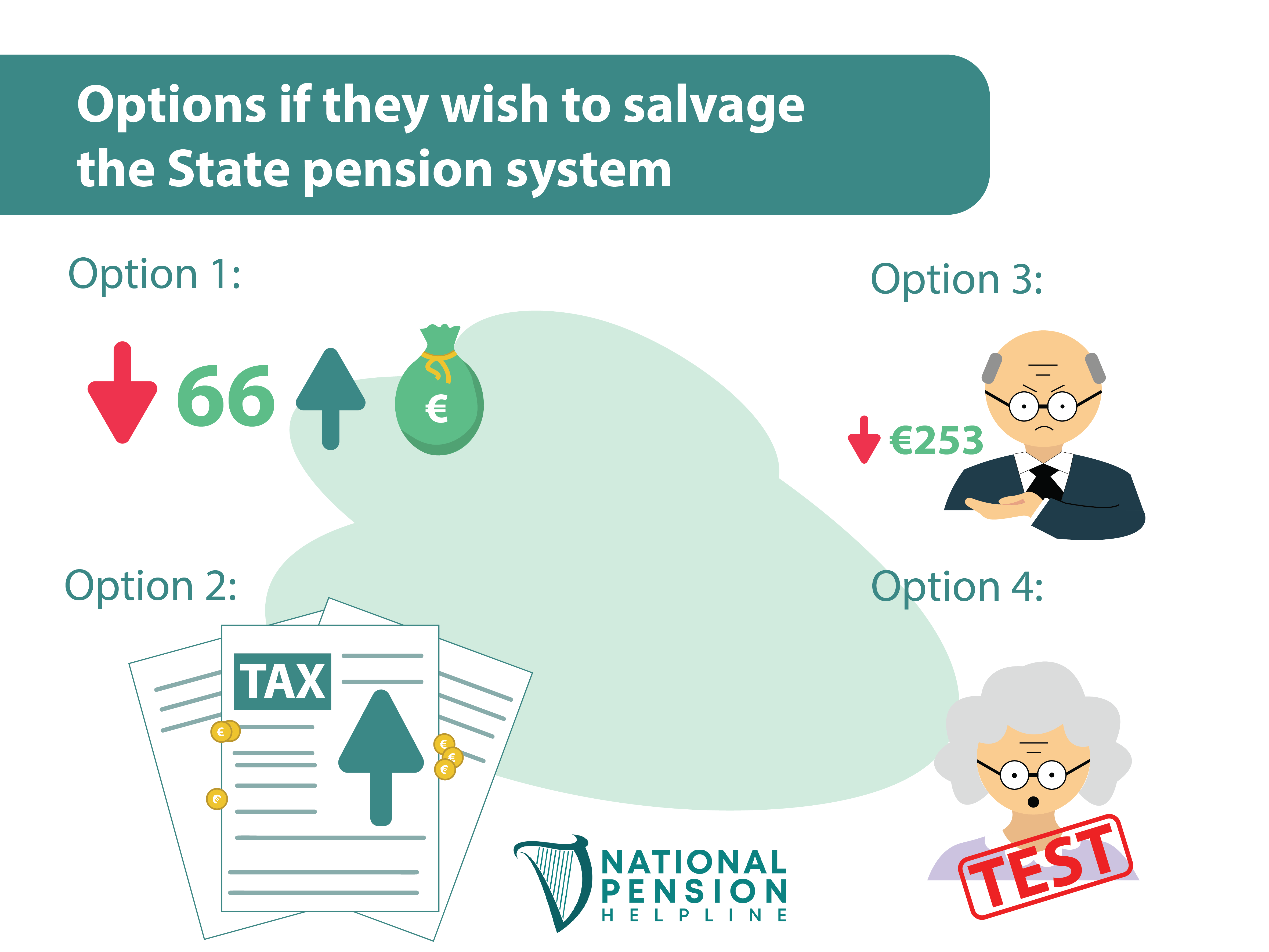

The government will ultimately be left with four options if they wish to salvage the State pension system for future retirees, none of which are favourable.

Option 1: Increase the State pension age to delay eligibility

By increasing the State pension age, the Government is encouraging people to work for longer and to stay out of retirement.

The later individuals become eligible for the State pension, the less time they’ll likely spend drawing from it, which in turn saves the State money.

This isn’t favourable for those who want to exit the workforce at the current State pension age of 66 (soon to be 67).

Option 2: Increase the rate of PRSI paid by workers to increase contributions

By increasing the rate of PRSI that is charged on income, the social insurance fund will collect more contributions from workers and will have more money available to payout to retirees.

This isn’t favourable for current workers, as it means that they’ll have to pay more tax, which will very likely reduce their current standard of living.

Option 3: Decrease the benefits paid out under the State pension system to alleviate pressure

By decreasing the amount of money that retirees receive under the State pension system, the social insurance fund will be able to be stretched across more retirees for a longer period of time.

This isn’t favourable for retirees as it will impact the standard of living that they can enjoy in retirement.

Option 4: Means test the State pension so that only certain individuals are entitled to receive it

By means testing the State pension, the Government would effectively be putting an additional set of criteria in place which would determine whether or not someone is entitled to receive the State pension.

In the case of means testing, only those deemed to have insufficient financial resources to sustain themselves would be entitled to receive the full pension payment from the social insurance fund.

This isn’t favourable for retirees who have appropriately planned for their retirement as they’re effectively being punished for doing so.

Options 1 and 2 are currently being explored by the Government, however there’s a very important message from all of this.

Anyone below the age of 50 cannot say with relative certainty that the State pension will be there to support them when they reach retirement.

The extent of this crisis cannot be understated, and it’s the opinion of the National Pension Helpline that workers should be preparing for their eventual retirement, as if they knew for certain that the State pension wouldn’t exist, it is far more prudent to do so.

Unfortunately, for those in the workforce today, the Irish State pension system is starting to look more and more like a State sponsored ponzi scheme, robbing Peter to pay Paul, where Peter is the Irish worker and Paul is the Irish retiree.

Private Pensions

So what’s the solution? Private pensions. Now more than ever before you need to take responsibility for your retirement planning.

A private pension allows you to invest money periodically over the course of your working life, with the ultimate goal being a pension pot far in excess of what the State pension could ever provide.

By reading our other articles on Defined Contribution Pension Schemes and Personal Retirement Savings Accounts (PRSAs) you’ll learn more about two of the most common ways to get started with a private pension in Ireland.

The best part? There are extremely valuable tax benefits associated with investing in a private pension in Ireland.

So not only are you looking out for your future self, but you’re also keeping more money in your pocket and less in the taxman’s! You can learn more about the tax benefits of pension investing here.

The Government has recognised that, in addition to the four options which we highlighted above to salvage the State pension, another very important solution is increasing the amount of private pension coverage which workers have.

Because of this, a system of pension auto enrolment will be brought into effect from 2024. Ireland is the only OECD country that does not yet have such a system in operation.

Under this system, Irish workers will automatically be opted into a private pension scheme at a predetermined percentage of their salary (as opposed to the current system which requires workers to voluntary opt-in on their own accord).

It is the National Pension Helpline’s opinion that the reader should not rely on this system for their private pension provision. The sole reason being that the percentages at which workers will be opted in are far too low to provide a sufficient nest egg at retirement age. Don’t rely on the Government, take matters into your own hands.

Closing Words

If you’d like to learn more about any of the information mentioned in this article, or if this article has inspired you to take control of your pension, the National Pension Helpline has a panel of vetted pension experts who can assist you with any queries you may have.

Simply submit your information through the platform and you’ll be matched with the advisor best suited to your situation.