Feeling confused about the differences between defined pension plans? Don’t worry – you are not alone.

Navigating the ins and outs of defined benefit and defined contribution pensions is no easy feat due to an abundance of technical jargon and complicated guidelines.

This article will outline key definitions and differences you need to know about before deciding what pension plan best suits you.

Table of Contents

What is a Defined Benefit pension

Opting into a defined benefit pension plan will ensure a solid structure amid planning for financial security in old age.

This scheme pays into a pension fund that is an add on to the already existing State pension and comes close to ensuring a person’s standard of living will continue to be maintained into old age.

For a defined benefit pension to work, it must be set up by an employer with the goal of benefiting an employee.

It should be comprised of a fixed payment each year that said employee will receive on retirement – ultimately this means their payment is defined no matter what.

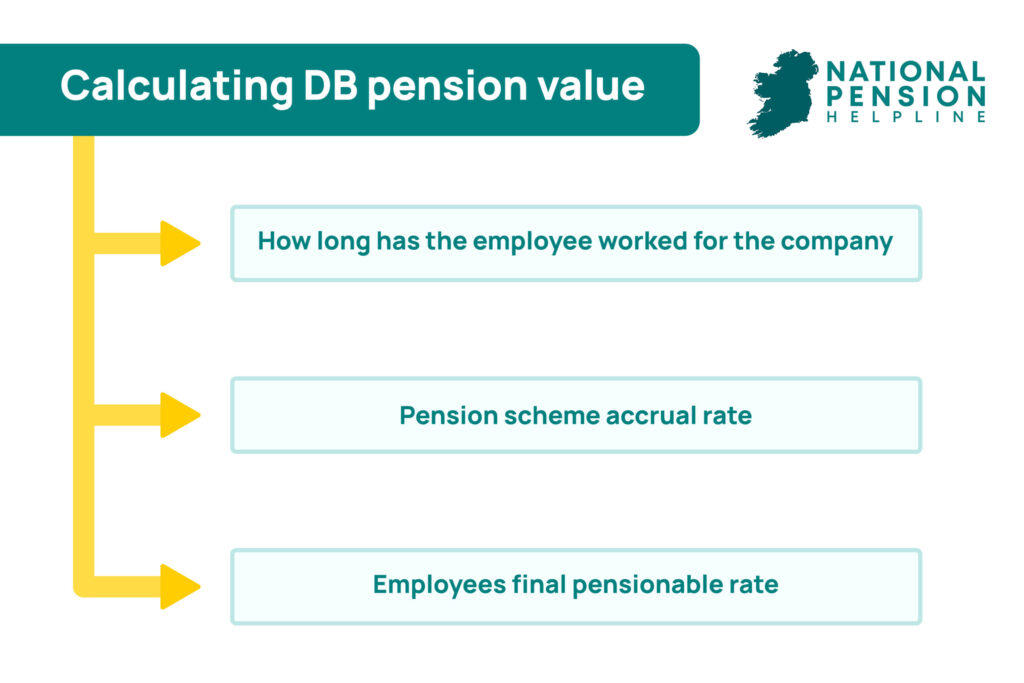

It is vital to understand that the amount of pension an employee receives is based on the amount of years they have been in employment, coupled with the salary they earned during that time period.

If that income rises and falls during employment, the amount that will be paid in retirement will mirror that movement.

What is a Defined Contribution pension

A Defined Contribution pension plan is the most commonly used of the two.

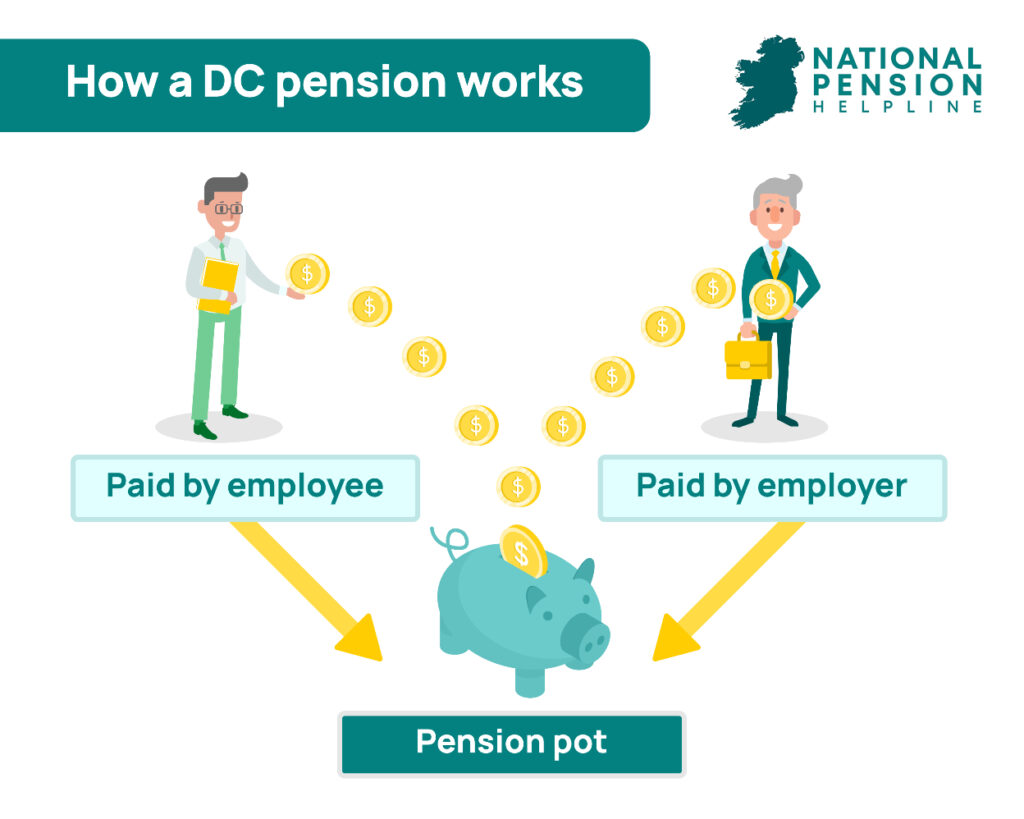

Operating on the grounds that both employee and employer are prepared to invest in the future pension fund of the employee, the scheme is not as mutual as it sounds.

For it to work, both parties sign up to the DC pension scheme and following this a percentage is deducted from their salary.

Percentages deducted in this case that will be matched by the employer must be agreed in advance.

These don’t have to be equal amounts from either side with the employer contribution being entirely based on the arrangements with each individual company.

A key point to note is that the employer does not have to match the employee contribution in this type of plan.

What is the difference between a Defined Benefit and Defined Contribution pension

These types of pension schemes are usually found within companies and pose a number of differences that are worth knowing about.

A defined benefit pension outlines a fixed amount from the very beginning of proceedings calculated with regards to the number of years worked by the employee alongside the salary earned during that term of employment.

The fixed nature of this scheme makes it a more reliable choice as – unless the years or salary number changes – the figures expected to be received on retirement won’t budge.

With a defined contribution pension, employees are working with an accumulation of funds that can wiggle over time.

For this to work an employee must pay an agreed amount into the pot each salary period that will then be generally matched by the employer.

Following this the two payments are combined and invested into a chosen pension fund leaving the ultimate value subject to change depending on the success of the fund’s performance over time.

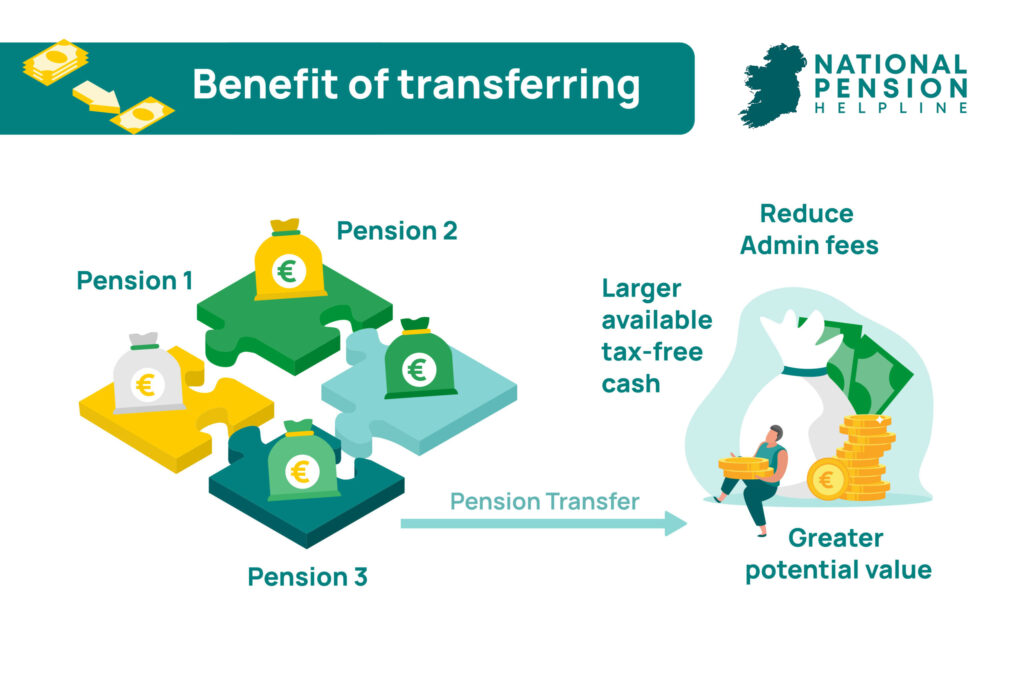

Can I transfer my DB and DC pension into one?

You can transfer your pension into a hybrid pension scheme that shares the risk of the value by both the employer and employee.

Defined benefit scheme – the risk is mostly shouldered by the employer as the value is agreed ahead of the beginning of the pension contributions.

A hybrid shares the risk for the employer and boasts components of both type of schemes.

Defined contribution pension – here the employee will face most of the risk as the final value of the pension will ultimately be decided by the pension fund’s performance.

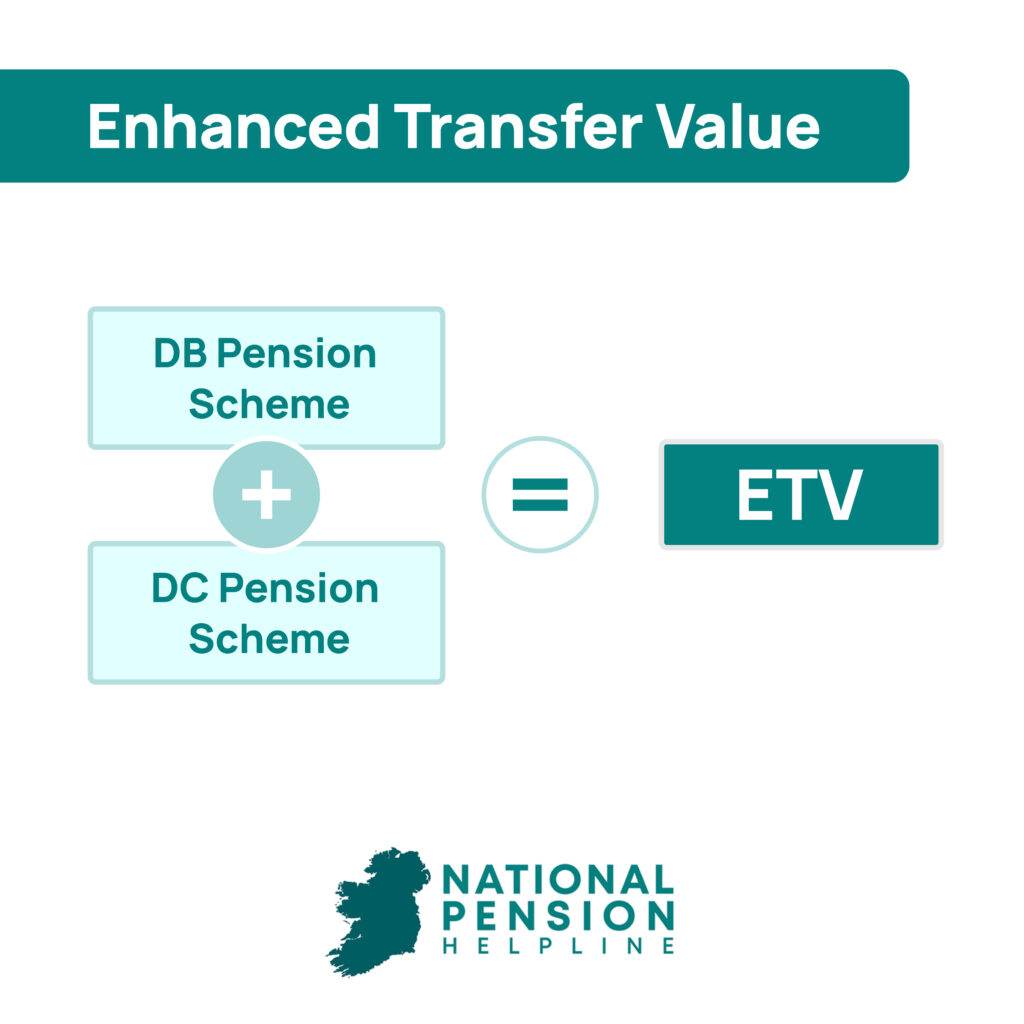

What is an enhanced transfer value

Should you decide to transfer funds from a defined benefit pension, you will encounter an enhanced transfer value that needs to be taken into consideration.

After calculations have been carried out, this will be the sum your full pension of this kind will be worth in today’s money.

In short, this is a one-time opportunity to transfer the value of your pension to another scheme with a more attractive rate.

How is an ETV calculated

It is always recommended to seek financial advice when working out your ETV but roughly it goes like this.

An average Enhanced Transfer Value should come to 20-30 times your defined benefit in retirement.

In order to reach a number, you must first take note of what your pension is currently worth and then apply the percentage value that your company will give you on top of this – and add the figures together.

The sum given will be as an attempt to encourage you to transfer your funds.

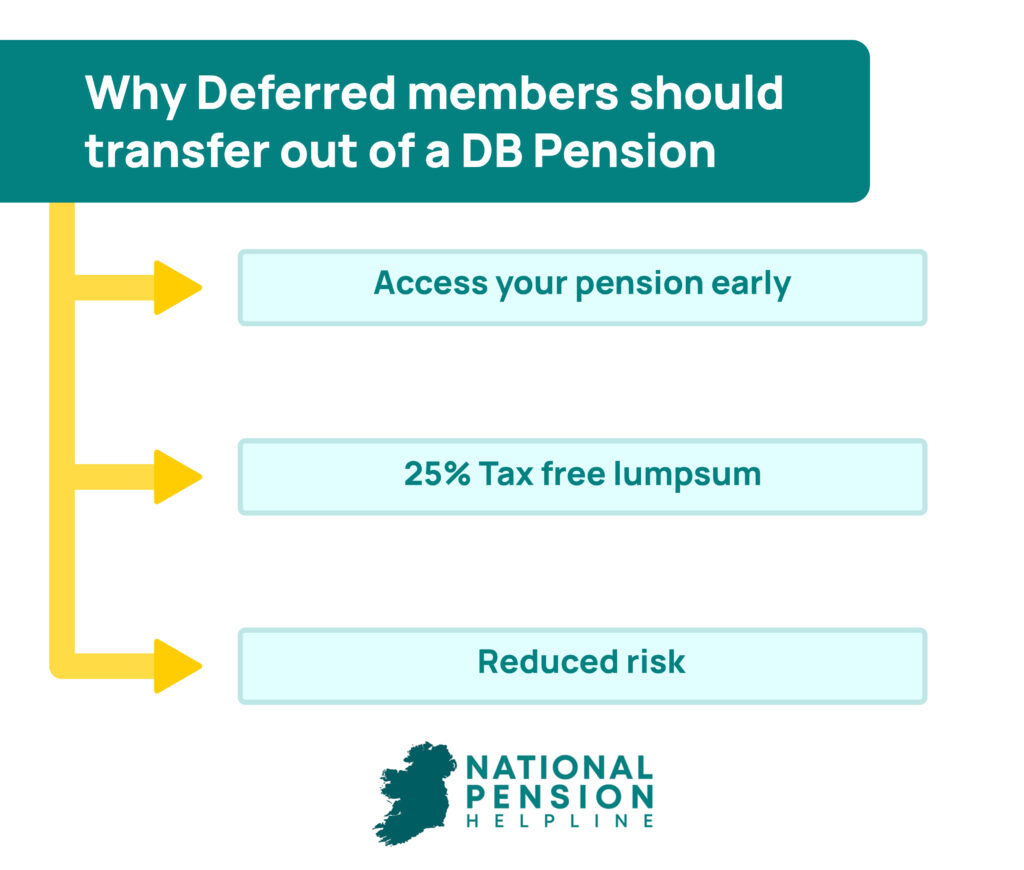

Should I accept my ETV?

Like everything there are pros and cons to leaving a current situation for a new one.

As a general rule, pension beneficiaries can expect an ETV to benefit them financially as it is an advantageous offer.

This is mostly the case for deferred members of the benefit scheme who have left early due to changing job.

In most cases these deferred members will have another pension scheme in place with their new employer.

Therefore, transferring an older defined benefit pension to a new pension arrangement can be very attractive.

In order to make a sound decision as to whether or not an ETV will work in your favour, one should consider seeking expert help.

Note, the benefits offered here will be specific to your personal situation and the likelihood of your holding company to follow through on their commitments to your pension in the decades to come.

Learn more about your DB and DC pension

We understand wading through the complicated nature of the different pension funds can be a headache at the best of times.

Contact the National Pension Helpline and one of our highly skilled advisors can walk you through your options ahead of confirming where your pension prospects currently stand.

Lines are open via email and phone so reach out and book an appointment with an advisor today.