There has been a lot of traction over the past decade to increase the state pension age from 66 to 68.

The reason for this is simple. We are living longer and healthier lives than previous generations and our pension system is struggling to keep up.

Some of us will still be fit to work by the time we reach retirement age but are incentivised to retire early.

In 2016 there were 637,567 individuals over the age of 66 and eligible to claim a state pension. This was a 19.1% increase from just 2011.

Cabinet has signed off on plans to keep the State pension age at 66. People will be given the option to work until age 70 in return for a higher state pension pic.twitter.com/MAKdID9bg7

— Seán Defoe (@SeanDefoe) September 20, 2022

New proposal

A new proposal was introduced by Heather Humphreys, Minister for Social Protection and should be brought to cabinet by next year.

The proposed plan is to help support those who feel they are not fit to work by the time they reach 66 and to incentivise those who are still fit to work to remain in the workforce until they reach age 70.

For those who feel like they are unable to work in their early 60’s will also be accommodated under Heather Humphreys proposal.

Also included in the proposal, long term carers will be eligible for a state pension.

Carers who had to give up work for a long period of time to take care of a relative or loved one will now be entitled to a state pension for the first time.

Is the proposed state pension scheme a good idea?

While some are welcoming this new proposal with open arms, others are claiming it is just the government increasing the pension age by stealth.

Opinions remain mixed in both government and public.

Mary Lou McDonald claimed it was a trojan horse designed to increase the pension age. She went on to say it was

“A ploy to force people into working until they are 70 years of age with the promise of then having a decent standard of living. Retire at 70 for an extra €60 in pension”.

This allegation was clapped back by Micheál Martin who claimed this was “Fake News”.

Sinn Féin leader Mary Lou McDonald calls the Government plan on pensions a Trojan horse designed to move the pension age to 70 ‘by stealth’. Taoiseach Micheál Martin says the pension age is 66 and accuses Ms McDonald of not telling the truth | Read more: https://t.co/sihHE8EkbO pic.twitter.com/Q42TtFaz2J

— RTÉ News (@rtenews) September 20, 2022

Irish State pension flexible model

A flexible model will allow for 5 different rates of state pension depending on retirement age:

Those who decide to continue in the workforce until aged 70 will benefit from a 24% increase in state pension income.

A flexible pension age system is something that has been introduced in a number of other EU countries.

Late retirement advantages

The main advantage of working beyond retirement age is to earn a wage higher than the state pension and to continue making tax free contributions to your personal pension.

The new plans from the government will now increase your retirement income by €62 a week or €3,224 a year for working until age 70.

What does this mean moving forward

As stated by Heather Humphreys, this is the “biggest ever structural reform to our State pension system“.

To help support the new state pension model, PRSI payments will increase but will be “modest” and gradual.

As of now, rates plan to increase over a 5 years period and the increased amount depends on a statutory actuarial review.

Is the state pension enough

Despite incentives that can increase your state pension by 24%, it is still not enough for a lot of people to live their planned retirement lifestyle.

There is a lot to consider when planning your retirement income.

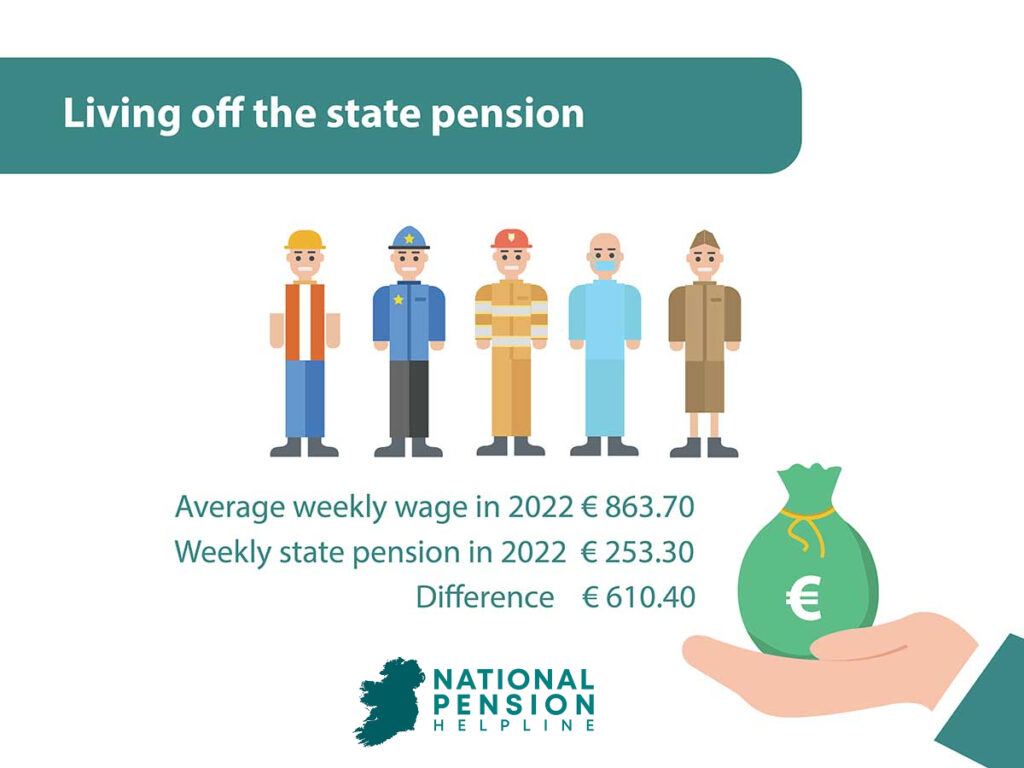

As of 2022, those who are planning to retire on the state pension alone will be living on €610.40 less a week than the average person’s wage in Ireland.

1 in 3 Irish workers do not have a personal pension or other post retirement income planned. This is leading to a high rate in pension inequality with the state pension not being enough to live off.

Don’t wait until it is too late to start a plan for retirement. Begin planning for the future today.

Start planning for your retirement today

Simply fill in the assessment form and a member of our team will be in touch to discuss your options.

This is a 100% cost and commitment free service.

Our Qualified Financial Advisor will guide you and help you make the best decisions for your financial future.