In Ireland, the EU, and other developed countries, ageing populations will have a significant impact on the ability of that country to finance state pension provision in its current form.

An ageing population is a population where there are both lower birth rates and a higher life expectancy. In effect, people live longer and have fewer children.

This population structure means that there are proportionally more older people in the population than at the time when national pensions systems were devised.

The combination of longer life expectancy and lower birth rates also means that there are proportionally less people of working age in the population compared with a relatively higher number of people who are retired.

Table of Content

Ageing populations

As populations age, there are fewer workers to contribute to the public finances of a country, meaning that the state pensions (and health and care) of an increased older population become more difficult to finance.

This ‘old age dependency ratio’, expressing the number of retirees as a fraction of the number of people working in the population, needs to be high enough that working people in a population make sufficient contributions to the public finances of that country to allow for the increase in age related spending by the State, including increased spending on state pensions.

Is Ireland’s population ageing?

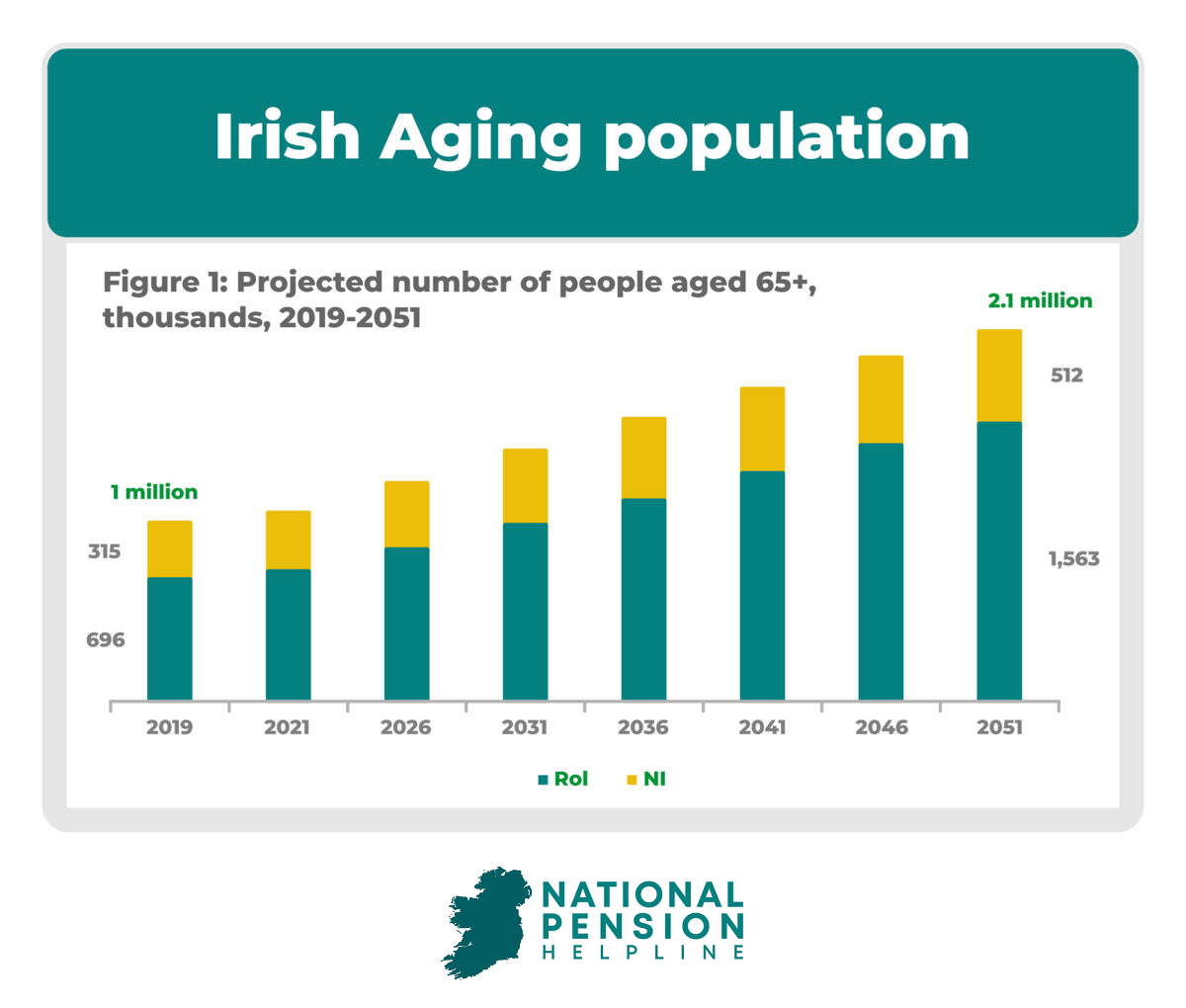

A report by the Department of Finance in 2021 suggests that, at the moment, Ireland has a relatively young population, with 4 people of working age to support each person over 65 at present.

However, this is expected to fall to just over 2 by 2050. This will inevitably lead to an increase in age- related public spending as well as slower economic expansion.

As revenue generated by the working age population must finance public expenditure, policy reforms may be required to finance increased age related public spending in the future.

How does Ireland compare to the rest of the EU?

According to the IMF, in Europe there are 3.4 people of working age to support each retiree over 65. This would suggest that Ireland currently has a relatively young population given that we have 4 people working to support each retired person.

However, the IMF suggests that to avoid poverty in an older population in the future, public pension provision must adapt to the realities of an ageing population.This will ensure the sustainability of the pension system in Ireland, Europe, and other developed countries.

Longer life spans and lower birth rates may require people to save more for retirement and also to retire at a higher age.

Pensions in the future

Measures such as less generous state pensions, increasing the retirement age, and tighter eligibility rules around accessing a state pension will all serve to alleviate the pressure on public spending caused by the ageing population.

Such measures may also encourage more people to invest in private pensions or public defined contribution programmes.

Alongside these measures, the IMF also encourages promoting labour force participation. Supporting more women to enter the labour force and encouraging older workers to remain in the workforce are two examples of this.

How is Ireland preparing for an older population?

In Ireland there have been a number of changes to the pension rules in the last ten years. These are designed to make the pensions system in Ireland sustainable and to prepare for the ageing of Ireland’s population in decades to come.

In 2014, the retirement age in Ireland changed from 65 to 66.

More recently, there have been changes to the way in which pension entitlements are calculated in Ireland, as well as moves to improve access to a state contributory pension for those who have spent time as carers during their lifetime.

Reckonable contributions

In Ireland, you have to have made 520 reckonable total contributions (10 years) from employment, although time spent as a career may also qualify, in order to be eligible for a state contributory pension.

A new Workplace Pension Scheme has also been introduced, which is an auto-enrollment pension for those in employment. In this scheme, contributions made by employees will be matched by contributions from employers, and a state contribution will also be made.

Defer your pension age

From January 2024, you may choose to defer the age at which you draw down your pension to 70. This will allow someone to continue to work and make contributions towards their pension for those who do not have enough qualifying contributions. You may also receive a higher rate of payment on retirement if you choose to defer your pension.

In Ireland, there are also significant tax advantages in making contributions to a private pension scheme.

Japan – an ageing population.

Due to a number of population factors, Japan has a rapidly ageing population. Japan currently has an age dependency ratio of just above 2, the point where Ireland may reach by 2050.

Japan has a high life expectancy which has been steadily increasing. This, coupled with a low fertility rate and very low rates of immigration, has meant that Japan has experienced what have been described as ‘shrinkonomics’

Where you have an ageing and shrinking population there is a clear impact on the ability of a shrinking labour force to provide for an increased number of retirees.

Falling labour force

The potential labour force in Japan, those aged 15 to 64, has fallen to just over 59% of the population and is expected to continue to decline. There is also unusually limited immigration in Japan, so there are no foreign workers to increase this potential labour force.

This means that there are insufficient workers to maintain current levels of economic activity in Japan. This will obviously have a knock on effect on Japan’s ability to maintain a pension system.

The answer to this, suggested by the IMF, is to increase female participation in the labour force, as well as encourage older workers to remain working.

Japan also has high levels of automation, AI, and robotics use and this may be a potential way to increase economic output despite the declining labour force.

Conclusion – benefit of a younger population.

It is clear that developed countries are facing a pensions crisis. And, in some respects Ireland is no different.

Populations are ageing in developed countries. Older people are living longer, and with improved healthcare, retirement has become a longer phase of life than in the past. Fertility rates are lower, so there are proportionally less young people to provide for those retirements.

Ireland’s younger population

Ireland, however, has a slightly younger population. Our ability to provide for older people in our population has been described as ‘relatively favourable at present’.

The benefit of a younger population is that we have more workers in our population to drive economic growth and also to finance age related public spending, including pensions.

The main benefit of Ireland’s slightly younger population is that it gives Ireland time to plan for the future. Measures such as increasing retirement age, encouraging older workers to remain at work, and supporting workers to make earlier provision for retirement take time to implement.

This will allow Ireland’s pension system to remain sustainable into the future and may avert the pensions crisis evident in other countries, such as Japan.